New York Non-IV-D Income Withholding Order (LDSS-5037)

Description

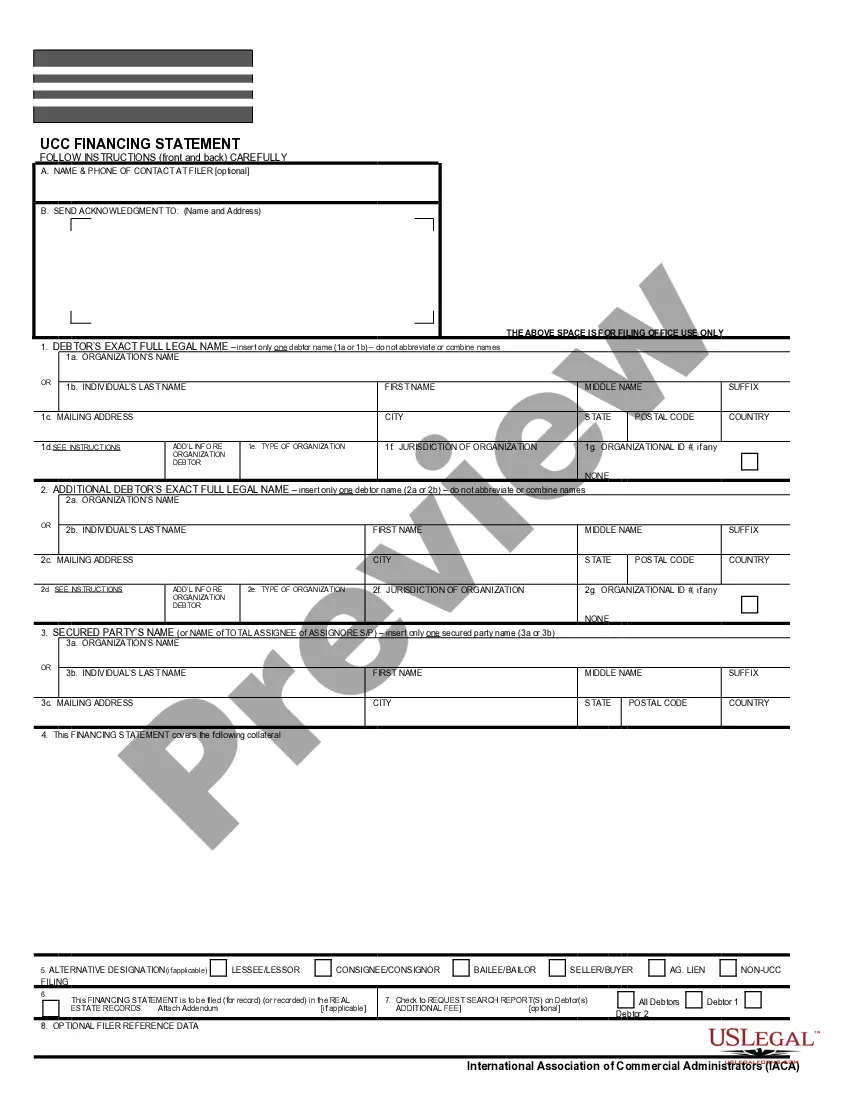

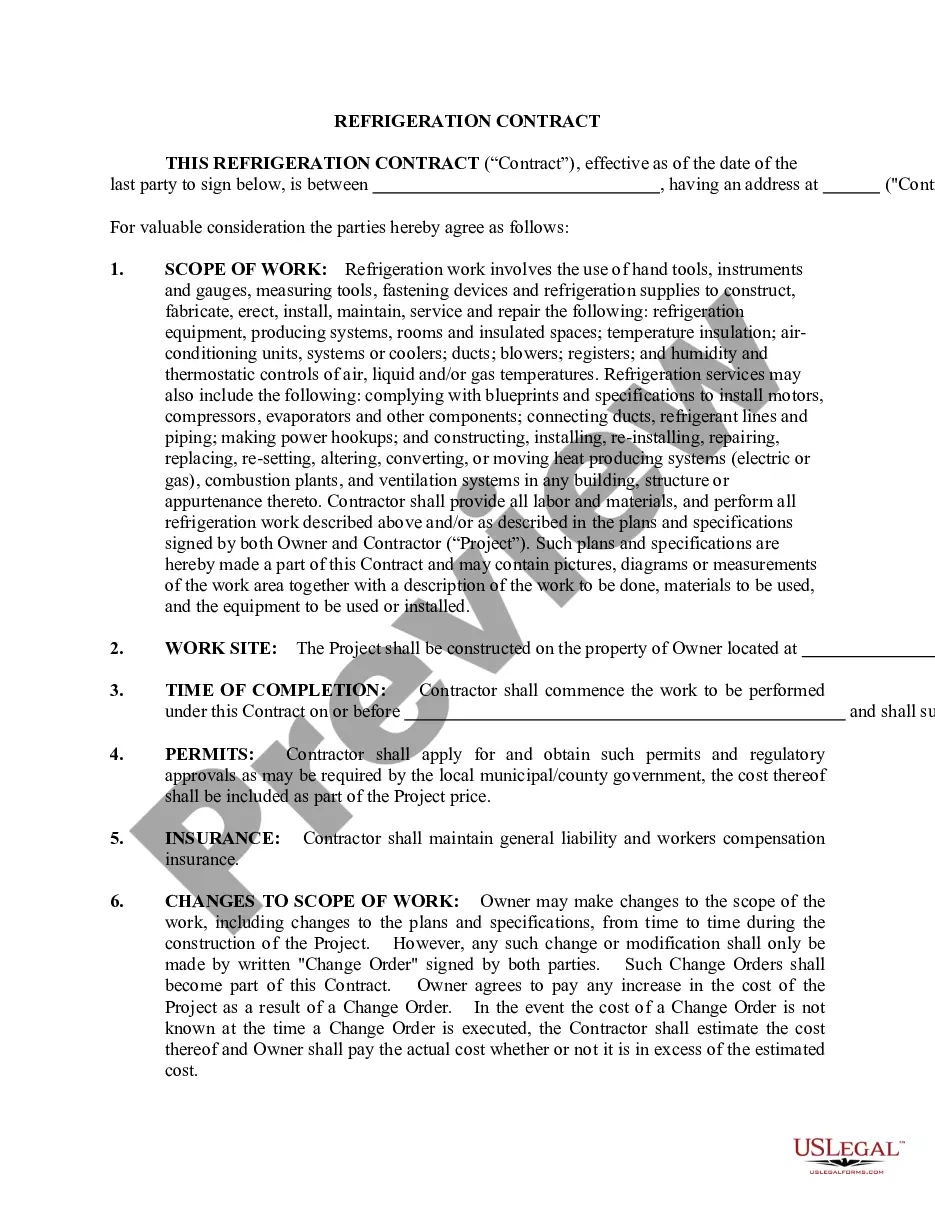

How to fill out New York Non-IV-D Income Withholding Order (LDSS-5037)?

When it comes to filling out New York Non-IV-D Income Withholding Order for Child Support, you almost certainly visualize a long process that requires getting a appropriate form among numerous similar ones and after that needing to pay an attorney to fill it out to suit your needs. On the whole, that’s a slow and expensive choice. Use US Legal Forms and choose the state-specific template in a matter of clicks.

If you have a subscription, just log in and click Download to find the New York Non-IV-D Income Withholding Order for Child Support form.

In the event you don’t have an account yet but need one, keep to the step-by-step manual below:

- Be sure the file you’re downloading is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and by clicking the Preview function (if readily available) to view the form’s content.

- Simply click Buy Now.

- Select the proper plan for your budget.

- Join an account and select how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx file format.

- Find the document on the device or in your My Forms folder.

Professional legal professionals work on creating our templates to ensure that after saving, you don't have to worry about modifying content outside of your individual information or your business’s information. Sign up for US Legal Forms and receive your New York Non-IV-D Income Withholding Order for Child Support sample now.

Form popularity

FAQ

Non-IV-D child support are cases where child support is established and maintained privately, such as following a divorce.In those situations, the custodial parent can ask the Office of Child Support Enforcement to step in to help collect outstanding, unpaid child support and ensure that future payments are paid.

