Schedule C — Sales, Transfers, and Returnstampededed Cigarettes Outside New York State is a form issued by the New York State Department of Taxation and Finance. It is used to report sales, transfers, and returns of stamped cigarettes to purchasers located outside New York State. This is required by law for taxable cigarette sales. There are three different types of Schedule C — Sales, Transfers, and Returnstampededed Cigarettes Outside New York State: 1. Schedule C-1: This is used to report sales, transfers, and returns of stamped cigarettes to purchasers located outside New York State. 2. Schedule C-2: This is used to report sales, transfers, and returns of stamped cigarettes to purchasers located within New York State. 3. Schedule C-3: This is used to report sales, transfers, and returns of stamped cigarettes to purchasers located in Canada.

Schedule C - Sales, Transfers, and Returns of Unstamped Cigarettes Outside New York State

Description New York State

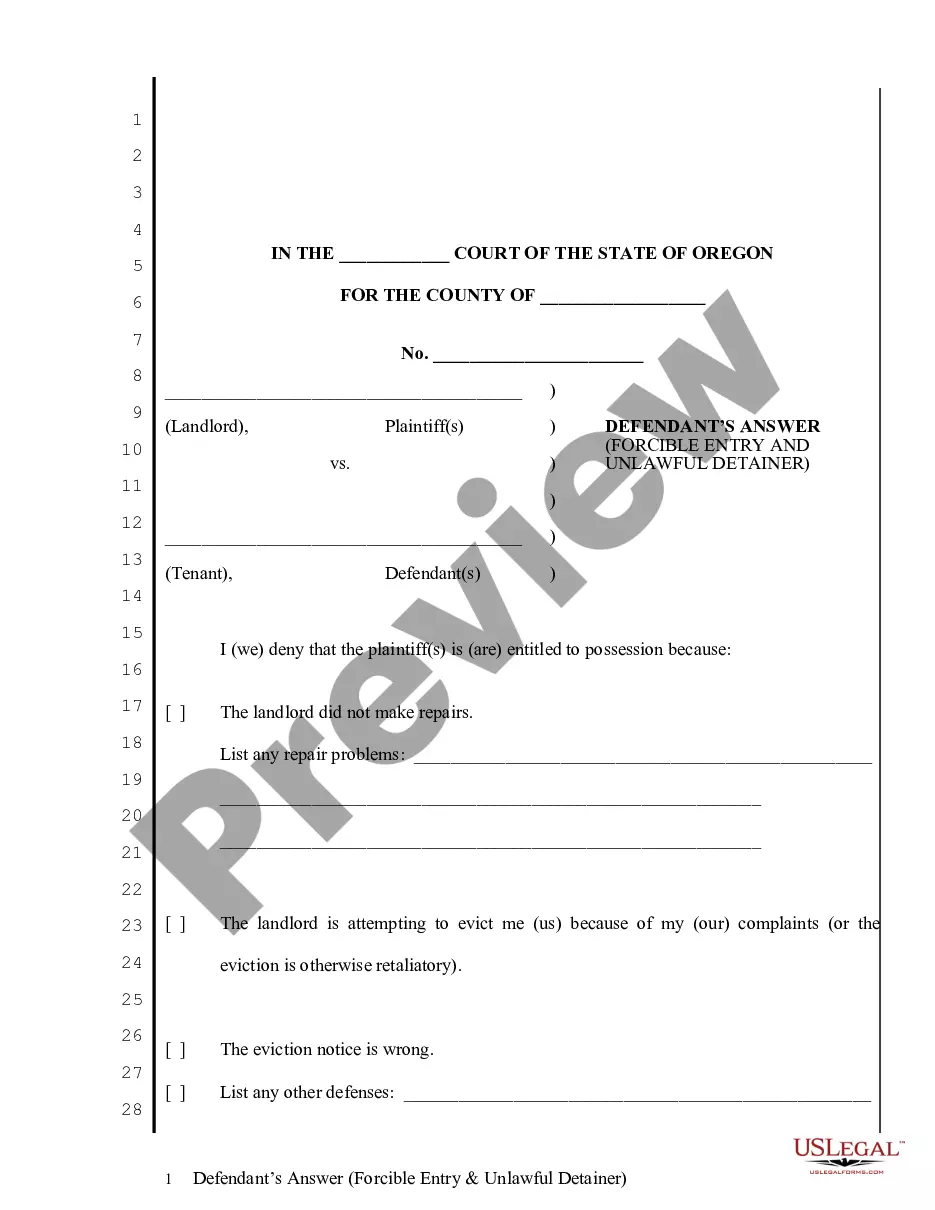

How to fill out Schedule C - Sales, Transfers, And Returns Of Unstamped Cigarettes Outside New York State?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state regulations and are verified by our specialists. So if you need to complete Schedule C - Sales, Transfers, and Returns of Unstamped Cigarettes Outside New York State, our service is the perfect place to download it.

Obtaining your Schedule C - Sales, Transfers, and Returns of Unstamped Cigarettes Outside New York State from our service is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they locate the correct template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it suits your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Schedule C - Sales, Transfers, and Returns of Unstamped Cigarettes Outside New York State and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Sales of tangible personal property are subject to New York sales tax unless they are specifically exempt. Sales of services are generally exempt from New York sales tax unless they are specifically taxable.

When it comes to sales tax laws, New York doesn't mess around. In fact, the state of New York was one of the first states with online sales tax laws requiring out-of-state sellers to remit sales tax to New York. Although this law was in place for decades, Supreme Court rulings prior to the South Dakota v. Wayfair Inc.

The prepaid tax equals the base retail price of cigarettes, multiplied by the 8% prepaid sales tax rate. This is then rounded to the nearest cent for the pack of cigarettes. The base retail sales price, effective September 1, 2022, is $12.110 for a pack of 20 cigarettes and $3.025 for each additional five cigarettes.

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

New York generally uses destination-based sourcing. In New York, the sales tax rate is generally determined by the point of delivery, which is where ownership and/or possession of the item is transferred by the seller to the purchaser.

Excise taxes are usually levied on the sale and production for sale of tobacco products, resulting in the price offered to buyers being higher relative to the cost of other goods and services.

Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax. Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

New York City charges sales tax on the sale or use of certain items and services, including but not limited to: Clothing and footwear purchases. Physical personal property. Prepared food and beverages such as candy, soft drinks, alcoholic beverages, sandwiches, and heated foods.