New York Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description Special Power Attorney

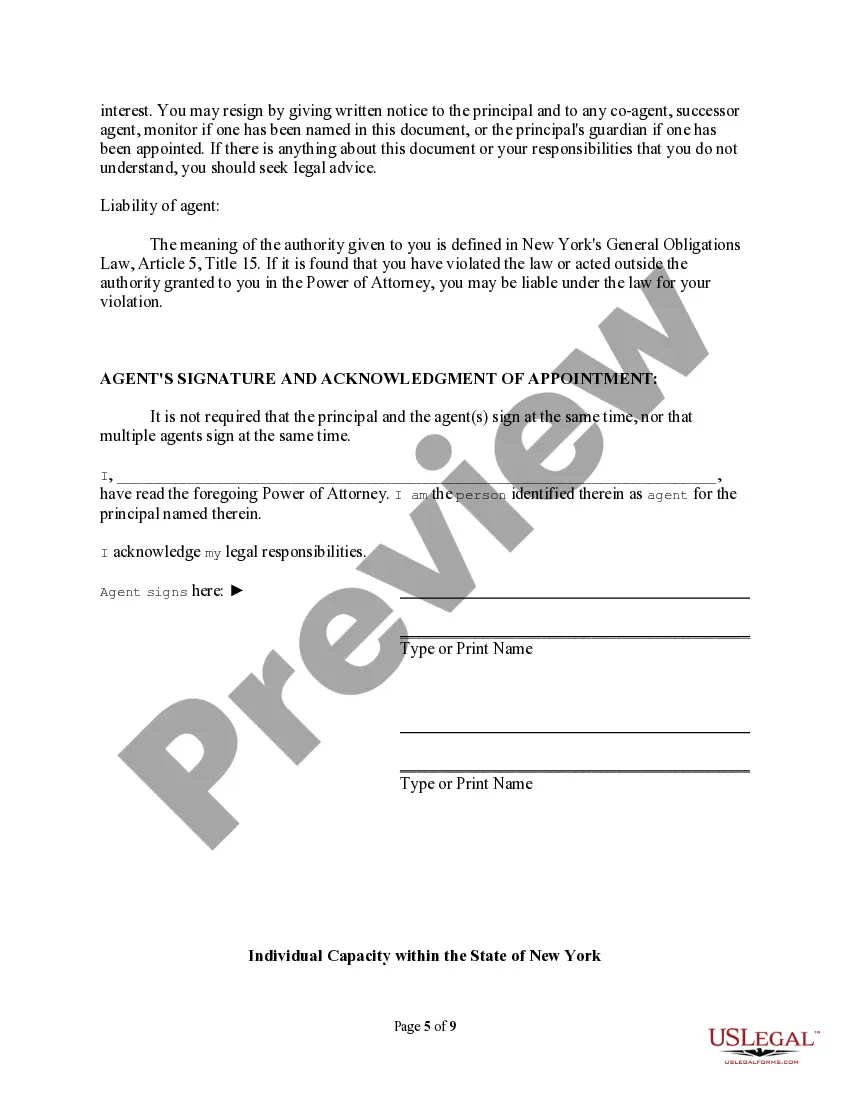

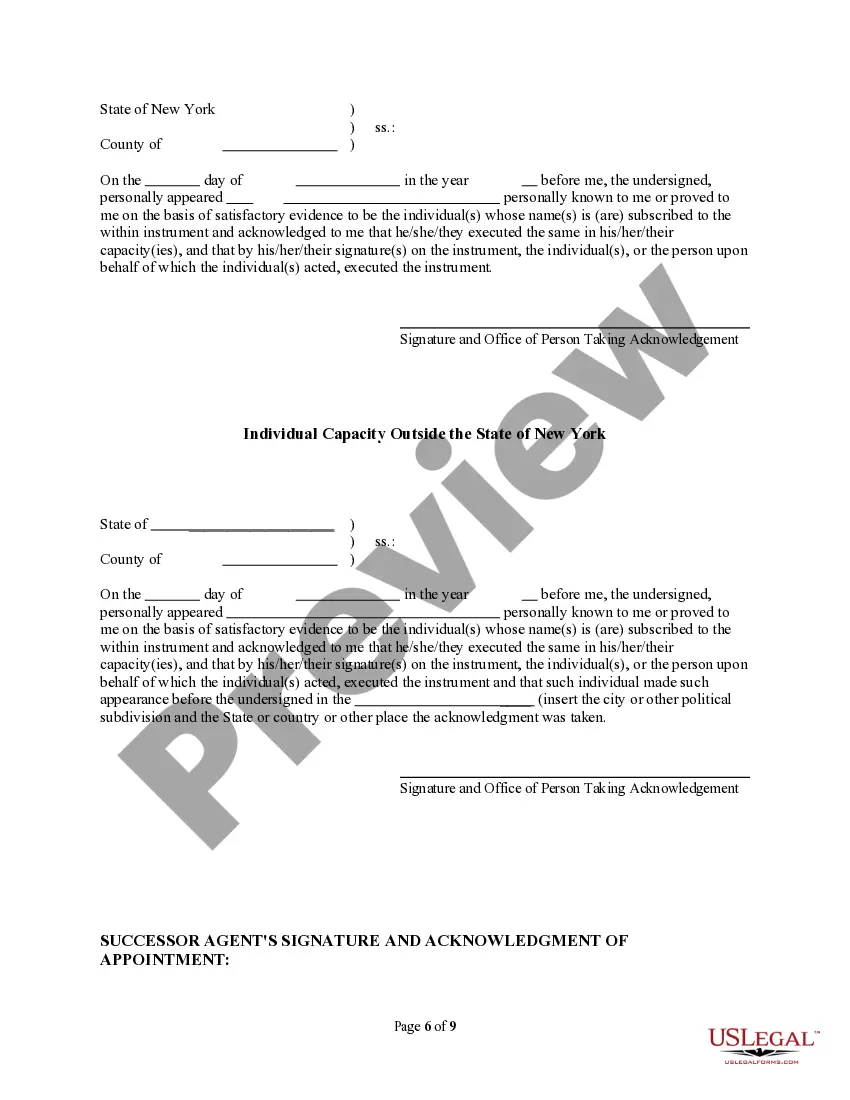

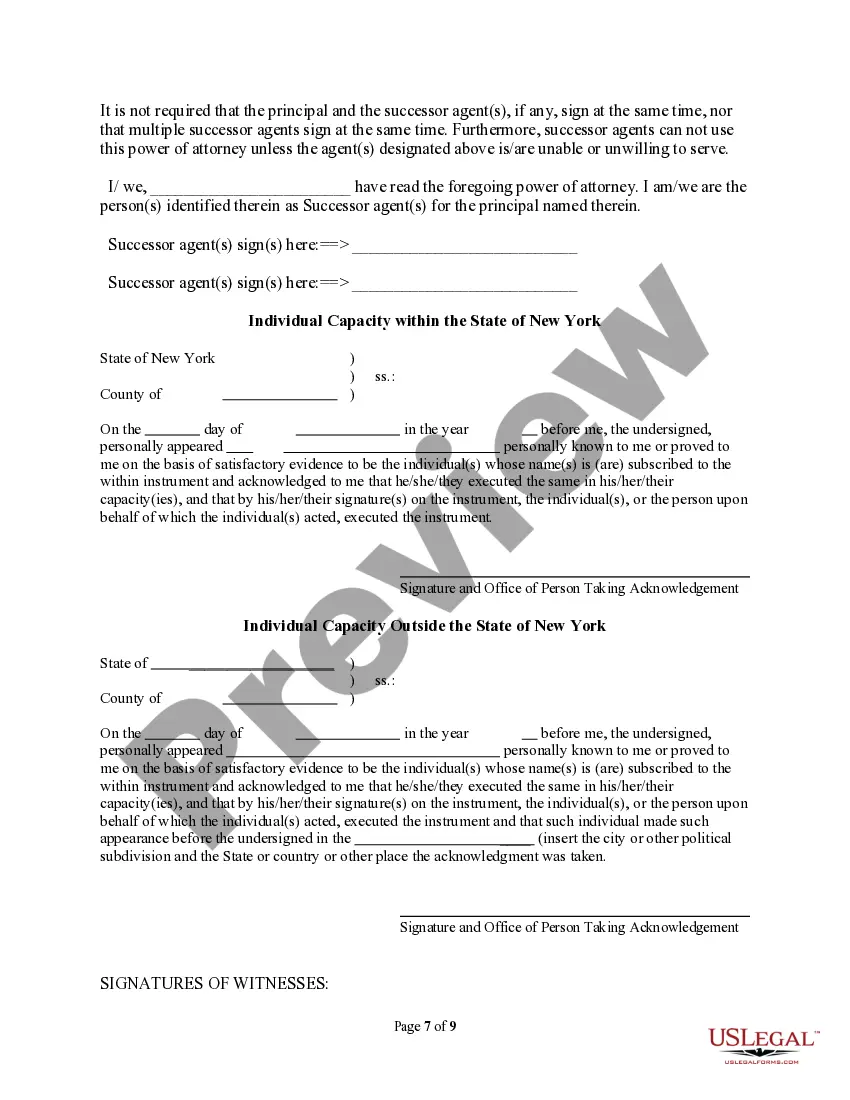

