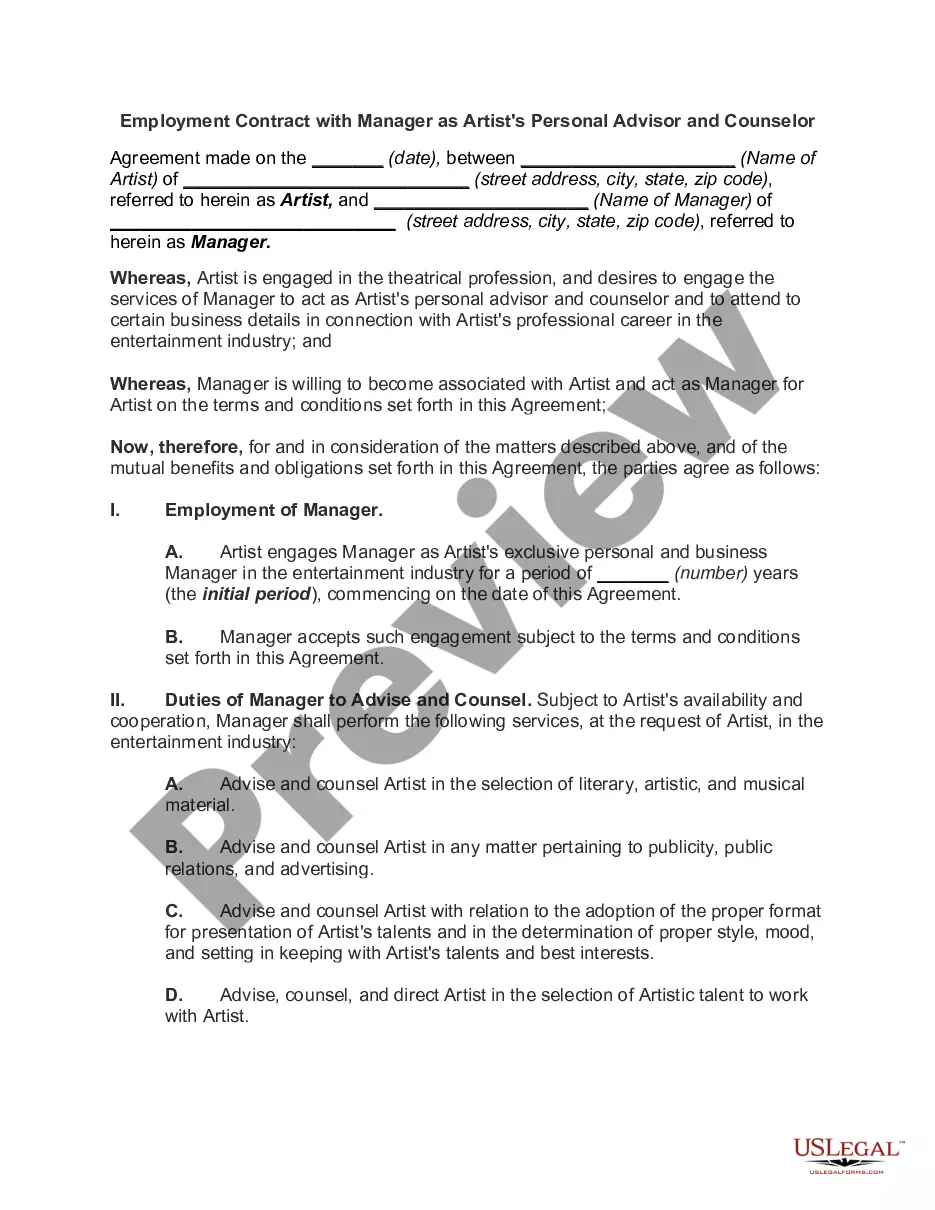

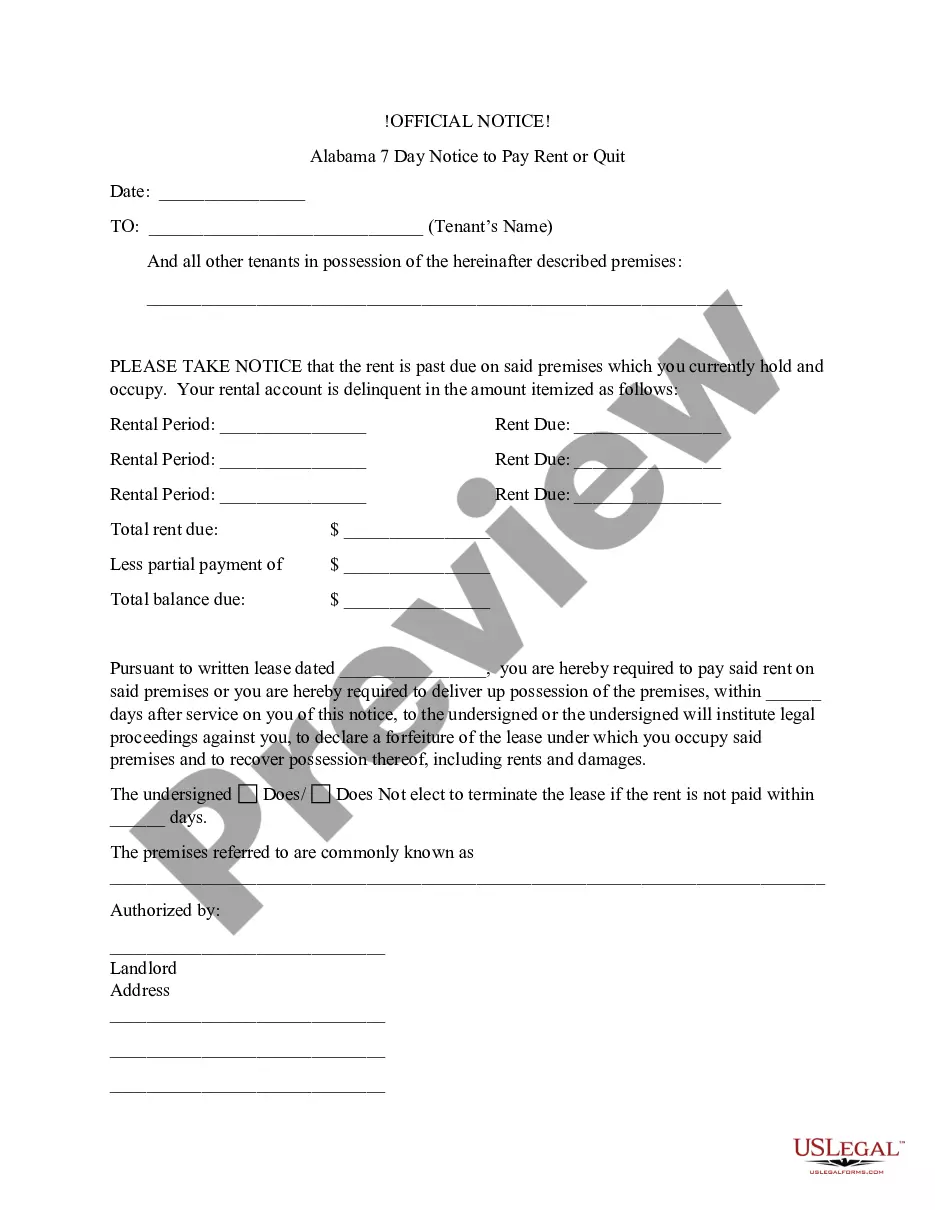

This form is a sample letter in Word format covering the subject matter of the title of the form.

New York Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney

Description

How to fill out Sample Letter To Credit Bureau Concerning Decedent's Credit Report - Attorney?

Choosing the best legal record design might be a battle. Obviously, there are a lot of layouts accessible on the Internet, but how can you get the legal develop you want? Take advantage of the US Legal Forms web site. The services offers thousands of layouts, including the New York Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney, that you can use for business and private needs. Every one of the types are inspected by experts and fulfill federal and state specifications.

If you are currently registered, log in to your account and then click the Obtain key to have the New York Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney. Make use of account to check throughout the legal types you have purchased formerly. Proceed to the My Forms tab of your account and acquire one more backup of your record you want.

If you are a new end user of US Legal Forms, listed here are easy recommendations for you to comply with:

- First, make certain you have selected the correct develop for your city/county. You are able to look through the form making use of the Review key and look at the form description to guarantee this is basically the best for you.

- If the develop does not fulfill your requirements, make use of the Seach field to discover the correct develop.

- Once you are positive that the form is proper, select the Get now key to have the develop.

- Select the pricing prepare you want and enter the necessary details. Create your account and pay money for the transaction with your PayPal account or charge card.

