New York Building Loan Agreement

Description How To Write A Contract For Loaning Money

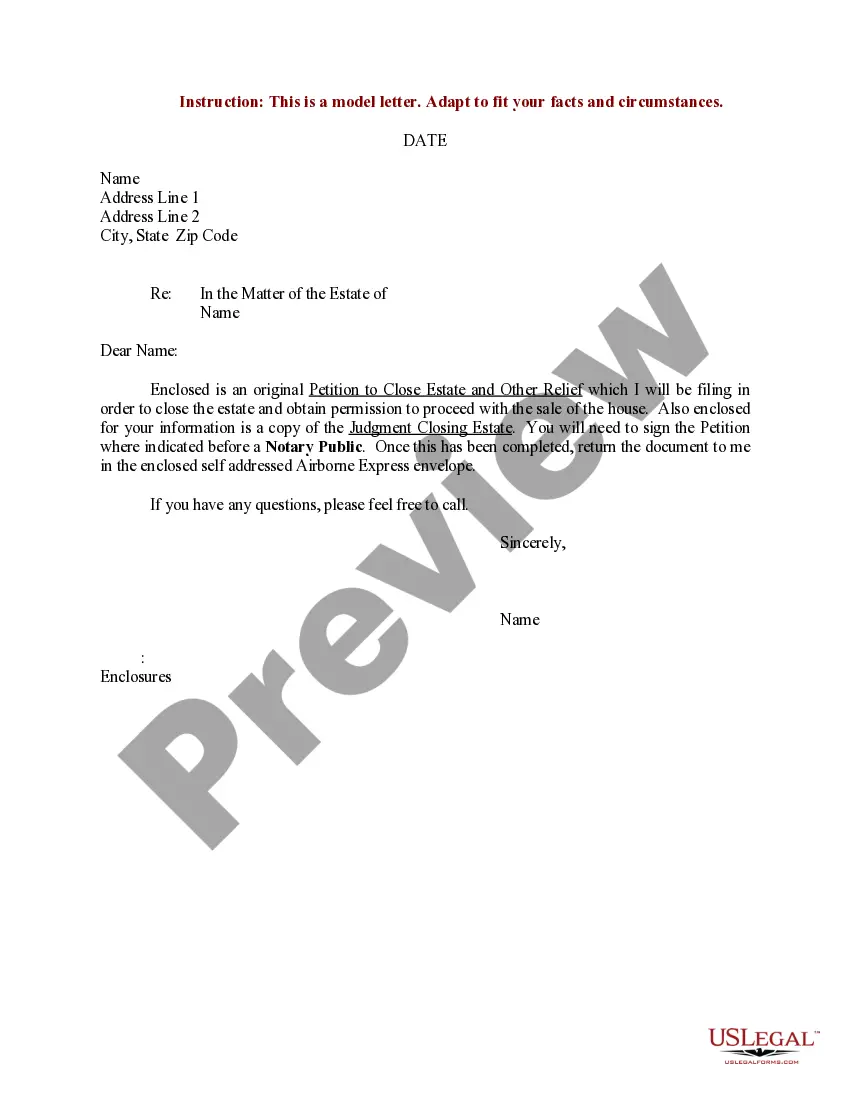

How to fill out New York Loan Agreement?

When it comes to filling out New York Building Loan Agreement, you almost certainly visualize an extensive procedure that involves choosing a suitable sample among numerous similar ones and then being forced to pay out a lawyer to fill it out for you. In general, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific document in just clicks.

For those who have a subscription, just log in and click on Download button to have the New York Building Loan Agreement template.

In the event you don’t have an account yet but need one, stick to the step-by-step manual below:

- Be sure the document you’re getting is valid in your state (or the state it’s needed in).

- Do it by reading through the form’s description and by visiting the Preview option (if available) to see the form’s content.

- Simply click Buy Now.

- Choose the suitable plan for your financial budget.

- Join an account and select how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx format.

- Find the record on your device or in your My Forms folder.

Professional attorneys draw up our templates so that after saving, you don't have to bother about modifying content outside of your individual info or your business’s info. Be a part of US Legal Forms and get your New York Building Loan Agreement document now.

Lending Contract Template Form popularity

Loan Contract Example Other Form Names

Loan Agreement FAQ

Loan agreements are binding contracts between two or more parties to formalize a loan process.Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

(a) If funds are advanced to or on behalf of a trustee, for the purposes of the trust, either the trustee or the person advancing the funds may file a "Notice of Lending" as provided in this subdivision.Each such notice shall be indexed by the name of the trustee to whom or on whose behalf the advances are made.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how.Once it has been executed, it is essentially a promise to pay from the lender to the borrower.

A loan agreement is a contract between a borrower and a lender which regulates the mutual promises made by each party.Loan agreements are usually in written form, but there is no legal reason why a loan agreement cannot be a purely oral contract (although oral agreements are more difficult to enforce).

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.

A personal loan agreement is a legally binding document regardless of whether the lender is a financial institution or another person.As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.