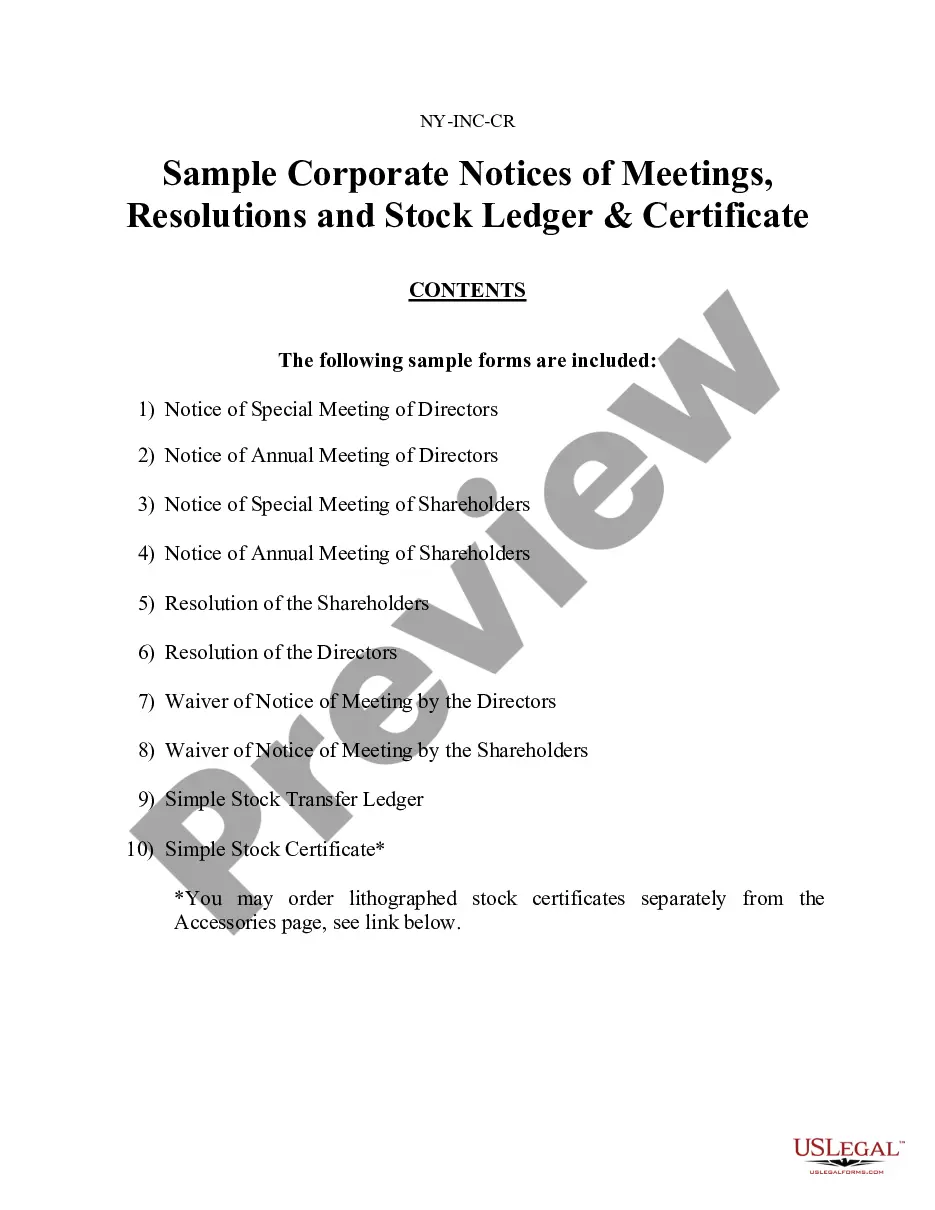

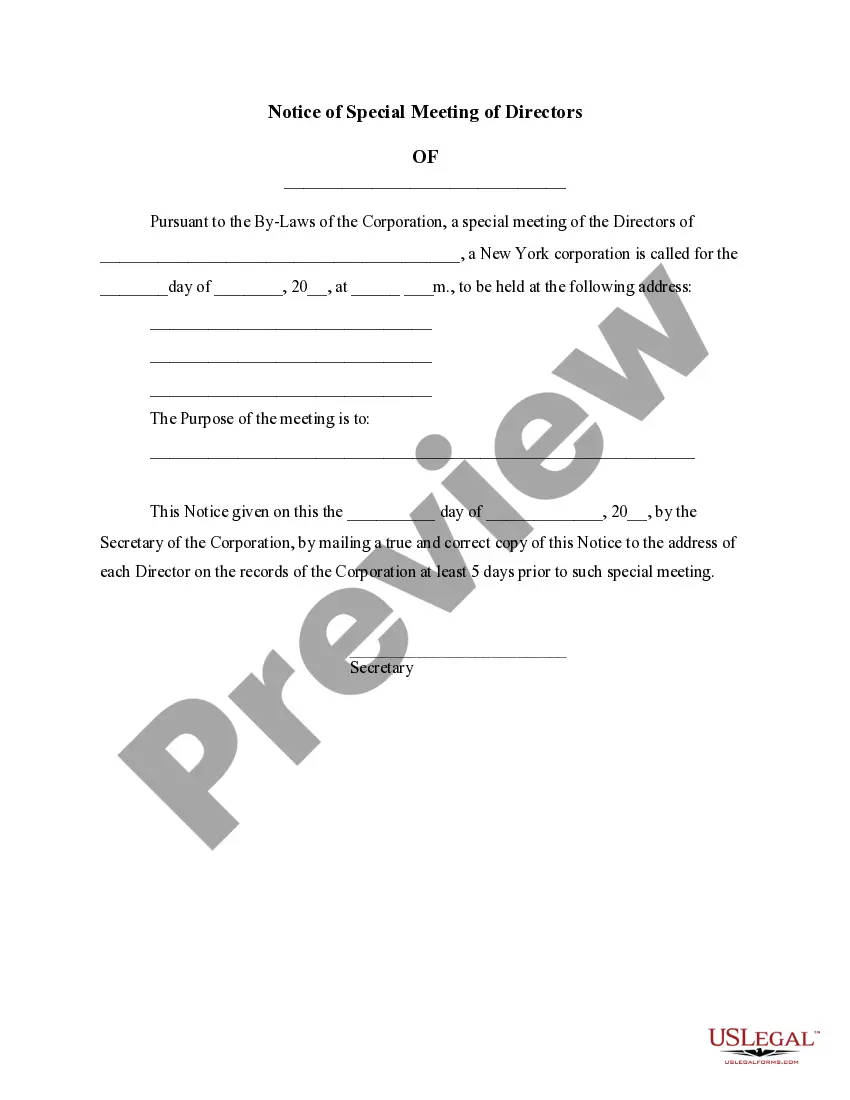

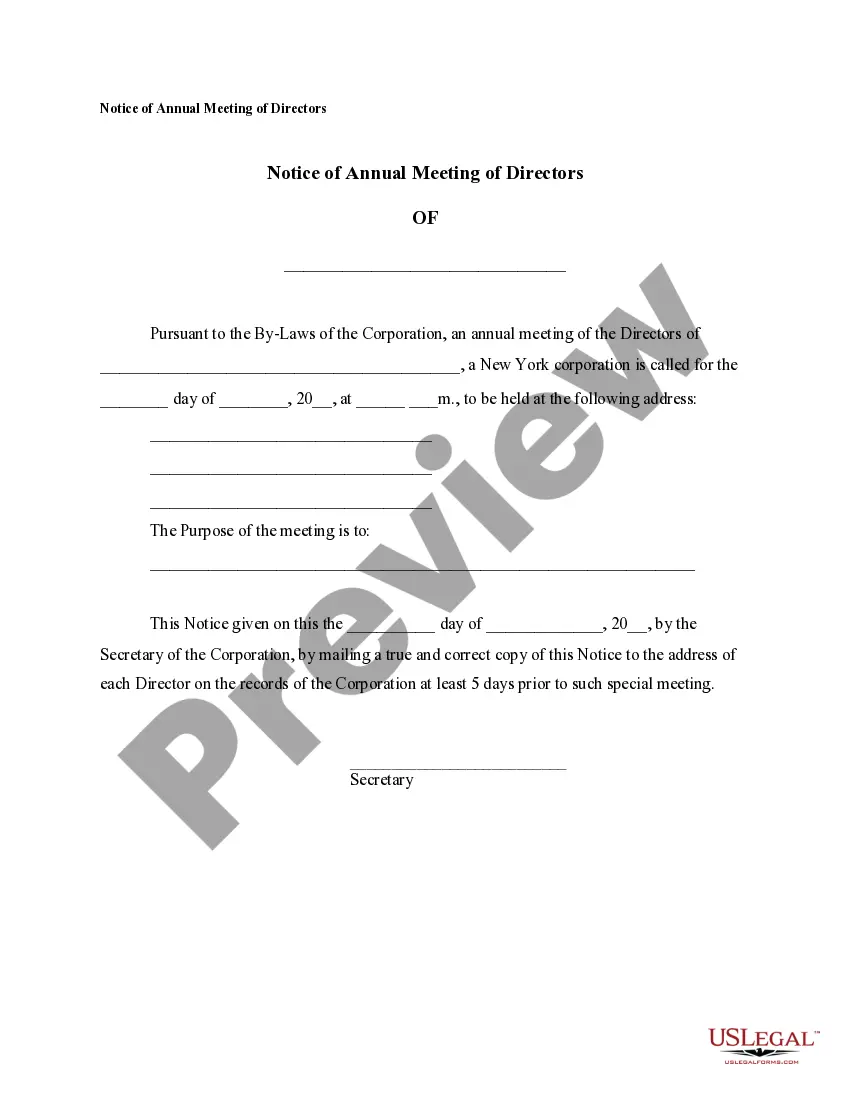

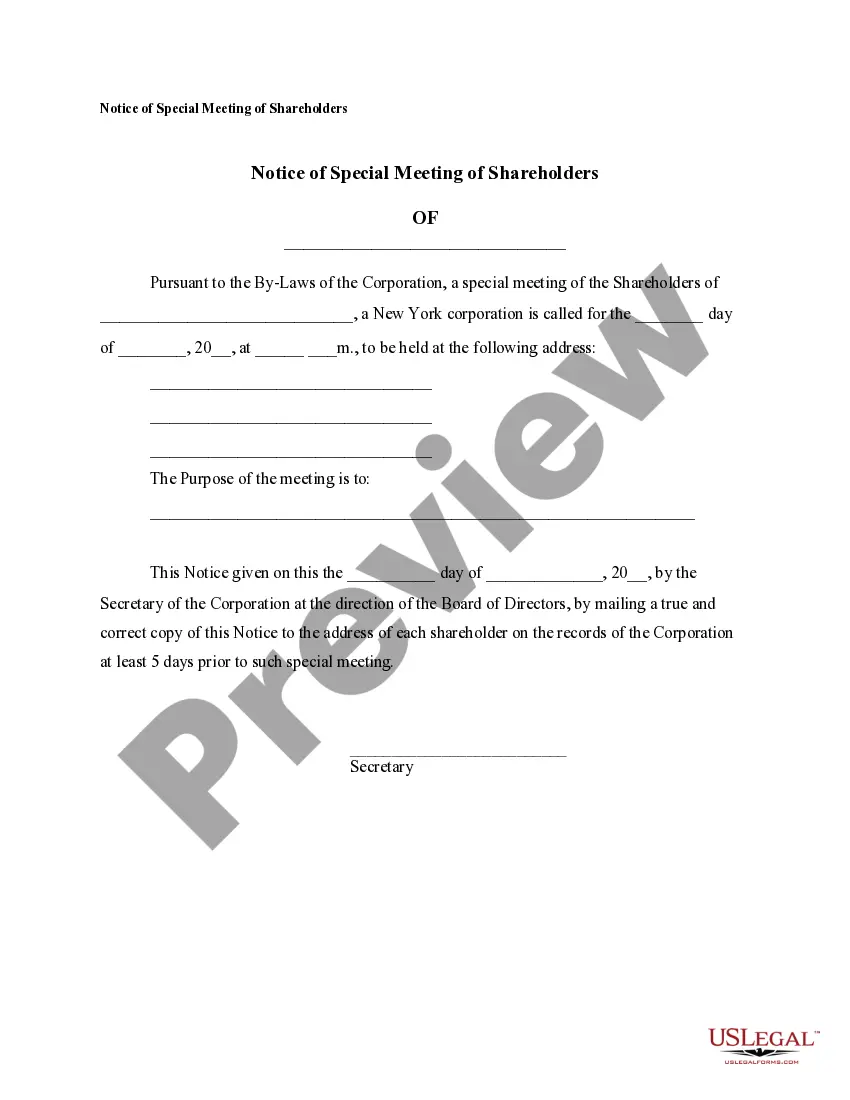

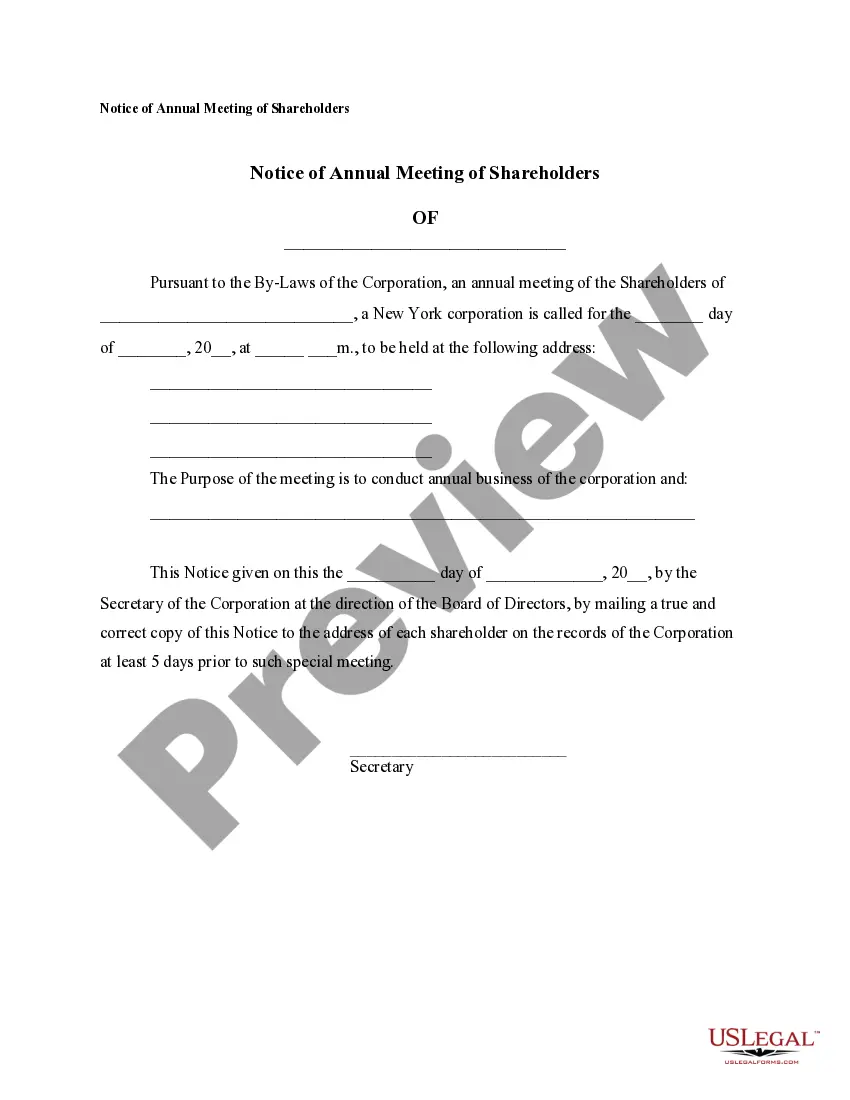

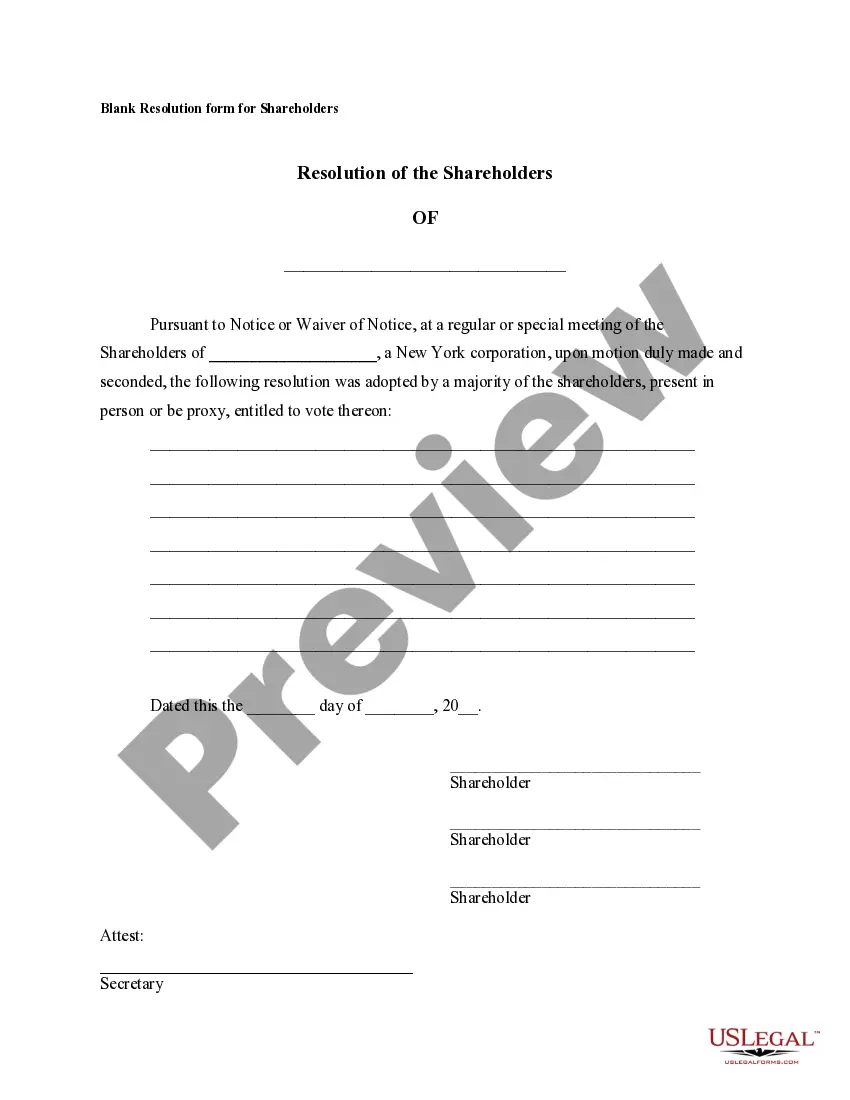

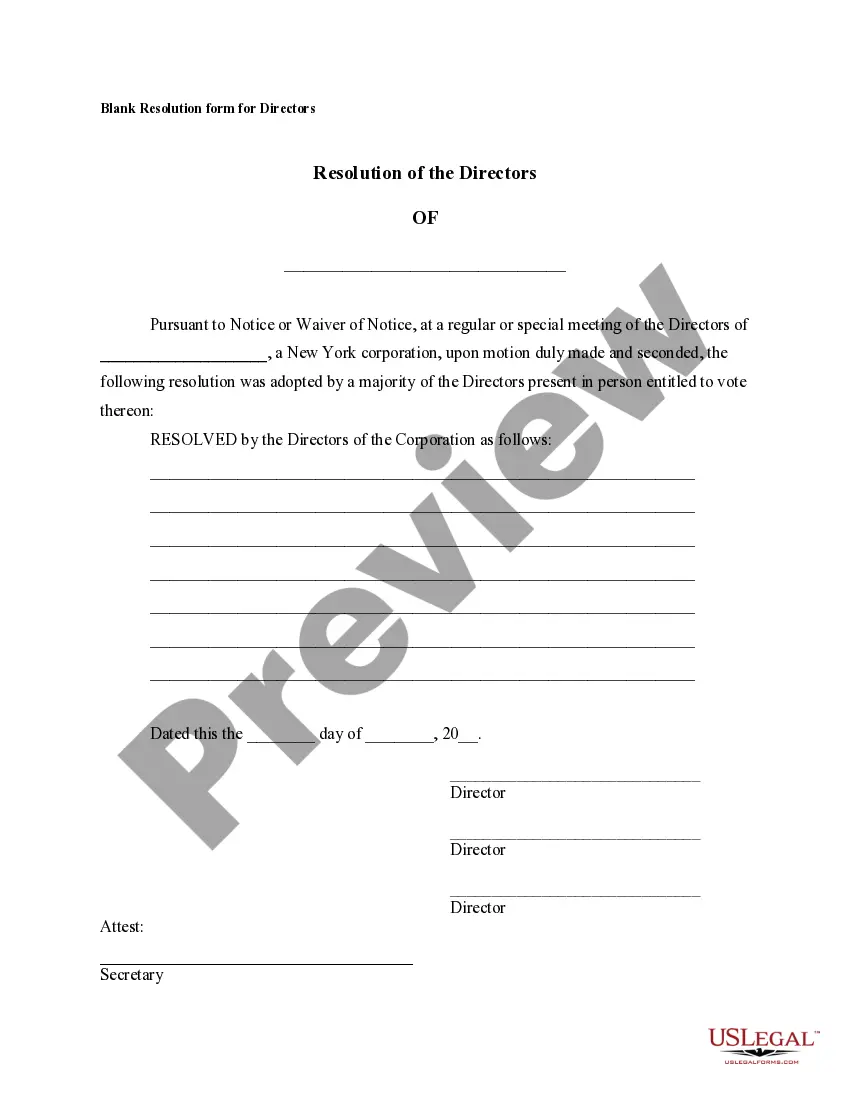

This is a group of forms that includes Notices of Meetings, Corporate Resolutions, a Stock Ledger, and a sample Stock Certificate.

