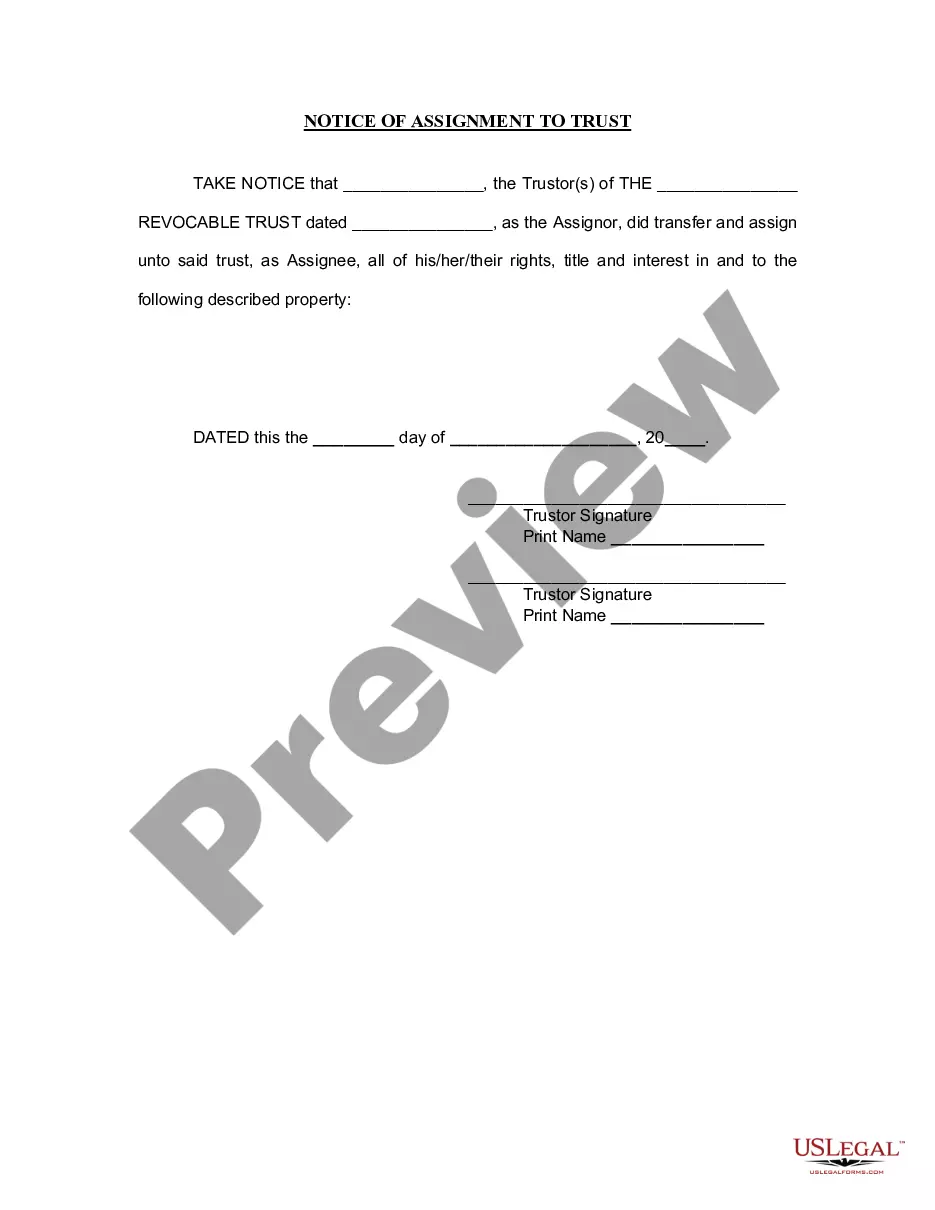

New York Notice of Assignment to Living Trust

Description New York Trust Template

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out New York Notice Of Assignment To Living Trust?

When it comes to filling out New York Notice of Assignment to Living Trust, you probably visualize an extensive process that requires getting a appropriate form among numerous very similar ones and then being forced to pay a lawyer to fill it out to suit your needs. Generally speaking, that’s a slow and expensive option. Use US Legal Forms and select the state-specific template in just clicks.

For those who have a subscription, just log in and then click Download to find the New York Notice of Assignment to Living Trust form.

In the event you don’t have an account yet but want one, stick to the step-by-step guide listed below:

- Make sure the document you’re saving is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and through clicking the Preview function (if offered) to find out the form’s information.

- Simply click Buy Now.

- Select the appropriate plan for your financial budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Find the document on your device or in your My Forms folder.

Professional lawyers work on creating our samples so that after saving, you don't have to bother about editing content outside of your individual details or your business’s details. Join US Legal Forms and get your New York Notice of Assignment to Living Trust sample now.

Notice Living Trust Form popularity

Notice Of Assignment Other Form Names

FAQ

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

New York State law does not currently require a trustee to disclose any information relating to the trust unless requested to do so by a beneficiary.Generally, at a minimum, it is recommended that a trustee provides a copy of the trust and the contact information of the trustee to all the current beneficiaries.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.