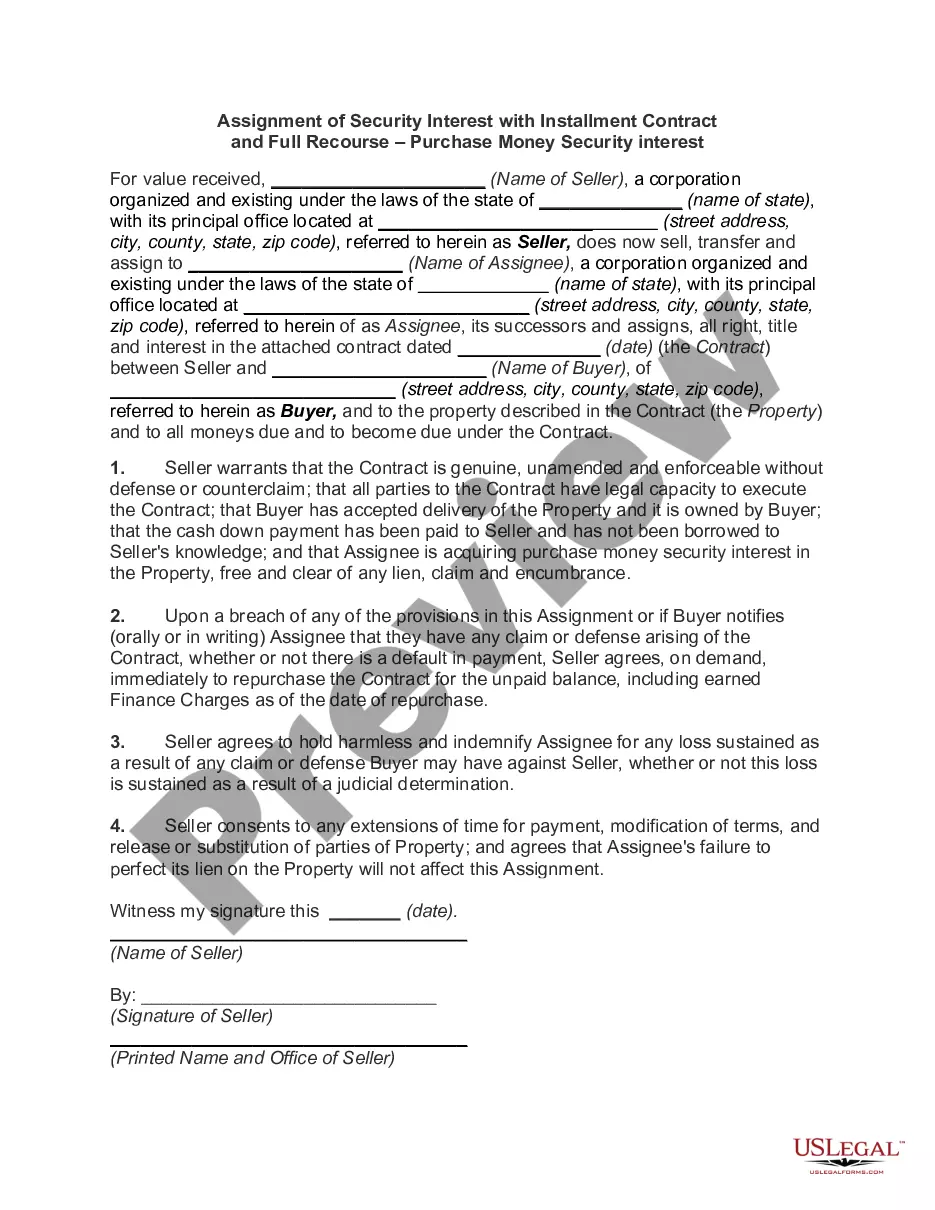

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

New York Sample Letter for Change of Venue and Request for Homestead Exemption

Description

How to fill out Sample Letter For Change Of Venue And Request For Homestead Exemption?

US Legal Forms - one of the largest libraries of lawful types in the United States - provides an array of lawful record layouts it is possible to obtain or print. Using the web site, you may get thousands of types for organization and person functions, categorized by types, suggests, or key phrases.You will find the most up-to-date models of types like the New York Sample Letter for Change of Venue and Request for Homestead Exemption in seconds.

If you currently have a registration, log in and obtain New York Sample Letter for Change of Venue and Request for Homestead Exemption from the US Legal Forms local library. The Obtain switch will appear on every kind you see. You gain access to all formerly saved types from the My Forms tab of your account.

If you wish to use US Legal Forms initially, listed below are straightforward recommendations to obtain started:

- Ensure you have picked the right kind for the city/area. Go through the Preview switch to check the form`s articles. Browse the kind explanation to ensure that you have selected the proper kind.

- If the kind doesn`t satisfy your specifications, use the Research field towards the top of the display to get the one that does.

- If you are satisfied with the shape, confirm your choice by visiting the Buy now switch. Then, pick the prices plan you like and supply your references to register on an account.

- Process the purchase. Use your credit card or PayPal account to complete the purchase.

- Find the structure and obtain the shape on your system.

- Make adjustments. Fill out, edit and print and indicator the saved New York Sample Letter for Change of Venue and Request for Homestead Exemption.

Every single design you put into your money does not have an expiry day which is your own eternally. So, in order to obtain or print yet another duplicate, just check out the My Forms segment and then click on the kind you require.

Gain access to the New York Sample Letter for Change of Venue and Request for Homestead Exemption with US Legal Forms, the most extensive local library of lawful record layouts. Use thousands of expert and express-certain layouts that satisfy your organization or person demands and specifications.

Form popularity

FAQ

You must be 65 years old or older. You must be living in the home to which the exemption applies on January 1 of the year for which the exemption applies. Your net income, or the combined net income of you and your spouse must not be greater than $10,000 for the preceding year.

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.

Must be 65 years of age on January 1 of the year they apply for the exemption. A surviving spouse of a qualifying owner. Must be the primary residence of the owner on record for 10 consecutive years. The property is classified as residential.

Colorado's statutory homestead exemption exempts a portion of a homestead from seizure to satisfy a debt, contract, or civil obligation. Section 2 increases the amount of the homestead exemption: From $75,000 to $250,000 if the homestead is occupied as a home by an owner of the home or an owner's family; and.

A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. You must file with the county or city where your home is located.

Exemption applications must be filed with your local assessor's office. See our Municipal Profiles for your local assessor's mailing address. Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services.

Age Exemption (Code L2-age 62) If you are 62 on January 1, this exemption will be an additional reduction of $20,000 of your assessed value towards your school tax. (Code L6-age 68) If you are 68 on January 1, this exemption will be an additional reduction of $120,000 of your assessed value towards your school tax.

(L3) - $40,000 From Assessed Value for County and School To qualify for this exemption, provide proof of income (Georgia and Federal Tax Returns), date of birth, and social security number.

Under New York's homestead protection law, the amount property owners may declare exempt varies based on county location and range from $75,000 to $150,000. The exemption amount is doubled for married couples, which can be as much as $300,000 for a couple in Suffolk County, for example.

Senior Tax Breaks by County Cobb: Complete exemption from all school tax at 62; additional exemptions may be available. ... Douglas: Complete exemption from all school tax at 62; additional exemptions may be available. ... Forsyth: Complete exemption from all school tax at 65; additional exemptions may be available.