New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday

Description Pay Notice Payday

How to fill out Rate Employees Complete?

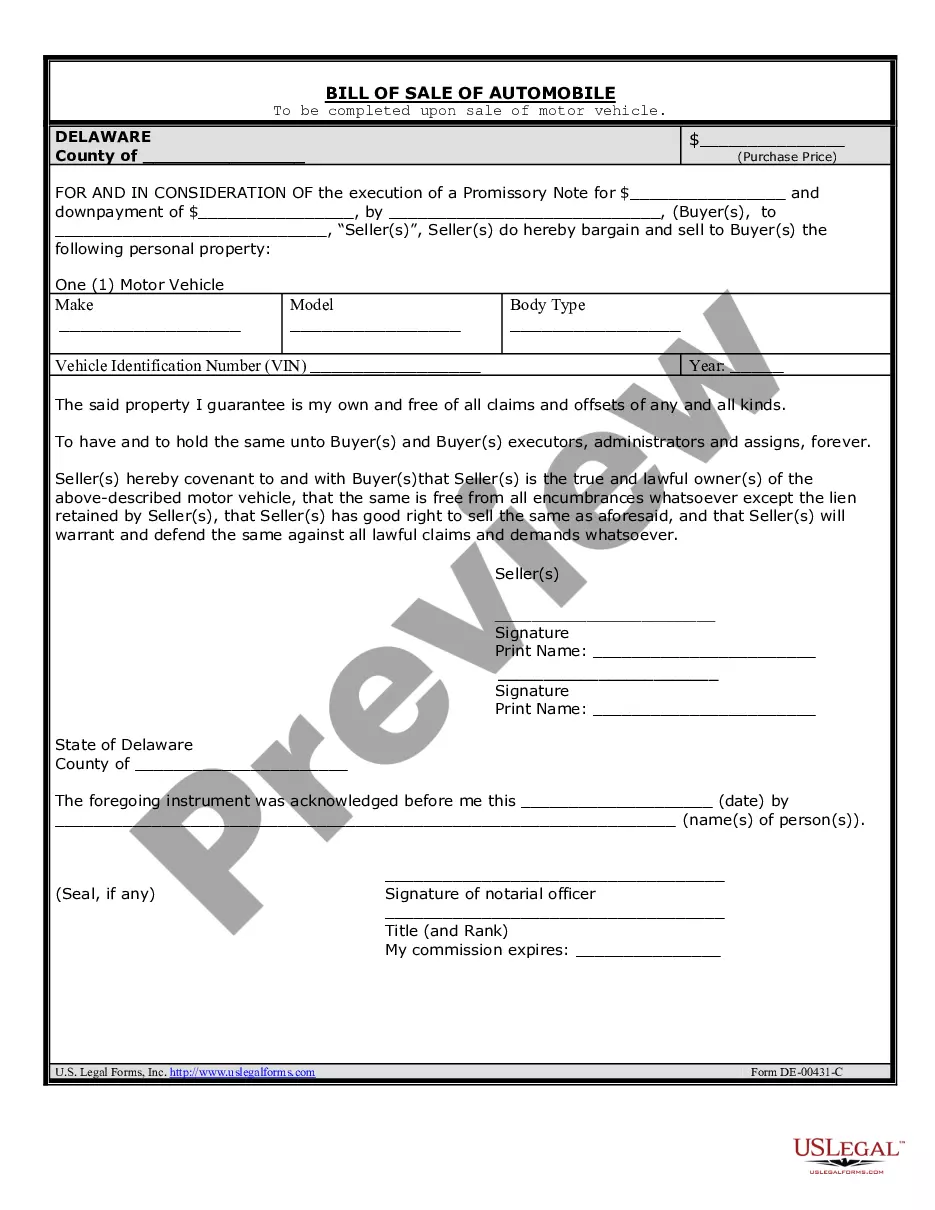

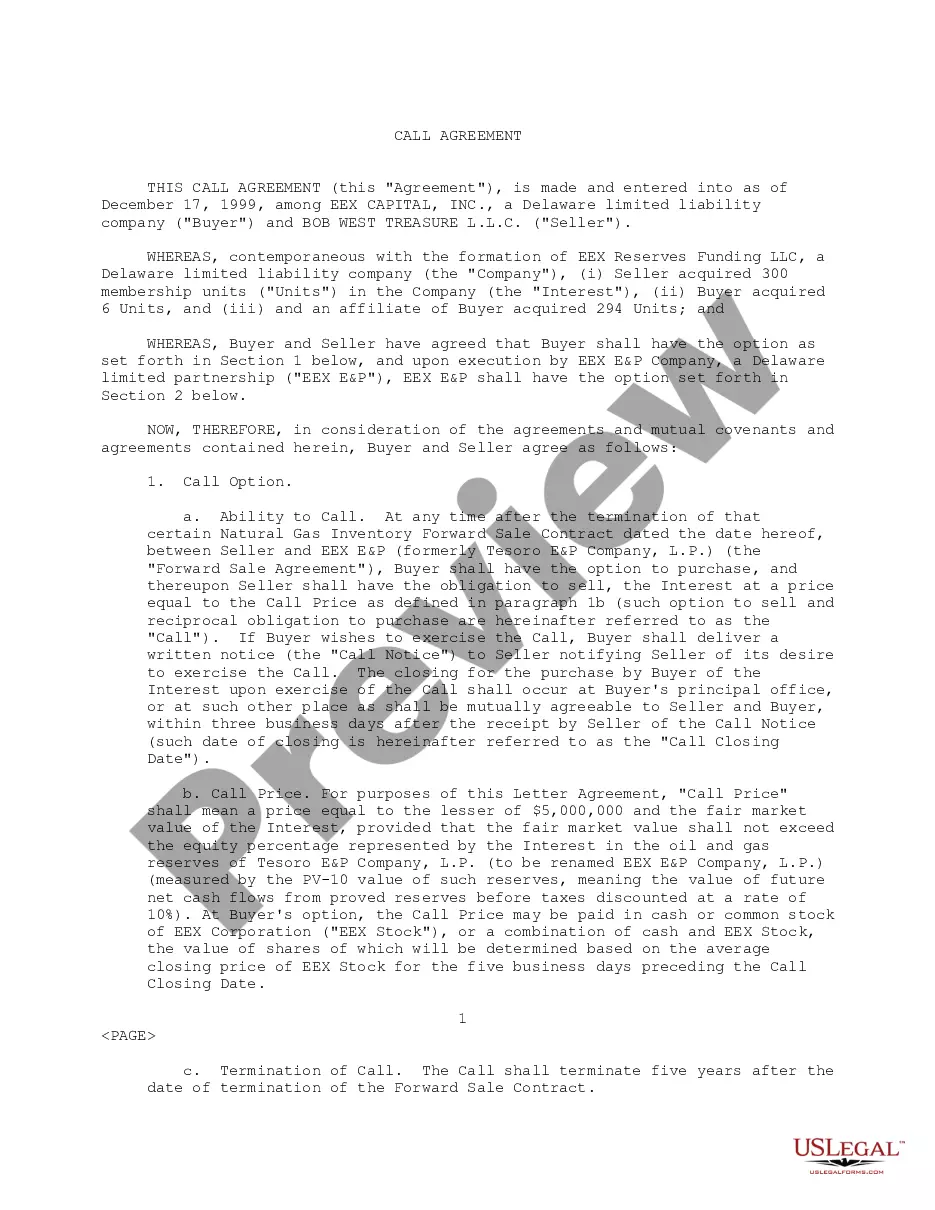

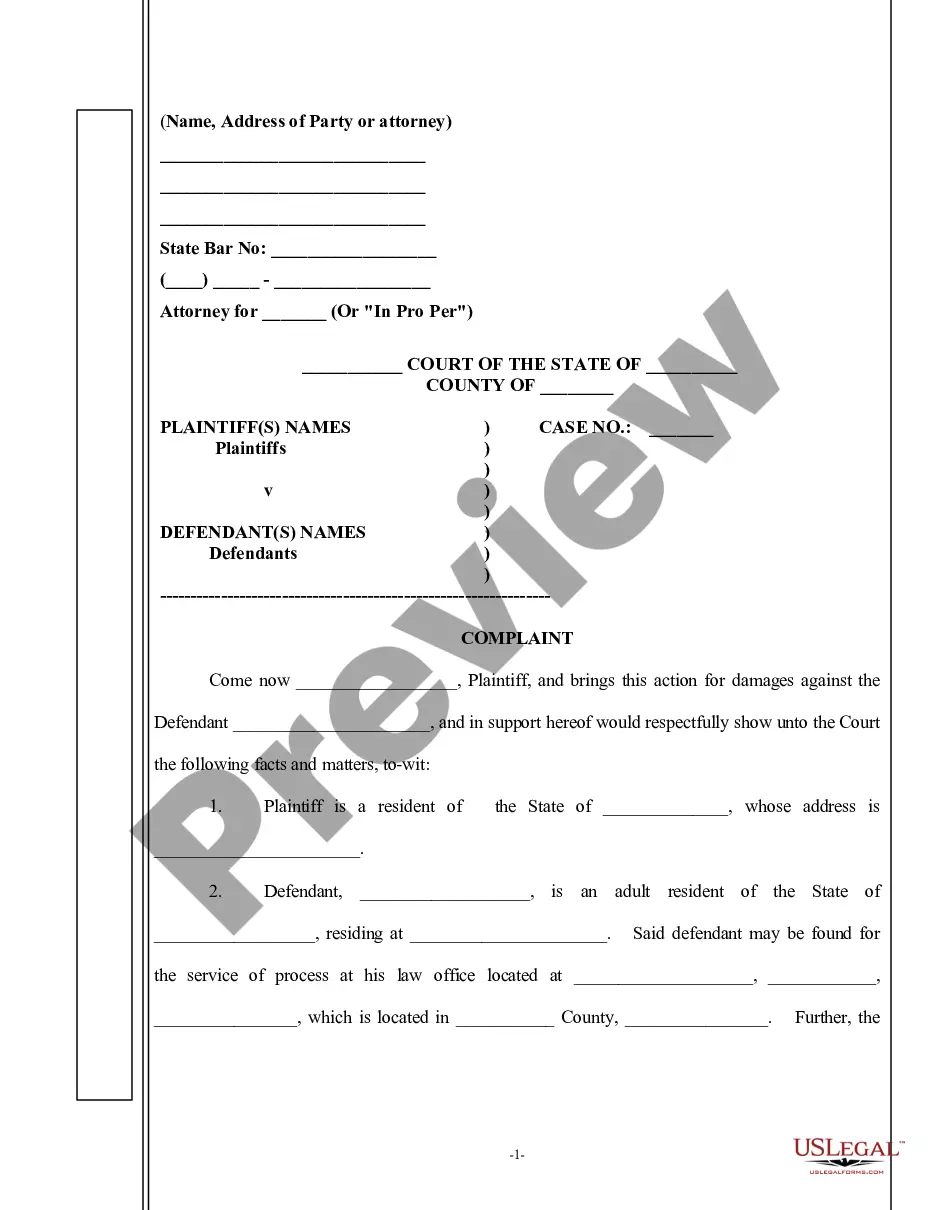

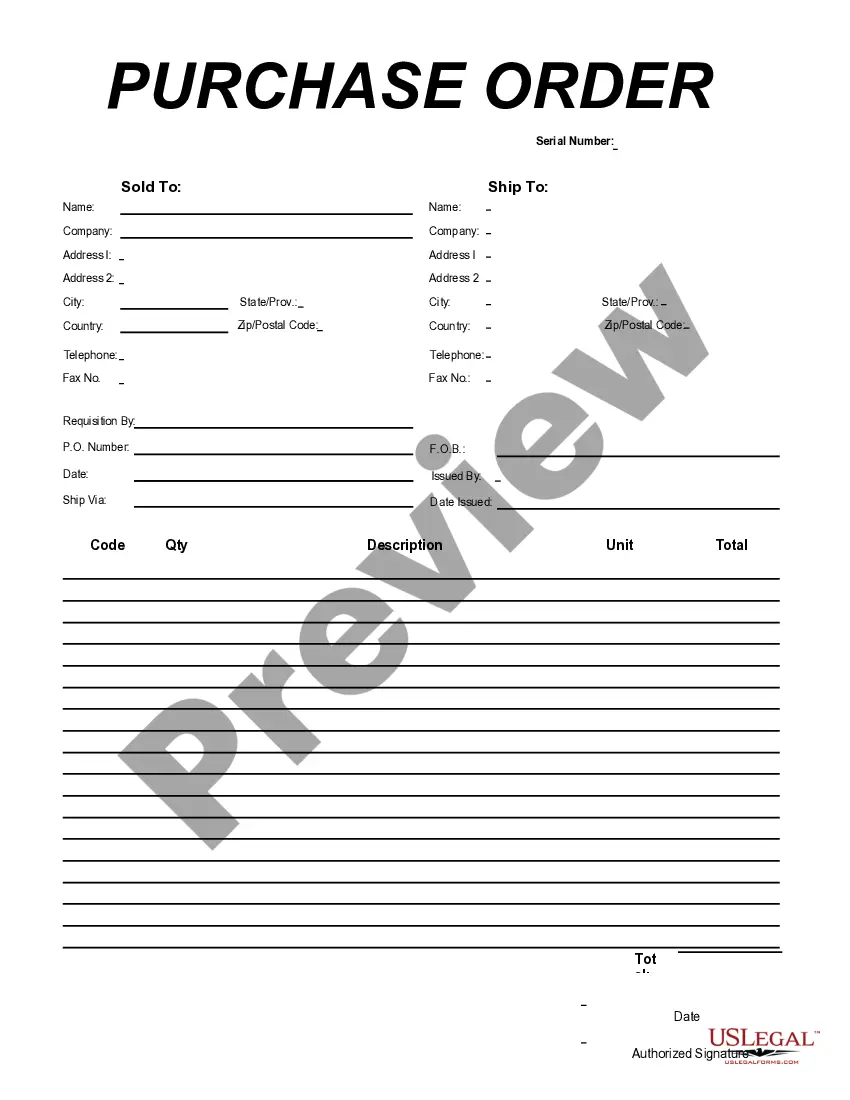

In terms of completing New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday, you almost certainly visualize an extensive procedure that requires choosing a appropriate form among numerous very similar ones and then being forced to pay a lawyer to fill it out to suit your needs. On the whole, that’s a sluggish and expensive option. Use US Legal Forms and pick out the state-specific template within clicks.

For those who have a subscription, just log in and then click Download to find the New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday template.

If you don’t have an account yet but need one, follow the point-by-point manual listed below:

