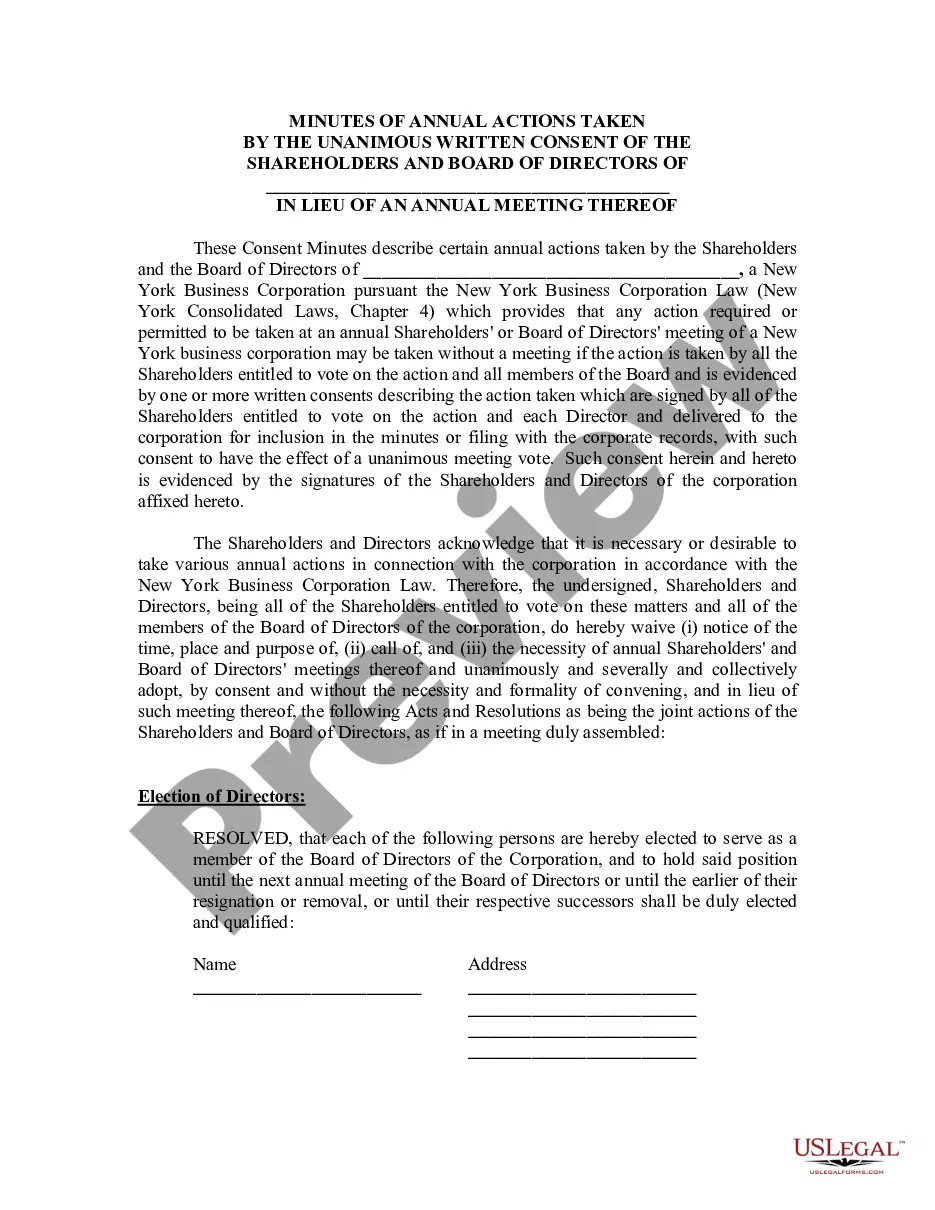

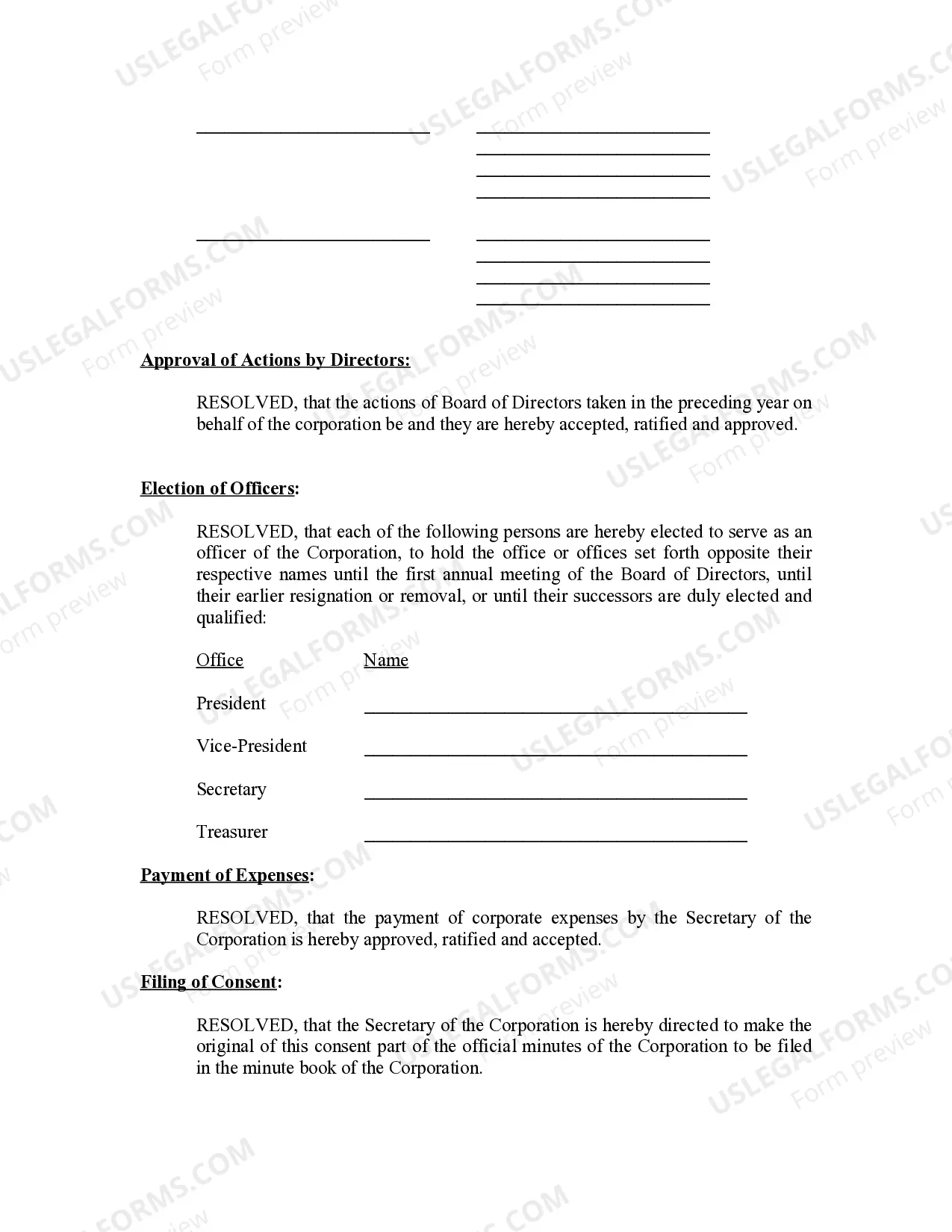

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

New York Annual Minutes

Description

How to fill out New York Annual Minutes?

When it comes to completing Annual Minutes - New York, you most likely visualize a long process that consists of choosing a perfect form among numerous very similar ones after which needing to pay out a lawyer to fill it out to suit your needs. Generally, that’s a slow and expensive choice. Use US Legal Forms and pick out the state-specific form within clicks.

In case you have a subscription, just log in and click on Download button to have the Annual Minutes - New York sample.

In the event you don’t have an account yet but want one, follow the step-by-step guideline listed below:

- Be sure the document you’re getting applies in your state (or the state it’s required in).

- Do this by reading through the form’s description and also by visiting the Preview function (if available) to find out the form’s information.

- Click on Buy Now button.

- Find the proper plan for your budget.

- Sign up for an account and select how you want to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Professional legal professionals work on creating our samples to ensure after downloading, you don't have to worry about modifying content outside of your personal information or your business’s info. Be a part of US Legal Forms and receive your Annual Minutes - New York example now.

Form popularity

FAQ

Yes. Biennial Statements may still be filed online on the Department's website. If the Biennial Statement cannot be filed online, you may request a paper form by contacting the Statement Unit of the Department of State's Division of Corporations. You may contact the Statement Unit by fax at (518) 486-4680 or by E-mail.

Annual meeting minutes for corporations are one of the important business compliance requirements that keep a company's corporate veil (legal and financial separation of a business and its owners) intact.

