A New York Notice of Lien and Sale is a legal document issued by a creditor to a debtor when the debtor has failed to pay back a loan or other debt. This document is a public announcement of the debt, and it gives the debtor a chance to pay the amount owed before the creditor takes legal action. A Notice of Lien and Sale gives the creditor the right to seize and sell the debtor’s property to recoup the unpaid debt. There are two main types of New York Notice of Lien and Sale: judicial liens and non-judicial liens. A judicial lien is a lien placed on a debtor’s property by a court order, while a non-judicial lien is a lien placed on a debtor’s property without a court order. Both types of liens are public records and can be used to collect the debt. The New York Notice of Lien and Sale must include all the relevant information about the debt, including the amount owed, the date of the lien, the debtor’s name, address, and contact information, and the creditor’s name and address. The notice should also include information about the creditor’s right to seize and sell the debtor’s property if the debt is not paid.

New York Notice of Lien and Sale

Description

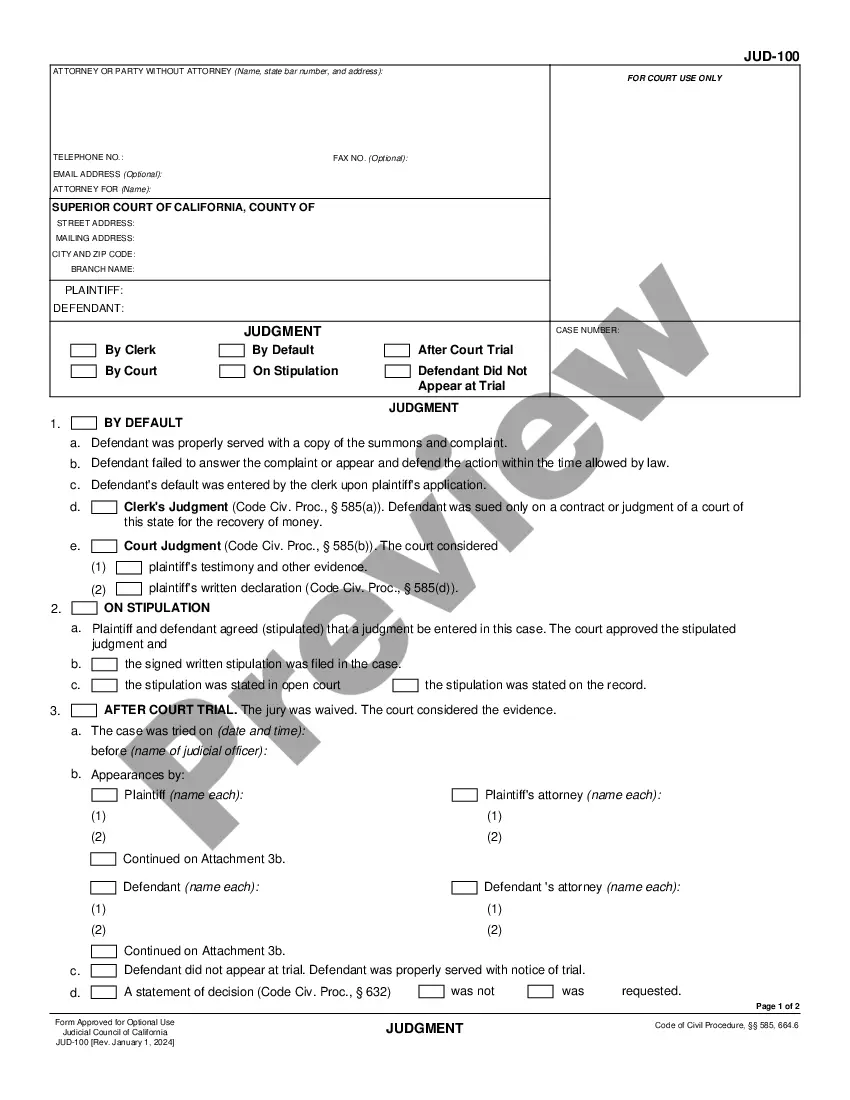

How to fill out New York Notice Of Lien And Sale?

US Legal Forms is the most straightforward and profitable way to locate suitable formal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with national and local laws - just like your New York Notice of Lien and Sale.

Getting your template takes only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted New York Notice of Lien and Sale if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your needs, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Notice of Lien and Sale and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more proficiently.

Take advantage of US Legal Forms, your reliable assistant in obtaining the required official paperwork. Give it a try!

Form popularity

FAQ

If the car's seller is unable to pay off their loan, they can sell the car while it still has a lien. If you're considering purchasing a car with a lien through a private party, you'll want to make sure that the lien is removed before you become the new owner.

Once you pay off your vehicle and would like the vehicle title in your name, you need to provide: Notice of Recorded Lien (Form MV-900): An official of the lien holder can complete this form and send it to you to give to the NY DMV. You need to contact the NY DMV office about receiving this form.

To remove a lien, you do not need to go to your local DMV. Just mail these items: proof that the lien was satisfied (must be the original - photocopies are not accepted) your current title certificate (must be the original ? photocopies not accepted)

Liens can be filed with the New York State DMV for all titled vehicles, boats and manufactured homes (MFH). The lien filing fee is $5.00 per lien filed, and is paid by the lender.

PLEASE NOTE: When you sell a vehicle, you do not need to remove a lien from the certificate of title. You can give the original title and the original lien release to the buyer. If you want to get a lien free title, please read below for further instructions.

There are only nine title-holding states: Kentucky, Maryland, Michigan, Minnesota, Missouri, Montana, New York, Oklahoma, Wisconsin. In the other 41 states, titles are issued to the lien holder of your vehicle until the loan is fully paid off.

The lienholder's statement that includes the owner's name and the year, make and VIN of the vehicle. The statement must be on the lien holder's letterhead and must state that the lienholder holds the original title and understands that the copy of the title will be used to register the vehicle in New York.

New York's program differs from other state's ELT programs because in New York titles are issued to the vehicle owners, not to lienholders; therefore there is no electronic title component in the DMV's System.