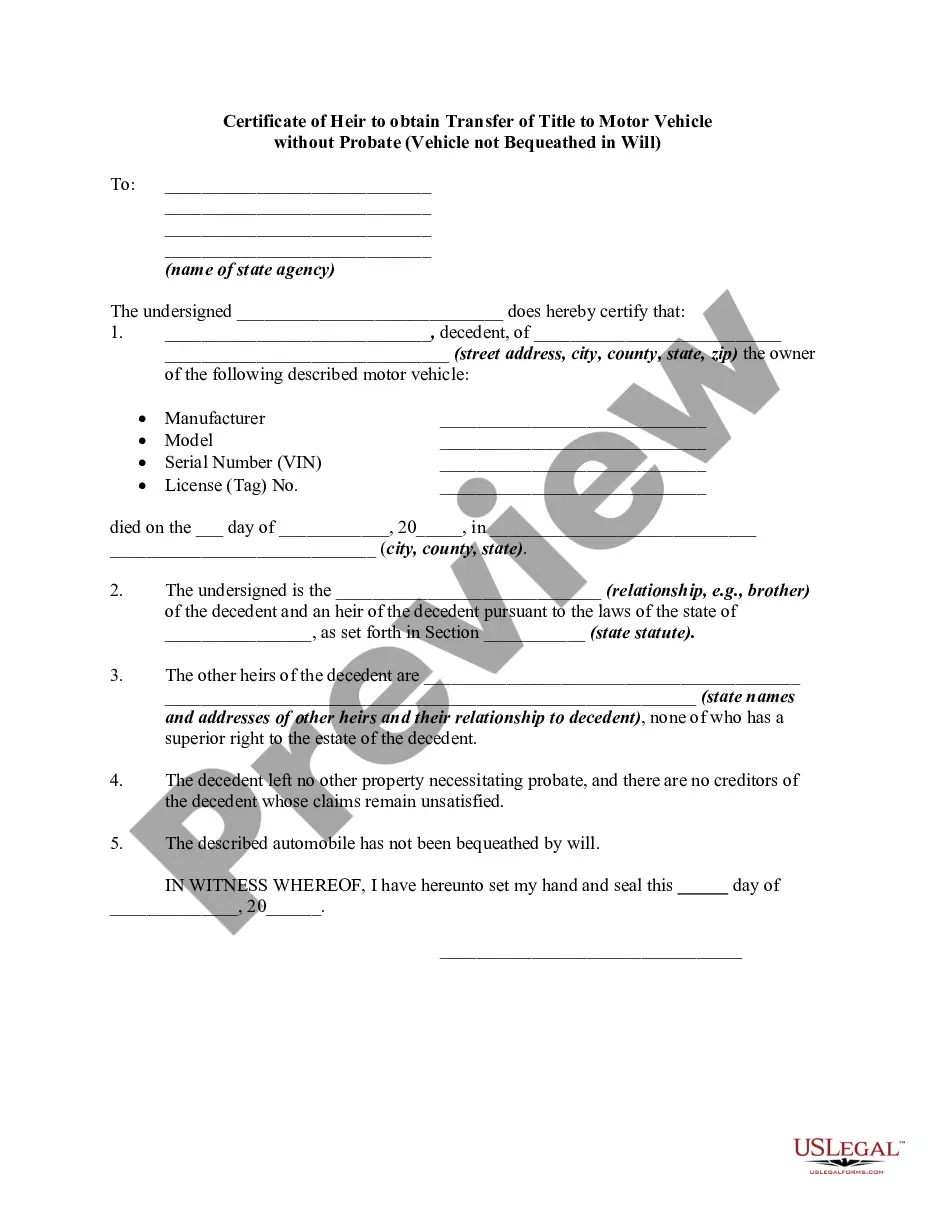

New York Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Finding the right legal record design might be a have difficulties. Needless to say, there are tons of layouts available on the Internet, but how would you find the legal type you will need? Use the US Legal Forms web site. The services offers a large number of layouts, for example the New York Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), that you can use for enterprise and private needs. All of the kinds are inspected by pros and fulfill state and federal requirements.

In case you are presently signed up, log in to the bank account and click the Down load option to have the New York Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will). Make use of bank account to look from the legal kinds you may have ordered earlier. Visit the My Forms tab of the bank account and acquire an additional copy of your record you will need.

