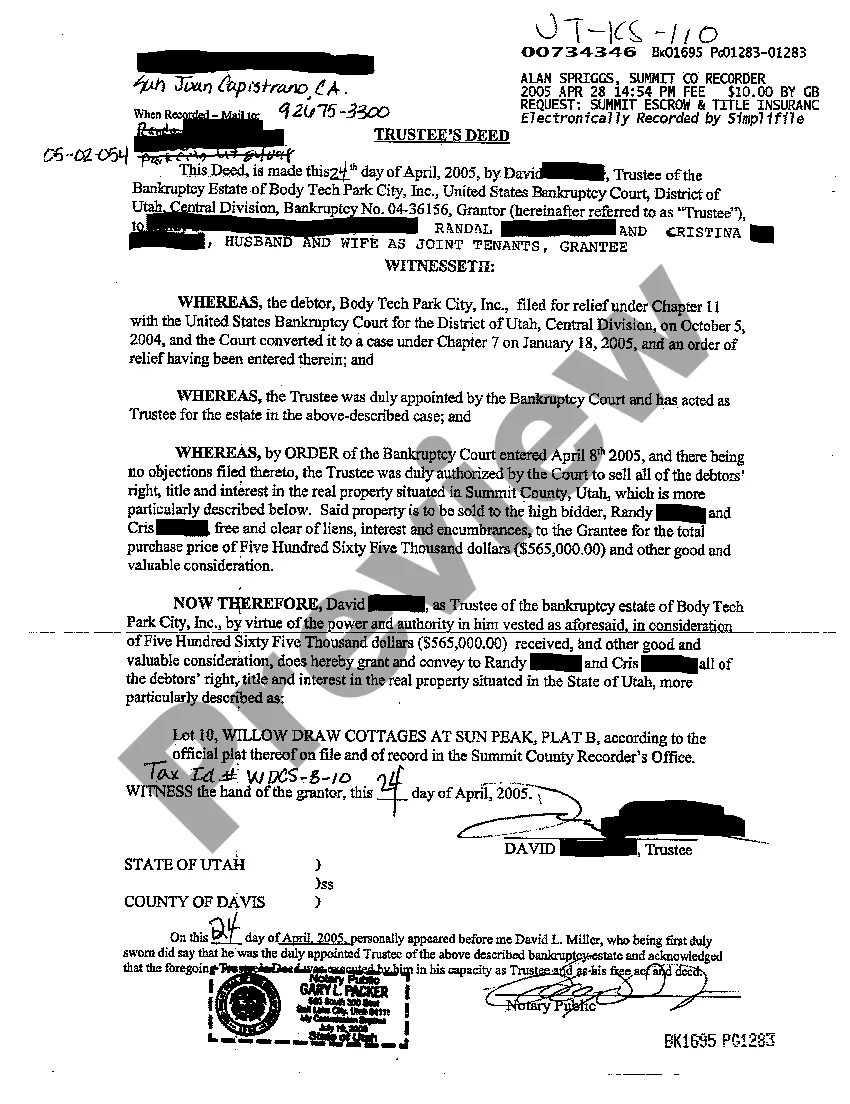

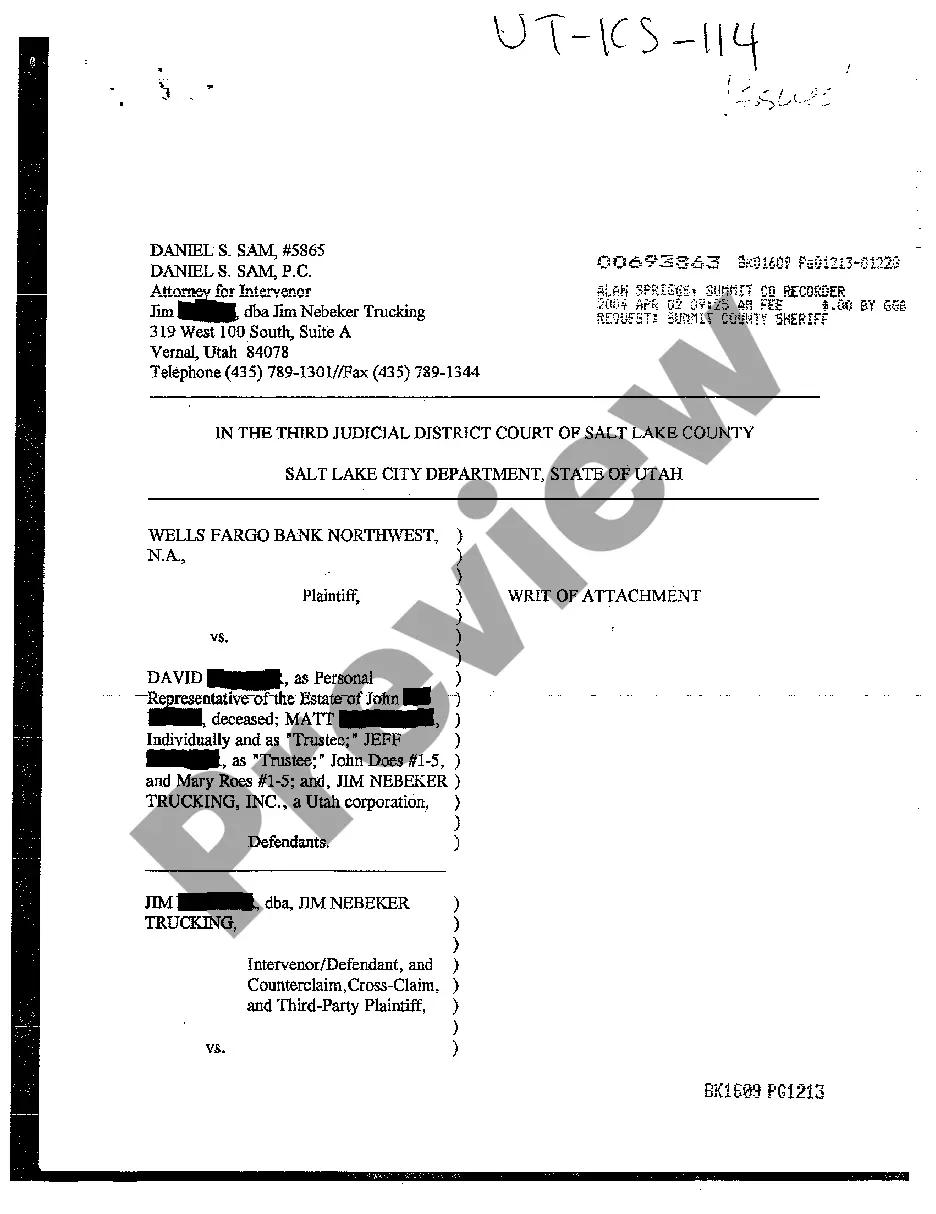

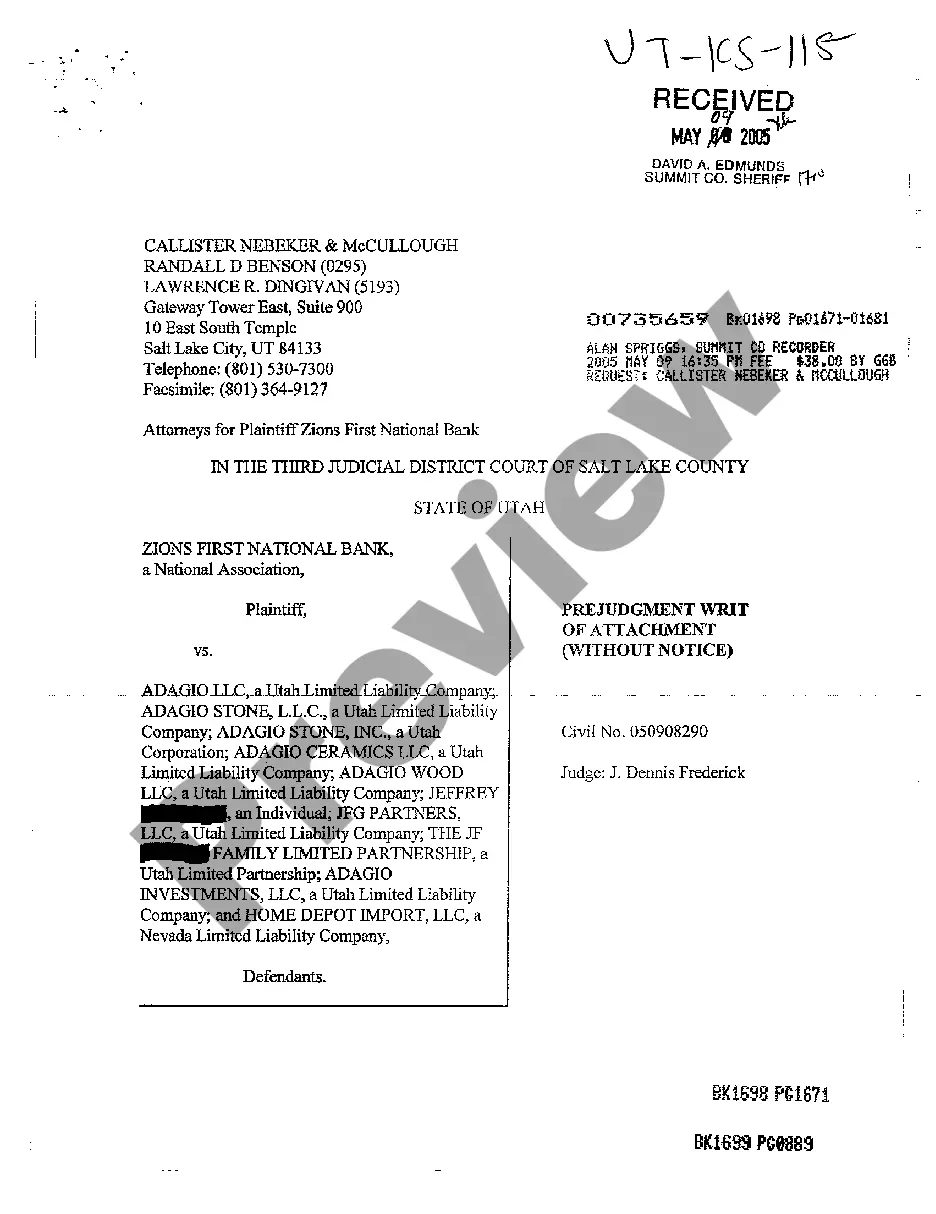

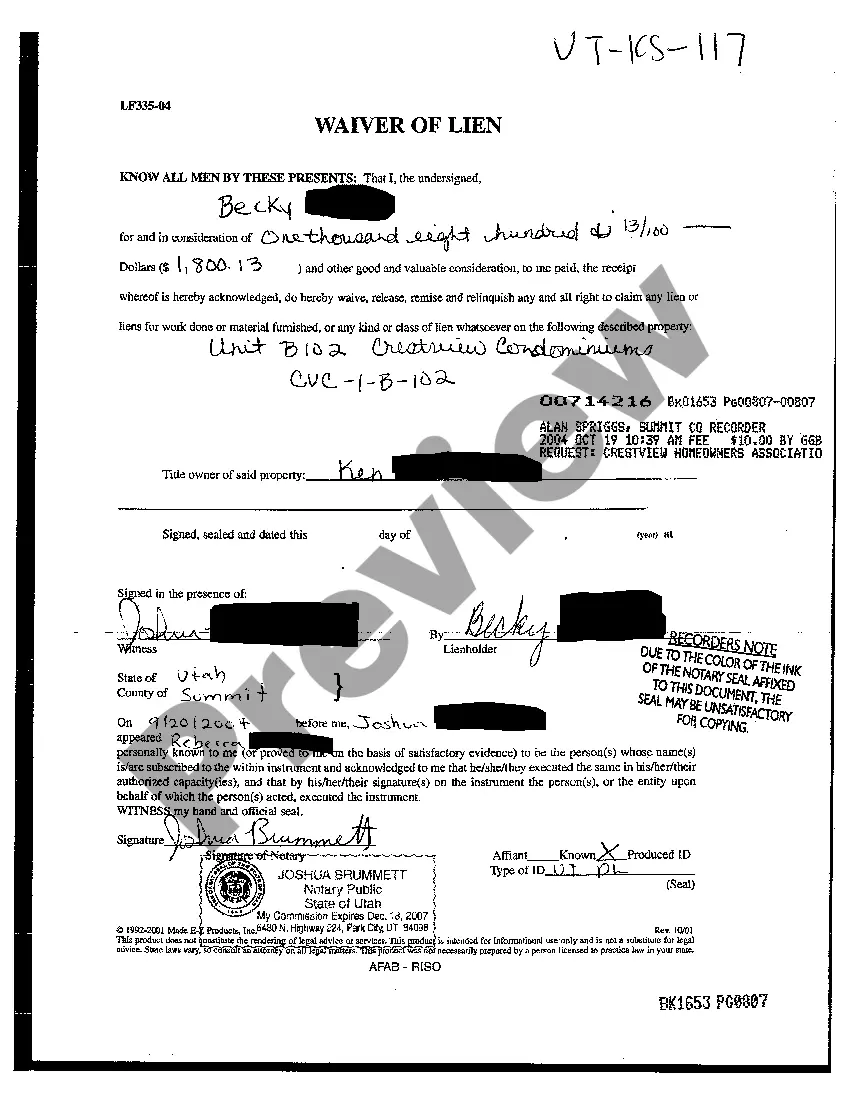

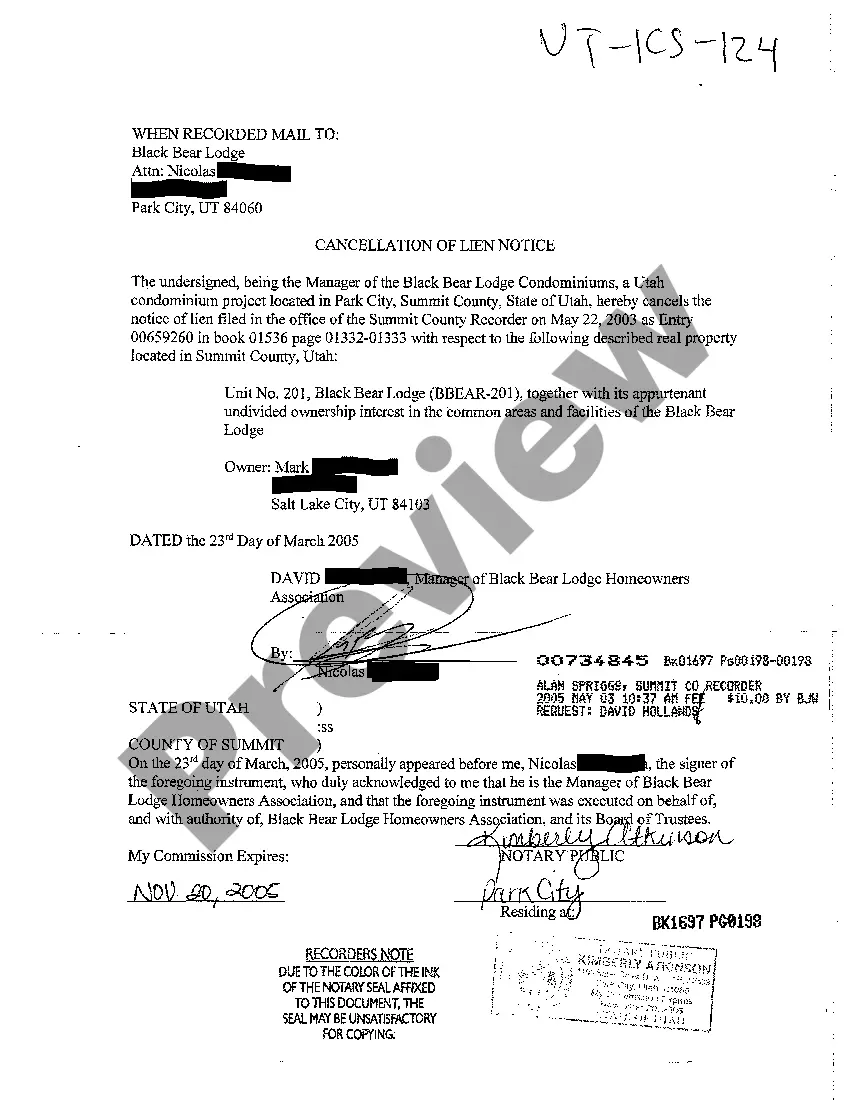

New York Foreclosure & Sale Judgement is a legal process that allows lenders to take possession of a property from a borrower who has defaulted on their mortgage loan. This process is governed by New York State Real Property Actions and Proceedings Law (RP APL). There are two main types of New York Foreclosure & Sale Judgement: judicial foreclosure and non-judicial foreclosure. Judicial foreclosure is a court-supervised process in which a lender can obtain a court order to foreclose on a borrower’s property. Non-judicial foreclosure