This is an official form from the New York State Unified Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New York statutes and law.

New York Surrogate's Court Proceeding Checklists

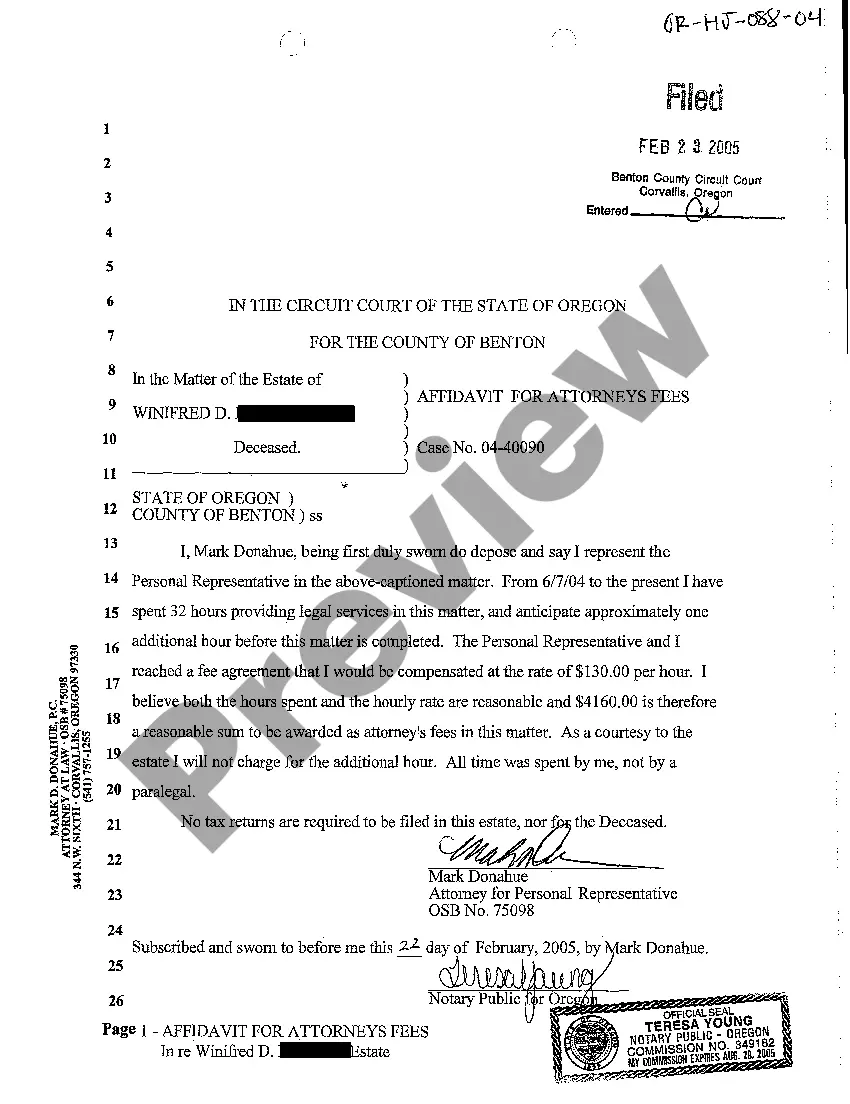

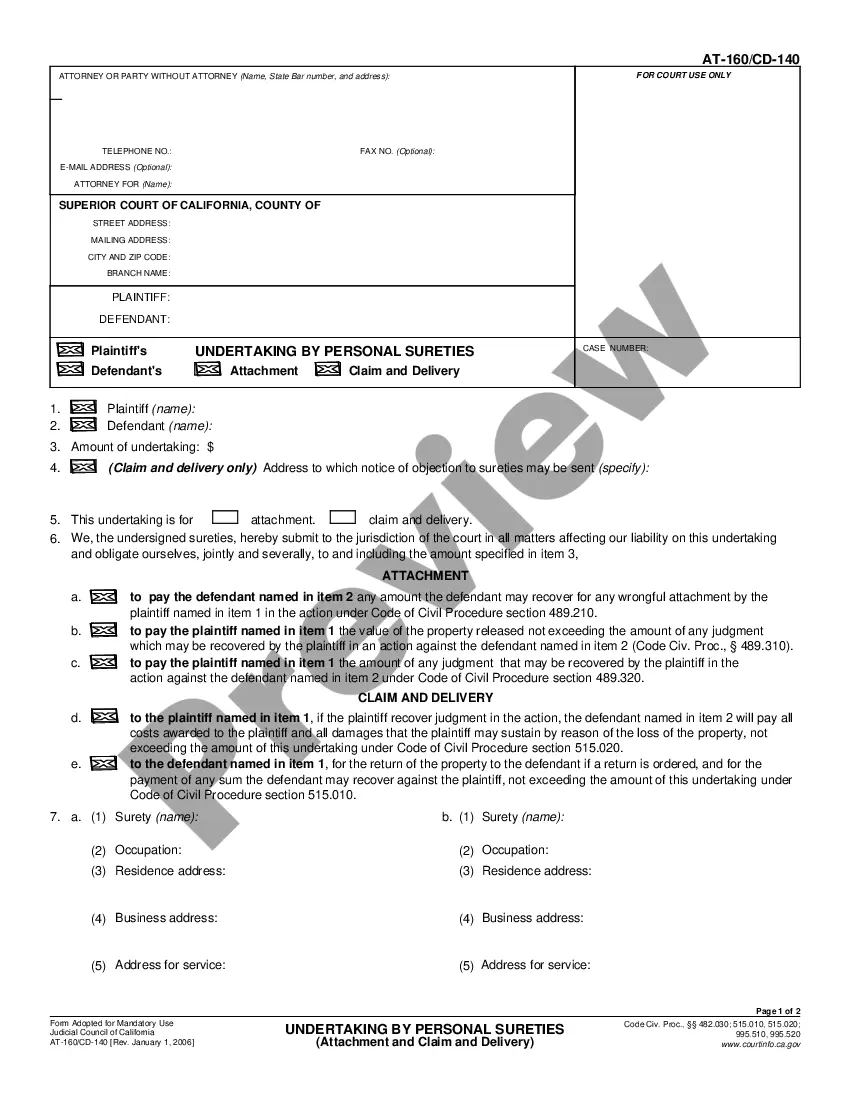

Description Ny Surrogate Court Forms

How to fill out New York Surrogate's Court Forms?

When it comes to completing New York Surrogate's Court Checklist, you almost certainly think about an extensive process that consists of finding a ideal form among hundreds of similar ones and then having to pay out a lawyer to fill it out to suit your needs. Generally speaking, that’s a slow-moving and expensive option. Use US Legal Forms and select the state-specific form within just clicks.

For those who have a subscription, just log in and click Download to find the New York Surrogate's Court Checklist template.

If you don’t have an account yet but need one, stick to the step-by-step guideline below:

- Be sure the document you’re saving applies in your state (or the state it’s needed in).

- Do it by reading the form’s description and by clicking the Preview option (if accessible) to view the form’s content.

- Click Buy Now.

- Pick the proper plan for your financial budget.

- Sign up for an account and choose how you would like to pay out: by PayPal or by credit card.

- Save the document in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Professional attorneys work on creating our samples to ensure after saving, you don't need to worry about enhancing content outside of your individual details or your business’s info. Sign up for US Legal Forms and get your New York Surrogate's Court Checklist example now.

Nys Surrogates Court Forms Form popularity

Ny Estate Administration Checklist Other Form Names

Surrogate's Court Of The State Of New York FAQ

In New York State, probate proceedings take place in the part of the court called the Surrogate's Court in the county where you were living when you died.Only an estate valued over $30,000 must be probated when there is a will. The court has a small estate proceeding when the estate is below $30,000.

