New York RPIE-2017 Worksheet and Instructions for Hotels is a form used to assist hotel owners in filing their property tax returns with the New York City Department of Finance. This form is used to report income and expenses from a hotel's rental operations. The worksheet and instructions provide guidance on how to compute the Real Property Income and Expense (PIE) tax due, which is based on the hotel's gross income and expenses. There are three types of New York RPIE-2017 Worksheet and Instructions for Hotels: 1) Hotel RPIE-2017 Worksheet and Instructions (for hotels located in New York City); 2) Hotel RPIE-2017 Worksheet and Instructions (for hotels located outside New York City); and 3) Hotel RPIE-2017 Worksheet and Instructions — Vacancy Adjustment (for hotels located in New York City). These forms provide information on how to report income and expenses for the hotel, such as room rental income, occupancy taxes, and other related expenses. Additionally, the instructions provide information on how to compute and report vacancy adjustments. These forms are used for filing purposes only and do not serve as a substitute for a hotel's financial records.

New York RPIE-2017 Worksheet and Instructions for Hotels

Description

How to fill out New York RPIE-2017 Worksheet And Instructions For Hotels?

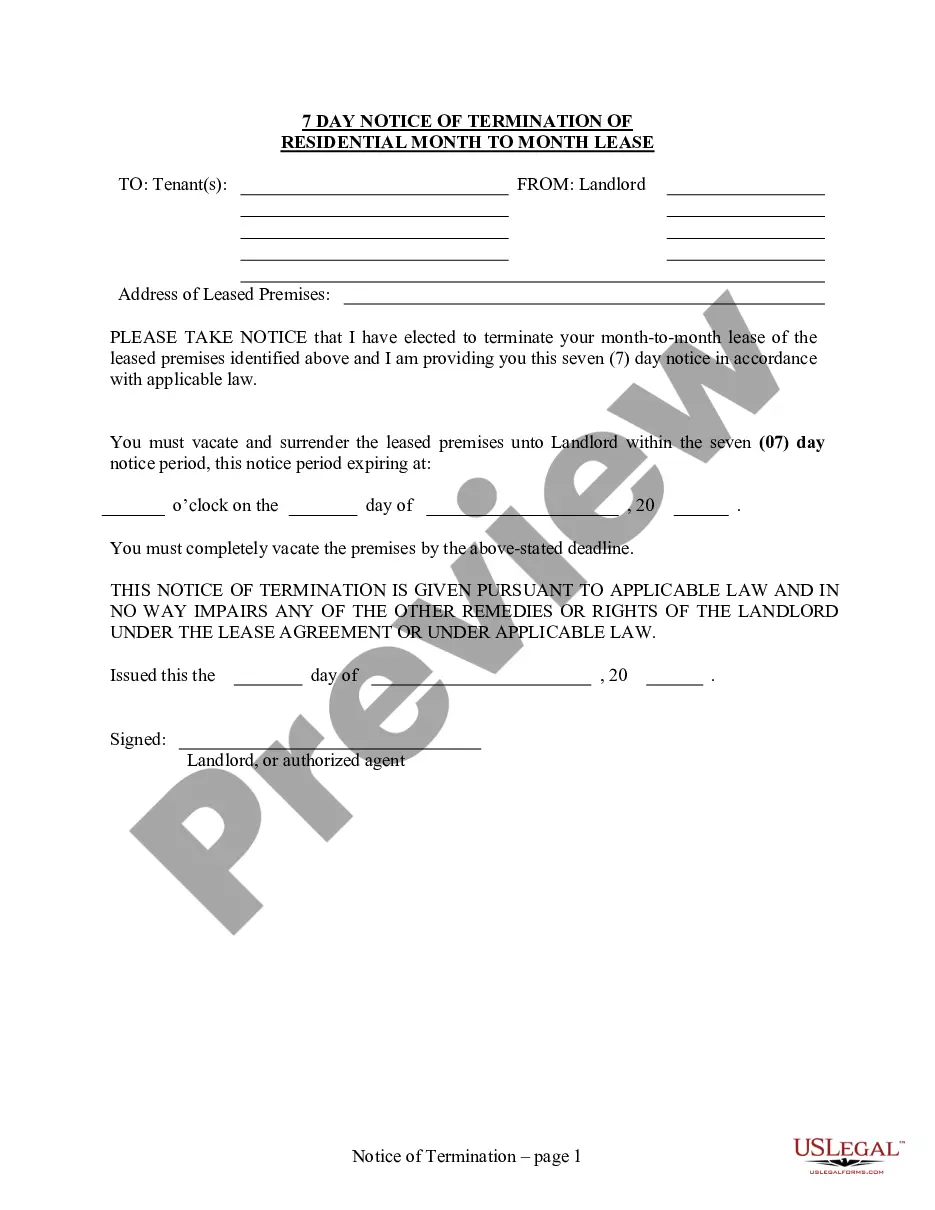

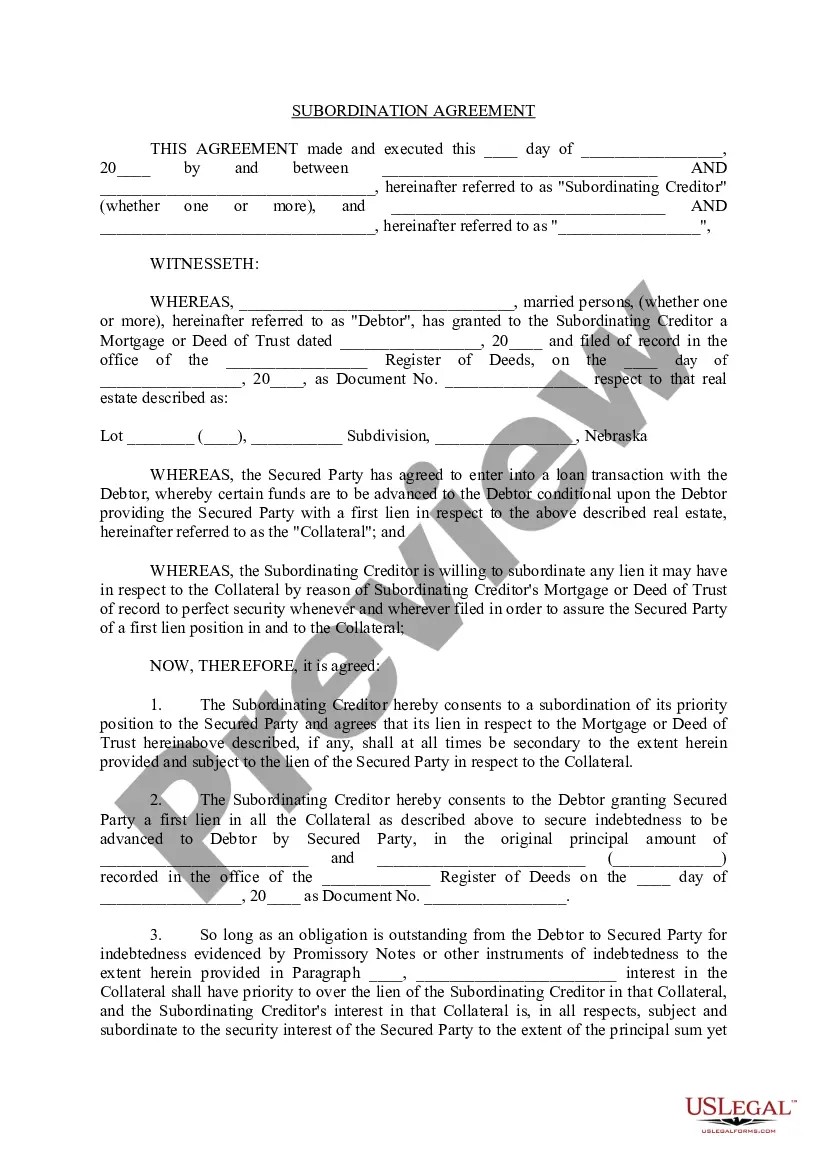

How much time and resources do you usually spend on composing official documentation? There’s a greater option to get such forms than hiring legal specialists or wasting hours browsing the web for a suitable blank. US Legal Forms is the premier online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the New York RPIE-2017 Worksheet and Instructions for Hotels.