In case you are a whole new customer of US Legal Forms, allow me to share simple guidelines that you should follow:

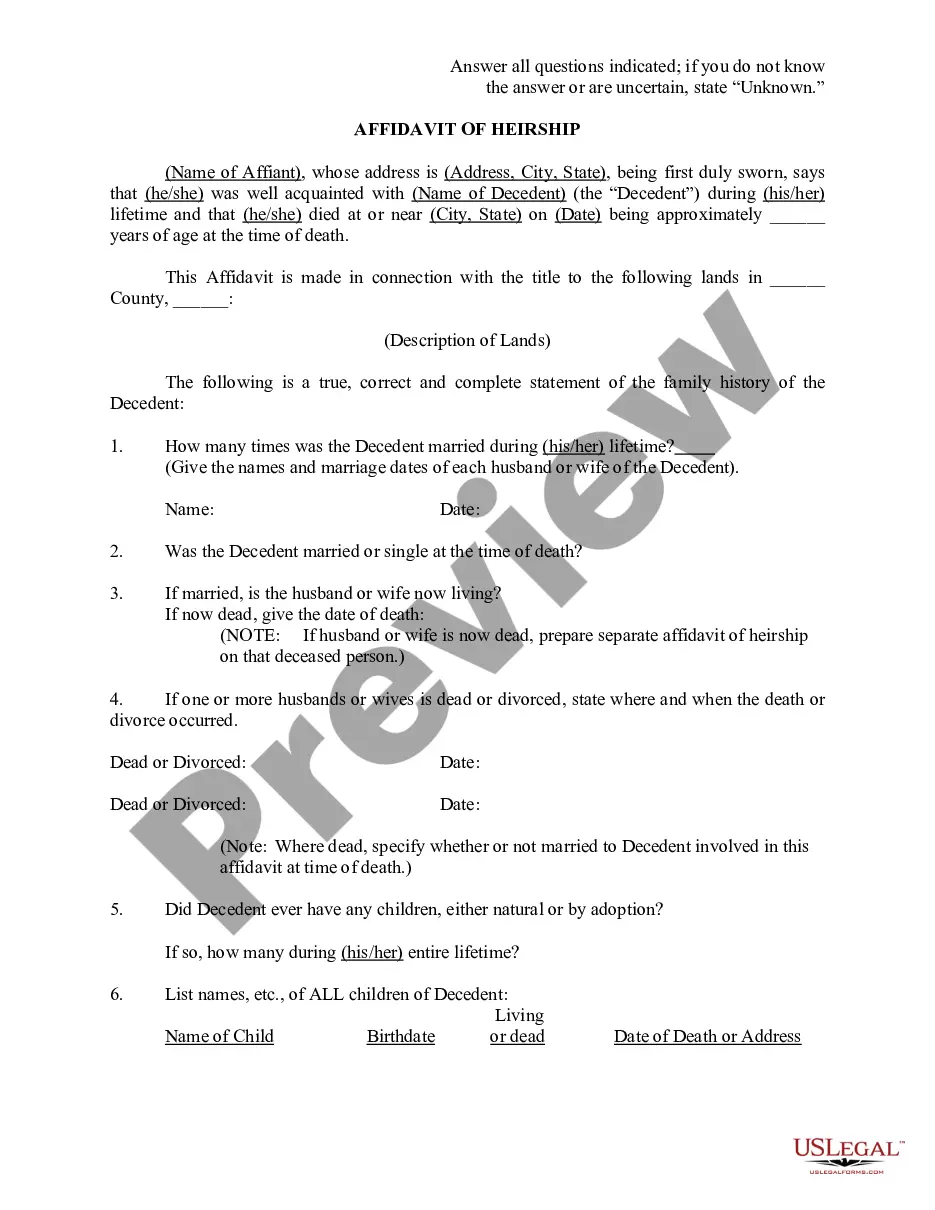

- Initially, make sure you have chosen the correct type for your town/region. You may check out the shape using the Review option and look at the shape outline to ensure it is the best for you.

- In the event the type does not fulfill your expectations, take advantage of the Seach discipline to get the right type.

- When you are sure that the shape is suitable, click the Purchase now option to have the type.

- Pick the prices prepare you desire and enter the necessary info. Create your bank account and buy an order with your PayPal bank account or Visa or Mastercard.

- Select the submit formatting and obtain the legal record design to the device.

- Comprehensive, change and print out and indicator the acquired New York Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will).