Assuming no one contests the will, the time it takes to get a will admitted to probate after it is filed in New York City is anywhere between one and three months, with two months being average. Once the will is admitted to probate, the estate needs to be administered by the executor.

Register the death. Find out if there's a will. Apply for a grant of probate and sort inheritance tax. Complete a probate application form. Complete an inheritance tax form. Send your application form. Tell all organisations and close accounts. Pay off any debts.

Locate the death certificate and the will. Locate the court that has jurisdiction. Request the relevant documents. Inventory the estate's assets. Submit a Petition for Probate and other relevant documents.

The notice2026 shall state whether such person is named or referred in the will as legatee, devisee, trustee, guardian or substitute or successor executor, trustee or guardian2026 (2) legatee: any person designated to receive a transfer by will of personal property (SCPA § 103.33).

There is no time limit to the filing of a petition for probate in New York. However, if there is significant delay in the filing of the petition, other important deadlines such as tax filing deadlines, discussed below, may be missed and the nominated Executor may be held responsible for the delay.

In order to obtain Letters Testamentary, an interested party (typically the nominated executor under the Will) will need to petition the Surrogate's Court and provide pertinent information regarding the decedent, relevant parties (i.e., the spouse, children, etc.) and the decedent's assets.

How Long to Settle an Estate in New York? The short answer: from 7 months to 3 years. Typically 9 months. Estate settlement (also known as estate administration) is the phase during which you, as the court-appointed executor, must collect the estate assets, organize and pays debts, and file all final taxes.

Since the executor is personally liable to creditors if he distributes assets before 7 months have elapsed from his appointment, the minimum time it takes to complete probate is 7 months from the time the will is admitted to probate, although we sometimes see estates stay opened for two years or more.