To obtain and prepare a suitable New York RPIE-2017 Worksheet and Instructions for Hotels blank, adhere to these simple instructions:

- Examine the form content to ensure it complies with your state regulations. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, find a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the New York RPIE-2017 Worksheet and Instructions for Hotels. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely secure for that.

- Download your New York RPIE-2017 Worksheet and Instructions for Hotels on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us today!

Form popularity

FAQ

Filing Instructions: Utility Properties Visit the REUC-RPIE filing portal. Help screens and form instructions are accessible from the top right hand of every screen. Create a password for each property that you must file. You can re-enter the system to amend or complete your RPIE using this password.

Amend an RPIE You can amend a submitted RPIE. Amend a submitted RPIE electronically using your NYC.ID. You are only allowed to file RPIE for the current RPIE year. For example, RPIE-2022 is filed in 2023.

Penalty Amount Owners required to file a claim of exclusion who do not submit a claim will be fined $100. Owners who fail to file a claim of exclusion in two consecutive years will be fined $500.

Who Is Required to File an RPIE? If you own an income-producing property with an actual assessed value greater than $40,000 on the Department of Finance's tentative assessment roll, you are required to file an annual RPIE statement.

Filing Instructions: Utility Properties Visit the REUC-RPIE filing portal.Create a password for each property that you must file.Enter the requested information on each screen. You will be instructed to submit the application electronically.