New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan is an application for employers in New York to establish an Association Union or Trustee Plan that meets the requirements of the Internal Revenue Code. The application is used by employers to obtain approval from the Internal Revenue Service (IRS) to accept employer contributions to the plan. There are two types of New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan: Form 5300 and Form 5310. Form 5300 is used by employers to establish a retirement plan, such as a 401k plan, profit sharing plan, or a stock bonus plan. It is also used to amend existing plans, including changing the plan’s eligibility, vesting, and contribution requirements. Form 5310 is used by employers to apply for a determination letter from the IRS to accept employer contributions to an existing plan. The letter will also specify the types of assets that can be held in the plan.

New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan

Description

How to fill out New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan?

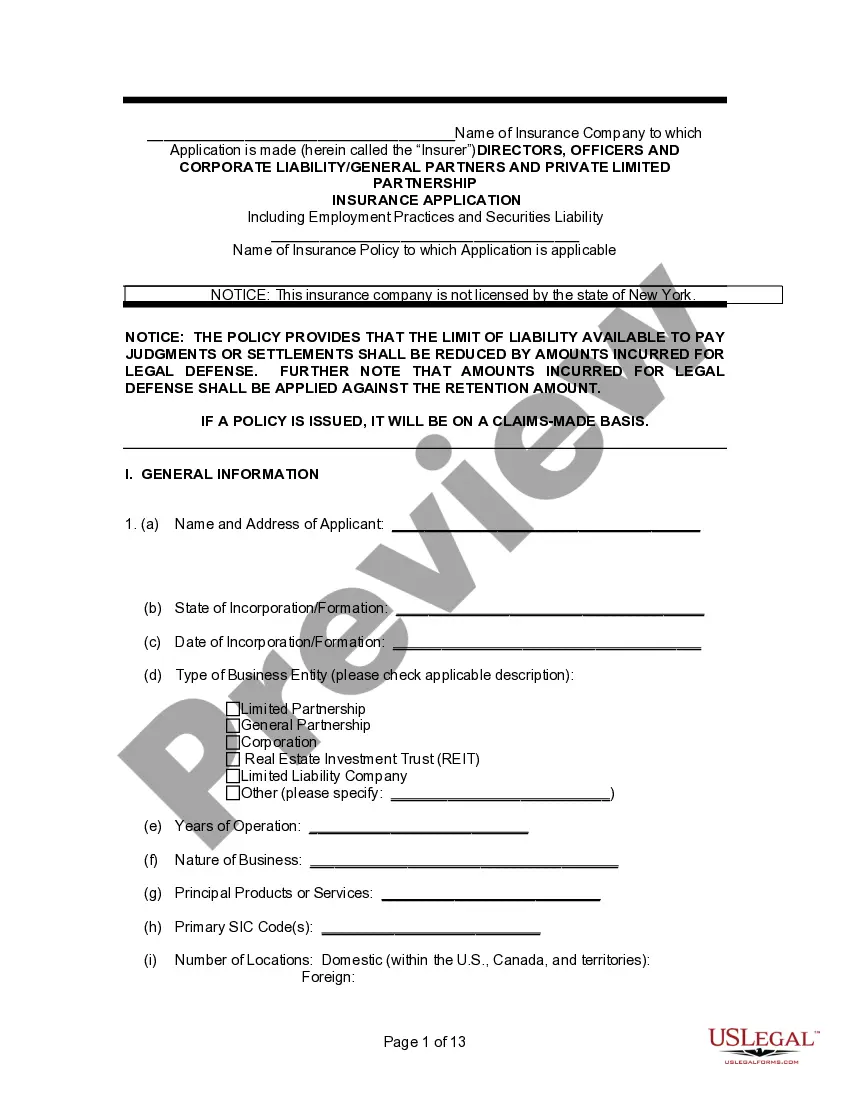

Handling legal documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan template from our service, you can be sure it complies with federal and state regulations.

Working with our service is simple and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan within minutes:

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan in the format you need. If it’s your first time with our service, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the New York Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

You cannot work due to a medical condition; You cannot do work that you did before; We decide that you cannot adjust to other work because of your medical condition(s); and. Your disability has lasted or is expected to last for at least one year or to result in death.

Report the injury online via NYSIF eFROI (electronic first report of injury). Use our eFROI Worksheet to help you submit your report or view our comprehensive eFROI User Guide. Call the 24/7 Accident Reporting Hotline phone at 1-844-879-2692.

After a seven-calendar-day waiting period or the exhaustion of your sick leave accruals (whichever is greater), you receive 50 percent of your average salary for the eight weeks before disability, up to the maximum benefit established under the New York State Disability Benefits Law, currently $170 per week.

Voluntary Short Term Disability You can receive income replacement benefits for up to 26 weeks. An employee working at least 50 percent of full time on a regular appointment and whose annual salary is at least $15,000 is eligible to enroll in the plan.

Employees with a regular work schedule of 20 or more hours per week are eligible after 26 consecutive weeks of employment preceding the first full day of leave. Employees with a regular work schedule of fewer than 20 hours per week are eligible after 175 days worked preceding the first full day of leave.

SI-12 (7/09) Affidavit Certifying That Compensation Has Been Secured. Employers with Board-approved self-insurance for workers' compensation. Filed with the government agency issuing a permit, license or contract. The SI-12 must be completed by the Board's Self-Insurance Office and approved by the Board's Secretary.

To file an NY DBL/PFL disability claim, call (866) 274-9887.