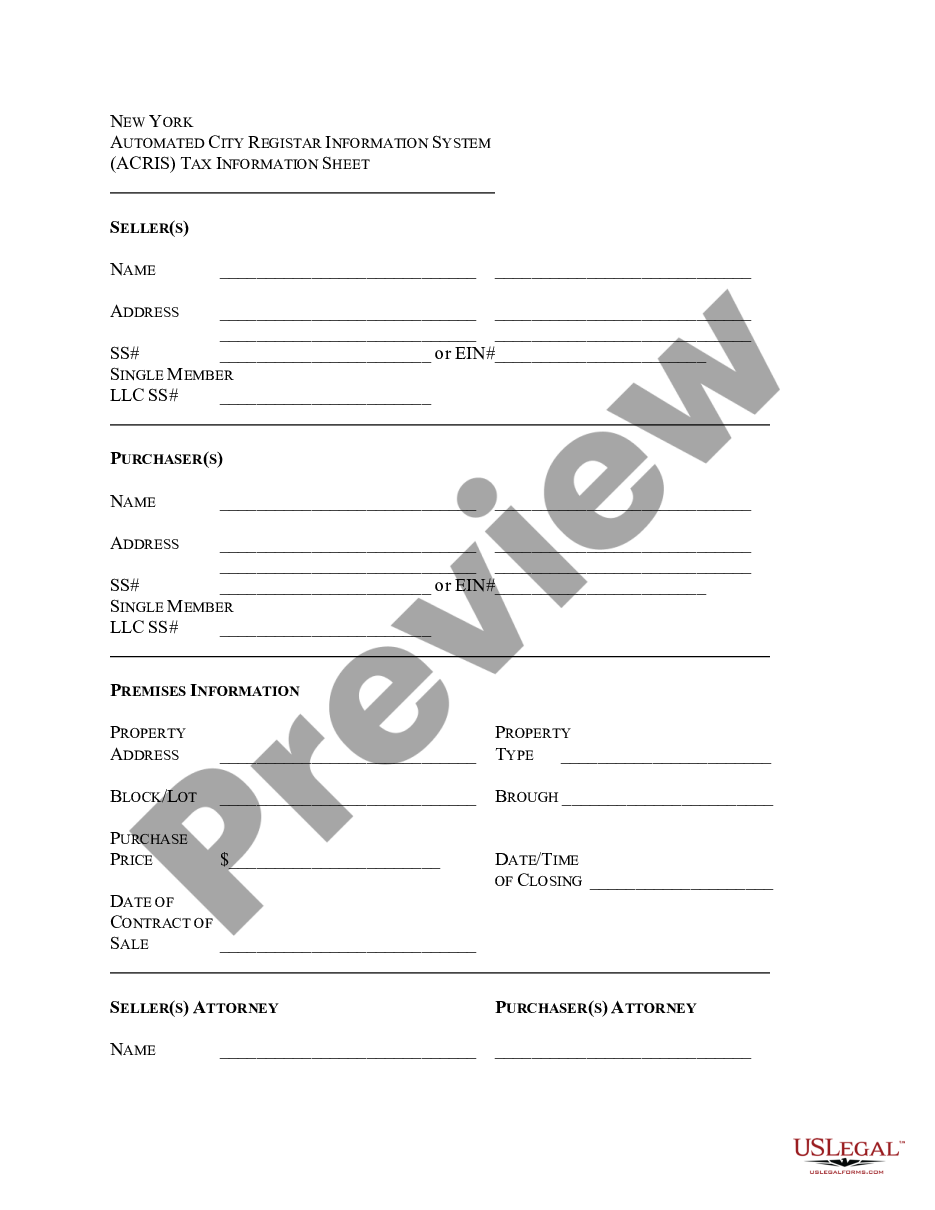

New York Application-Partial Tax Exemption For New Multiple Dwellings is a program that allows new multiple dwellings to receive a partial tax exemption. This exemption applies to both real estate taxes and any applicable mortgage recording taxes. The application must be filed with the New York State Department of Taxation and Finance for the property to be eligible for the tax exemption. There are two types of New York Application-Partial Tax Exemption For New Multiple Dwellings: 421-a and J-51. 421-a is an exemption for new multiple dwellings built between January 1, 1974, and June 15, 2019, that are used for residential purposes and are located in certain New York City neighborhoods. Under the 421-a program, the property owner receives a partial tax exemption for a period of 10 to 25 years. J-51 is an exemption for new multiple dwellings built or substantially renovated after January 1, 1974. This program provides a partial tax exemption for a period of 10 to 25 years for new multiple dwellings that are used for residential purposes and that have received certain property improvements.

New York Application-Partial Tax Exemption For New Multiple Dwellings

Description

How to fill out New York Application-Partial Tax Exemption For New Multiple Dwellings?

US Legal Forms is the most simple and profitable way to find appropriate formal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and verified by legal professionals. Here, you can find printable and fillable templates that comply with national and local laws - just like your New York Application-Partial Tax Exemption For New Multiple Dwellings.

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted New York Application-Partial Tax Exemption For New Multiple Dwellings if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one meeting your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your New York Application-Partial Tax Exemption For New Multiple Dwellings and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the corresponding official paperwork. Try it out!

Form popularity

FAQ

421-a Tax Abatement Enhanced 35-year Benefit The benefit includes 100% real estate tax exemption for up to three years during the construction period and an additional 35 years after construction. Overall, for the first 25 years of the tax abatement, projects will receive a 100% tax exemption.

Homestead Exemption New York City property tax exemptions are only available for your primary residence. If you have moved outside of New York City and have a new primary residence, you must submit a property tax exemption removal request to the NYC Department of Finance.

The amount of a 421a abatement is determined by the percentage of property tax that is abated in the benefit year. For all term lengths, the abatement percentage starts at 100% in benefit year 1 and phases out based on a set schedule over the 10-year, 15-year, 20-year, or 25-year term.

What is 421-a? ?421-a? refers to a section of the New York State Real Property Tax Law that exempts certain new multiple dwellings from local property taxation.

Plan B for 421a. Developers admitted taking a ?leap of faith? when they pitched a $2 billion transformation of five blocks of parking lots and industrial buildings in Astoria, Queens. The most publicized aspect of their risk paid off: The City Council approved the rezoning they needed to build more than 3,000 homes.

Real Property Tax Law, section 467, gives local governments and public school districts the option of granting a reduction in the amount of property taxes paid by qualifying senior citizens. To qualify, seniors must be 65 years of age or older, meet certain income limitations, and other requirements.

The 421-a tax exemption is a property tax exemption in the U.S. state of New York that is given to real-estate developers for building new multifamily residential housing buildings in New York City.

The New 421-a Program is available to projects that commence construction between January 1, 2016 and June 15, 2022, and are completed on or before June 15, 2026.