New York Certificate of Authority

Description New York State Certificate Of Authority

How to fill out New York Certificate Of Authority?

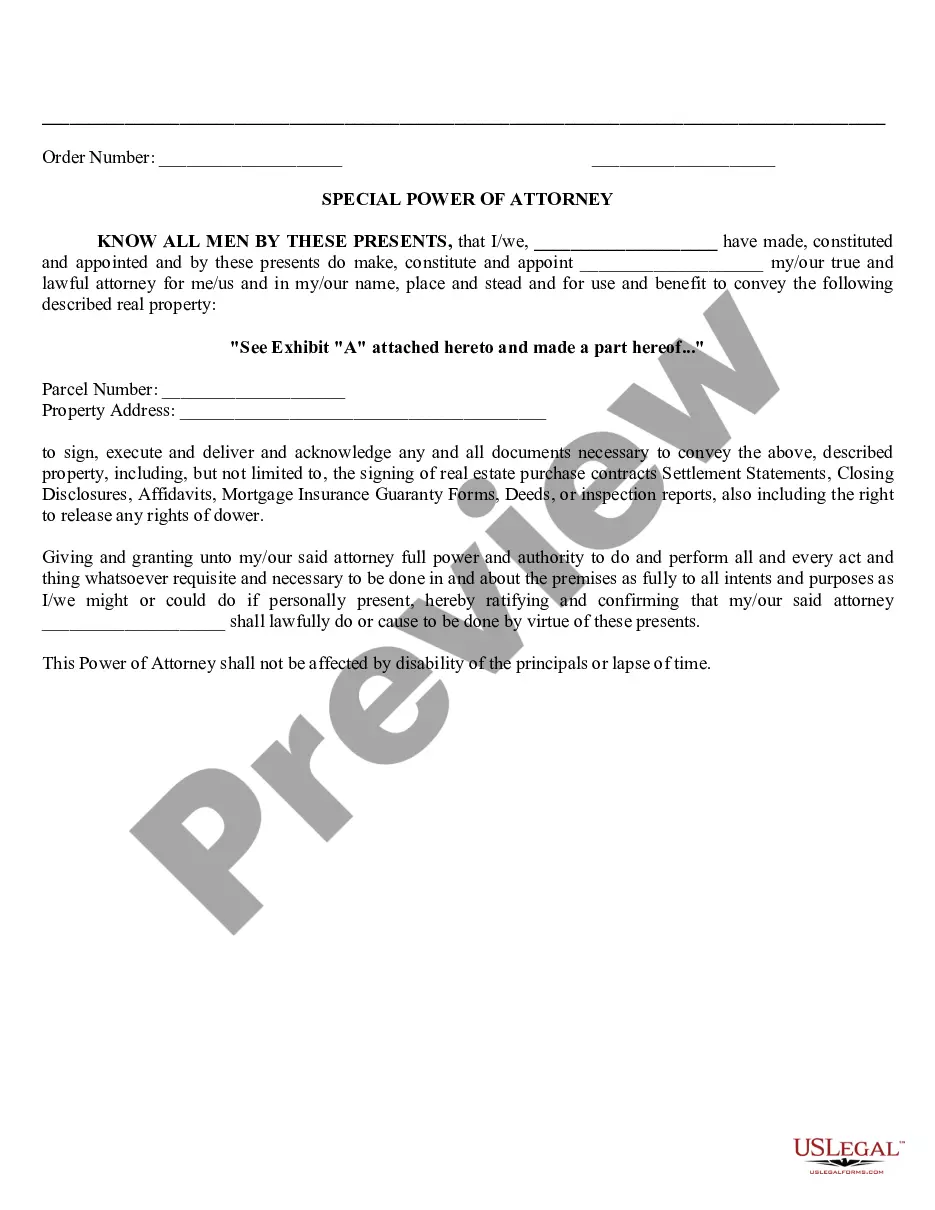

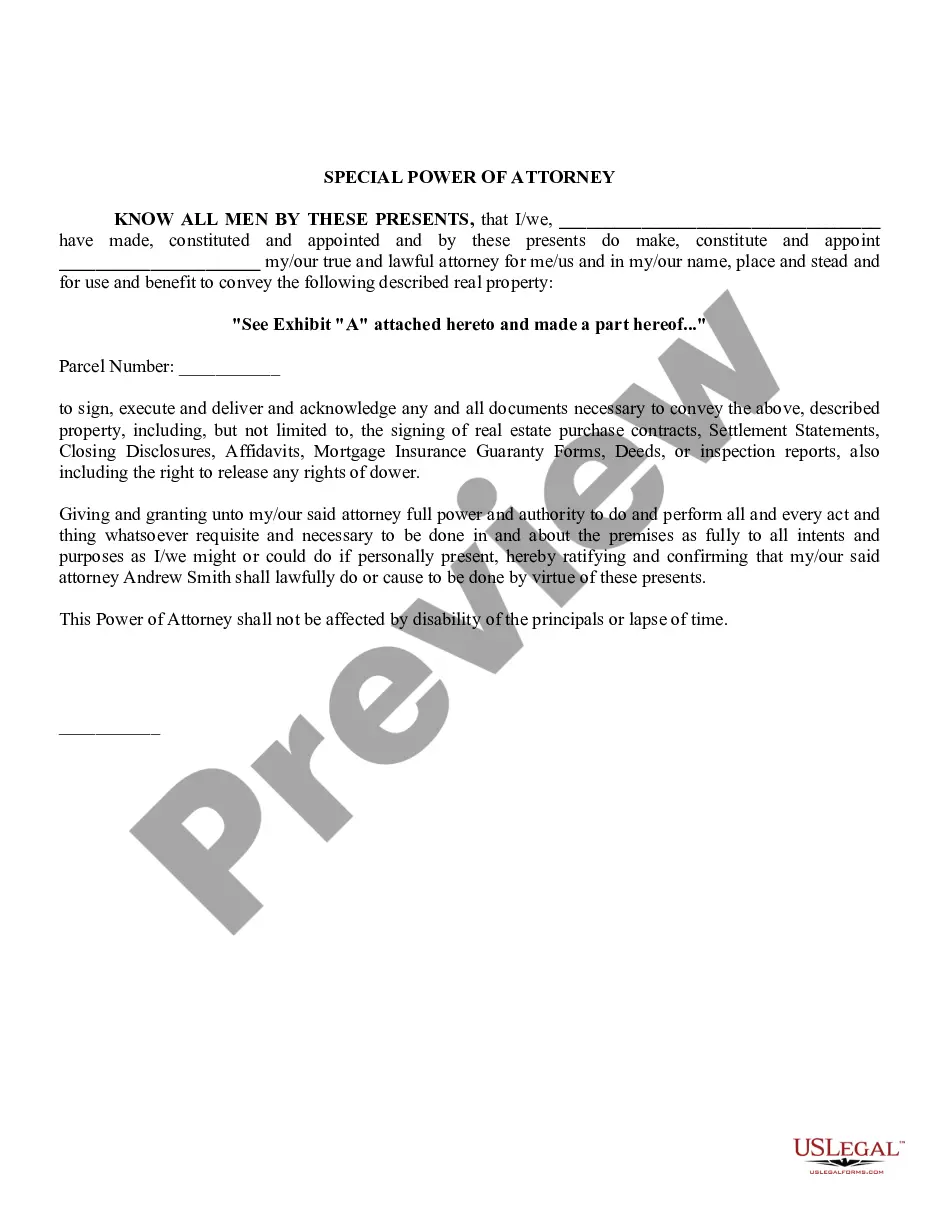

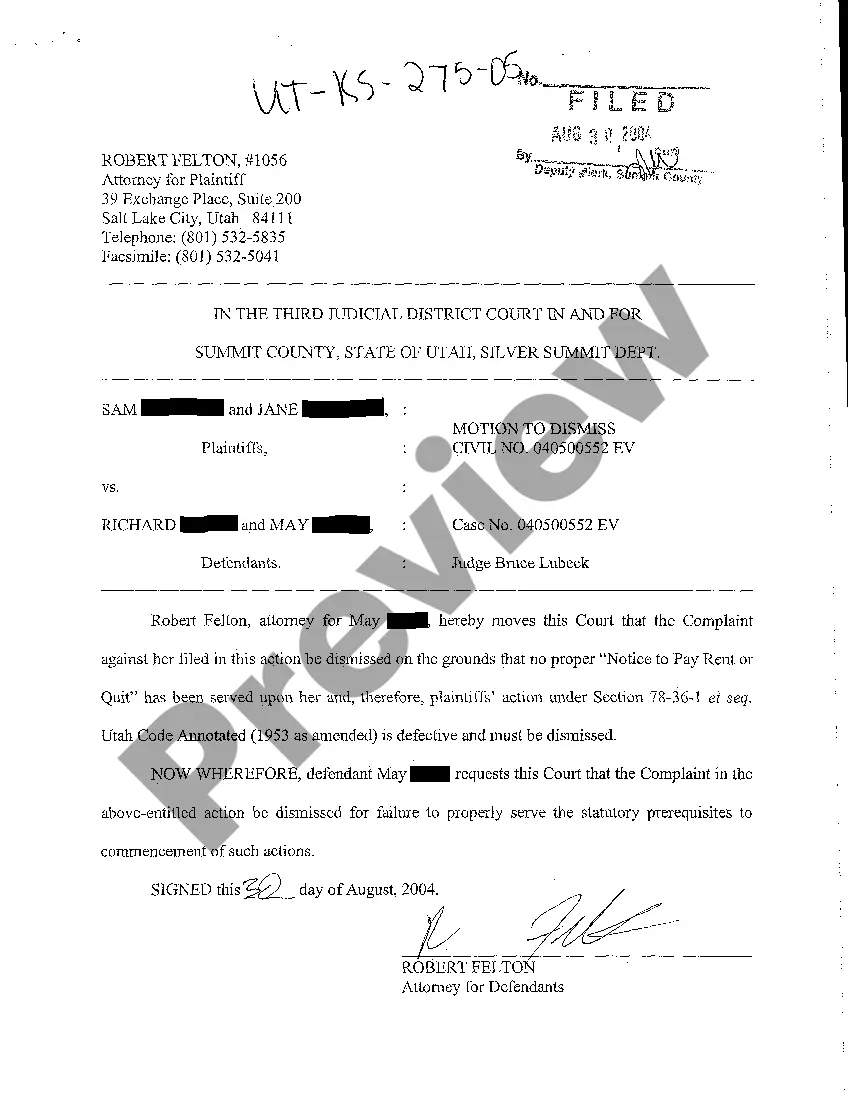

When it comes to filling out New York Certificate of Authority, you probably imagine an extensive procedure that involves getting a suitable sample among numerous very similar ones then having to pay out an attorney to fill it out to suit your needs. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and select the state-specific template in just clicks.

In case you have a subscription, just log in and click Download to have the New York Certificate of Authority template.

If you don’t have an account yet but need one, follow the point-by-point guideline below:

- Make sure the document you’re downloading applies in your state (or the state it’s required in).

- Do it by reading the form’s description and by visiting the Preview option (if readily available) to see the form’s content.

- Click Buy Now.

- Choose the suitable plan for your financial budget.