is a process in which a lender can foreclose on a property without going through court. Both types of foreclosure require the lender to obtain a foreclosure judgement before they can take possession of the property. Once the lender obtains a foreclosure judgement, they can then proceed with the sale of the property at a public auction. The proceeds from the foreclosure sale are used to pay off the outstanding debt of the borrower.

New York Foreclosure & Sale Judgement

Description

How to fill out New York Foreclosure & Sale Judgement?

US Legal Forms is the most simple and profitable way to locate appropriate formal templates. It’s the most extensive web-based library of business and personal legal documentation drafted and checked by legal professionals. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your New York Foreclosure & Sale Judgement.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted New York Foreclosure & Sale Judgement if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make certain you’ve found the one corresponding to your demands, or locate another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your New York Foreclosure & Sale Judgement and save it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more proficiently.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding official paperwork. Give it a try!

Form popularity

FAQ

Ing to the New York State Department of Financial Services, an average foreclosure case takes about 445 days to be concluded in New York, with some taking much longer depending on the court in which the case was filed.

Unfortunately New York State does NOT have a right of redemption period post foreclosure sale. Once the property is sold at the public auction to the highest bidder, the original foreclosed owner has no right to satisfy the entire amount owed the lender.

New York is a judicial foreclosure state, which means that the lender has to sue the borrower in order to enforce their rights under the mortgage and note. If the lender wins the lawsuit, it obtains a judgment from the court, which allows the lender to sell the property at an auction.

5 Steps to Buying a Foreclosure Hire a Real Estate Agent. Hire a Real Estate Agent.Get a Preapproval Letter. Get a Preapproval Letter.Do a Comparative Market Analysis Before Buying.Bid Higher If Other Foreclosures are Selling Quickly.Be Aware that You'll be Buying the Foreclosed Home in 'As-Is' Condition.

New York is a judicial foreclosure state, which means that the lender has to sue the borrower in order to enforce their rights under the mortgage and note. If the lender wins the lawsuit, it obtains a judgment from the court, which allows the lender to sell the property at an auction.

The pre-foreclosure notice informs homeowners of steps they can take to avoid foreclosure, including working with their lender to find an affordable solution to foreclosure and consulting with a not-for-profit housing counselor.