New York Warranty Deed from two Individuals to Two Individuals

Description New York Deed

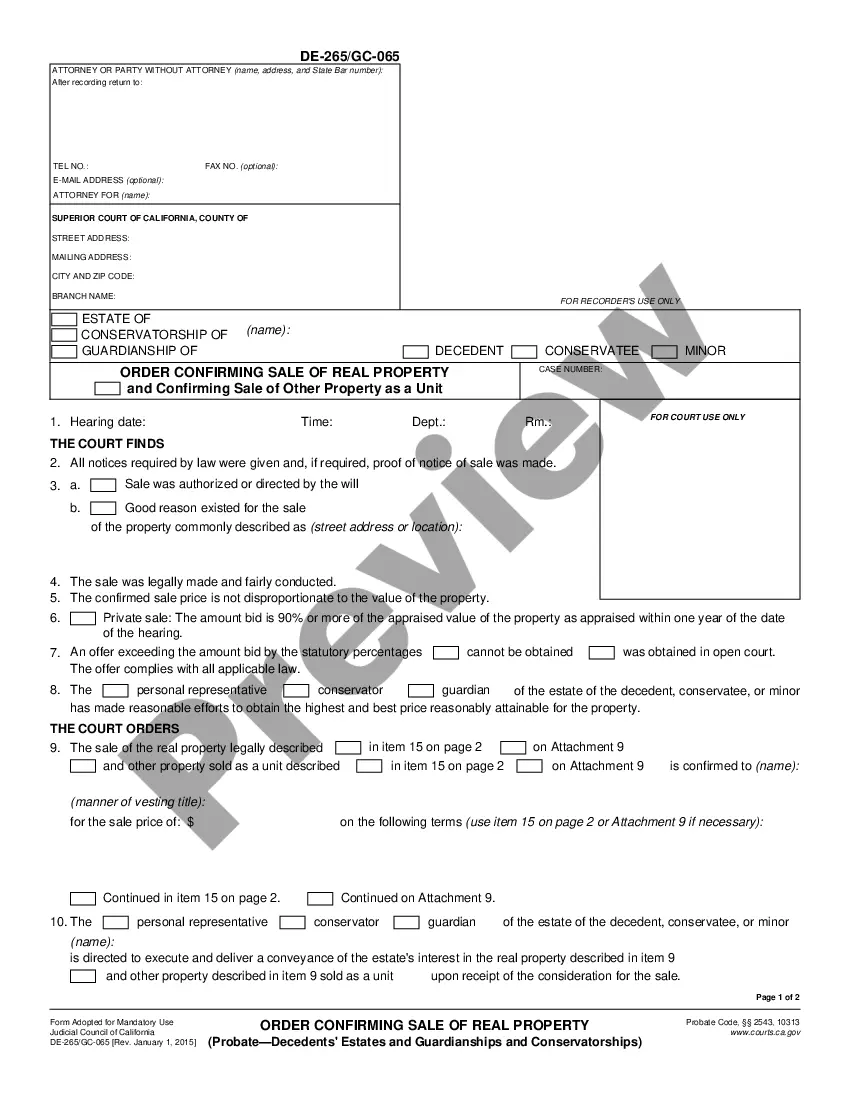

How to fill out New York Warranty Deed From Two Individuals To Two Individuals?

Among numerous free and paid templates that you find on the internet, you can't be sure about their accuracy and reliability. For example, who made them or if they’re qualified enough to take care of what you need those to. Keep relaxed and utilize US Legal Forms! Get New York Warranty Deed from two Individuals to Two Individuals templates made by skilled legal representatives and get away from the high-priced and time-consuming process of looking for an lawyer or attorney and then paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you’re trying to find. You'll also be able to access your previously downloaded templates in the My Forms menu.

If you’re making use of our platform the very first time, follow the guidelines below to get your New York Warranty Deed from two Individuals to Two Individuals easily:

- Ensure that the document you see is valid in your state.