Yes. Biennial Statements may still be filed online on the Department's website. If the Biennial Statement cannot be filed online, you may request a paper form by contacting the Statement Unit of the Department of State's Division of Corporations. You may contact the Statement Unit by fax at (518) 486-4680 or by E-mail.

What Are Annual Meeting Minutes? Corporate annual meeting minutes serve as a record of a business's annual meeting. Most states except for Delaware, Kansas, Nevada, North Dakota, and Oklahomarequire corporations to keep meeting minutes (this applies to the Board of Directors meetings, too).

Every two years, domestic and foreign corporations are required to file a Biennial Statement with the New York Department of State. This document essentially allows these corporations to maintain their entity status. To file, eligible corporations and Limited Liability Companies (LLCs) must pay a $9 fee.

This confirms your LLC is now a legally formed business in the State of New York. Your Filing Receipt will contain your LLC's name, the date filed, and your Department of State ID Number (also known as your DOS ID Number). Your DOS ID Number is unique to your LLC and you will use it when dealing with the State.

Date, time, and location. Minutes should include this basic information about when and where the meeting was held and how long it lasted. Creator. List of persons present. Topics list. Voting record. Review and approval.

In California, a biennial report is a regular filing that your LLC must complete every two years. The report is essentially updating your registered agent address and paying a $20 fee, in addition to a $20 initial statement filing.

Filing the Articles of Organization By mail, send the completed Articles of Organization with the filing fee of $200 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.