- Select the file structure and obtain the legal record design to your device.

- Comprehensive, change and produce and indication the attained New York Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney.

US Legal Forms is the most significant local library of legal types where you can see different record layouts. Take advantage of the company to obtain expertly-manufactured papers that comply with express specifications.

Form popularity

FAQ

How do I obtain a credit report for a deceased person? The spouse or executor of the estate may request the deceased person's credit report by mailing a request to each of the credit reporting companies. Send a letter along with the following information about the deceased: Legal name.

The creditors often find out directly through a surviving family member. The second source is the Social Security Administration (SSA), which routinely sends out a list of newly deceased individuals to the three major credit bureaus: Experian, TransUnion, and Equifax.

To do that, of course, the SSA itself needs to have been notified about the death. This is often done by the funeral home. Additionally, the deceased person would need to have been receiving Social Security benefits for the SSA to inform the credit bureaus. From the executor or a relative.

How to Notify Credit Bureaus of Death Obtain the death certificate. Call the credit agencies and request a credit freeze. Send the death certificate. Request a copy of the credit report. Work with the estate executor to close out credit accounts or pay off any remaining balance.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Their mailing address is: Experian, P.O. Box 9701, Allen, TX 75013. Include your name, address, and relationship to the deceased, as well as the full name, Social Security number, date of birth, and most recent address of the deceased.