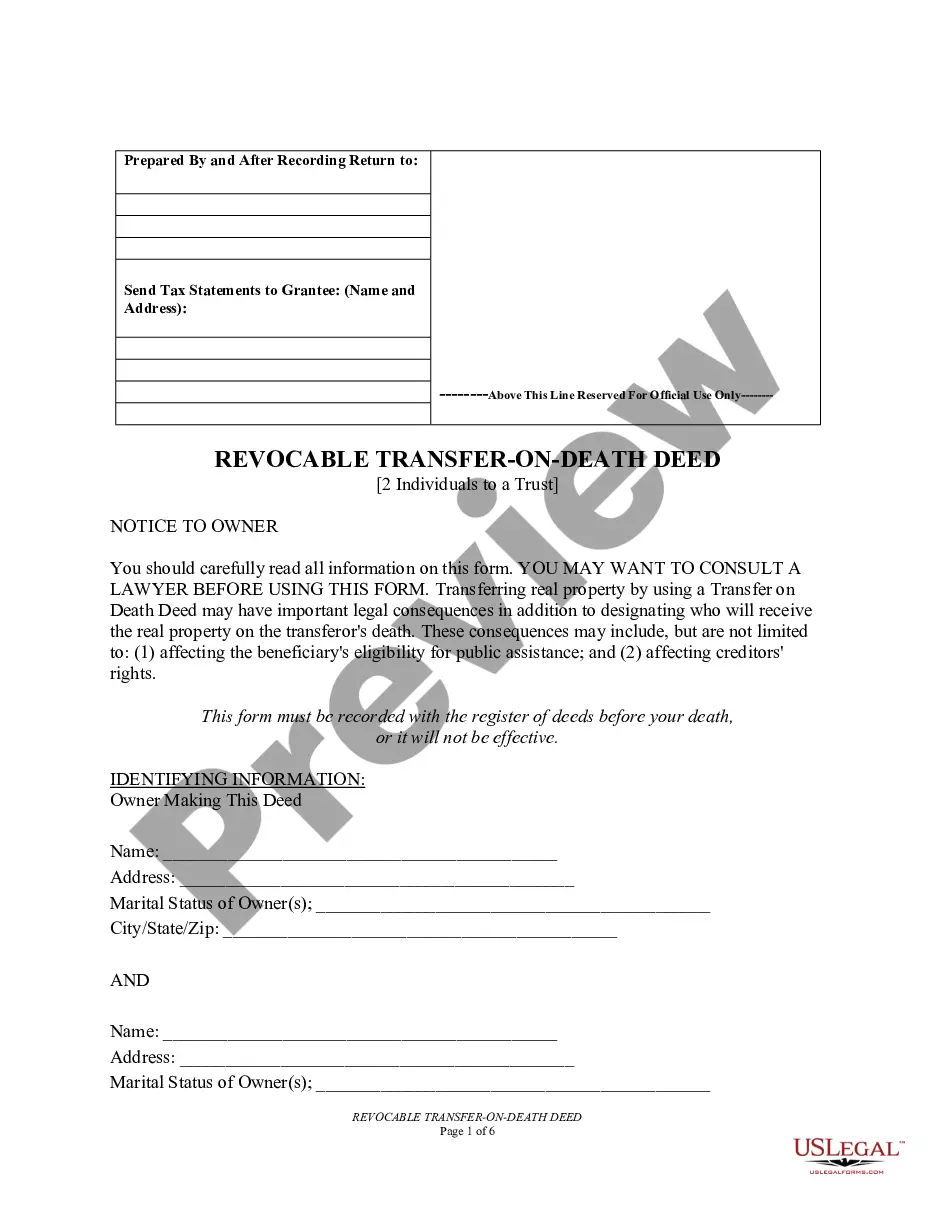

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another example utilizing the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you have signed up and bought your subscription, you may use your New York Warranty Deed from two Individuals to Two Individuals as many times as you need or for as long as it stays valid in your state. Edit it in your favored editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

New York Form Ny Form popularity

Warranty Deed Form Fillable Other Form Names

New York Form Order FAQ

The New York City Real Property Transfer Tax is 1% of the price if the value is $500,000 or less, or 1.425% if it is more. Unfortunately New York State also has a transfer tax. New York State charges you an additional 0.40% transfer tax on the purchase price.

