The New York Packet for Dispute over Refund is a document packet consisting of several forms and instructions that must be completed and submitted to the New York State Department of Taxation and Finance (MYSELF) in order to dispute a refund claim. This document packet is used when a taxpayer believes that they are entitled to a refund from the, but have not received it. The packet includes a Request for Refund Form, a Request for Refund Summary Form, and a Taxpayer Information Form, along with instructions on how to complete and submit the forms. There are two types of New York Packet for Dispute over Refund: one for individuals and one for businesses. The individual packet is used when the taxpayer is an individual, while the business packet is used when the taxpayer is a business entity.

New York Packet for Dispute over Refund

Description

How to fill out New York Packet For Dispute Over Refund?

Coping with official paperwork requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your New York Packet for Dispute over Refund template from our service, you can be certain it meets federal and state laws.

Dealing with our service is simple and fast. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your New York Packet for Dispute over Refund within minutes:

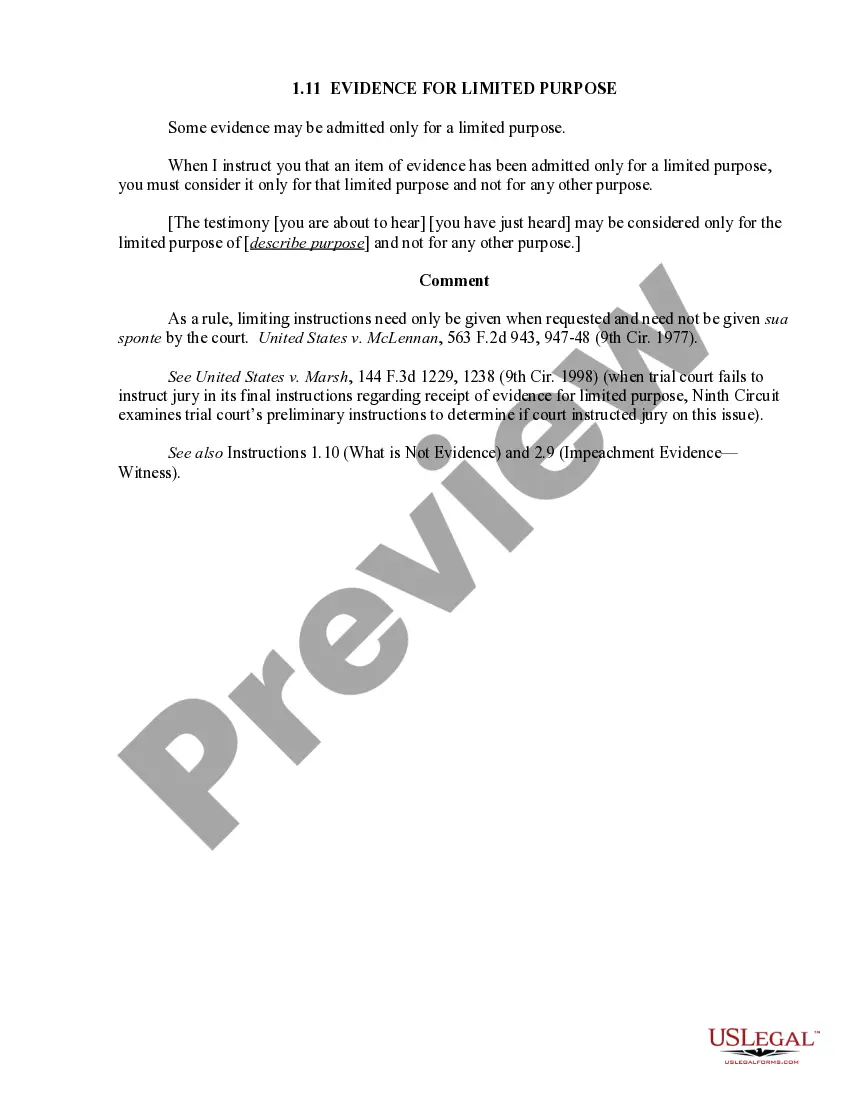

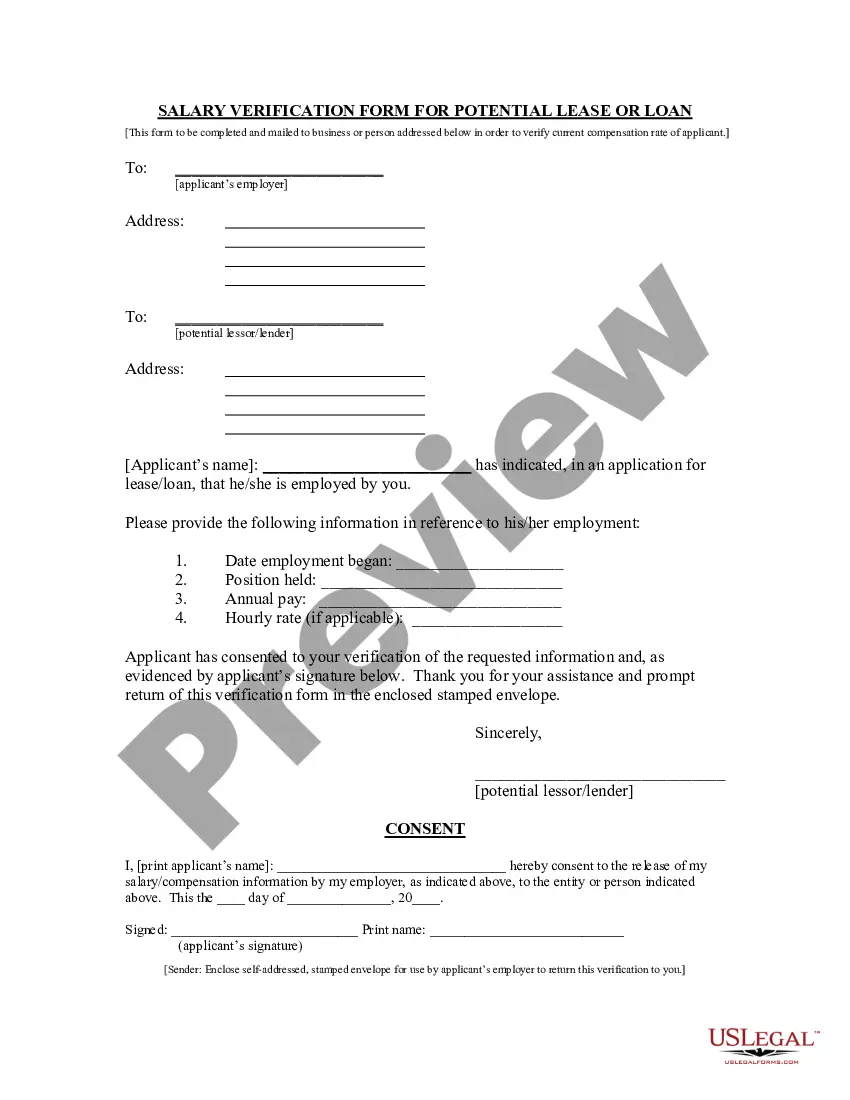

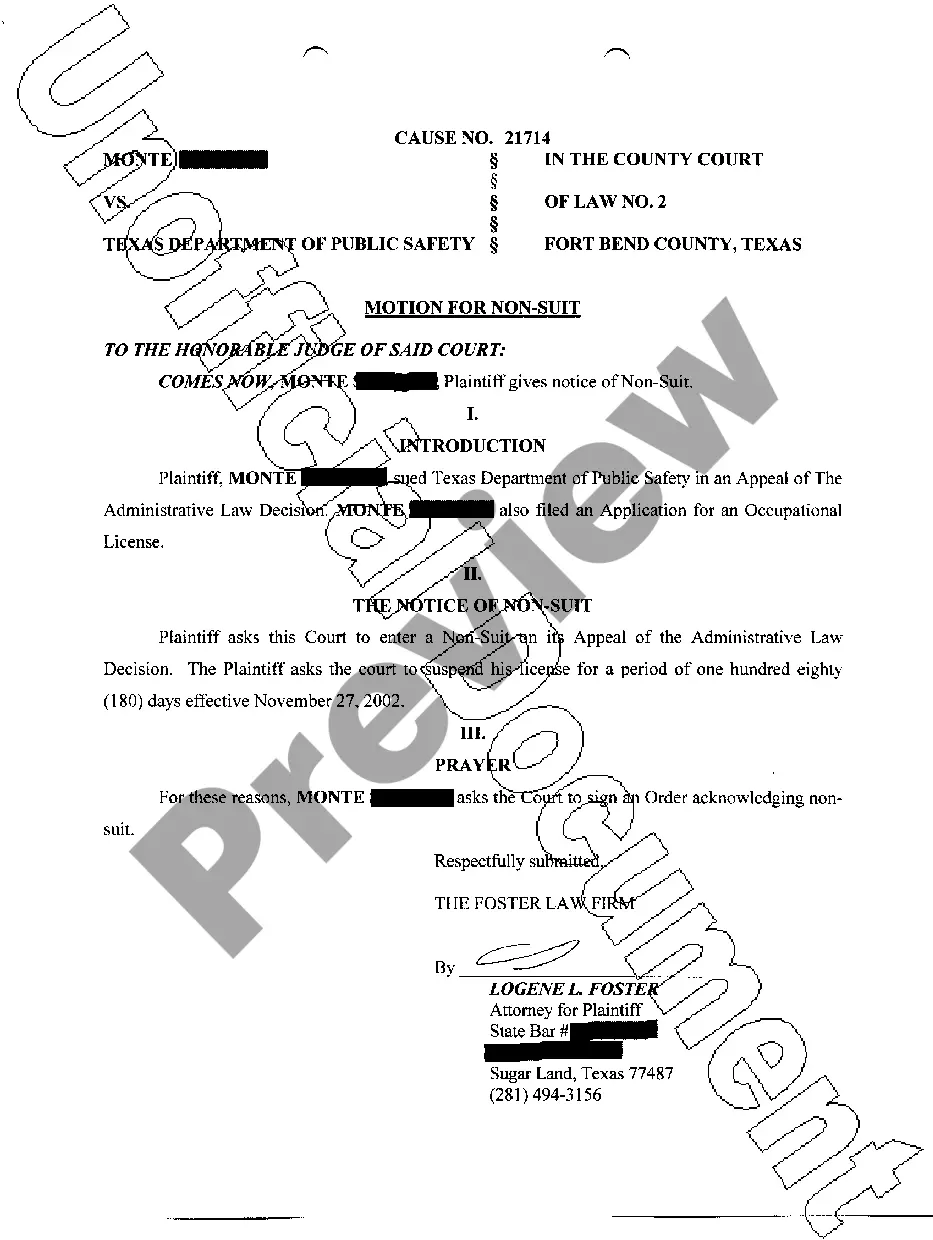

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the New York Packet for Dispute over Refund in the format you prefer. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the New York Packet for Dispute over Refund you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

To dispute IRS back tax collections, the IRS generally recommends that you contact a tax professional instead of handling the case on your own. However, contacting the Taxpayer Advocate Service or a Local Taxpayer Clinic is another option. Both of these organizations can help you settle IRS disputes.

We can consider offers in compromise from: individuals and businesses that are insolvent or discharged in bankruptcy, and. individuals who are not insolvent or bankrupt, if payment in full would create undue economic hardship.

File a petition for a Tax Appeals hearing Your petition must state which department actions you're protesting. After the hearing, an impartial administrative law judge (ALJ) will issue a determination that decides the dispute unless you or the department request further review by the Tax Appeals Tribunal.

You can submit your request in any of the following ways: online: You can respond to your bill or notice online and attach supporting documentation. by phone: Speak directly to a Tax Department representative by calling the number on the notice you received.

The primary letter we use to request information about a return is Form DTF-948 or DTF-948-O, Request for Information (RFI). If your refund status says we sent you one of these letters, it's important you respond by the date noted on the letter so we can continue processing your return.

Section 137.2 General. (a) In the event of a fee dispute between attorney and client, whether or not the attorney already has received some or all of the fee in dispute, the client may seek to resolve the dispute by arbitration under this Part.

You have options for settling your back taxes, including an installment payment agreement and an offer in compromise. You can take action to reach an amicable agreement with your state's department of revenue and taxation. You may be able to reduce the amount that you have to pay with an offer in compromise.

If we made one or more adjustments to your personal income tax return: you may receive a refund amount that's different than what you claimed on your return, and. you will receive an account adjustment notice (Form DTF-160 or Form DTF-161) explaining the adjustment.