New York Certificate of Discontinuance of Assumed Name Form

Description

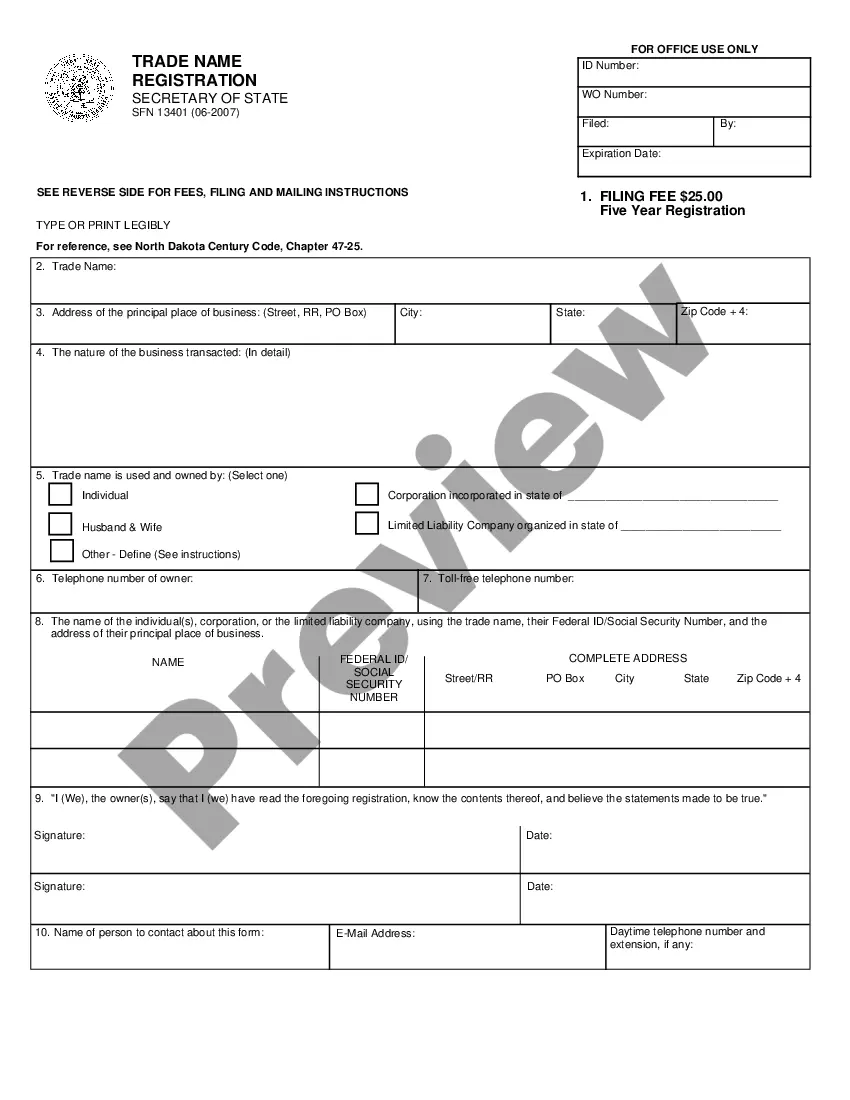

How to fill out New York Certificate Of Discontinuance Of Assumed Name Form?

Working with legal documentation requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New York Certificate of Discontinuance of Assumed Name Form template from our service, you can be sure it meets federal and state regulations.

Working with our service is straightforward and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your New York Certificate of Discontinuance of Assumed Name Form within minutes:

- Make sure to carefully look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New York Certificate of Discontinuance of Assumed Name Form in the format you prefer. If it’s your first experience with our service, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the New York Certificate of Discontinuance of Assumed Name Form you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

A DBA is required whenever a business is operating under a name other than its legal name. In the case of a sole proprietorship, you will need a DBA if you are operating under a name other than your own personal name. Partnerships in NY must always file a DBA in all counties where they transact business.

Complete and file the Certificate of Amendment with the Department of State. The completed Certificate of Amendment, together with the statutory filing fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

A DBA is discontinued when the individual or partners cease to conduct business. There is no fee involved in filing a discontinuance, but the form must be purchased and completed by the filer. In the case of a partnership, a majority of those listed must sign the document.

In New York State, DBAs have no expiration date and renewals aren't necessary. You do, however, need to file a Certificate of Discontinuance if you're no longer conducting business.

The fee is $100 for each county within New York City, which include the Bronx, Kings, New York, Queens, and Richmond. Counties outside of New York City cost $25 each. A total fee of $1,950 is currently charged for corporations to register for this certificate. Checks of $500 and more must be certified.

Complete and file the Certificate of Amendment with the Department of State. The completed Certificate of Amendment, together with the statutory filing fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

There are no annual renewal requirements; the trade name is yours for the foreseeable future. If you decide to cancel an assumed name for a corporation or LLC, you'll file a Certificate of Discontinuance with the state and pay a $25 fee. Paperwork and fees for county filings may vary.

Voluntary dissolution is generally a two-step process: Obtaining written consent from the Tax Department1 (which will check to see if the corporation owes back taxes and if it has filed all its returns)2; and. Filing paperwork with the New York Department of State, including a Certificate of Dissolution.