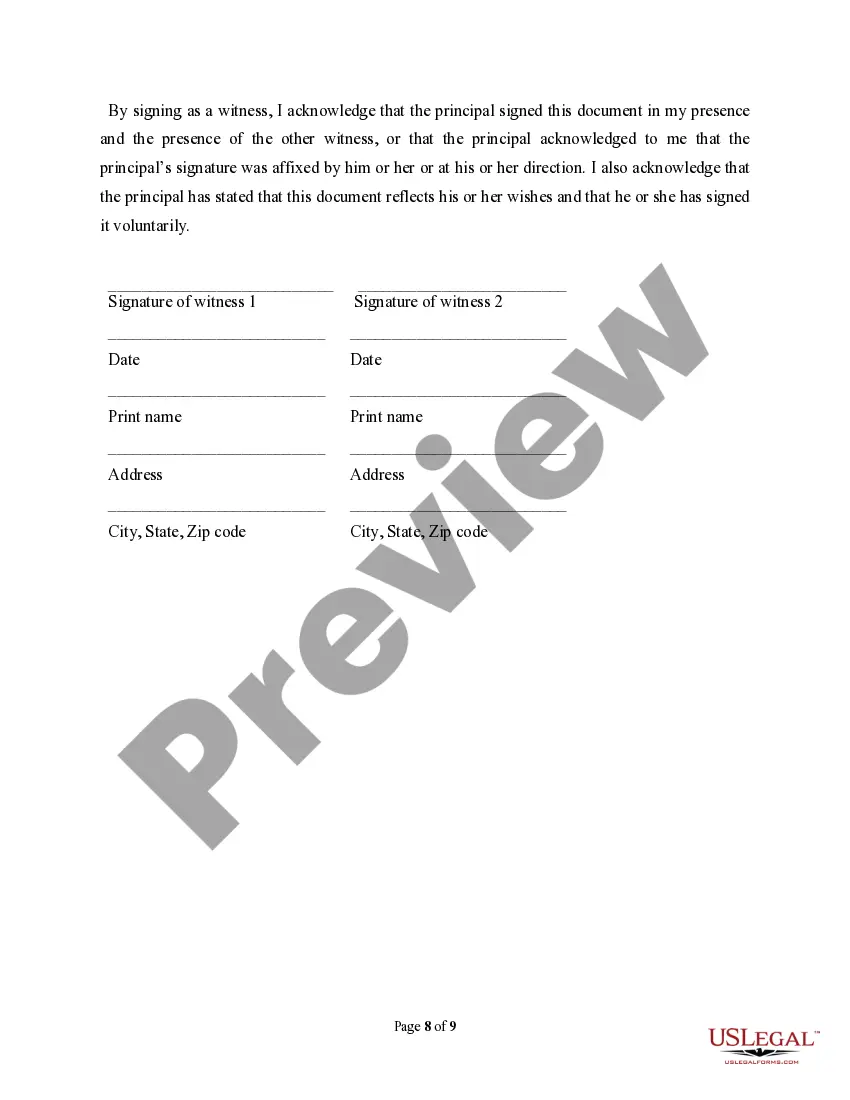

How to fill out Special Power Attorney Form?

