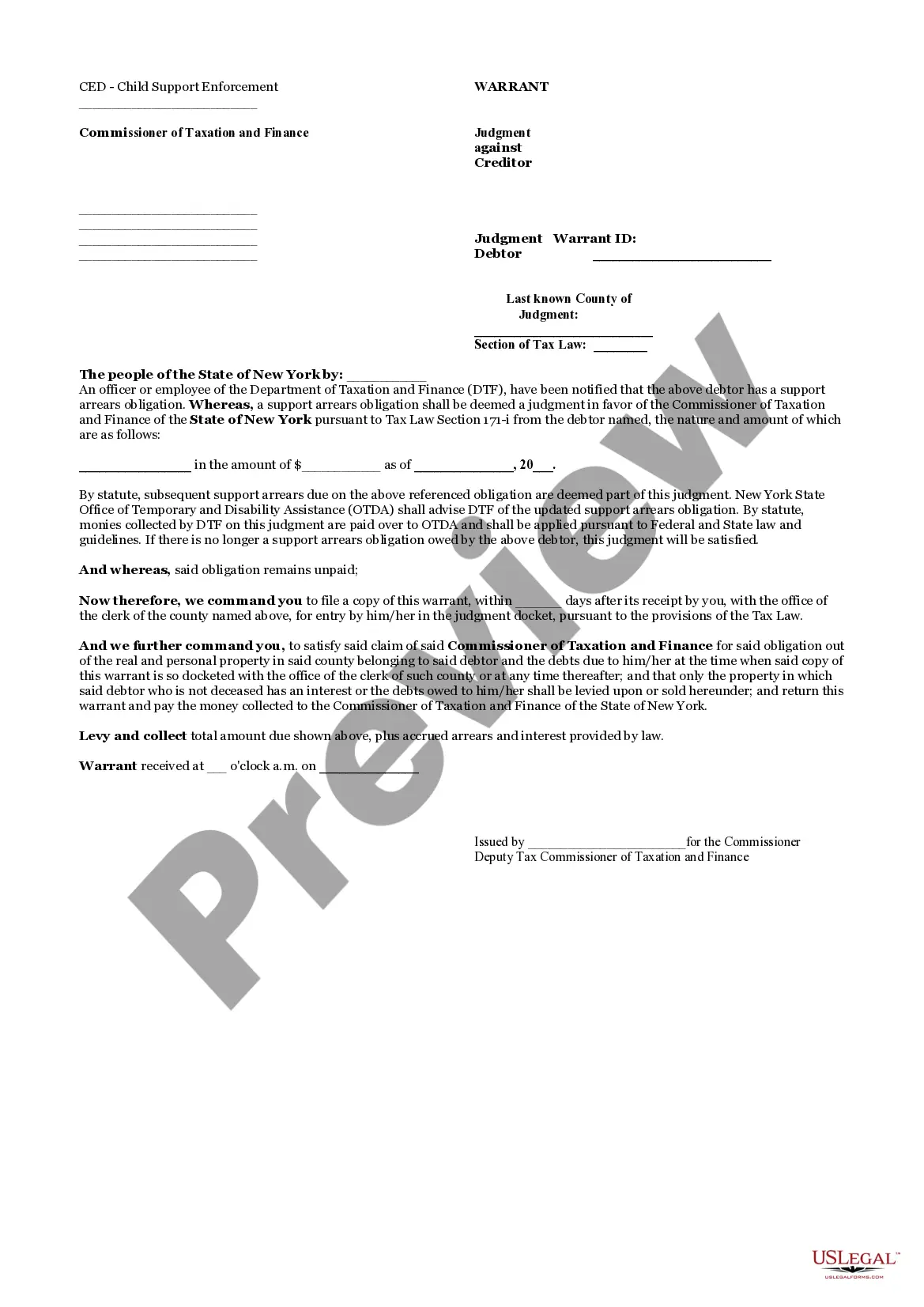

New York Warrant

Description

How to fill out New York Warrant?

When it comes to filling out New York Warrant, you almost certainly imagine a long process that consists of choosing a ideal sample among countless similar ones and after that being forced to pay a lawyer to fill it out for you. Generally speaking, that’s a slow and expensive option. Use US Legal Forms and select the state-specific form in just clicks.

If you have a subscription, just log in and then click Download to have the New York Warrant sample.

In the event you don’t have an account yet but need one, follow the step-by-step guide below:

- Make sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by reading the form’s description and also by clicking the Preview function (if available) to view the form’s information.

- Click on Buy Now button.

- Select the proper plan for your financial budget.

- Join an account and select how you want to pay: by PayPal or by card.

- Download the document in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Professional attorneys work on drawing up our templates to ensure after saving, you don't have to worry about editing content outside of your individual details or your business’s info. Be a part of US Legal Forms and get your New York Warrant sample now.

Form popularity

FAQ

The State of New York has 20 years from the date a warrant could have been filed to collect on a tax debt. This is double the ten years given for the IRS Collection Statute Expiration Date. NYS will be actively trying to collect while IRS debts are already expired.

Police are not allowed to keep you under arrest without charge indefinitely. Unless you are suspected of terrorism, they can only keep you under arrest for six hours before they either charge you with an offence or release you from custody, unless an extension is granted by a detention warrant.

You can get information about arrest warrants issued by the New York City Police Department by contacting the Criminal Court's information line or office of arrest. If you are going in person, you must bring a valid ID. The offices are open Monday to Friday, 9 AM to 5 PM.

A tax warrant is a public record that is attached to all your current and future assets. You will be unable to sell or refinance these assets while the lien is in effect. If you do not attempt to settle your tax debt with the IRS, your property can be seized to satisfy the debt.

If a law enforcement officer stops an individual with an outstanding bench warrant against him, the person may be detained on the warrant, and may be held in jail until a bond is posted or a hearing is held on the warrant.

Like a summons, a warrant is also a written order issued by a court after the filing of a criminal or traffic complaint, but unlike a summons, a warrant requires the police to arrest the person named in the warrant.

A tax warrant is equivalent to a civil judgment against you, and protects New York State's interests and priority in the collection of outstanding tax debt. We file a tax warrant with the appropriate New York State county clerk's office and the New York State Department of State, and it becomes a public record.

Property taxes are considered delinquent for purposes of this program under either of the following circumstances: The taxes remain unpaid one year after the last date on which they could have been paid without interest.