New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday

Description Ny Multiple

How to fill out Rate Work Employee?

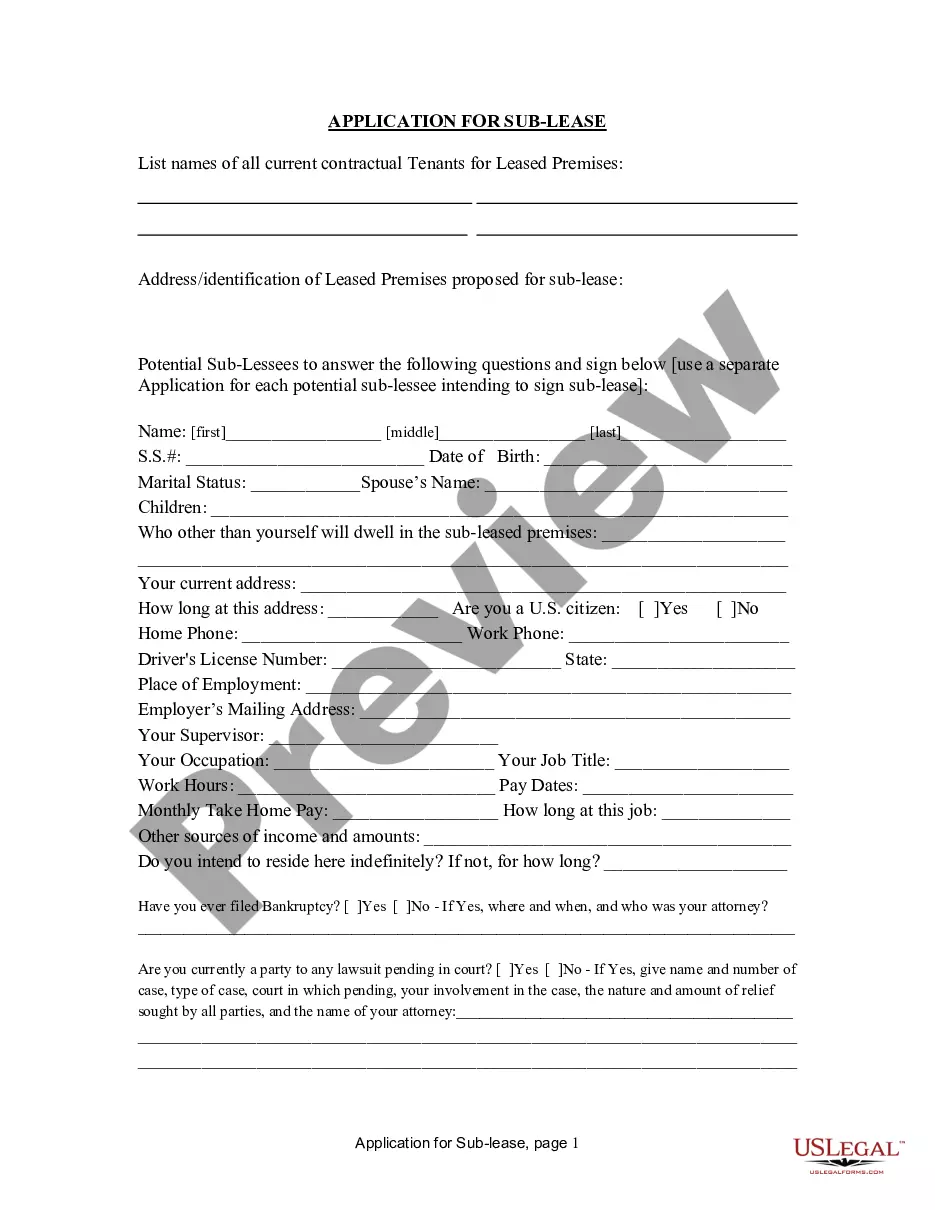

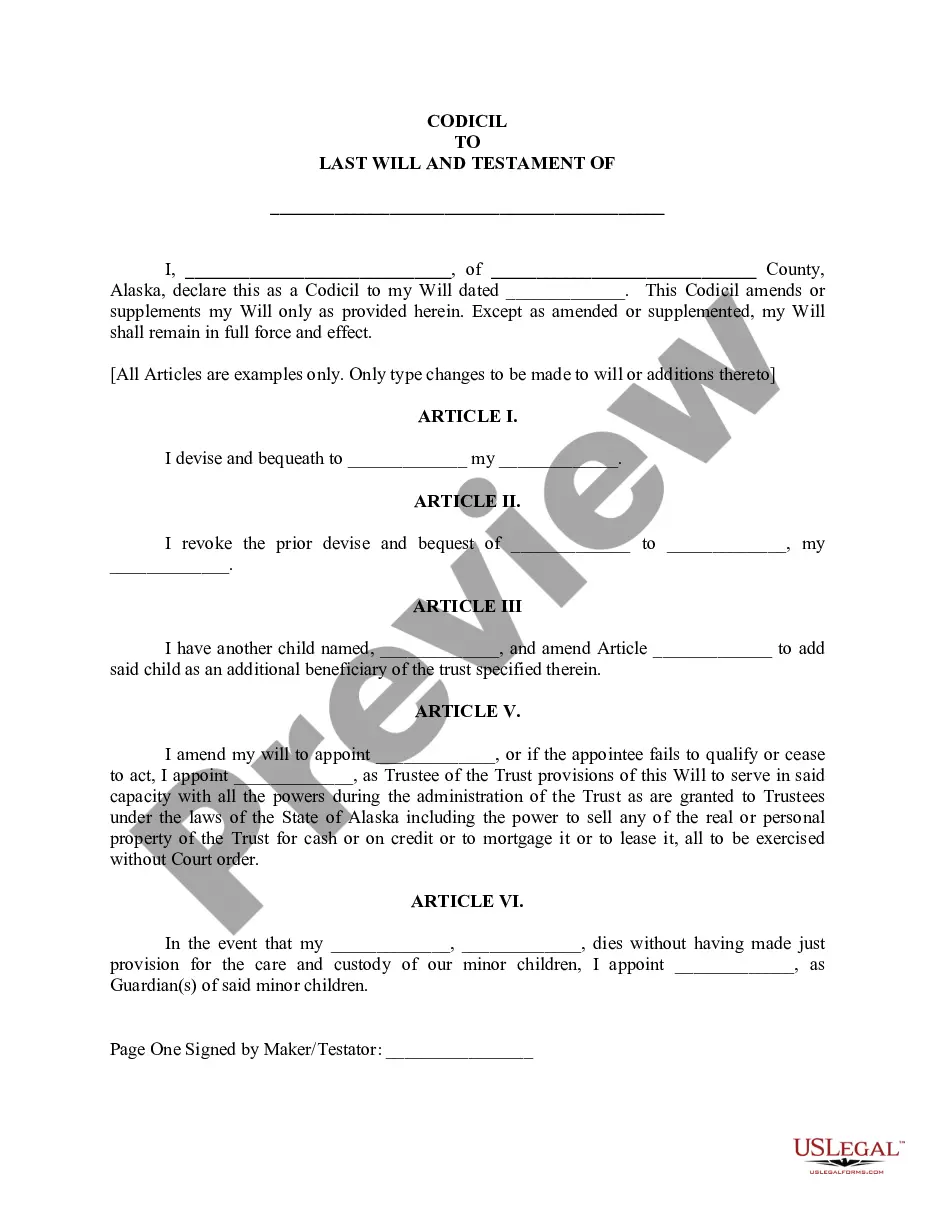

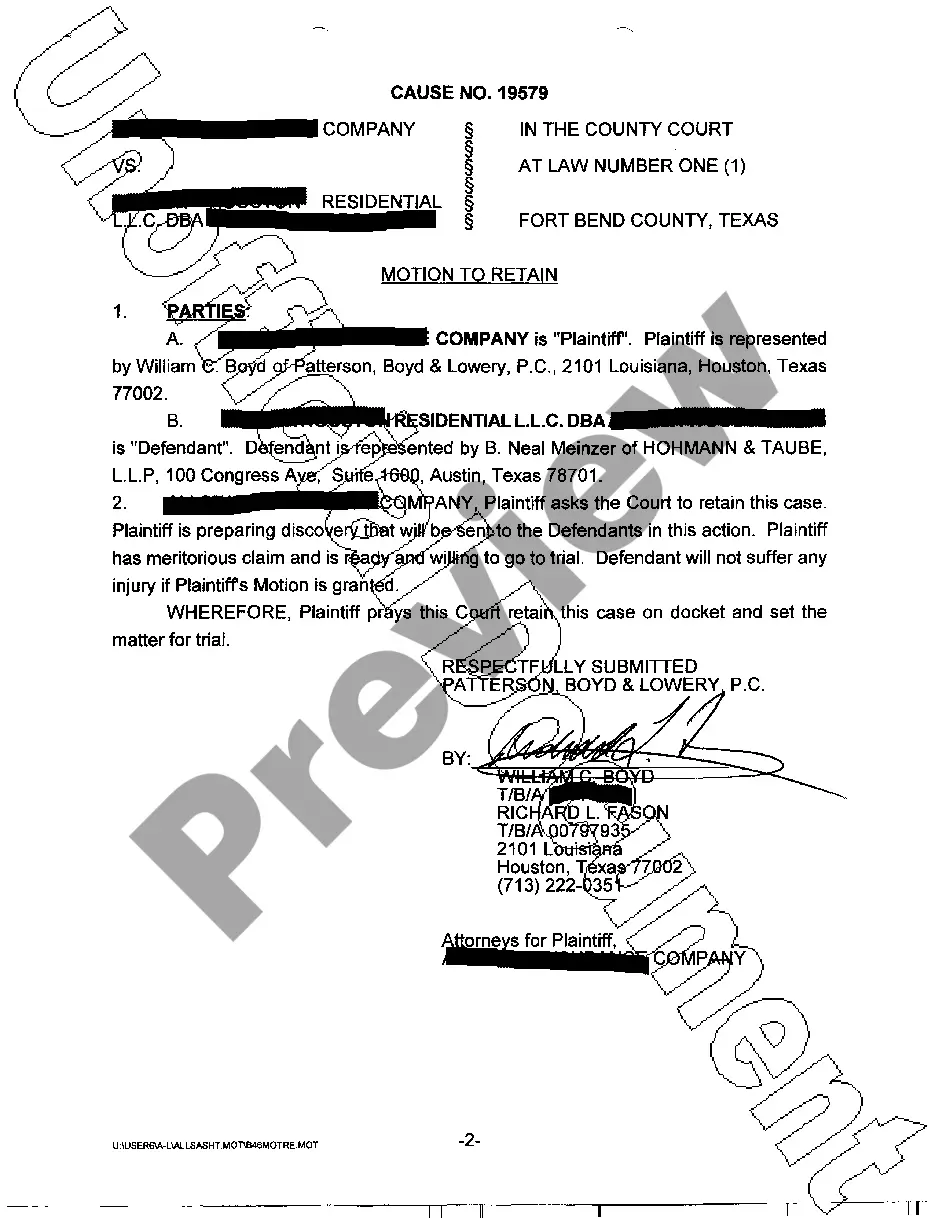

When it comes to completing New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday, you probably imagine an extensive procedure that consists of choosing a ideal sample among numerous similar ones and after that being forced to pay out an attorney to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific form in just clicks.

For those who have a subscription, just log in and then click Download to have the New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday form.

If you don’t have an account yet but need one, follow the point-by-point manual listed below:

- Be sure the document you’re getting applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and by clicking on the Preview function (if readily available) to find out the form’s content.

- Click on Buy Now button.

- Pick the proper plan for your budget.