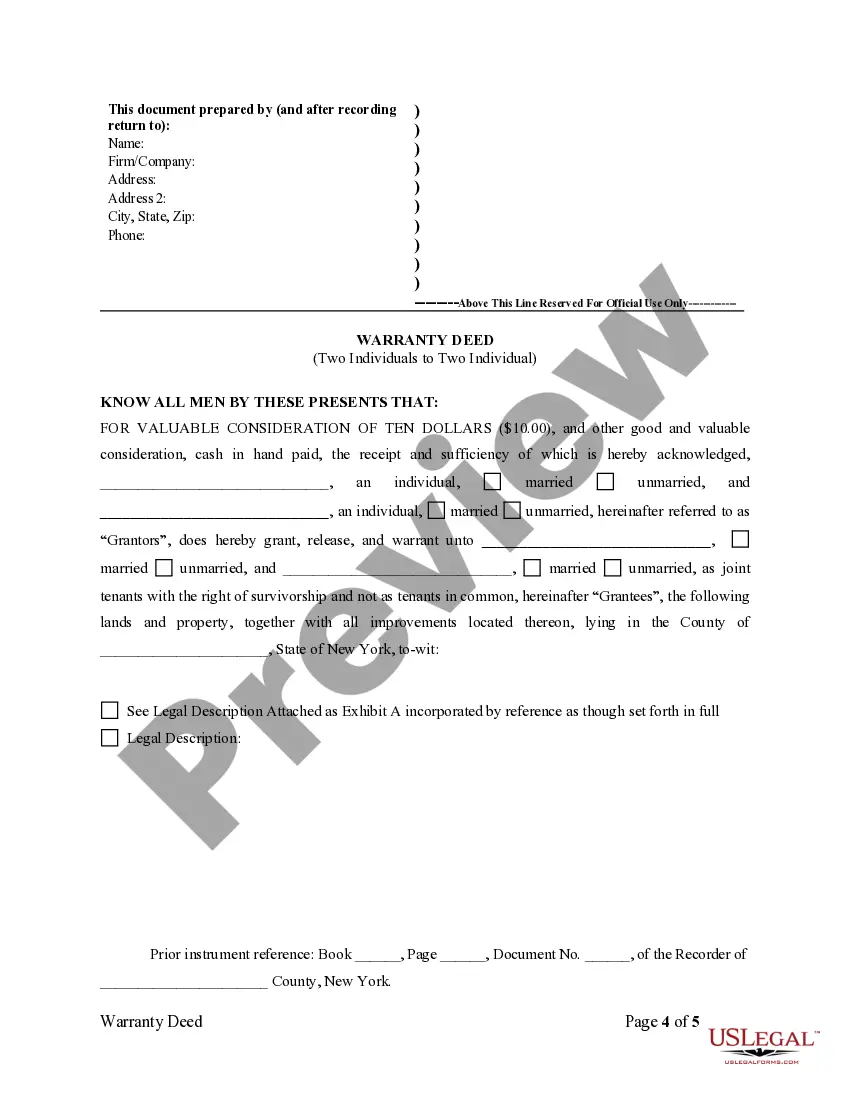

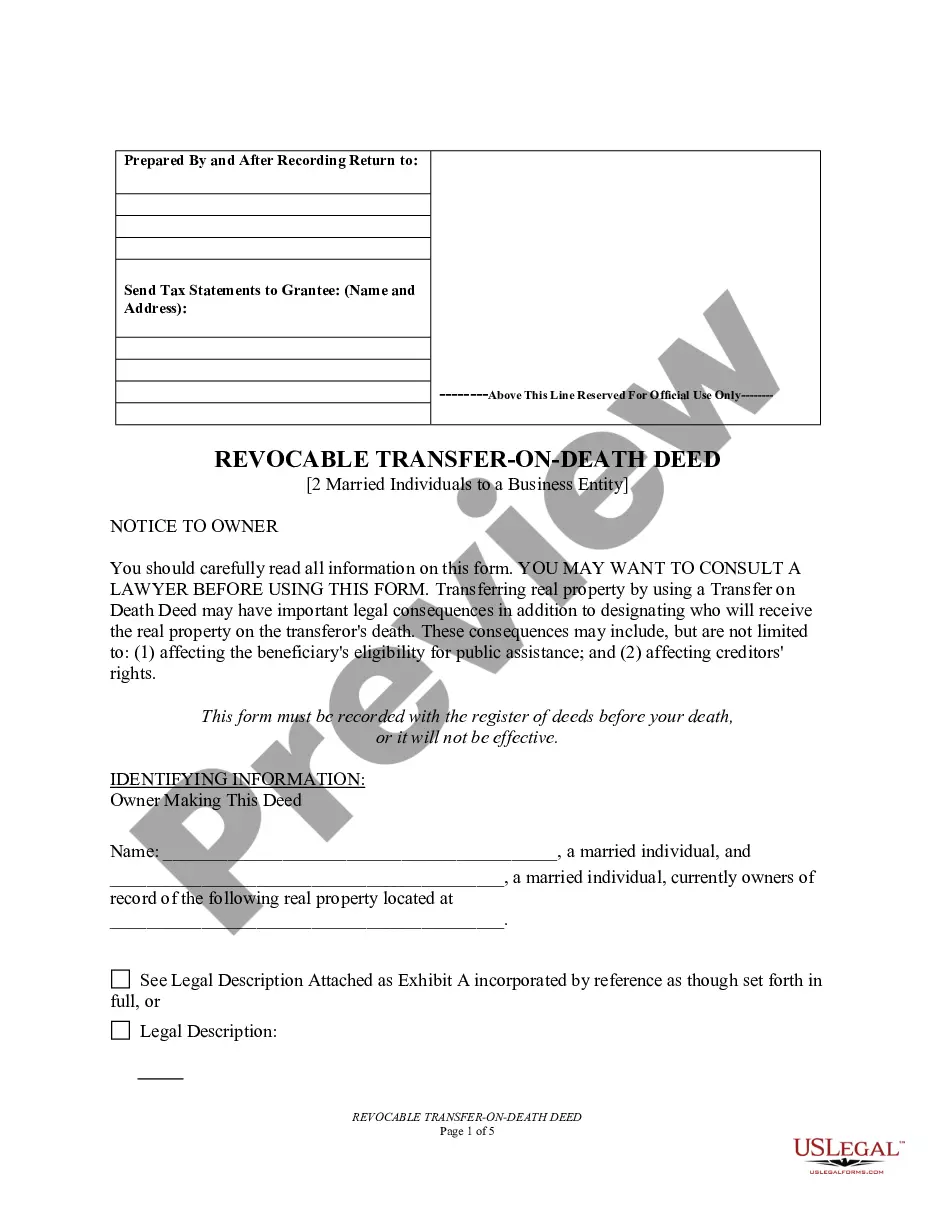

Under New York law, a person who wishes to update her name on a deed must execute a new deed and record it with the county clerk where the property is located. Obtain or purchase a New York warranty deed form.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

