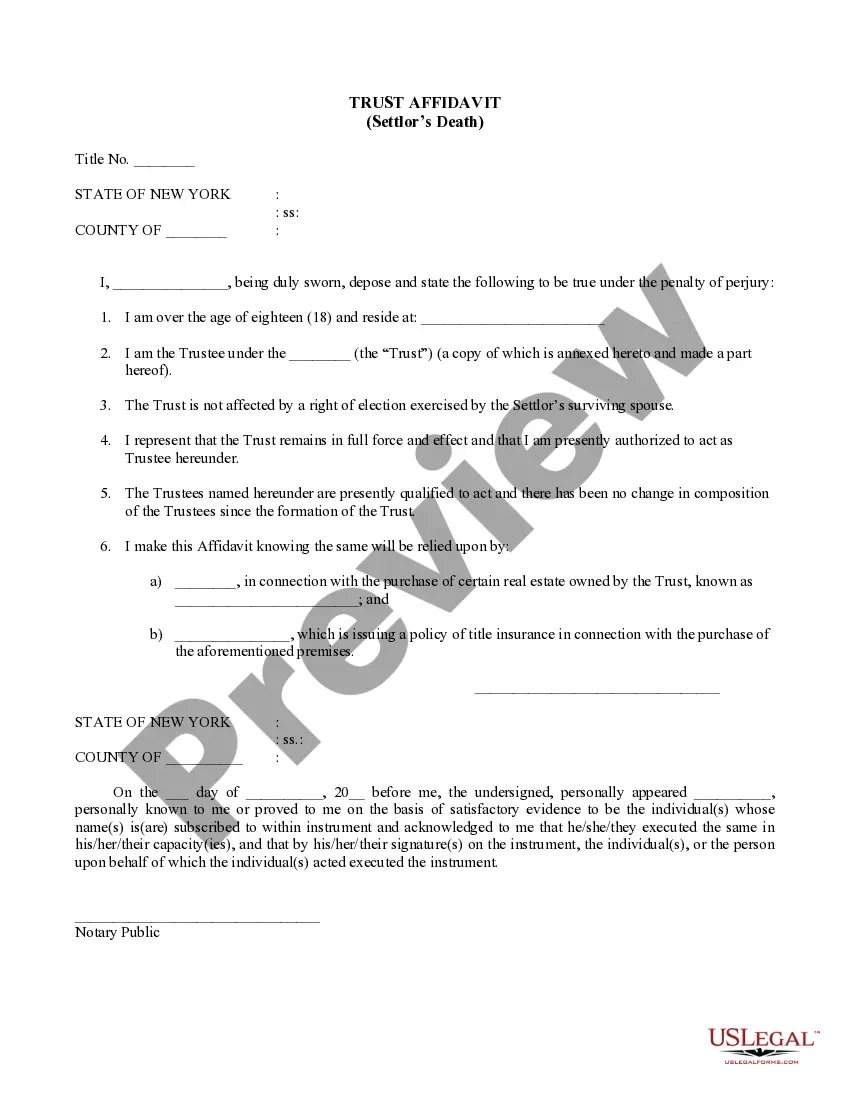

A New York Trust Affidavit (Settler's Death) is a legal document that is used to declare the death of the settler (creator) of a trust. This affidavit must be used by the trustee (person responsible for managing the trust) to prove to the court that the settler has died and that the trust is now inactive. The affidavit must be sworn to by a witness (or witnesses) who have first-hand knowledge of the settler's death. There are two types of New York Trust Affidavit (Settler's Death): the Standard Affidavit of Death and the Supplemental Affidavit of Death. The Standard Affidavit of Death is used when the settler has died and the trust is no longer active. The Supplemental Affidavit of Death is used when the settler has died and the trust is still active. In either case, the affidavit must include information about the settler such as their name, date of birth, date of death, and the name of the trust. It must also include the name and contact information of the witness(BS). The affidavit must be signed and notarized before it is submitted to the court.

New York Trust Affidavit (Settlor's Death)

Description

How to fill out New York Trust Affidavit (Settlor's Death)?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state laws and are examined by our specialists. So if you need to prepare New York Trust Affidavit (Settlor's Death), our service is the best place to download it.

Getting your New York Trust Affidavit (Settlor's Death) from our service is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the proper template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance verification. You should attentively examine the content of the form you want and ensure whether it satisfies your needs and meets your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find a suitable template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York Trust Affidavit (Settlor's Death) and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

The affidavit, officially known as the ?Affidavit in Relation to Settlement of Estate Under Article 13,? appoints a voluntary administrator to collect a decedent's property, resolve estate debts and expenses, and distribute the estate among distributees and beneficiaries.

Information Checklist The name and address of the decedent (the person who died) A certified copy of the death certificate. The name and address of the decedent's husband or wife, children, and grandchildren. The original Will, if the decedent had a Will, and the names and addresses of people mentioned in the Will.

You must file Form ET-706 within nine months after the decedent's date of death, unless you receive an extension of time to file the return. An extension of time to file the estate tax return may not exceed six months, unless the executor is out of the country.

Filing for a Small Estate If there is a Will, the Executor files the original Will and a certified death certificate with the small estate affidavit petition and other supporting documents in the Surrogate's Court in the county where the Decedent had their primary residence.

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

New York law, SCPA §1310, permits certain relatives and creditors to collect the decedent's assets without going to court. The law requires that an affidavit be presented with specific information.

Under New York law, a trust is valid if signed by the creator and by the trustee and either witnessed by two disinterested adults or acknowledged before a notary public.

The New York State Surrogate's Court Procedure Act (Section 1310) allows the surviving spouse and certain relatives of a deceased person to collect a benefit without court administration.