- Sign up to an account and choose how you want to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Professional lawyers draw up our templates to ensure after saving, you don't need to bother about editing and enhancing content outside of your personal info or your business’s info. Be a part of US Legal Forms and receive your New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday document now.

Rates Acknowledgement Rate Form popularity

Ny Acknowledgement Rate Other Form Names

Pay Hour Over FAQ

Hourly employees are paid a wage for each hour of work they complete.They're usually considered non-exempt employees and must be paid overtime wages starting after 40 hours of work in a week.

The general standard notice period is two weeks, though many contracts require four weeks' notice. Whether you want to avoid awkwardness or haven't had the greatest experience with your employer, leaving suddenly and abruptly isn't just unprofessional, it may also be illegal.

Here's how to compute the employee's daily rate. For Monthly Paid employees. Hourly rate = (Monthly Rate X 12) / total working days in a year/ total working hours per day. Php 71.88 = (15,000 X 12) / 313 / 8. For Daily paid employees. Hourly rate = (Daily rate/total working hours per day) Php 57.00 = (456.00/8)

So, for example, let's say you were hiring a new employee with an annual salary of $50,000; according to this formula, the true cost of that employee would be anywhere between $62,500 and $70,000. If you were hiring a new employee at $25 per hour, their total cost would likely be in the $31.25 to $35 per hour range.

Pay Rate Notice Requirements. Many states require employers to provide written notice to employees of their regular rate of pay and overtime rate, if applicable, at time of hire and when the rate of pay changes.

The national average salary in the United States is $43,460, according to the National Compensation Survey. That works out to be $20.90 per hour. So in order to be above average, you have to earn more than $21 per hour.

Unlike a salary where you make the same amount regardless of how much time you work, hourly workers are paid for exactly the amount of time they spend working. A fixed hourly rate of pay means you have a set amount you're paid for each hour of work you perform.

Understand the Wage Laws The Fair Labor Standards Act (FLSA) is a federal law that sets minimum wage and overtime pay standards for full-time and part-time employees in the private sector and in federal, state, and local governments. The current federal minimum wage is $7.25 per hour.

: the amount of money workers are paid per hour, week, etc.