New York New Resident Guide

Description New York Personal

How to fill out New York New Resident Guide?

When it comes to completing New York New Resident Guide, you almost certainly think about a long procedure that consists of getting a perfect form among hundreds of similar ones and after that being forced to pay legal counsel to fill it out to suit your needs. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific form within just clicks.

In case you have a subscription, just log in and click on Download button to have the New York New Resident Guide form.

In the event you don’t have an account yet but need one, stick to the step-by-step guide listed below:

- Make sure the file you’re getting applies in your state (or the state it’s required in).

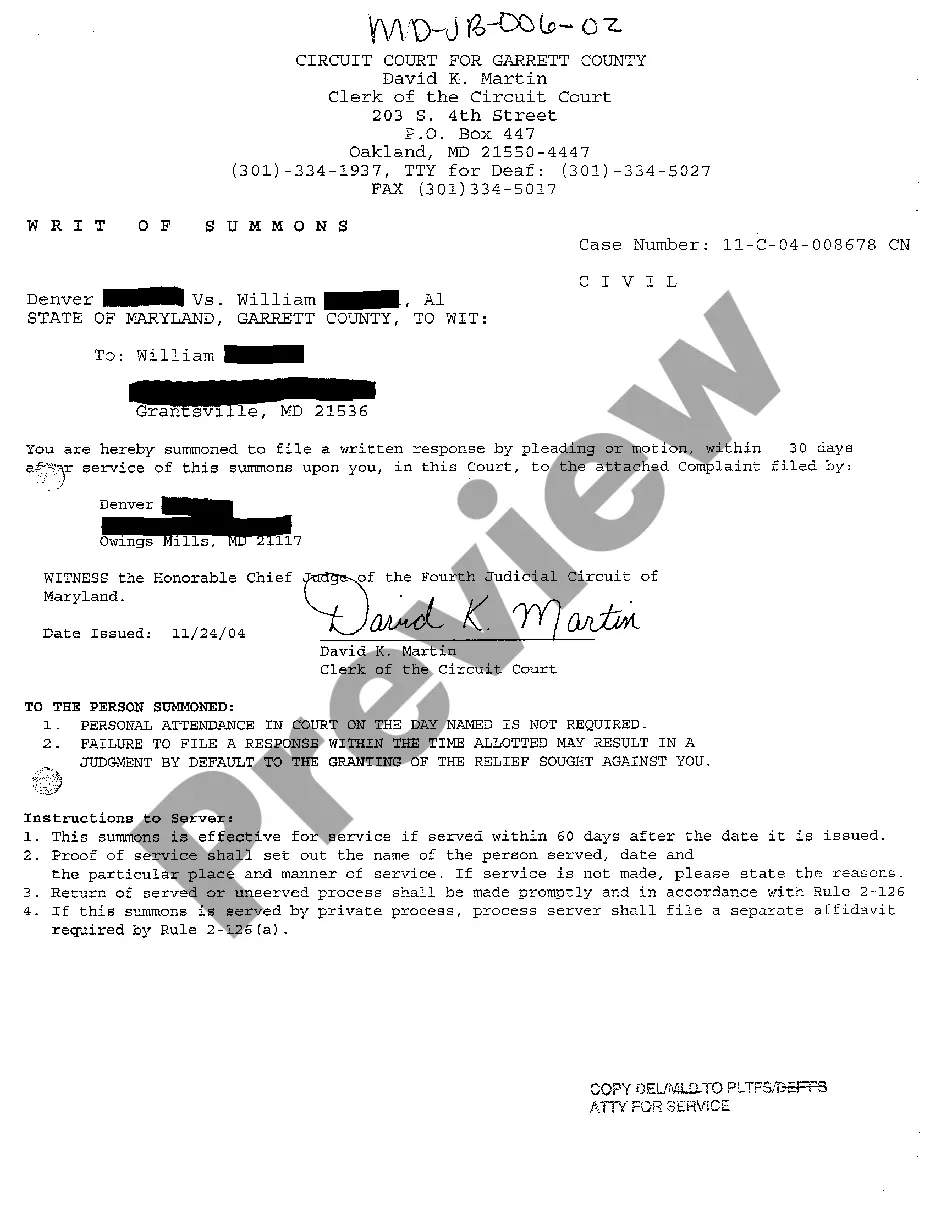

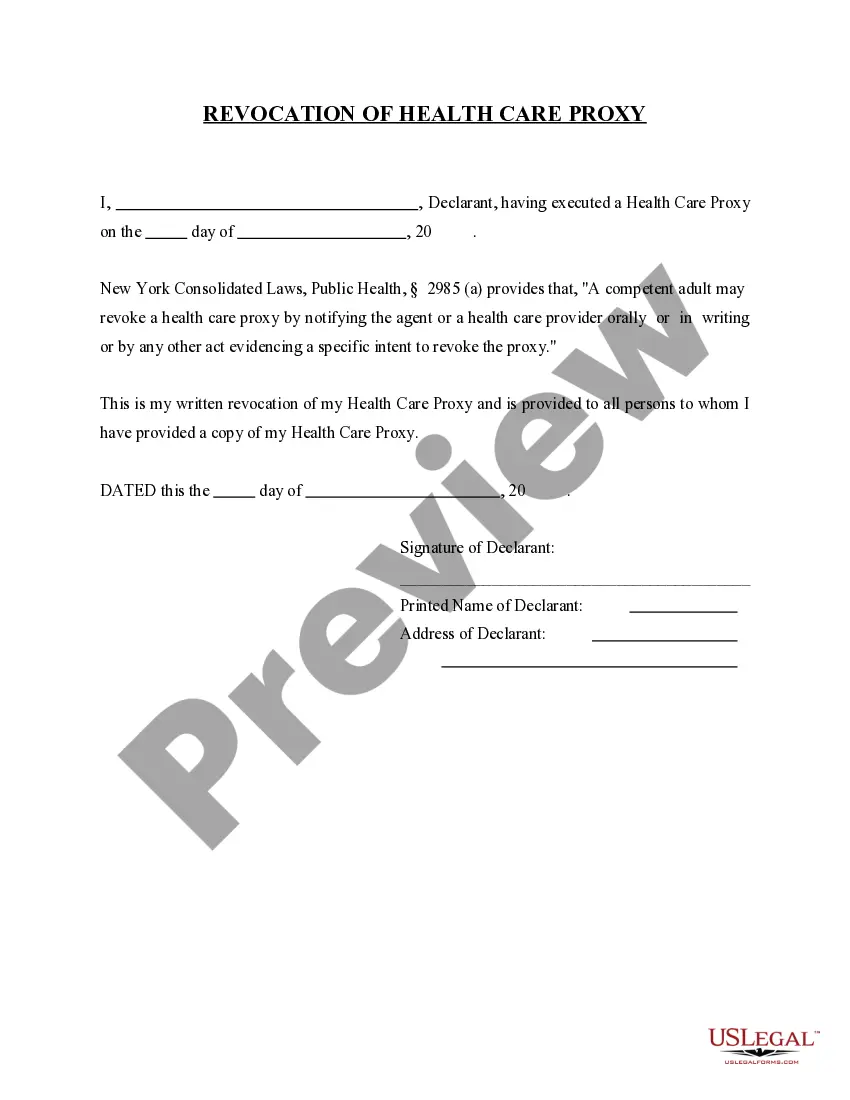

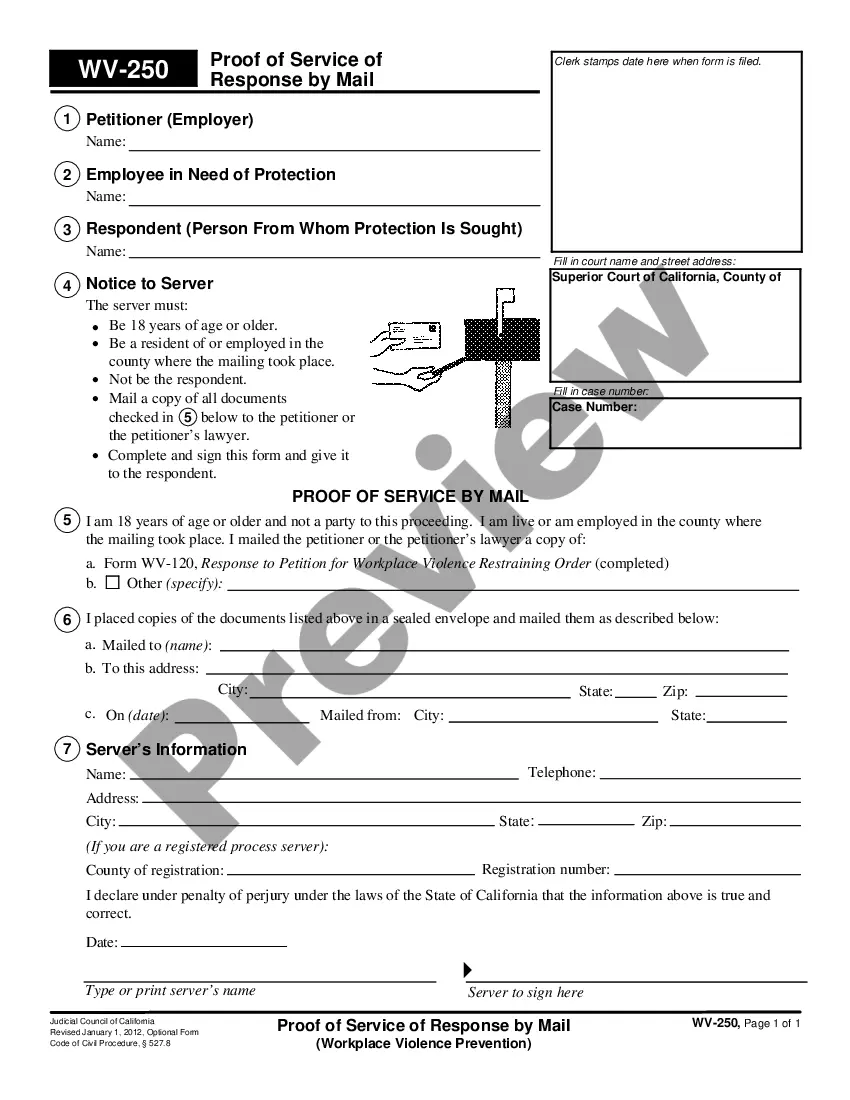

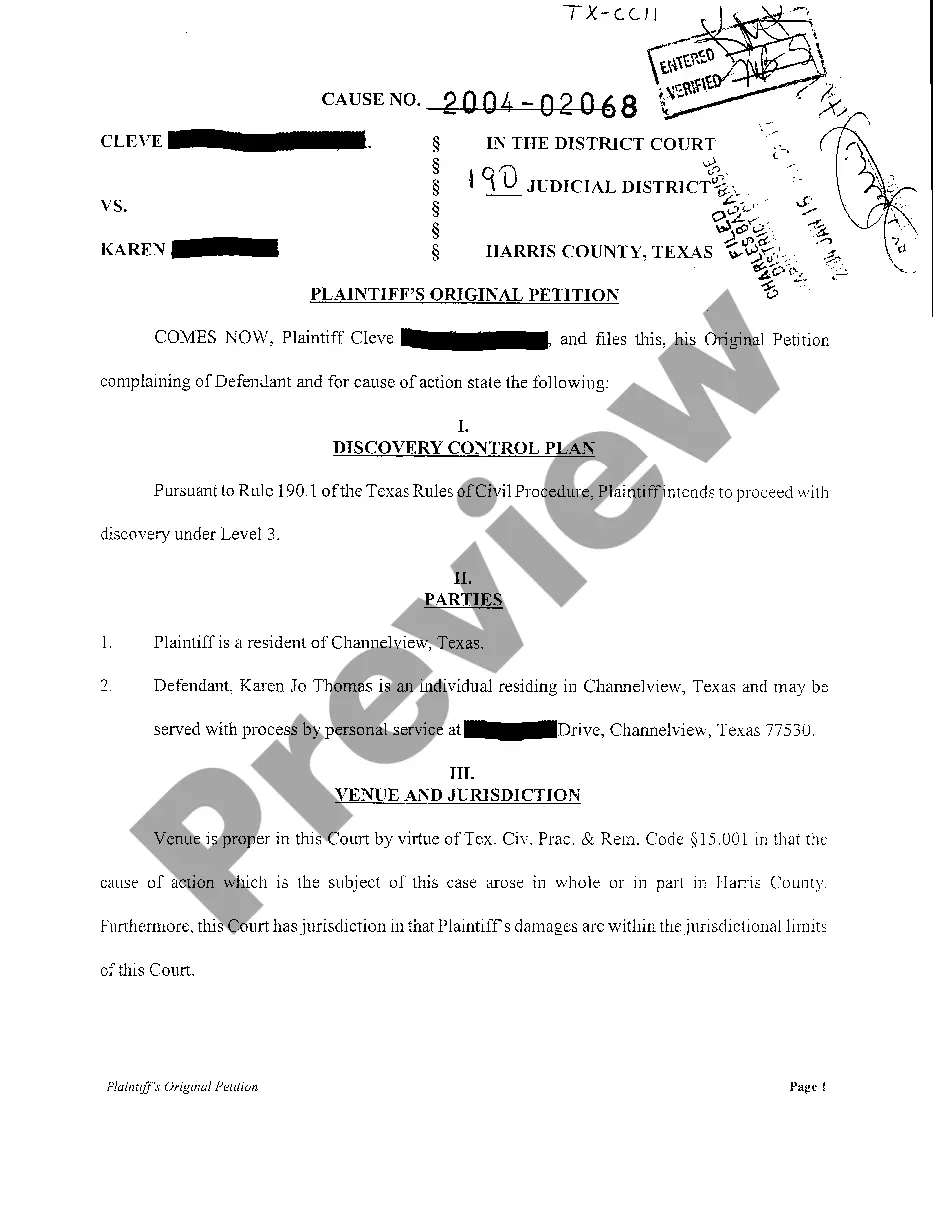

