A New York Corporate Resolution for Single Member LLC is a legal document that outlines the decisions, actions, and policies of an LLC with only one member or owner. It serves as a written record of the owner's intentions and decisions made on behalf of the LLC. The resolution typically contains relevant keywords such as "single member LLC," "New York," and "corporate resolution." It is important for the resolution to clearly state that the LLC has only one member, and that the resolutions are authorized and agreed upon by that sole member. Some common types of New York Corporate Resolutions for Single Member LLC include: 1. Organizational Resolutions: These resolutions are passed at the formation of the single member LLC and cover vital decisions such as the adoption of the operating agreement, appointment of the LLC's registered agent, authorization for opening bank accounts, and approval of initial capital contributions. 2. Financial and Banking Resolutions: These resolutions pertain to the authorization of financial activities, such as signing checks, borrowing funds, opening lines of credit, and making investments on behalf of the LLC. 3. Employment Resolutions: These resolutions might deal with the hiring, termination, and compensation of employees or independent contractors for the operation of the LLC. They may also determine their roles, responsibilities, and duties within the company. 4. Real Estate Transactions Resolutions: These resolutions allow the LLC to engage in real estate activities, such as property purchase, sale, leasing, or mortgage agreements. 5. Contractual Resolutions: These resolutions grant the single member LLC the authority to enter into various contractual agreements, including vendor contracts, service agreements, partnership agreements, and more. 6. Tax Resolutions: These resolutions authorize the LLC's elected tax treatment, such as electing to be taxed as a disregarded entity or a partnership for federal income tax purposes. They also address tax-related decisions, such as filing tax returns, making tax elections, and appointing tax preparers. It is essential to ensure that any New York Corporate Resolution for Single Member LLC complies with the applicable laws and regulations of the state and serves as a clear and unambiguous record of the owner's decisions and intentions. Consulting with a lawyer or legal professional specializing in business law is advisable to draft, review, and approve these resolutions properly.

New York Corporate Resolution for Single Member LLC

Description

How to fill out New York Corporate Resolution For Single Member LLC?

Have you ever found yourself in circumstances where you require documents for potentially business or specific applications almost every day.

There is a wide array of legal document templates accessible online, yet locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the New York Corporate Resolution for Single Member LLC, which can be tailored to comply with state and federal regulations.

Once you find the right form, click on Purchase now.

Select the payment plan you prefer, complete the required information to create your account, and finalize your purchase using PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Following that, you can download the New York Corporate Resolution for Single Member LLC template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it corresponds to the appropriate area/county.

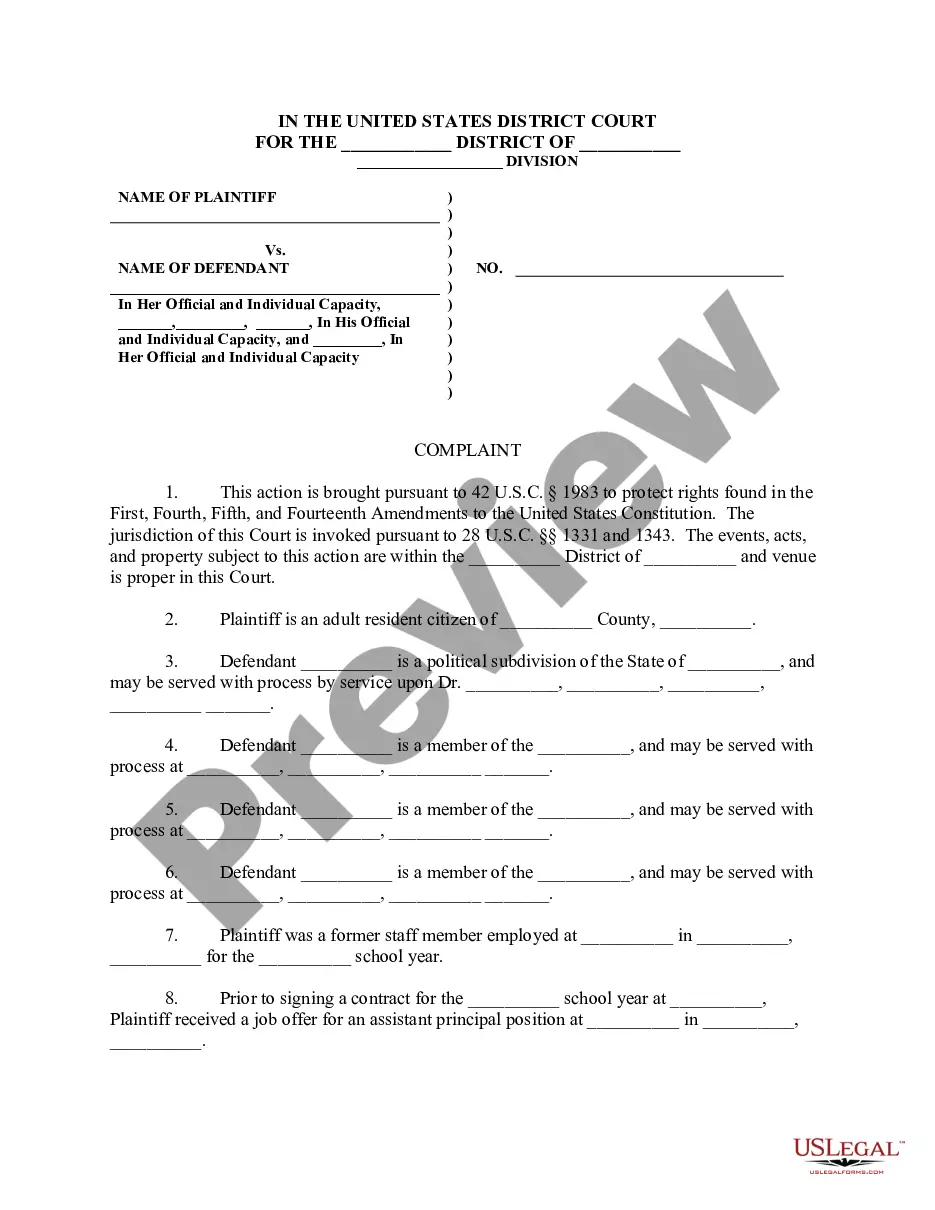

- Use the Review button to examine the document.

- Read the description to confirm that you have selected the correct form.

- If the form does not match your search, utilize the Search field to find the one that meets your needs and requirements.

Form popularity

FAQ

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

Unlike LLCs, corporations are required to make resolutions. Therefore, they are used to preparing them when shareholders or the board of directors make decisions. Although an LLC is not required to make resolutions, there are many reasons for getting in the habit of maintaining resolutions.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

With a SMLLC, you'd only use a resolution to document the most important business matters or actions such as: buying or selling real estate. getting a loan, establishing a bank account, or otherwise working with a financial institution.

A corporate resolution is a legal document that outlines actions a board of directors will take on behalf of a corporation. by Staff.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

During the first meeting of the members (LLC) or Board of Directors (Corporation), it is common for a business to establish a board resolution top open a bank account. A banking resolution is often one of the most necessary, as a business cannot generally create a bank account without one.

Corporate resolutions are required whenever the board of directors makes a major decision. The resolution acts as a written record of the decision and is stored with other business documents. These board resolutions are binding on the company.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

Interesting Questions

More info

All over to go for legal advice, and help to find the right legal firm in your area.