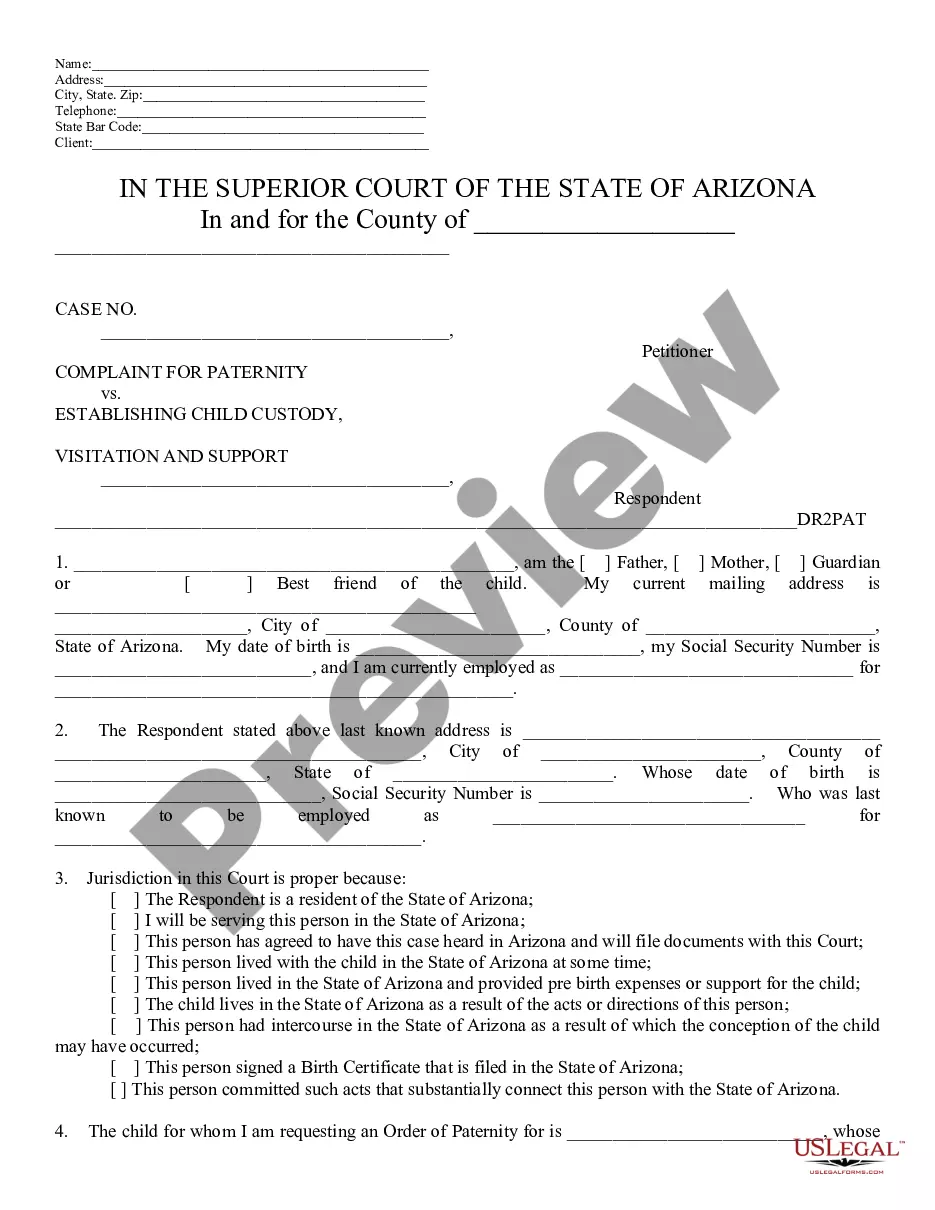

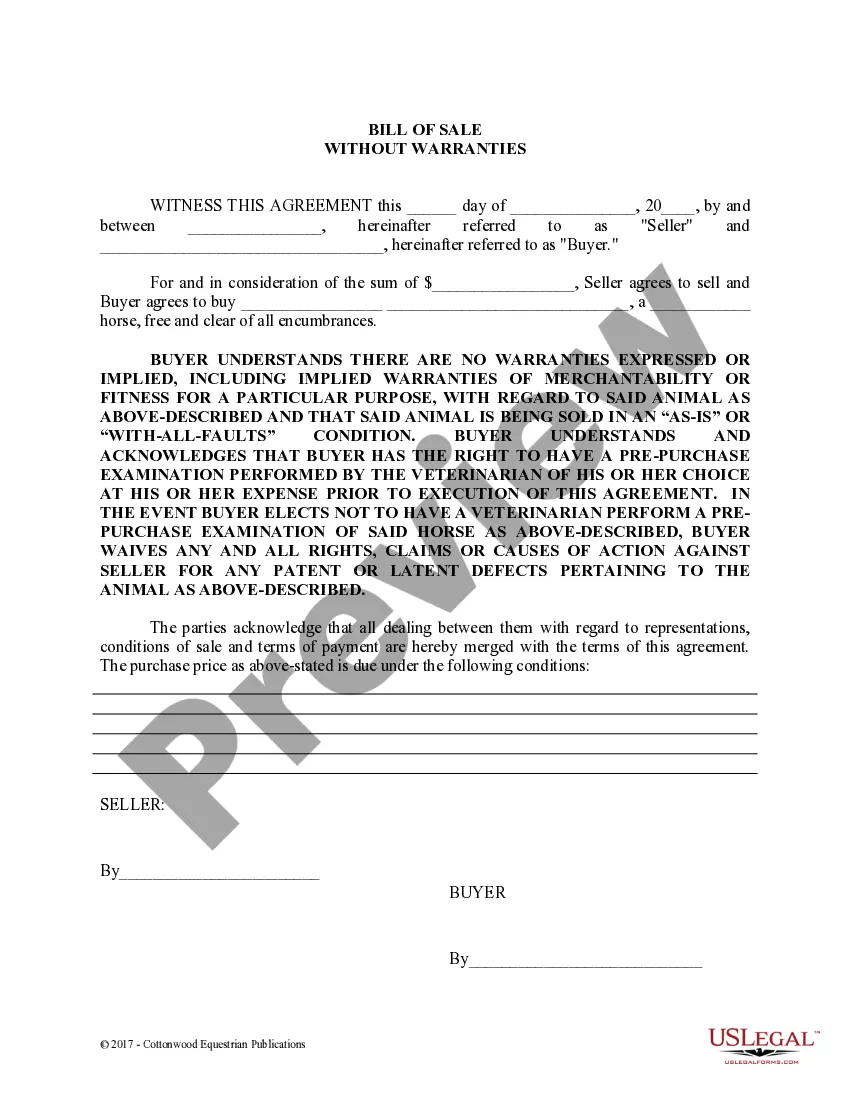

When it comes to submitting New York Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser, you almost certainly think about an extensive procedure that involves getting a appropriate form among a huge selection of very similar ones and then needing to pay out a lawyer to fill it out for you. Generally, that’s a slow-moving and expensive choice. Use US Legal Forms and select the state-specific template within clicks.

If you have a subscription, just log in and click Download to have the New York Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser form.

In the event you don’t have an account yet but need one, follow the step-by-step manual below:

- Be sure the document you’re saving applies in your state (or the state it’s needed in).

- Do so by reading the form’s description and by clicking on the Preview function (if accessible) to see the form’s information.

- Simply click Buy Now.

- Pick the appropriate plan for your budget.

- Sign up to an account and select how you want to pay out: by PayPal or by credit card.

- Save the file in .pdf or .docx format.

- Find the record on the device or in your My Forms folder.

Skilled lawyers draw up our templates so that after downloading, you don't need to bother about editing and enhancing content material outside of your individual info or your business’s information. Join US Legal Forms and receive your New York Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser sample now.

Agent State Person Form popularity

Closing Real Estate Transaction Other Form Names

Limited Power Attorney FAQ

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

The states that require a real estate attorney to be involved include Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New York, North Dakota, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia

Remember that all of the authorized agents under the power of attorney or representatives in an estate must sign the listing agreement, disclosure documents, etc. For example, when there are two executors in an estate, then they both must sign the Listing Contract.

The durable power of attorney is almost always required. This instrument gives another person specific powers to sign for an individual in a real estate transaction where the exact name and description of the property is stated in the document.

A limited PoA, amongst other things, grants the PoA holder access and permission to execute trades/orders on your trading account, on your behalf. However, it does not allow the PoA holder to perform withdrawals requests or transfer of funds. All withdrawals must be requested by the authorized signatory of the account.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.