New York Transfer Form (Commercial Part 2) is a form used to transfer ownership of a commercial property in the state of New York. It is a legal document used to establish the transfer of real estate ownership from one party (the seller) to another (the buyer). The form is composed of two parts: Part 1 is the deed/title transfer document, and Part 2 is the financing/closing disclosure document. Part 1 requires the seller to provide information about the property, such as property address, purchase price, deed restrictions, and other legal requirements. Part 2 requires both parties to provide information about the sale, including the buyer's name and address, the purchase price, the loan amount, and other closing costs. There are three different types of New York Transfer Forms (Commercial Part 2): (1) Standard Transfer Form (Commercial Part 2), (2) Electronic Transfer Form (Commercial Part 2), and (3) Limited Transfer Form (Commercial Part 2).

New York Transfer Form (Commercial Part 2)

Description

How to fill out New York Transfer Form (Commercial Part 2)?

US Legal Forms is the most easy and affordable way to locate suitable formal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with national and local laws - just like your New York Transfer Form (Commercial Part 2).

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New York Transfer Form (Commercial Part 2) if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one meeting your requirements, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Transfer Form (Commercial Part 2) and download it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reputable assistant in obtaining the corresponding formal documentation. Give it a try!

Form popularity

FAQ

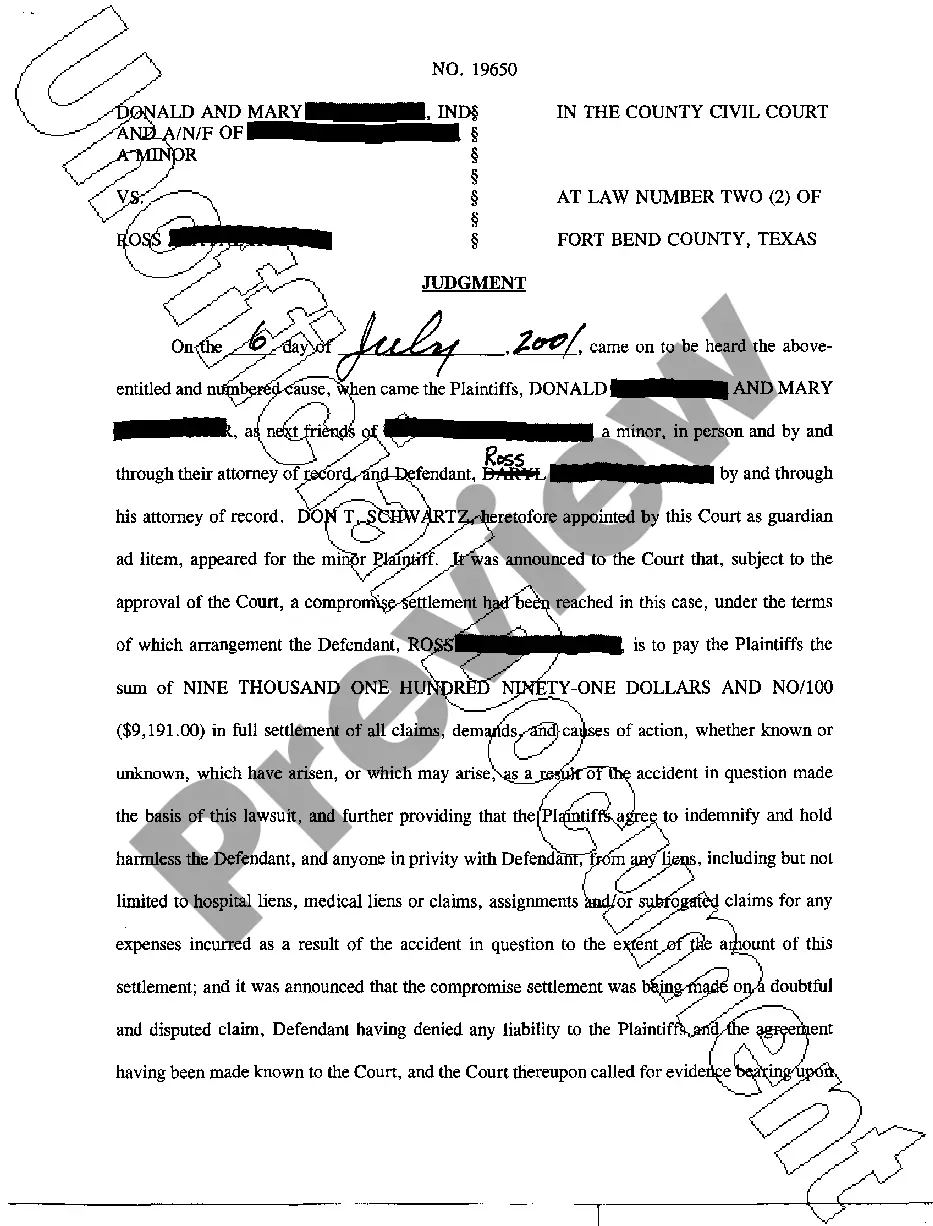

Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of. Exemption from the Payment of Estimated Personal Income Tax.

Who pays the real estate transfer tax in New York? The tax is generally paid for by the seller and can't be imposed on the buyer. However, there are certain exceptions to this rule (new construction often transfers the obligation to the buyer).

Form TP-584 must be used to comply with the filing requirements of the real estate transfer tax (Tax Law Article 31); the tax on mortgages (Tax Law Article 11), as it applies to the Credit Line Mortgage Certificate; and the exemption from estimated personal income tax (Tax Law Article 22), as it applies to the sale or

New York City Real Property Transfer Tax (RPTT) is imposed on transfers of real property or interests in real property when consideration exceeds $25,000. The RPTT is assessed at a graduated rate ranging from 1% to 2.625%, depending on the conveyed property's classification and the total consideration paid.

If you do not pay your tax when due, we will charge you a penalty in addition to interest. The penalty may be waived if you can show reasonable cause for paying late. The penalty charge is: 0.5% of the unpaid amount for each month (or part of a month) it is not paid, up to a maximum of 25%

How long do you have to own a home to avoid capital gains tax in New York? You must have lived in the house for two years within the last five years of the sale.