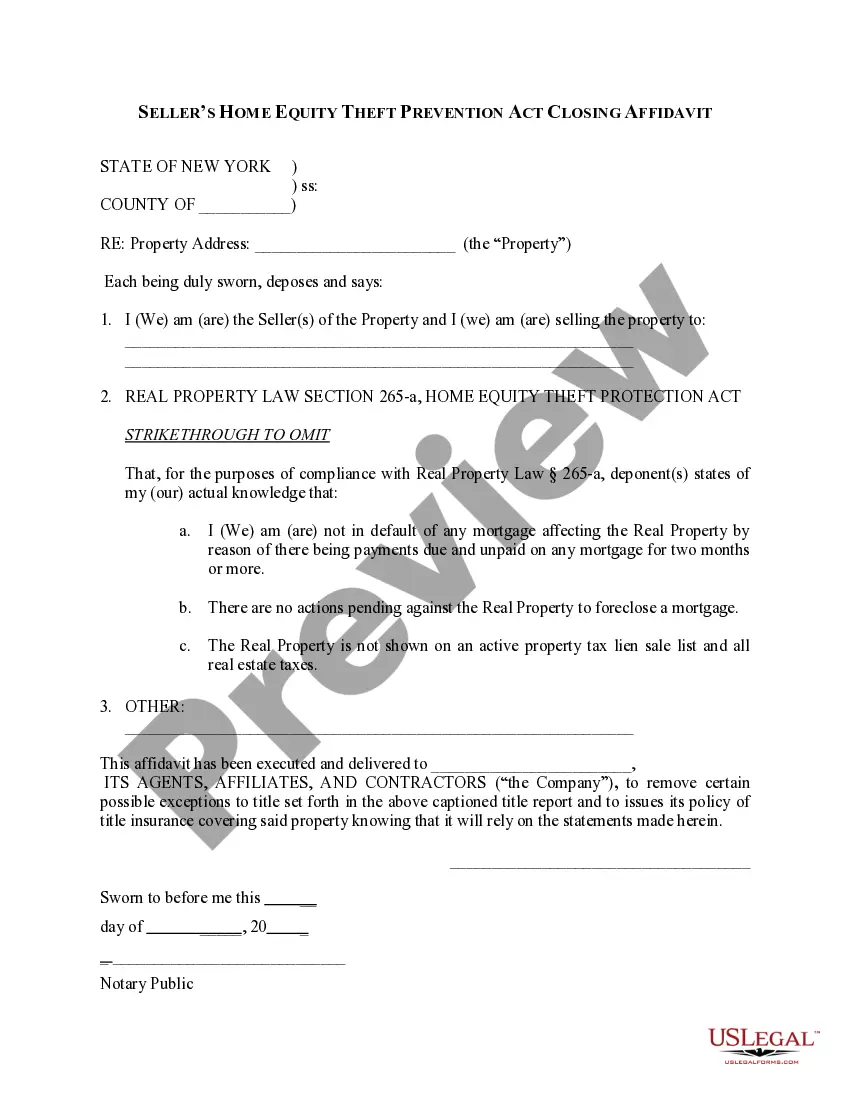

New York Seller's Home Equity Theft Prevention Act Closing Affidavit is a type of sale contract used when selling a property in New York State. The affidavit is used to protect the seller from any potential home equity theft or fraud. It requires the seller to provide a written statement to the buyer that includes information about the seller's mortgage debt, property taxes, and any other liens on the property. The affidavit must also include a statement that the seller is not aware of any home equity theft or fraud against the property. There are two types of New York Seller's Home Equity Theft Prevention Act Closing Affidavit: one for cooperative apartments and one for non-cooperative apartments.

New York Seller's Home Equity Theft Prevention Act Closing Affidavit

Description

How to fill out New York Seller's Home Equity Theft Prevention Act Closing Affidavit?

US Legal Forms is the most simple and affordable way to find suitable legal templates. It’s the most extensive online library of business and individual legal documentation drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with federal and local regulations - just like your New York Seller's Home Equity Theft Prevention Act Closing Affidavit.

Getting your template requires just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted New York Seller's Home Equity Theft Prevention Act Closing Affidavit if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one meeting your needs, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you like most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your New York Seller's Home Equity Theft Prevention Act Closing Affidavit and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your reliable assistant in obtaining the corresponding formal documentation. Try it out!

Form popularity

FAQ

Twelve states currently allow home equity theft: Alabama, Arizona, Colorado, Illinois, Maine, Massachusetts, Minnesota, Nebraska, New Jersey, New York, Oregon, South Dakota, and the District of Columbia.

Section 265-a of the Real Property Law is intended to address instances of ?home equity theft? that occur when homeowners of residential property (defined as a 1?4 family owner/occupied residence) are in default on their mortgage payments or the property is in foreclosure, including the preservation of the equity in

Established by the Truth in Lending Act (TILA) under U.S. federal law, the right of rescission allows a borrower to cancel a home equity loan, home equity line of credit (HELOC), or refinance with a new lender, other than with the current mortgagee, within three days of closing.

The Home Equity Theft Prevention Act (HETPA, NY RPL §265-a) is a New York State law passed on July 26, 2006, to provide homeowners of residential property with information and disclosures in order to make informed decisions when approached by persons seeking a sale or transfer of the homeowner's property, particularly

Section 265-a of the Real Property Law is intended to address instances of ?home equity theft? that occur when homeowners of residential property (defined as a 1?4 family owner/occupied residence) are in default on their mortgage payments or the property is in foreclosure, including the preservation of the equity in

In Alabama, Colorado, Maine, Massachusetts, Michigan, Minnesota, New York, North Dakota, Oregon, and Wisconsin, governments not only keep the value of unpaid property taxes and interest from the sale of a seized home?they also keep the surplus value rather than returning it to the property owner.

A recent study from Pacific Legal Foundation dug into the numbers of this issue of ?home equity theft.? The report found that between 2014 and 2021, 7,900 homes were taken as payment on property tax debts.