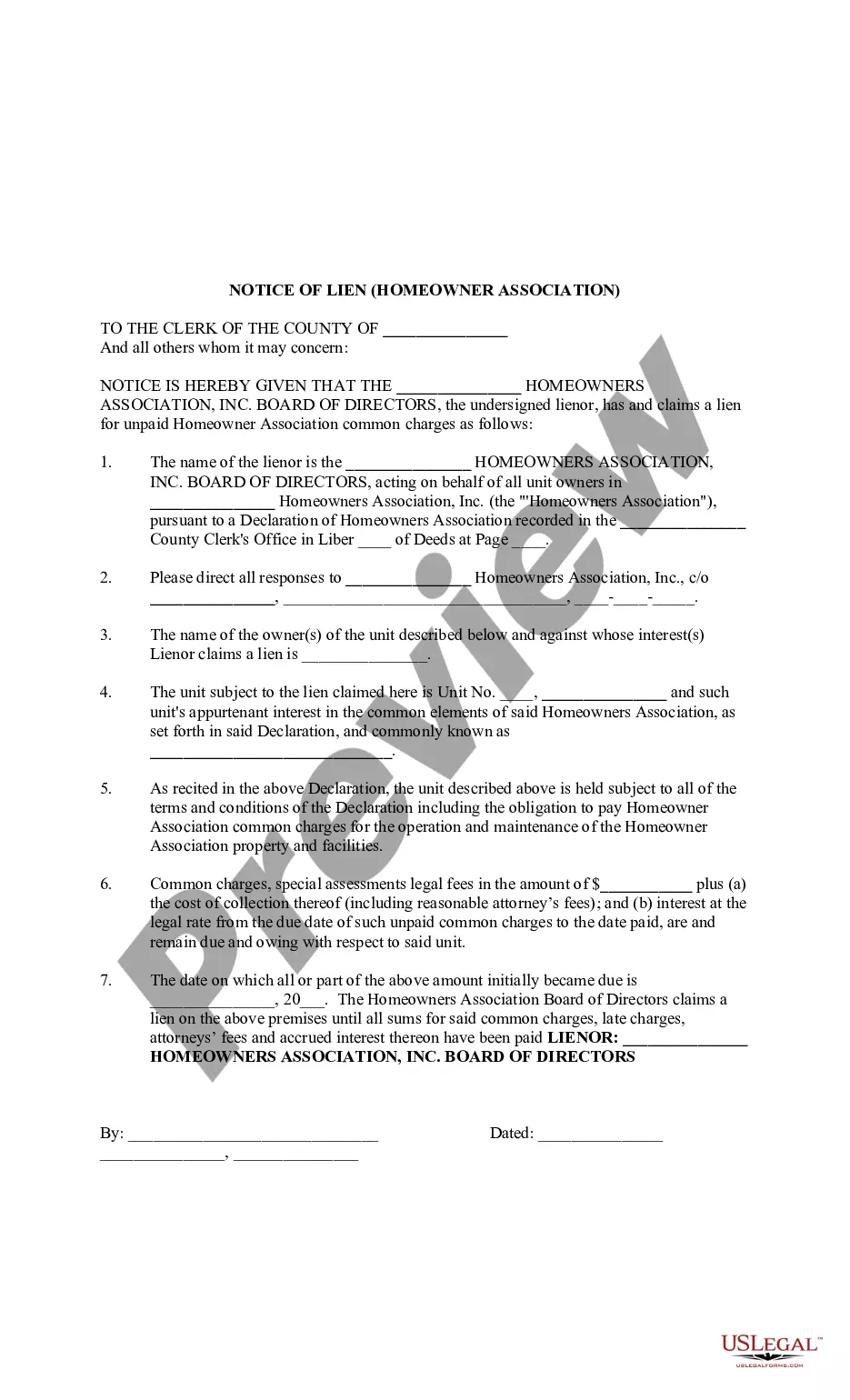

New York Notice of Lien from Homeowner Association

Description Homeowner Association Ny

How to fill out Homeowner Association Template?

In terms of submitting New York Notice of Lien from Homeowner Association, you probably think about a long process that consists of getting a perfect sample among a huge selection of very similar ones and after that needing to pay out a lawyer to fill it out to suit your needs. Generally, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific form within just clicks.

For those who have a subscription, just log in and then click Download to get the New York Notice of Lien from Homeowner Association form.

In the event you don’t have an account yet but want one, stick to the point-by-point manual listed below:

- Make sure the document you’re getting applies in your state (or the state it’s needed in).

- Do so by reading the form’s description and by clicking the Preview option (if available) to find out the form’s content.

- Simply click Buy Now.

- Find the suitable plan for your financial budget.

- Sign up to an account and choose how you would like to pay out: by PayPal or by card.

- Save the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled lawyers work on drawing up our samples to ensure that after saving, you don't have to worry about editing and enhancing content outside of your individual info or your business’s info. Sign up for US Legal Forms and get your New York Notice of Lien from Homeowner Association document now.

Notice Homeowner Association Form popularity

Homeowner Association Statement Other Form Names

Homeowner Association Sample FAQ

Foreclosure Eliminates Liens, Not Debt Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title.

Removal of Association's Lien To remove a lien on a property, homeowners must first satisfy the debt owed to the homeowners association. To pay off an HOA lien, the homeowner must make payment to the association in the amount of the delinquent assessments, plus interest and any applicable fees.

Liens Wiped Out, Not Debt The HOA first sends you a notice of the delinquent fees and ways to resolve the debt.Foreclosure by a mortgage lender wipes out the HOA lien, but doesn't resolve the debt itself.

Liens Wiped Out, Not Debt The HOA first sends you a notice of the delinquent fees and ways to resolve the debt.Foreclosure by a mortgage lender wipes out the HOA lien, but doesn't resolve the debt itself.

Majority of Members Must Consent to Dissolution of HOA Because an HOA technically consists of two parts, the legal entity plus its membership, one part usually needs the consent and approval of the other in order to take an extreme action like dissolution.

If an HOA has a lien on a homeowner's property, it may forecloseeven if the home already has a mortgage on itas permitted by the CC&Rs and state law. The HOA can foreclose either through judicial foreclosure or a nonjudicial foreclosure, depending on state law and the terms in the CC&Rs.

All negative information, including the HOA lien, affects your credit score. The HOA lien stays on your credit report for seven years.If your HOA pursues foreclosure after placing the lien, it would force your first mortgage holder to also file foreclosure.

Some people use HOA rules and HOA covenants interchangeably. You can find HOA covenants within your association's Covenants, Conditions, & Restrictions (CC&Rs). These dictate the association's and the members' obligations and rights.Both HOA covenants and rules are legally binding and enforceable.

So, like tax liens, property liens don't impact your credit score because they don't show on your credit report.That means that if a lender checks public records, a property lien could still affect your ability to get approved for a loan, even though the lien doesn't appear on your report.