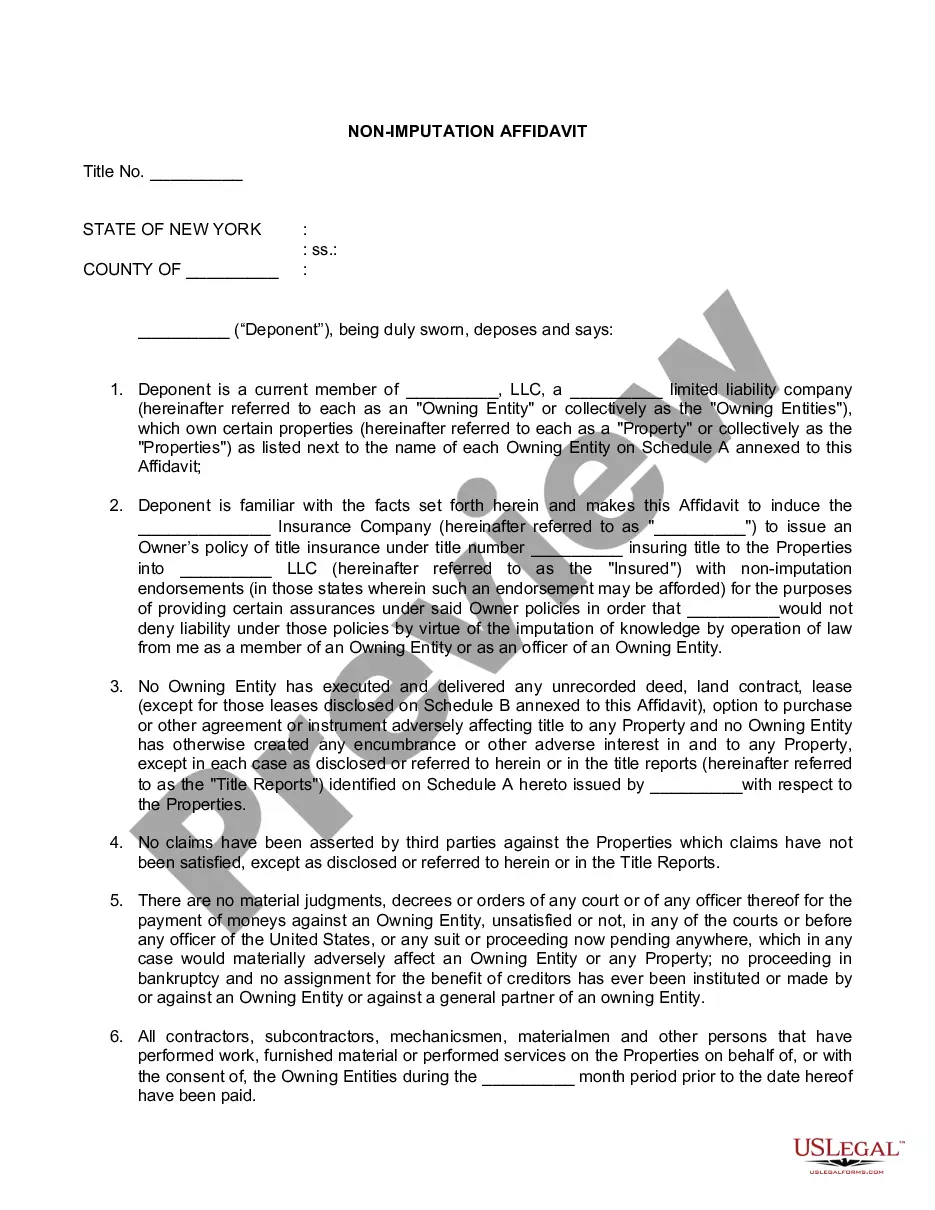

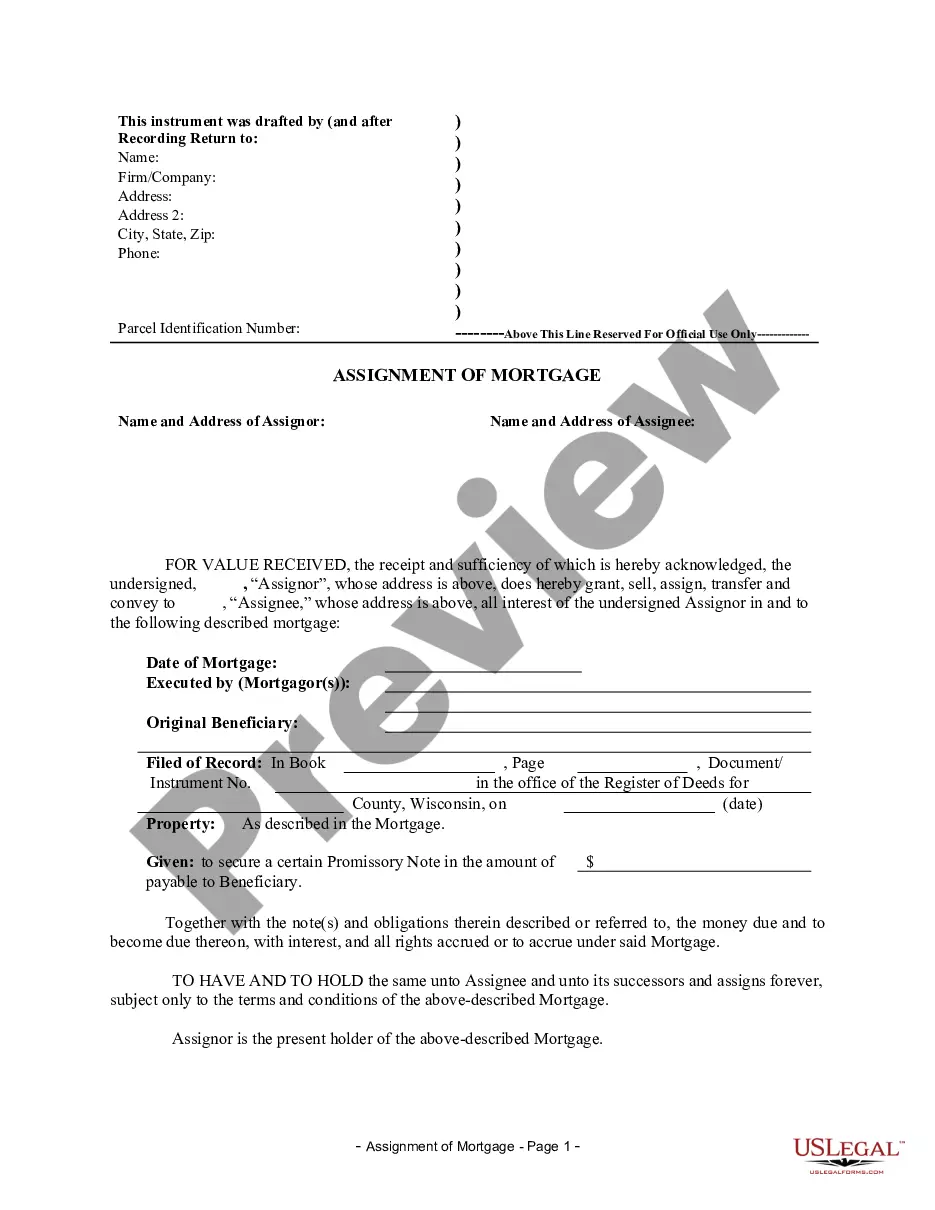

The New York Non-Imputation Affidavit is a type of document used in the state of New York to protect the interests of the creditor and the debtor in a loan transaction. It is used to document the fact that the creditor has not imputed any fault to the debtor in regard to the loan transaction. It also protects the debtor from any potential legal action from the creditor. There are two types of New York Non-Imputation Affidavit: an unconditional non-imputation affidavit, and a conditional non-imputation affidavit. An unconditional non-imputation affidavit is used when the creditor has not imputed any fault to the debtor and has accepted the loan as is. A conditional non-imputation affidavit is used when the creditor has imputed some fault to the debtor, but is willing to accept the loan with certain conditions. The New York Non-Imputation Affidavit must be signed by both the creditor and the debtor and must be filed with the New York State Department of Financial Services. It is a legally binding document and provides both parties with legal protection in the event of a dispute.

New York Non-Imputation Affidavit

Description

How to fill out New York Non-Imputation Affidavit?

US Legal Forms is the most simple and affordable way to find appropriate legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with federal and local laws - just like your New York Non-Imputation Affidavit.

Obtaining your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted New York Non-Imputation Affidavit if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one meeting your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you like most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your New York Non-Imputation Affidavit and download it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Try it out!