In 1975, in response to public pressure, Congress amended the Social Security Act to add Title Iv-D. This amendment mandated that all States establish a program to locate noncustodial parents, establish paternity, establish and enforce child support obligations, and collect, distribute, and disburse support payments.

Child support withholding is a court-mandated payroll deduction. You will receive a withholding notice if you are required to make child support deductions from an employee's wages. Typically, an employee's disposable income is used to determine the limits of child support deductions.

Despite its official-sounding name, Title IV-D simply refers to the federal law that requires states to manage a public child support program. This is important because many parents do not have an attorney to help them with child support matters or know how to establish or enforce a court order on their own.

Income withholding is a deduction of a payment for child support from a parent's income. This order can be from a court or administratively ordered by a child support agency.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages.If the IWO is on an official Income Withholding for Support form, you must honor the requested withholding.

Calculating Child Support in New York. Generally, the court calculates the amount of child support based on both parents' income per year and the number of children for whom the parents are responsible. If the parents' combined income is $154,000 or less, the court follows the simple guidelines listed below.

The term IVD comes from the Title IV Section D of the Social Security Act, which established the Child Support Enforcement program in 1975. IVD cases are opened for all public assistance cases involving children not living with one or both parents.

Non-IV-D child support are cases where child support is established and maintained privately, such as following a divorce.In those situations, the custodial parent can ask the Office of Child Support Enforcement to step in to help collect outstanding, unpaid child support and ensure that future payments are paid.