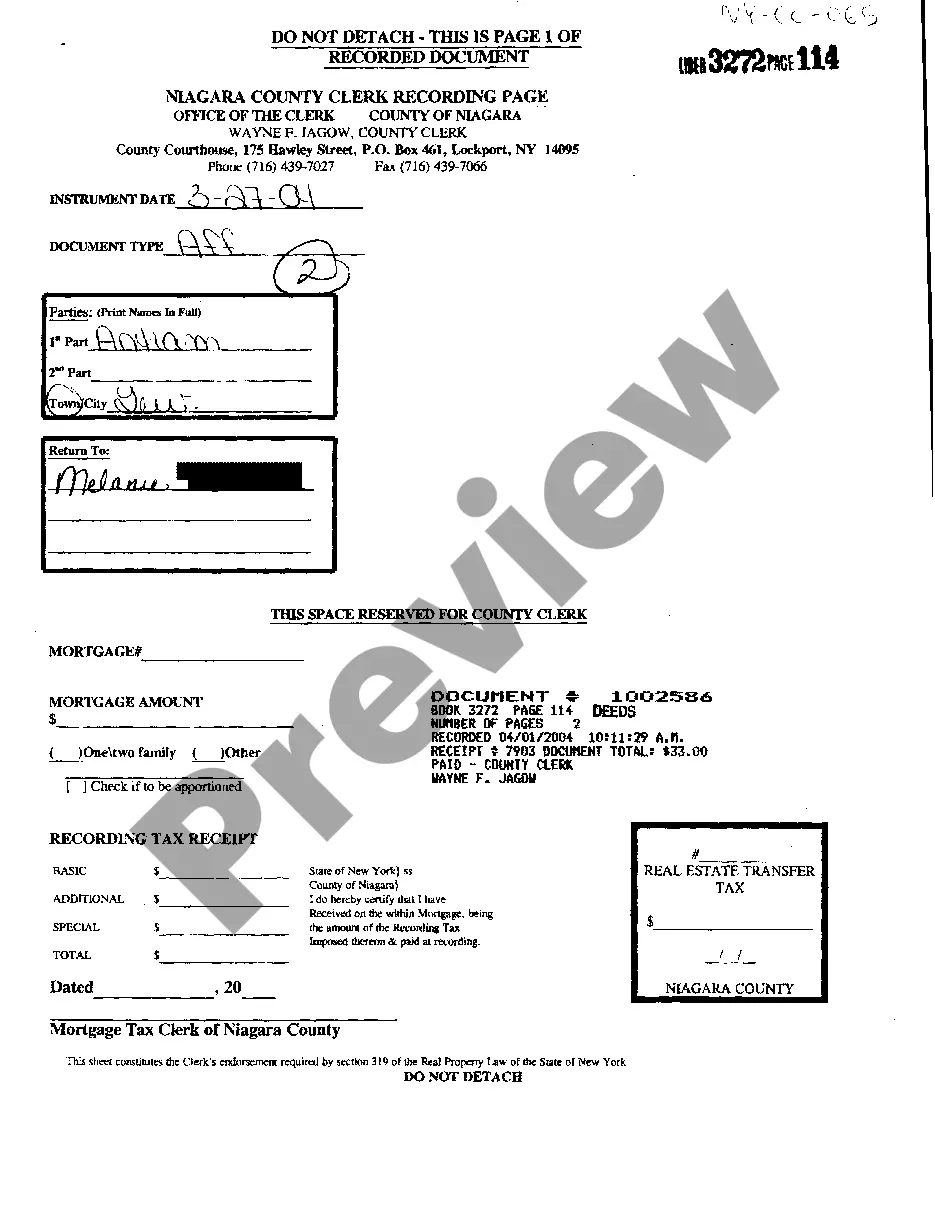

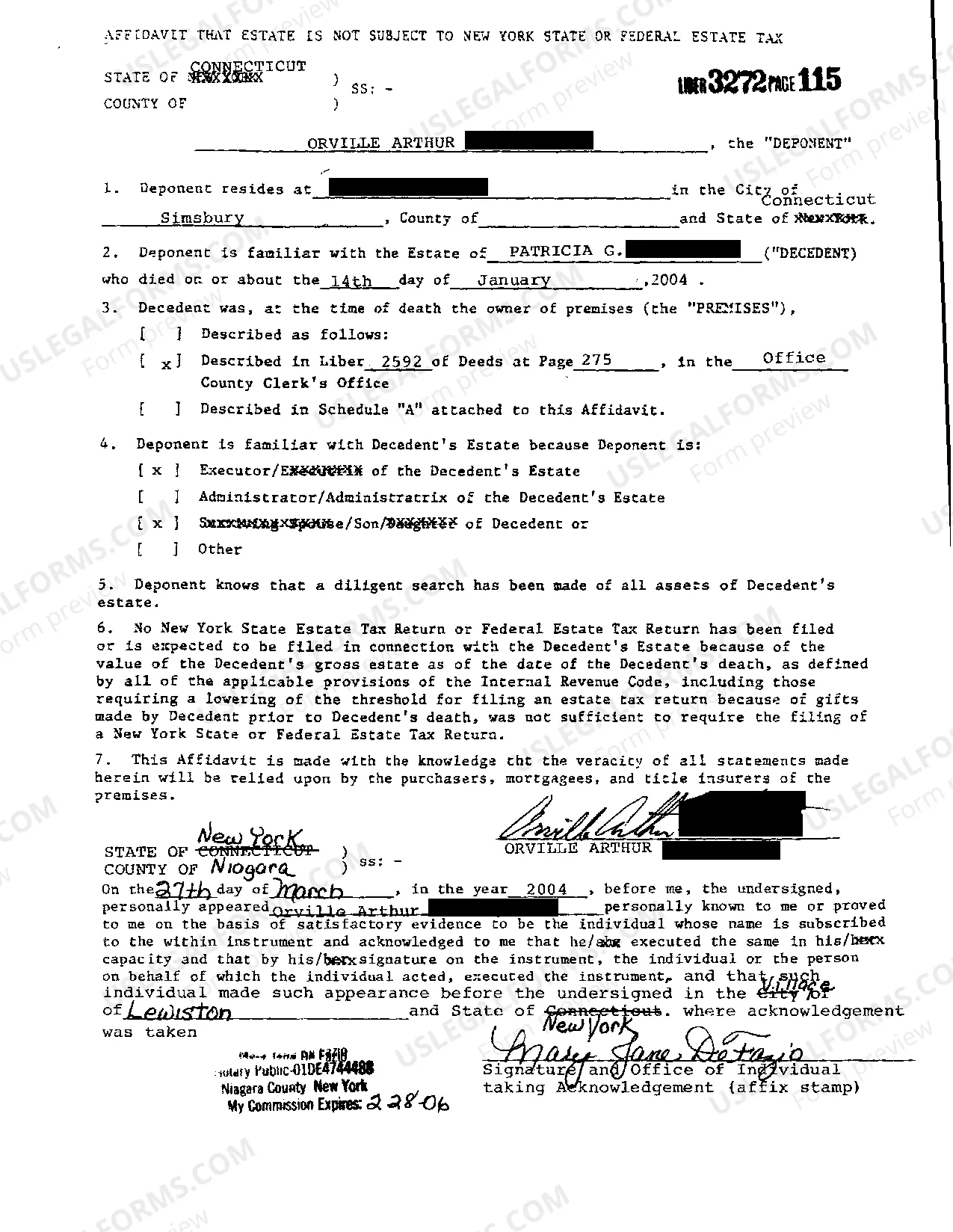

New York Affidavit Estate Not Subject To Federal or State Tax

Description New York State Estate Tax

How to fill out New York Affidavit Estate Not Subject To Federal Or State Tax?

Among lots of paid and free samples that you can get online, you can't be certain about their accuracy. For example, who created them or if they are qualified enough to deal with what you need these people to. Keep calm and utilize US Legal Forms! Locate New York Affidavit Estate Not Subject To Federal or State Tax samples made by skilled lawyers and avoid the costly and time-consuming procedure of looking for an attorney and after that having to pay them to draft a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you’re seeking. You'll also be able to access all of your previously downloaded samples in the My Forms menu.

If you are utilizing our platform the very first time, follow the guidelines listed below to get your New York Affidavit Estate Not Subject To Federal or State Tax fast:

- Make sure that the document you see applies in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another template using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you’ve signed up and bought your subscription, you can utilize your New York Affidavit Estate Not Subject To Federal or State Tax as many times as you need or for as long as it stays active where you live. Change it in your favored offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

New York Estate Tax Form popularity

FAQ

Technically speaking there is no federal inheritance tax, but there is a federal estate tax. The estate's personal representative or executor is responsible for filing the necessary documents with the Internal Revenue Service (IRS), and for paying any tax that might be owed.