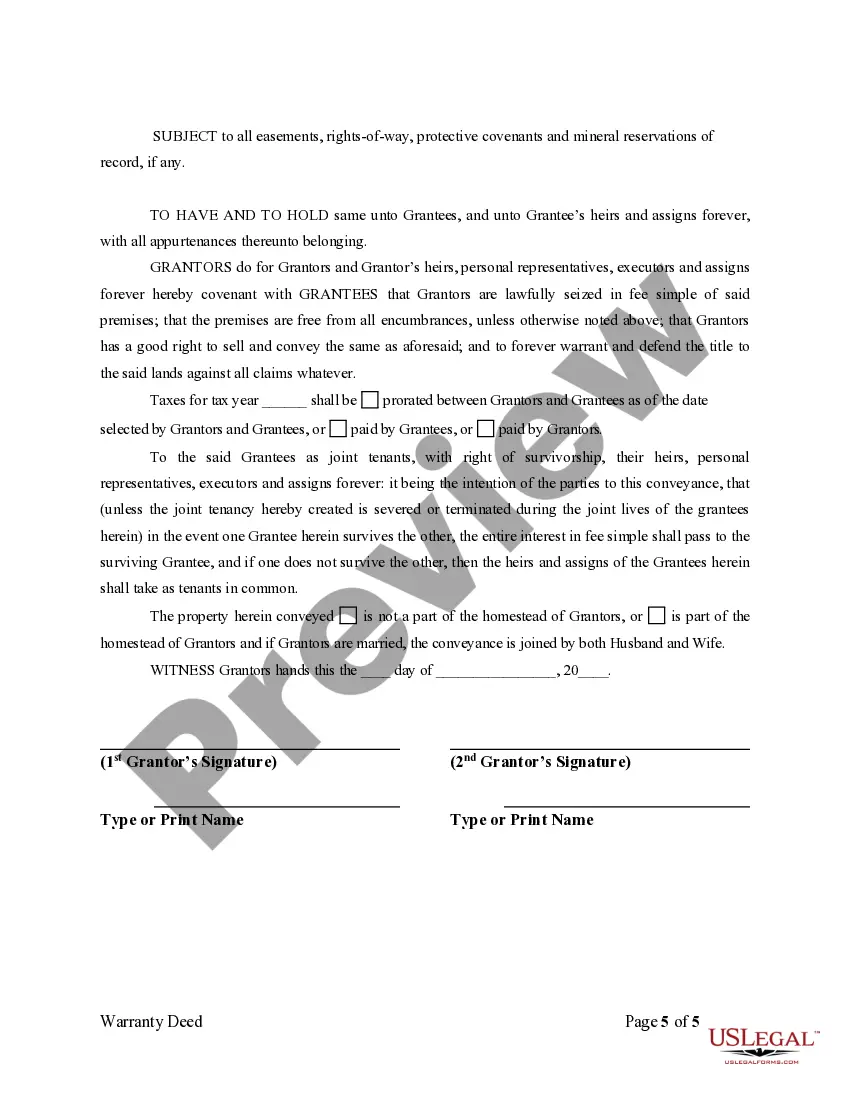

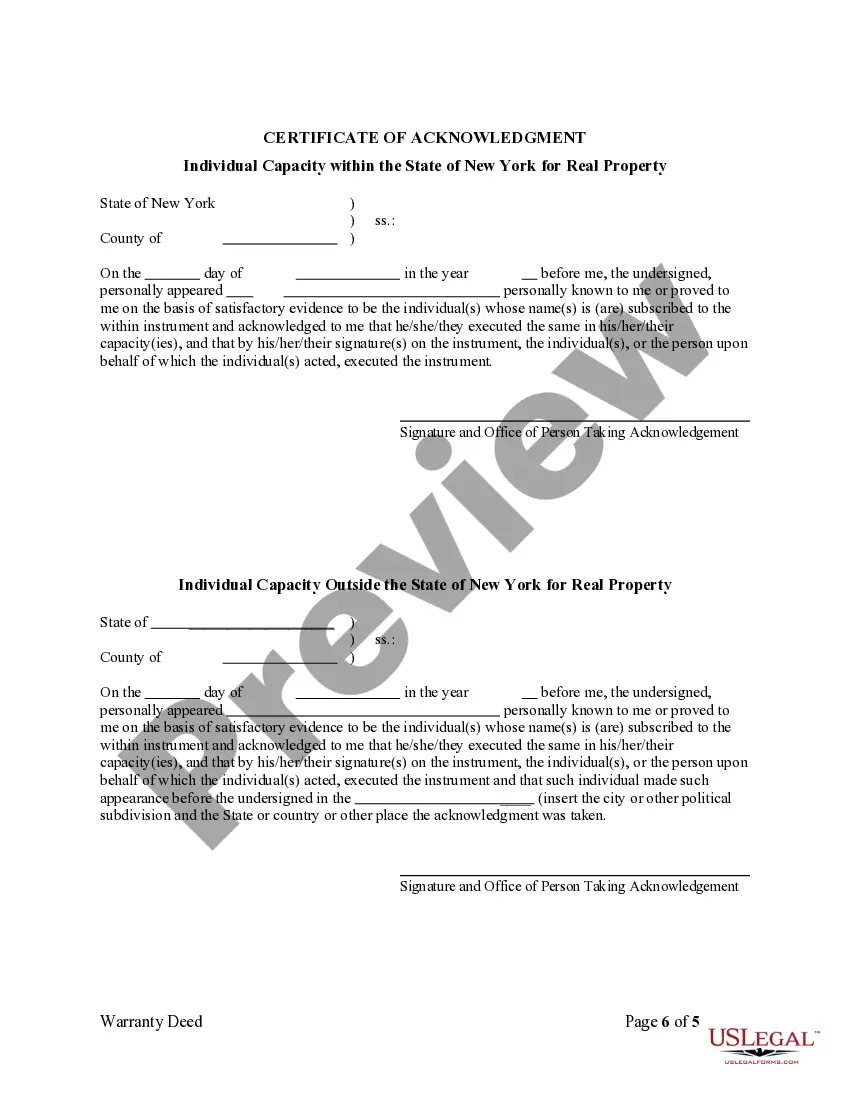

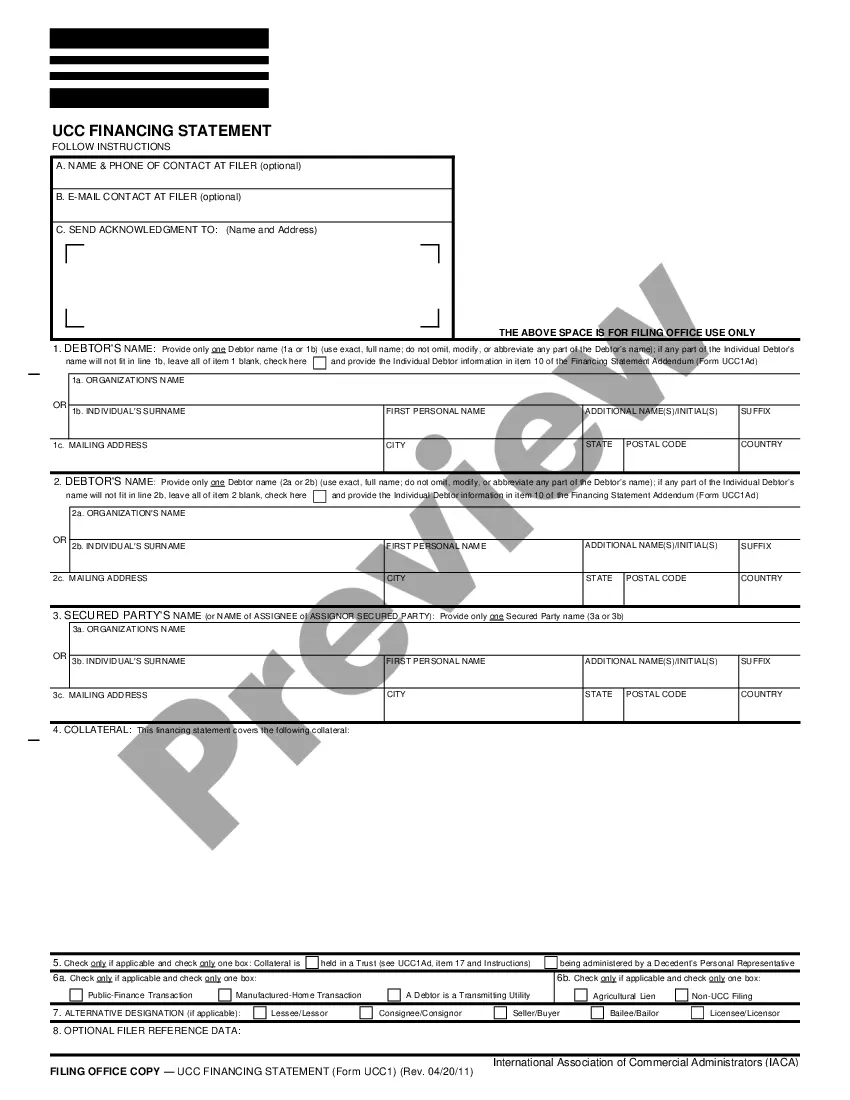

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

The fees to file a New York quitclaim deed vary from county to county, but some of the fees are similar. As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.