New York Notices, Resolutions, Simple Stock Ledger and Certificate

Description New York Notices

How to fill out Sample Stock Form?

In terms of submitting New York Notices, Resolutions, Simple Stock Ledger and Certificate, you probably visualize a long procedure that consists of getting a suitable sample among countless similar ones after which needing to pay out legal counsel to fill it out for you. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific form in a matter of clicks.

In case you have a subscription, just log in and click on Download button to find the New York Notices, Resolutions, Simple Stock Ledger and Certificate template.

In the event you don’t have an account yet but want one, stick to the point-by-point manual below:

- Make sure the file you’re getting applies in your state (or the state it’s needed in).

- Do it by looking at the form’s description and also by clicking on the Preview function (if available) to find out the form’s content.

- Click on Buy Now button.

- Select the appropriate plan for your budget.

- Sign up for an account and select how you would like to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Find the document on the device or in your My Forms folder.

Professional attorneys work on drawing up our samples to ensure that after saving, you don't need to bother about editing content material outside of your individual details or your business’s info. Be a part of US Legal Forms and get your New York Notices, Resolutions, Simple Stock Ledger and Certificate sample now.

Ny Stock Certificate Form popularity

Sample Meetings Resolutions Other Form Names

New York Stock Form FAQ

The three types of resolutions are joint resolutions, simple resolutions and concurrent resolutions. Roll Call Vote There are several different ways of voting in Congress, one of which is the roll call vote, where the vote of each member is recorded.

Write the Name of the Company. State at the top of the page, the governing body and the legal name of the organization making the corporate resolution. Add Further Legal Identification.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.