- Do it by reading the form’s description and also by clicking on the Preview function (if accessible) to see the form’s content.

- Click on Buy Now button.

- Select the suitable plan for your budget.

- Sign up to an account and select how you want to pay: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Skilled attorneys work on drawing up our templates to ensure after downloading, you don't need to bother about editing and enhancing content outside of your individual information or your business’s information. Sign up for US Legal Forms and get your New York New Resident Guide document now.

York Form Certificate Form popularity

York State Certificate Other Form Names

FAQ

It shall be presumptive evidence that a person who maintains a place of abode in this state for a period of at least ninety days is a resident of this state." To live in a house, a home, an apartment, a room or other similar place in NY State for 90 days is considered "presumptive evidence" that you are a resident of

You are a New York State resident for income tax purposes if:you maintain a permanent place of abode in New York State for substantially all of the taxable year and spend 184 days or more in New York State during the taxable year, whether or not you are domiciled in New York State for any portion of the taxable year.

Typical factors states use to determine residency. Often, a major determinant of an individual's status as a resident for income tax purposes is whether he or she is domiciled or maintains an abode in the state and are present" in the state for 183 days or more (one-half of the tax year).

You are a New York State resident if your domicile is New York State OR:you spend 184 days or more in New York State during the taxable year. Any part of a day is a day for this purpose, and you do not need to be present at the permanent place of abode for the day to count as a day in New York.

Persons who have been physically present in New York State for at least twelve months but have maintained a fixed, permanent and principal residence outside of New York State shall not be considered New York State residents.

NYS Driver License. NYS Identification Card (DMV Issued ) NYS Vehicle Registration. NYS Voter Registration. Signed New York State Residential Lease or Deed (At least 12 months prior to the start of the semester) New York State Resident Income Tax Return (from prior year.)

To qualify as a New York State resident, you must have established legal residence by maintaining a domicile in New York State for a period of at least one year preceding the date of the semester.

Find a new place to live in the new state. Establish domicile. Change your mailing address and forward your mail. Change your address with utility providers. Change IRS address. Register to vote. Get a new driver's license. File taxes in your new state.