All the assets of a deceased person that are worth $11.70 million or more, as of 2021, are subject to federal estate taxes. 12 states and the District of Columbia also charge estate taxes, but the rules are different depending on the state.

You can start giving money to your heirs now, and it will reduce the value of your estate.Start gifting money to family and friends up to $15,000 per person per year, or $30,000 if married and if you can get your estate value down below the exemption, you can avoid paying estate taxes later.

Introduction. An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. Unlike the federal estate tax, the beneficiary of the property is responsible for paying the tax, not the estate. However, as of 2020, only six states impose an inheritance tax.

Eleven states have only an estate tax: Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. Washington, D.C. does, as well. Estate taxes are levied on the value of a decedent's assets after debts have been paid.

Reduce taxable estate through gifting. For those with estates at or slightly above the exclusion amount, they may wish consider lifetime gifts as a means of reducing their taxable estates. In addition, charitable gifts in your Will can reduce your taxable estate.

New York does not have an inheritance tax, so there wouldn't be an inheritance tax owed on property owned in New York.A federal estate tax may also be incurred on estates that exceed the federal exemption, presently $11.85 million for decedents dying in 2020.

The estate tax is a tax on a person's assets after death. In 2020, federal estate tax generally applies to assets over $11.58 million. Estate tax rate ranges from 18% to 40%. Some states also have estate taxes.

Give Gifts. One way to get around the estate tax is to hand off portions of your wealth to your family members through gifts. Set up an Irrevocable Life Insurance Trust. Make Charitable Donations. Establish a Family Limited Partnership. Fund a Qualified Personal Residence Trust.