This is an official form from the New York State Unified Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New York statutes and law.

New York Surrogate's Court Information

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New York Surrogate's Court Information?

In terms of filling out New York Surrogate's Court, you most likely imagine an extensive procedure that involves choosing a appropriate sample among countless very similar ones and then being forced to pay out legal counsel to fill it out for you. Generally speaking, that’s a slow-moving and expensive choice. Use US Legal Forms and choose the state-specific form within clicks.

If you have a subscription, just log in and then click Download to get the New York Surrogate's Court sample.

If you don’t have an account yet but want one, keep to the step-by-step guide listed below:

- Make sure the file you’re getting applies in your state (or the state it’s required in).

- Do it by reading through the form’s description and also by clicking the Preview function (if offered) to see the form’s content.

- Click Buy Now.

- Find the proper plan for your financial budget.

- Sign up to an account and select how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Skilled lawyers work on creating our templates to ensure after downloading, you don't need to bother about modifying content outside of your personal details or your business’s information. Join US Legal Forms and get your New York Surrogate's Court document now.

Form popularity

FAQ

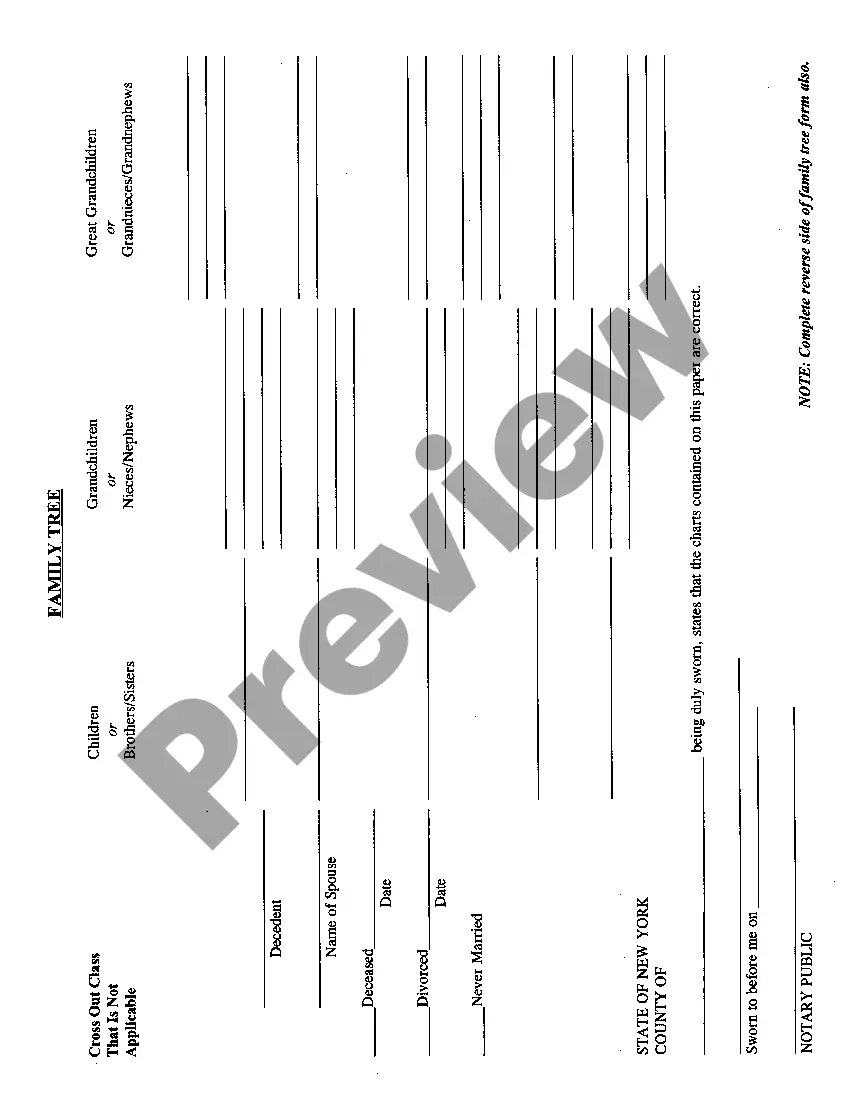

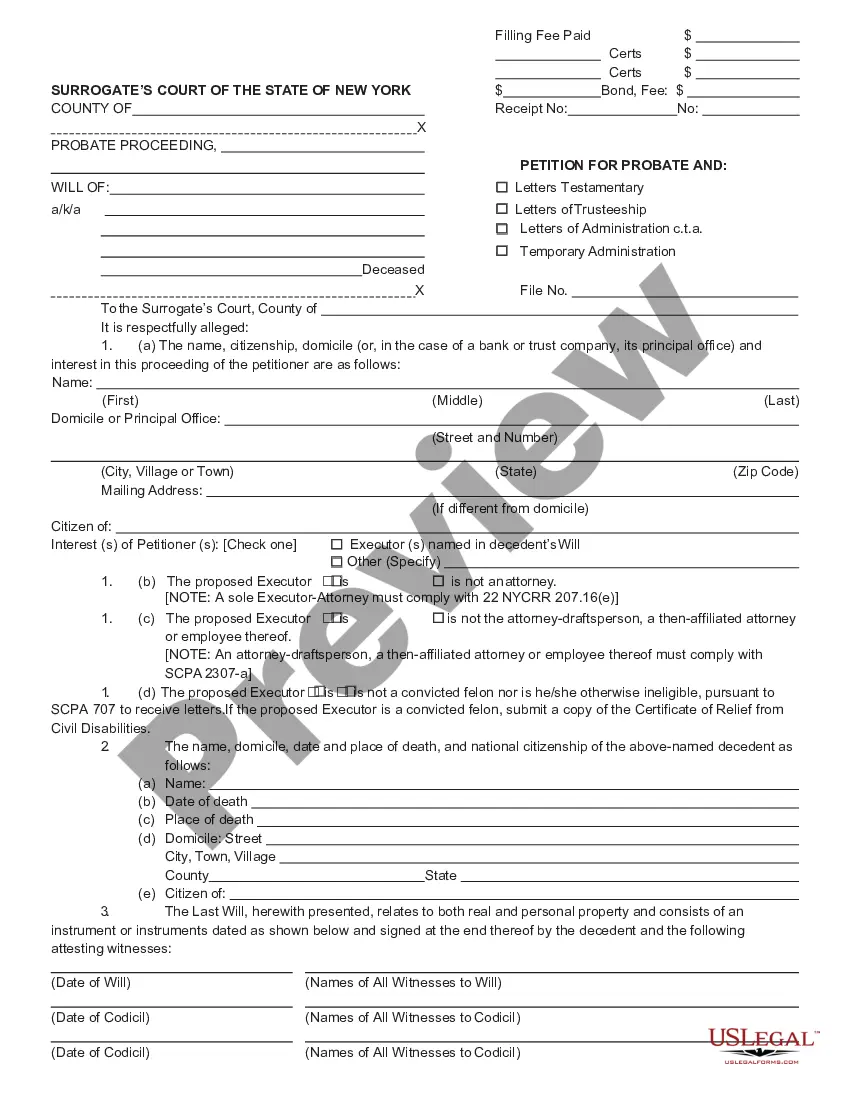

In a probate proceeding, the executor named in the will files a petition in Surrogate's Court along with the original of your will. The petition will include the date of death, beneficiaries named in the will, heirs-at-law in case the will is invalid, and an estimate of the value of the estate.

Since the executor is personally liable to creditors if he distributes assets before 7 months have elapsed from his appointment, the minimum time it takes to complete probate is 7 months from the time the will is admitted to probate, although we sometimes see estates stay opened for two years or more.

