The New York Additional Notice of Consumer Credit Action is a document that must be provided to consumers when an action has been taken on their consumer credit account. This includes when a collection agency has placed a collection on the consumer’s account, when a credit report has been updated, or when a creditor has taken action against the consumer. The notice must include the name of the creditor or collection agency, the amount of the debt, the date the consumer was notified, the type of action taken, the consumer’s rights, and any additional information related to the action. There are two types of New York Additional Notice of Consumer Credit Action: a Notice of Collection and a Notice of Credit Report Update.

New York Additional Notice of Consumer Credit Action

Description

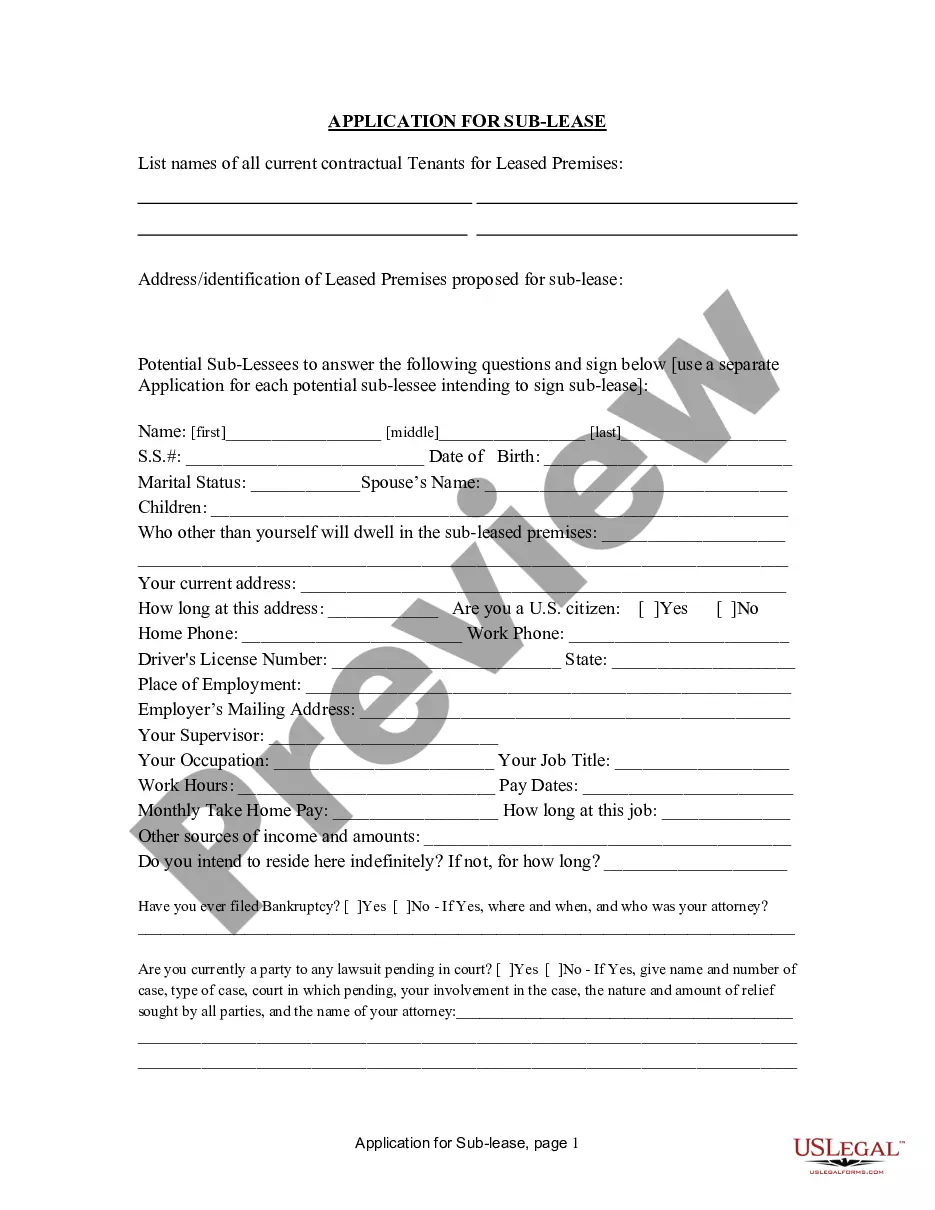

How to fill out New York Additional Notice Of Consumer Credit Action?

US Legal Forms is the most easy and affordable way to find suitable legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and verified by legal professionals. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your New York Additional Notice of Consumer Credit Action.

Obtaining your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted New York Additional Notice of Consumer Credit Action if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your needs, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you like most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Additional Notice of Consumer Credit Action and save it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

The judgment will appear on the defendant's credit report, and it can be there for up to seven years if it is not paid. The judgment also gives the plaintiff the right to collect money from the defendant's bank account or salary.

Thanks to a law passed in 2021, the statute of limitations of debt in New York is three years, which means that's how much time a debt collector has to file a lawsuit to recover the debt through the court system.

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt. State where you live.

Although the unpaid debt will go on your credit report and cause a negative impact to your score, the good news is that it won't last forever. Debt after 7 years, unpaid credit card debt falls off of credit reports. The debt doesn't vanish completely, but it'll no longer impact your credit score.

You can either answer the summons in writing or in person. If you answer in person, you must go to the courthouse clerk's office and tell the clerk about your defenses to the plaintiff's claims. The clerk will check off the boxes in a Consumer Credit Transaction Answer In Person form.

What benefits does the Consumer Credit Fairness Act give to debtors? By reducing the statute of limitations for debt collection lawsuits from six years to three years, the Consumer Credit Fairness Act will significantly reduce the amount of debt involved in a lawsuit.

Summary: The statute of limitations on most debt in New York is just three years. This means that creditors and debt collectors only have three years from the date of the last activity on an account to sue someone for a debt.

New York Judgment Statute of Limitations The statute of limitations for collecting on a New York judgment is 20 years, which starts the day the judgment creditor is first able to collect on the judgment. This timeline can sometimes be restarted.

Statute of Limitations in New York Thanks to a law passed in 2021, the statute of limitations of debt in New York is three years, which means that's how much time a debt collector has to file a lawsuit to recover the debt through the court system.