New York Donation or Gift to Charity of Personal Property refers to the act of giving away personal property, such as clothing, furniture, artwork, vehicles, or any other tangible assets, to a charitable organization or non-profit entity located in the state of New York. This type of donation is made without any expectation of compensation or personal benefit, and it is an altruistic gesture aimed at supporting the cause or mission of the chosen charity. There are different types of New York Donation or Gift to Charity of Personal Property, which can vary based on the nature of the assets being donated or the formality of the donation process. Some common types include: 1. Clothing and Household Item Donations: This category covers the donation of clothing, shoes, accessories, and household items, such as kitchenware, bedding, and furniture, to charities that assist individuals and families in need. 2. Artwork and Collectibles Donations: Individuals can donate valuable artwork, antiques, collectibles, or other high-value items to charitable organizations, including museums or art galleries, supporting the arts and culture sector. 3. Vehicle Donations: This type of donation involves giving away automobiles, boats, motorcycles, or any other registered vehicles to charities that either directly use them for their organizational purposes or sell them to generate funds for their programs. 4. Real Estate Donations: In some cases, individuals may choose to donate real estate properties, including land, houses, or commercial buildings, to charitable organizations. These donations often provide the donor with tax benefits while contributing to causes such as affordable housing, community development, or conservation efforts. 5. Stock or Securities Donations: Donating stocks, bonds, or securities that have appreciated in value to charitable organizations allows donors to potentially avoid capital gains taxes while supporting philanthropic endeavors. Donating personal property to a charity in New York typically involves the completion of relevant legal documentation, which may vary depending on the value and type of the donated property. These documents may include a written donation agreement, a transfer deed for real estate donations, a title transfer for vehicles, or the completion of a non-cash charitable contribution form for tax purposes. It is important to consult with a tax advisor or attorney experienced in charitable donations to understand the specific requirements, legal implications, and tax benefits associated with donating personal property in the state of New York. Additionally, individuals donating valuable or high-value items may want to consider obtaining a professional appraisal for tax deduction purposes. By making a New York Donation or Gift to Charity of Personal Property, individuals contribute to the betterment of society by supporting organizations working towards various charitable causes, ranging from poverty alleviation to environmental conservation, education, healthcare, and beyond.

New York Donation or Gift to Charity of Personal Property

Description

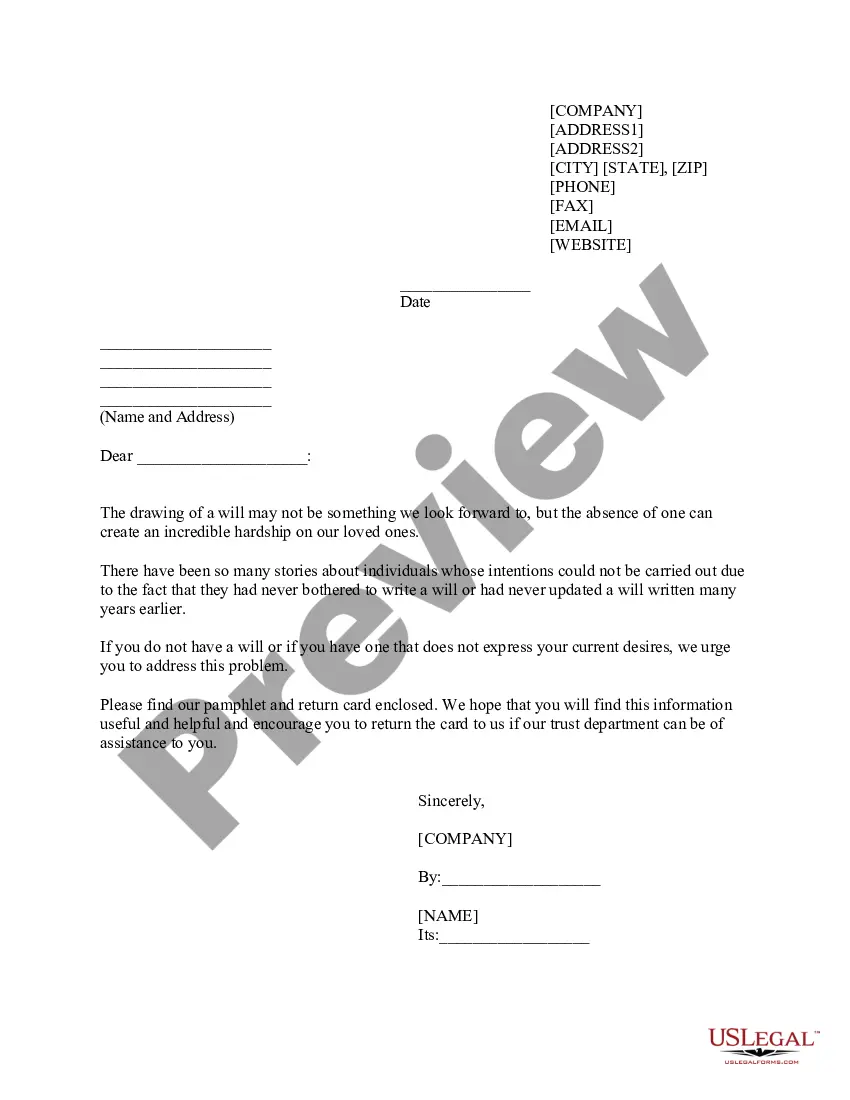

How to fill out New York Donation Or Gift To Charity Of Personal Property?

You can spend several hours on the web attempting to find the legitimate document design that meets the federal and state specifications you want. US Legal Forms gives a huge number of legitimate types which can be analyzed by experts. You can actually acquire or produce the New York Donation or Gift to Charity of Personal Property from your assistance.

If you already have a US Legal Forms profile, you are able to log in and click the Obtain button. Afterward, you are able to total, change, produce, or indication the New York Donation or Gift to Charity of Personal Property. Each and every legitimate document design you buy is yours eternally. To have an additional duplicate of the acquired form, go to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website for the first time, keep to the basic guidelines listed below:

- Initially, be sure that you have chosen the right document design for your county/city of your choice. Read the form description to make sure you have chosen the correct form. If available, take advantage of the Review button to search with the document design at the same time.

- If you would like locate an additional model from the form, take advantage of the Lookup field to obtain the design that fits your needs and specifications.

- After you have discovered the design you would like, just click Acquire now to move forward.

- Choose the pricing plan you would like, enter your qualifications, and sign up for an account on US Legal Forms.

- Complete the transaction. You may use your bank card or PayPal profile to cover the legitimate form.

- Choose the formatting from the document and acquire it for your device.

- Make changes for your document if required. You can total, change and indication and produce New York Donation or Gift to Charity of Personal Property.

Obtain and produce a huge number of document templates while using US Legal Forms Internet site, that provides the greatest collection of legitimate types. Use skilled and condition-certain templates to tackle your company or personal requirements.