New York Release of Lien of Estate Tax

Description

How to fill out New York Release Of Lien Of Estate Tax?

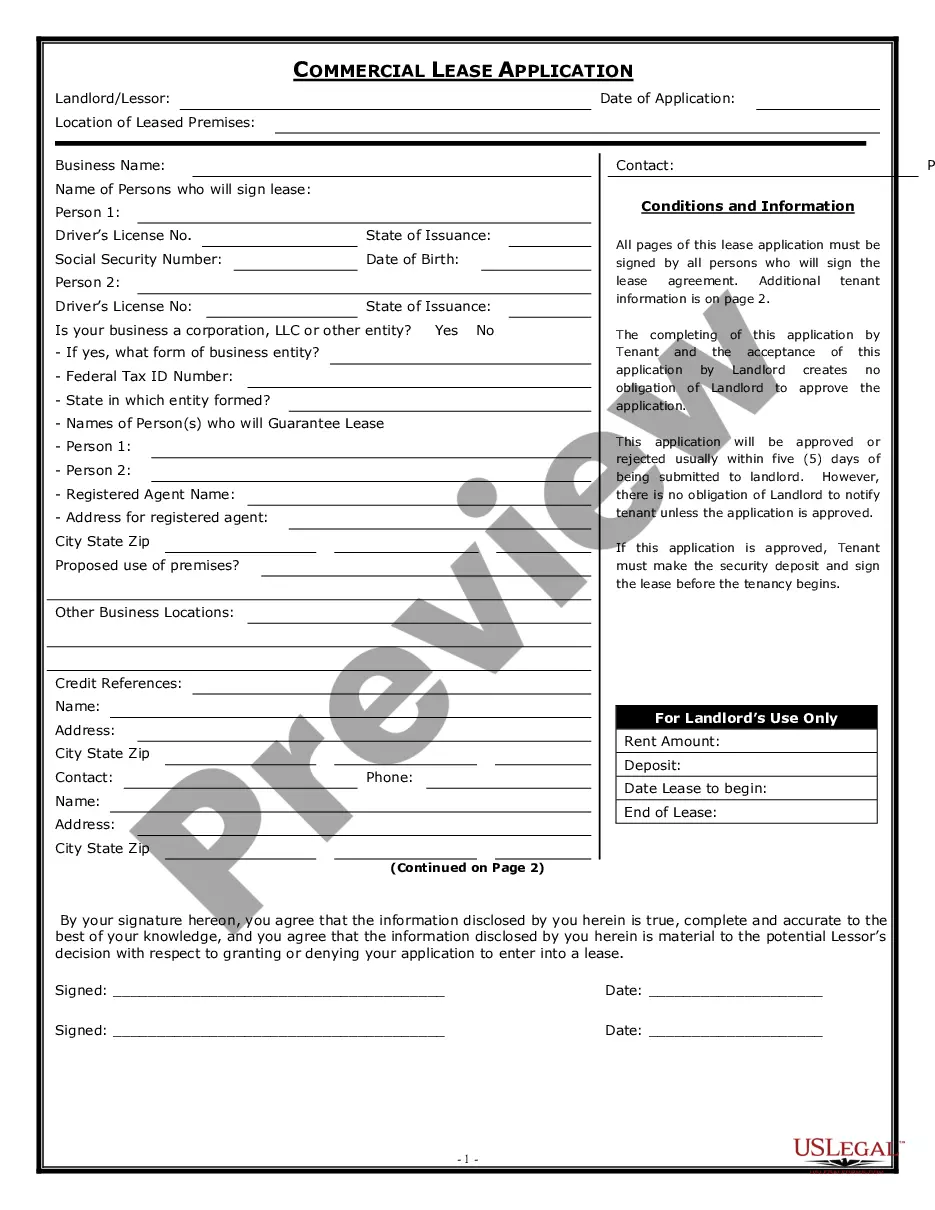

When it comes to filling out New York Release of Lien of Estate Tax, you almost certainly visualize an extensive procedure that involves choosing a appropriate sample among a huge selection of similar ones and after that being forced to pay legal counsel to fill it out to suit your needs. Generally speaking, that’s a slow and expensive choice. Use US Legal Forms and select the state-specific form in just clicks.

In case you have a subscription, just log in and click on Download button to find the New York Release of Lien of Estate Tax sample.

If you don’t have an account yet but want one, stick to the point-by-point manual listed below:

- Make sure the document you’re saving applies in your state (or the state it’s needed in).

- Do this by reading through the form’s description and through clicking on the Preview option (if available) to find out the form’s content.

- Click on Buy Now button.

- Find the suitable plan for your financial budget.

- Subscribe to an account and choose how you would like to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the record on your device or in your My Forms folder.

Skilled lawyers work on creating our templates so that after saving, you don't need to worry about enhancing content outside of your personal details or your business’s info. Be a part of US Legal Forms and receive your New York Release of Lien of Estate Tax example now.

Form popularity

FAQ

The estate of an individual who was a NYS resident at the time of death must file a NYS estate tax return if the total of the federal gross estate plus any includible taxable gifts made while the individual was a resident of New York State exceeds the New York State basic exclusion amount ($5,850,000) applicable for

The current New York estate tax exemption amount is $5,930,000 for 2021. Under current law, this number will remain until January 1, 2022, at which point it will rise again with inflation.

The estate tax rate in New York ranges from 3.06% to 16%. Estates over $5.25 million are subject to this tax.

For deaths occurring after January 1, 2020, New York will tax estates valued at more than $5,850,000. Even if your estate is not large enough to owe federal estate tax (currently, the exemption amount is $11,580,000 for an individual), you may still owe an estate tax to the great state of New York.

If you've inherited money or property after a loved one dies, you may be subject to an inheritance tax.The main difference between an inheritance and estate taxes is the person who pays the tax. . Unlike an inheritance tax, estate taxes are charged against the estate regardless of who inherits the deceased's assets.

When authorization is required for the release of personal property, it is usually referred to as an estate tax waiver or a consent to transfer. New York State does not require waivers for estates of anyone who died on or after February 1, 2000. For details, See Publication 603, Estate Tax Waivers.

Does New York have an estate tax? Yes. New York, like several other states, has a state estate tax. This means that when someone dies a resident of New York, or with property physically located in New York, his or her estate may be subject to tax not only by the federal government, but also by New York.

New York does not have an inheritance tax, so there wouldn't be an inheritance tax owed on property owned in New York.A federal estate tax may also be incurred on estates that exceed the federal exemption, presently $11.85 million for decedents dying in 2020.