Filing for Administration The closest distributee files a copy of the paid funeral bill, a certified copy of the death certificate with the Petition for Letters of Administration and other supporting documents in the Surrogate's Court in the county where the Decedent had their primary residence.

Locate the death certificate and the will. Locate the court that has jurisdiction. Request the relevant documents. Inventory the estate's assets. Submit a Petition for Probate and other relevant documents.

In order to obtain Letters Testamentary, an interested party (typically the nominated executor under the Will) will need to petition the Surrogate's Court and provide pertinent information regarding the decedent, relevant parties (i.e., the spouse, children, etc.) and the decedent's assets.

If you want to legally transfer ownership of property, one of the best ways to avoid probate is to transfer all of your assets into a living trust. In New York, living trusts can prevent probate on nearly any type of asset you ownfrom funds in bank accounts to vehicles and real estate.

In a probate proceeding, the executor named in the will files a petition in Surrogate's Court along with the original of your will. The petition will include the date of death, beneficiaries named in the will, heirs-at-law in case the will is invalid, and an estimate of the value of the estate.

Register the death. Find out if there's a will. Apply for a grant of probate and sort inheritance tax. Complete a probate application form. Complete an inheritance tax form. Send your application form. Tell all organisations and close accounts. Pay off any debts.

Because creditors are allowed up to seven months to file claims against an estate in New York, it takes a minimum of eight or nine months to complete the probate of even a relatively modest estate. A more complex and/or valuable estate can easily take well over a year to probate.