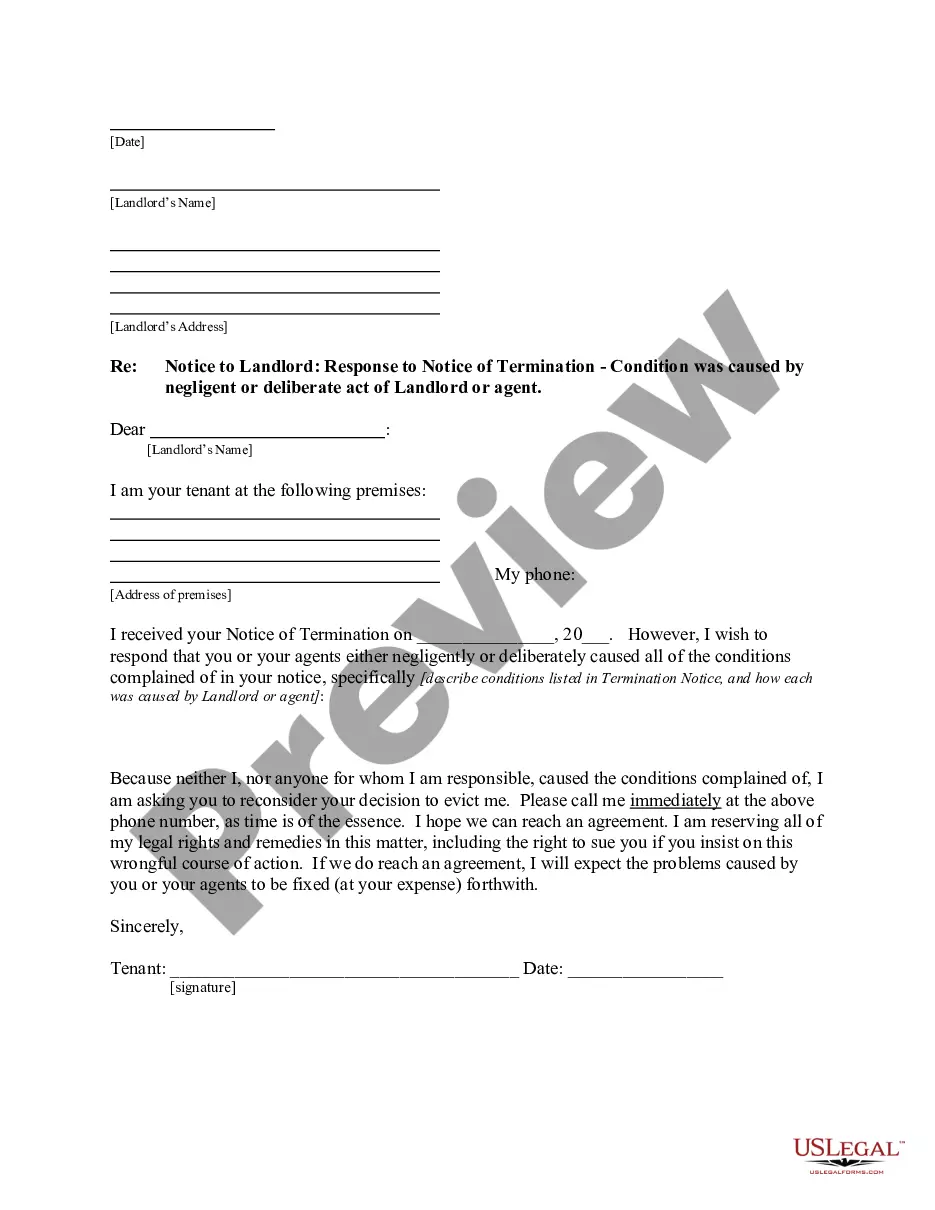

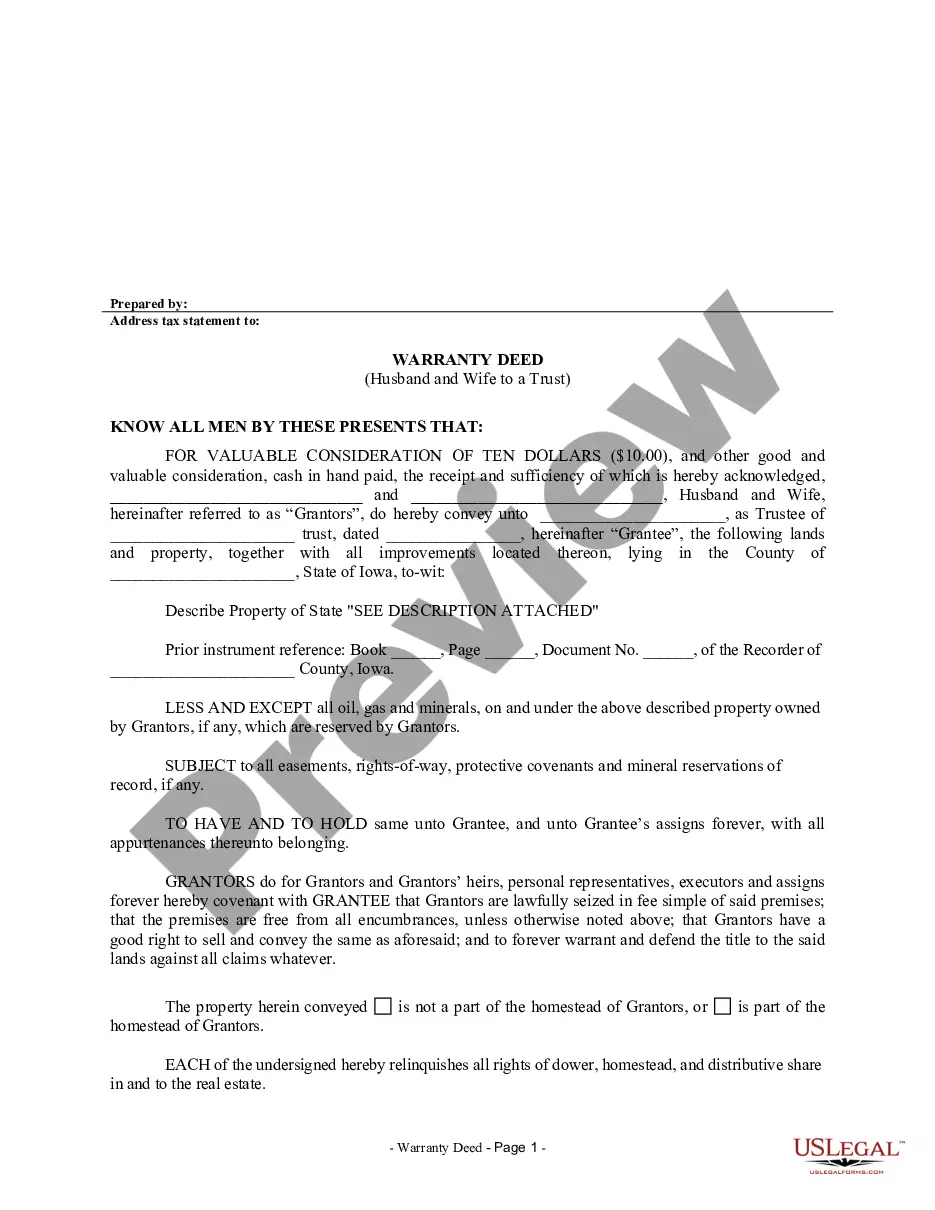

This New York adoption proceeding form, a Petition for Extension of Expired Certification, is an official New York court model form. Available in Wordperfect or pdf format.

New York Petition for Extension of Expired Certification

Description

How to fill out New York Petition For Extension Of Expired Certification?

When it comes to completing New York Petition for Extension of Expired Certification, you most likely visualize a long procedure that involves finding a appropriate form among a huge selection of very similar ones then needing to pay out legal counsel to fill it out for you. Generally, that’s a slow-moving and expensive option. Use US Legal Forms and pick out the state-specific form within clicks.

In case you have a subscription, just log in and click Download to get the New York Petition for Extension of Expired Certification form.

If you don’t have an account yet but want one, stick to the point-by-point manual listed below:

- Make sure the document you’re getting is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and by clicking on the Preview function (if available) to see the form’s information.

- Click on Buy Now button.

- Select the suitable plan for your financial budget.

- Sign up for an account and choose how you want to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Find the file on the device or in your My Forms folder.

Professional lawyers work on creating our templates to ensure that after downloading, you don't have to worry about enhancing content outside of your individual details or your business’s information. Sign up for US Legal Forms and get your New York Petition for Extension of Expired Certification document now.

Form popularity

FAQ

New York Tax Extension Tips: The State of New York does not accept the Federal tax extension (IRS Form 7004) in place of the state application (Form CT-5).

New York State has extended the due date for personal income tax returns and related payments originally due on April 15, 2021 to May 17, 2021. This follows the federal tax deadline which was also extended from April 15, 2021 to May 17, 2021.

Form IT-201, Resident Income Tax Return. Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

2019 returns due on April 15, 2020, and related payments of tax or installments of tax, including installments of estimated taxes for the 2020 tax year, will not be subject to any failure to file, failure to pay, late payment, or underpayment penalties, or interest if filed and paid by July 15, 2020.