- Be sure the document you’re getting applies in your state (or the state it’s required in).

- Do this by reading the form’s description and also by clicking the Preview option (if accessible) to find out the form’s content.

- Click Buy Now.

- Select the suitable plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Professional lawyers draw up our samples to ensure that after downloading, you don't need to bother about enhancing content material outside of your individual details or your business’s information. Sign up for US Legal Forms and receive your New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday sample now.

Rate Employees Form popularity

Form Pay Hour Other Form Names

Ny Notice Hourly FAQ

A pay cut cannot be enacted without the employee being notified. If an employer cuts an employee's pay without telling him, it is considered a breach of contract. Pay cuts are legal as long as they are not done discriminatorily (i.e., based on the employee's race, gender, religion, and/or age).

The following states require advance notice of pay reductions, but do not specify the amount of advance notice required or provide for any particular form of notice: Colorado, Connecticut, Delaware, Hawaii, Idaho, Illinois, Indiana, Kansas, New Jersey, Michigan, Minnesota, New Hampshire, New Mexico, Oregon,

Pay Rate Notice Requirements. Many states require employers to provide written notice to employees of their regular rate of pay and overtime rate, if applicable, at time of hire and when the rate of pay changes.

The general standard notice period is two weeks, though many contracts require four weeks' notice. Whether you want to avoid awkwardness or haven't had the greatest experience with your employer, leaving suddenly and abruptly isn't just unprofessional, it may also be illegal.

: the amount of money workers are paid per hour, week, etc.

You are entitled to your full salary during notice pay period. A notice period is an effective way by which the employer and the employee can part ways through better management of current scope of work. YIn the current case your notice period shall start w.e.f 01.06.

Unlike a salary where you make the same amount regardless of how much time you work, hourly workers are paid for exactly the amount of time they spend working. A fixed hourly rate of pay means you have a set amount you're paid for each hour of work you perform.

As of 1 July 2020 the national minimum wage is $19.84 per hour or $753.80 per week. Employees covered by an award or registered agreement are entitled to the minimum pay rates, including penalty rates and allowances in their award or agreement. These pay rates may be higher than the National Minimum Wage.

A day rate is usually based on an eight-hour workday. A worker who is paid a day rate is entitled by law to time-and-a-half for work beyond a 40-hour week.An employee who works at a day rate is entitled to an overtime rate of one and a half times the hourly rate, based on the actual number of hours worked.