A New York Certificate of Amendment of Certificate of Incorporation (Domestic Not For Profit Corp) is a legal document used to make changes to an existing New York not-for-profit corporation. This certificate is filed with the New York Department of State and is used to amend the articles of incorporation of a New York not-for-profit corporation. The types of changes that can be made to the articles of incorporation include adjustments to the corporate name, purpose, powers, duration, and capital structure. The amendment must be approved by the board of directors and a majority of the shareholders before it can be filed. Once the amendment is filed, it becomes part of the corporation's official records.

New York Certificate of Amendment of Certificate of Incorporation (Domestic Not For Profit Corp)

Description

How to fill out New York Certificate Of Amendment Of Certificate Of Incorporation (Domestic Not For Profit Corp)?

If you’re searching for a way to appropriately complete the New York Certificate of Amendment of Certificate of Incorporation (Domestic Not For Profit Corp) without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business situation. Every piece of documentation you find on our online service is drafted in accordance with federal and state laws, so you can be sure that your documents are in order.

Follow these simple guidelines on how to get the ready-to-use New York Certificate of Amendment of Certificate of Incorporation (Domestic Not For Profit Corp):

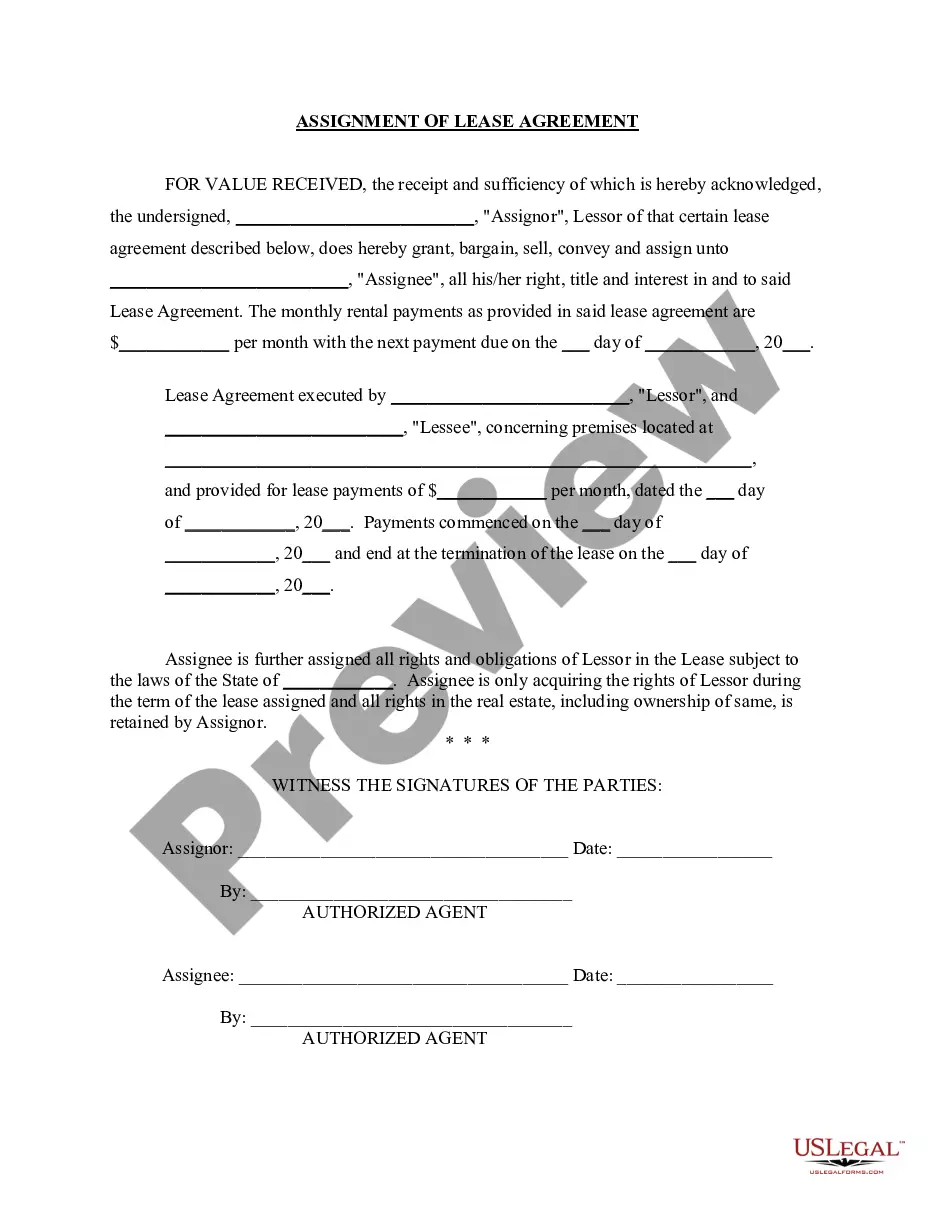

- Make sure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the list to find another template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your New York Certificate of Amendment of Certificate of Incorporation (Domestic Not For Profit Corp) and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

A certificate of amendment is a legal document that amends the articles of incorporation. It can amend anything from the name and address to the number of shares available for issuance and voting rights.

Follow these steps for a smooth process when you add an owner to an LLC. Understand the consequences.Review your operating agreement.Decide on the specifics.Prepare and vote on an amendment to add an owner to LLC.Amend the articles of organization (if necessary)File any required tax forms.

To amend your corporation in New York, there is a $60 filing fee.

The name change must be approved by an organization's Board of Directors, or, if applicable, by its members. Pay close attention to bylaws, which may require a supermajority vote for changes to the certificate of incorporation. changing the purpose or other provisions of a certificate of incorporation.

How to File a New York Tax Amendment. If you need to change or amend an accepted New York State Income Tax Return for the current or previous Tax Year you need to complete Form IT 201-X. Form IT 201-X is a Form used for the Tax Return and Tax Amendment.

How to File Complete and file the Certificate of Amendment with the Department of State. The completed Certificate of Amendment, together with the statutory filing fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.