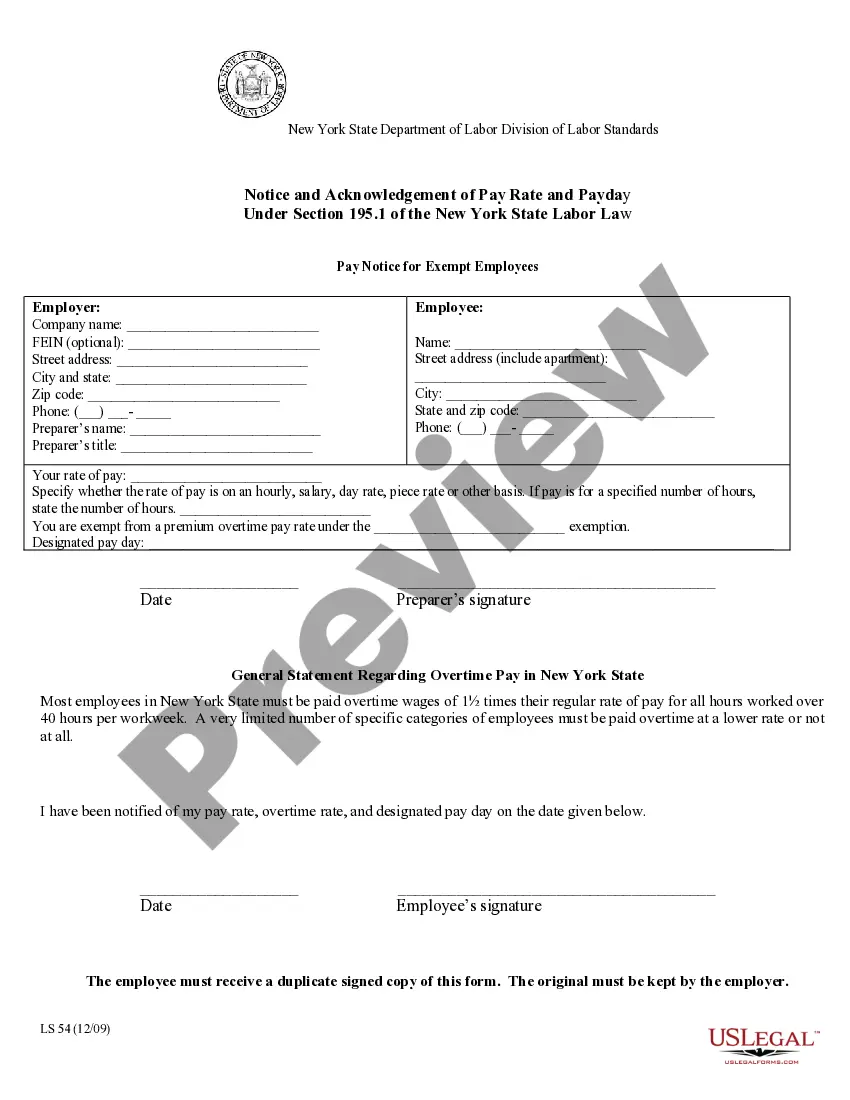

New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday

Description Exempt Employees Ny

How to fill out Exempt Rate Ny?

When it comes to submitting New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday, you probably imagine an extensive procedure that consists of choosing a suitable form among hundreds of very similar ones after which needing to pay legal counsel to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific document in a matter of clicks.

For those who have a subscription, just log in and then click Download to get the New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday template.

In the event you don’t have an account yet but want one, stick to the step-by-step manual below:

- Make sure the document you’re downloading applies in your state (or the state it’s required in).

- Do this by looking at the form’s description and also by clicking the Preview option (if accessible) to find out the form’s information.

- Click Buy Now.

- Pick the appropriate plan for your financial budget.

- Sign up for an account and select how you want to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Professional attorneys draw up our templates to ensure that after saving, you don't need to bother about editing content material outside of your individual information or your business’s info. Join US Legal Forms and get your New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday document now.

Notice Payday Sample Form popularity

Ny Notice Exempt Other Form Names

Exempt Employees Payday FAQ

Key takeaway: The advantages of hiring exempt employees include no overtime pay and more knowledge and responsibility. Downsides include higher pay rates and no ability to deduct pay for hours not worked.

In order to be classified as exempt, an employee must be paid a minimum of $23,000 per year, or $455 per week. However, that isn't the only test. There are many people who earn more than this amount and are still classified as non-exempt.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

If the worker meets all the requirements of the duties test as an exempt employee, their minimum salary can be no less than the requirement for 2020: $35,568. An employee who doesn't meet the duties requirements and the salary minimum must be classified as nonexempt, or eligible for overtime pay.

1. Employees who are exempt can work over 40 hours without additional compensation. Here's why: the FLSA and state fair labor standards legislation requires employees who work more than 40 hours in any work week to be paid time-and-a-half for those hours.

The term exempt employee refers to a category of employees set out in the Fair Labor Standards Act (FLSA). Exempt employees do not receive overtime pay, nor do they qualify for the minimum wage. When an employee is exempt, it primarily means that they are exempt from receiving overtime pay.

Under the FLSA, exempt workers qualify for time and a half, their normal hourly wage plus half that wage, when they work overtime. Workers who volunteer for overtime or have mandatory overtime can benefit significantly from their status as non-exempt employees, as they can make a large amount of money in overtime pay.

Salaried employees enjoy the security of steady paychecks, and they tend to pull in higher overall income than hourly workers. And they typically have greater access to benefits packages, bonuses, and paid vacation time.

As an exempt employee, an employer could require the employee to work more than 40-hours per week without overtime pay. An employer would also not have to provide rest breaks and meal breaks to an exempt employee. An employer may intentionally or unintentionally classify a non-exempt employee as an exempt employee.