- Join an account and select how you want to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Professional lawyers draw up our templates so that after downloading, you don't need to worry about editing and enhancing content material outside of your individual details or your business’s information. Sign up for US Legal Forms and get your New York Certificate of Authority document now.

Nys Certificate Of Authority Number Form popularity

What Is A Certificate Of Authority In Ny Other Form Names

Ny Certificate Of Authority FAQ

The Certificate of Authority gives you the right to collect tax on your taxable sales and to issue and accept most New York State sales tax exemption certificates. Generally, the seller collects the tax from the purchaser and remits it to New York State.

To apply for a Certificate of Authority use New York Business Express. Your application will be processed and, if approved, we'll mail your Certificate of Authority to you. You cannot legally make any taxable sales until you have received your Certificate of Authority.

If you go this route, your certificate will arrive within four to six weeks. Delays can occur if the office needs to request additional information. When you receive the certificate, it should be displayed prominently at your office or place of business.

To obtain your New York Certificate of Authority, you will submit an Application for Certificate of Authority, along with required certificates or certified copies from your home state. You will need to appoint a registered agent in order for your filing to be approved.

In New York State, the Certificate of Authority, also known as the Certificate of Authority to Collect Sales Tax, is the Sales Tax ID number the state requires a business to use when collecting sales tax. Requests for a Sales Tax ID number must go through the New York State (NYS) Department of Taxation and Finance.

The new Certificate of Authority will not contain an expiration date, but will be subject to the same renewal procedures when reregistration is again required.

In short, a state ID number (certificate of authority) and an EIN number are two different things. One is given to you by the federal government. The other tax identification number is given to you by the state.