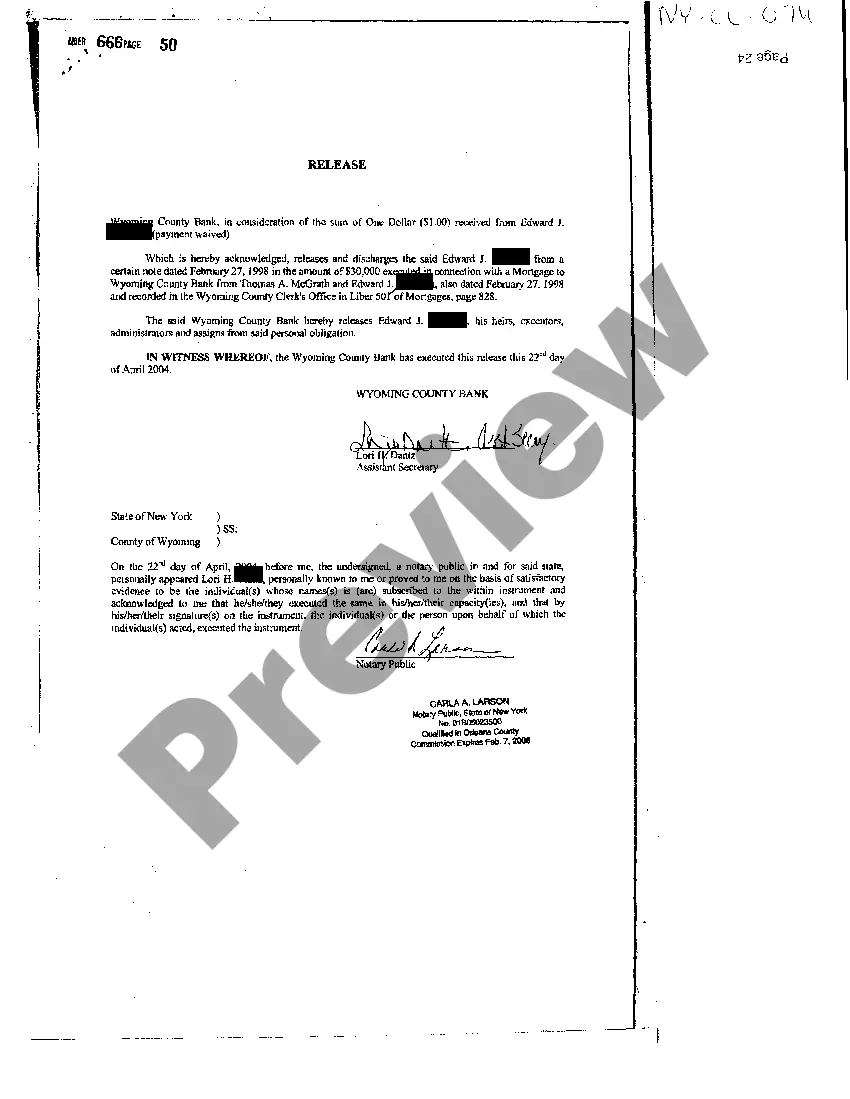

New York Release of Loan Obligation

Description

How to fill out New York Release Of Loan Obligation?

Among numerous paid and free samples that you’re able to find on the web, you can't be sure about their accuracy and reliability. For example, who made them or if they are competent enough to take care of what you require them to. Keep calm and utilize US Legal Forms! Get New York Release of Loan Obligation samples made by skilled attorneys and avoid the expensive and time-consuming process of looking for an attorney and then having to pay them to write a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access your earlier saved files in the My Forms menu.

If you are utilizing our platform the first time, follow the guidelines below to get your New York Release of Loan Obligation fast:

- Make sure that the document you discover applies where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you’ve signed up and bought your subscription, you can utilize your New York Release of Loan Obligation as often as you need or for as long as it stays valid where you live. Change it in your favorite editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

A discharge of mortgage is removing a home loan from the title of your property. When you have a home loan, the bank holds the Certificate of Title on your property until the home loan is repaid.

Notwithstanding any other provision of law, the unpaid balance of the loan or forbearance may be prepaid, in whole or in part, at any time. If prepayment is made on or after one year from the date the loan or forbearance is made, no penalty may be imposed.

The statute of limitations in New York is six years for any type of debt. The six-year time period is counted from when a debt repayment became due or when the debtor made the most recent payment, whichever is more recent.

You may be surprised to learn that money judgments in New York are enforceable for a period of twenty (20) years. That judgment can be enforced against any property you have that can be assigned or transferred (such as money, bank accounts and real property).

So, there is a time limit for starting cases. This is called the "statute of limitations." The statute of limitations for filing a debt collection lawsuit for a "consumer credit transaction" is 6 years, counting from the "date of the default." The "date of the default" is about 30 days after you last made a payment.

This practice is legal. However, consumers should understand that in New York a creditor has six years to sue a debtor to collect on the amount owed. Although a creditor may attempt to sue a debtor after this period of time, the creditor may not be successful.

It means that you have no personal liability on the mortgage, but the lender still has a lien on the house for payment of the loan. If you don't make your payments on time, the lender can foreclose and require the trustee to sell the property.

However, consumers should understand that in New York a creditor has six years to sue a debtor to collect on the amount owed. Although a creditor may attempt to sue a debtor after this period of time, the creditor may not be successful.

The statute of limitations in New York is six years for any type of debt. The six-year time period is counted from when a debt repayment became due or when the debtor made the most recent payment, whichever is more recent.