US Legal Forms is definitely the most significant local library of legal kinds for which you can discover various record layouts. Use the company to obtain professionally-made files that follow express requirements.

Form popularity

FAQ

Affidavit for Transfer of Motor Vehicle: If the vehicle has an estimated value of less than $25,000, the next of kin can use form MV-349 (Transfer of Vehicle Registered in Name of Deceased Person). For surviving spouses and minor children under 21, use MV-349.1 (Affidavit for Transfer of Motor Vehicle).

Use the form Vehicle Registration/Title Application (PDF) (MV-82), available at any motor vehicle office, by request from a DMV Call Center or by download from the DMV internet site. You must pay the registration and license plate fees, any appropriate sales tax, and the fee for a title certificate $50.00.

If the vehicle was a gift or was purchased from a family member, use the Statement of Transaction {Sales Tax Form} (pdf) (at NY State Department of Tax and Finance) (DTF-802) to receive a sales tax exemption. If you paid out-of-state sales tax, show the out-of-state dealer bill of sale.

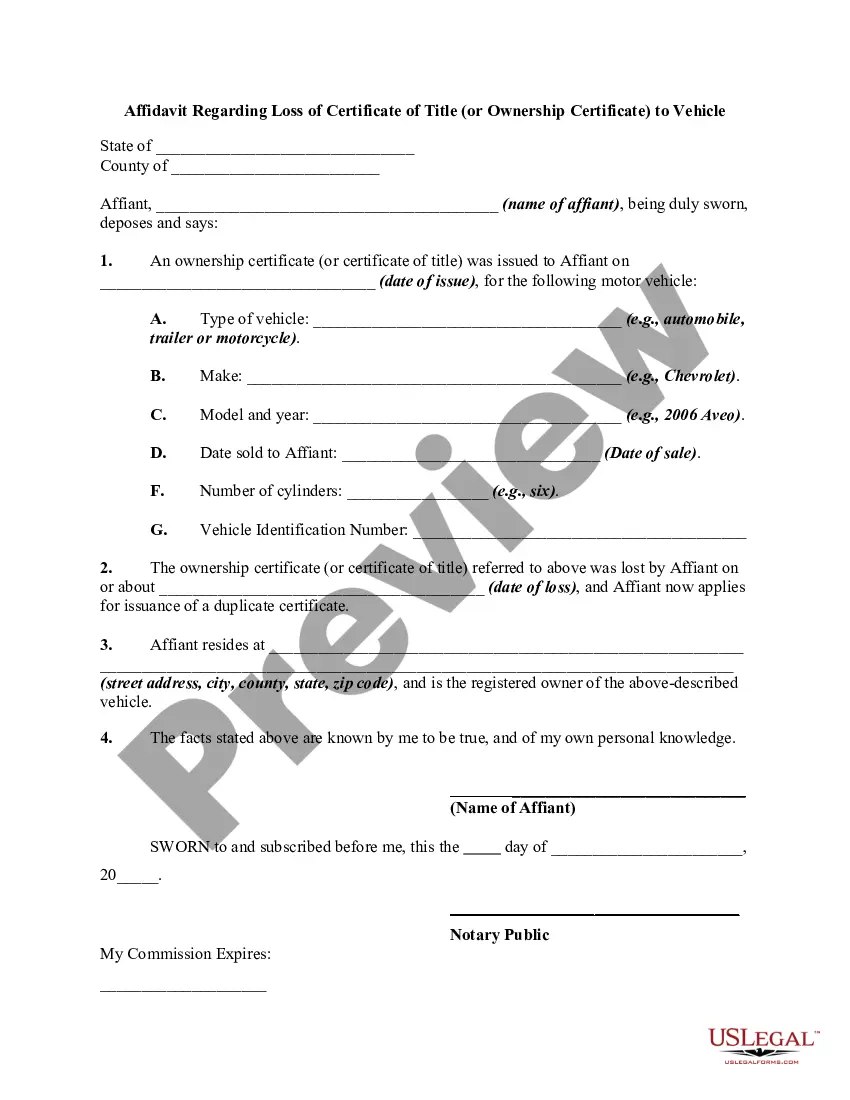

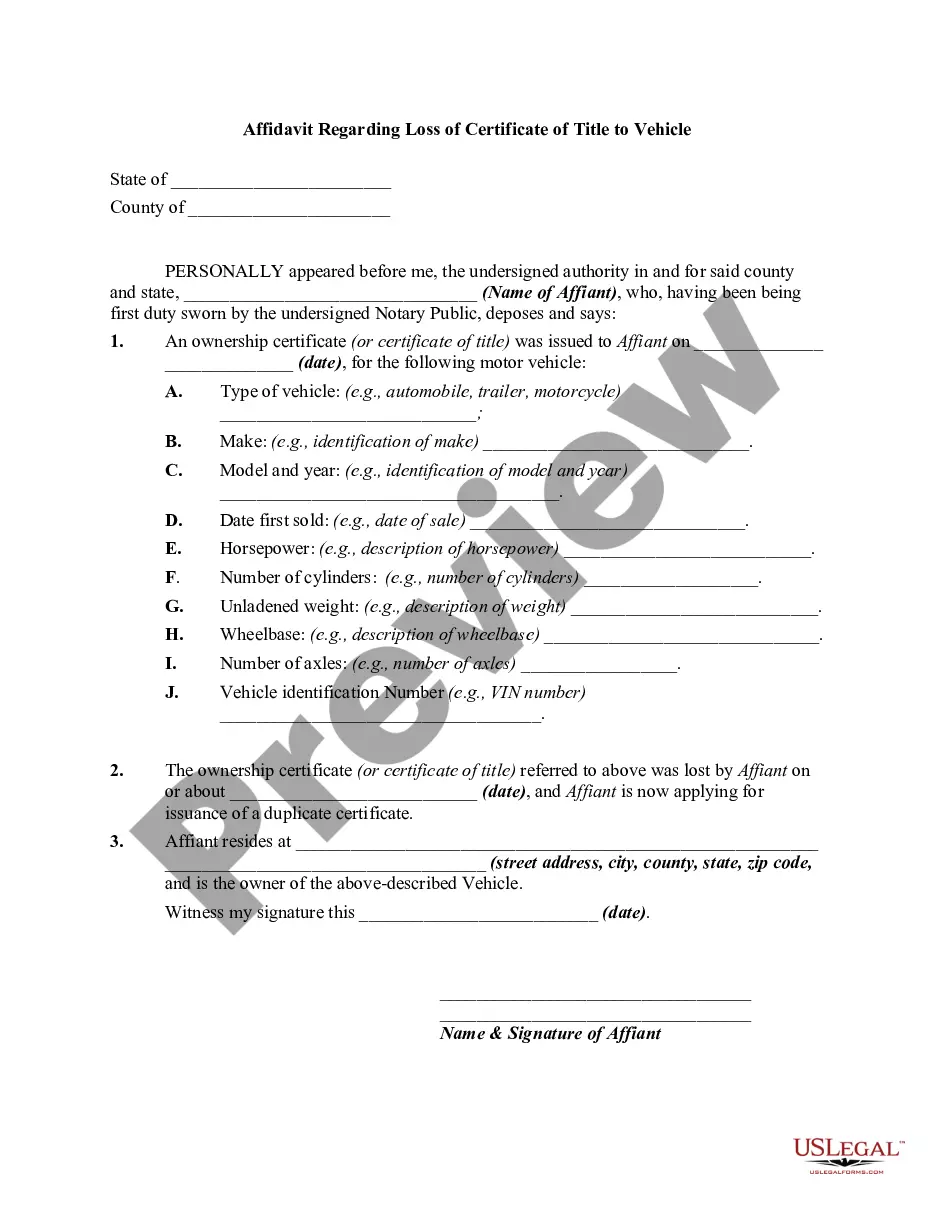

Send these items to the DMV a completed Application for Duplicate Title (PDF) (MV-902) proof of identity - this can be a photocopy of your NY State Driver License, Learner Permit, or Non-Driver ID (see Proofs of Identify for Registration and Title (PDF) (ID-82) for other acceptable proof)

* Copy of the Death Certificate ? A copy of the death certificate or a certification of death must be provided whenever the owner of the vehicle (that is, the person whose name is printed on the Certificate of Title or transferable registration) is deceased and the new owner is presenting form MV-349 or MV-349.1.

Send an Application for a Duplicate Certificate of Title (PDF) (MV-902) and the original proof that indicates that the lien is satisfied to the address above, or bring them to a DMV office.

The form to accomplish the transfer is the MV 349 and it must be submitted to the DMV with an original death certificate. All of the necessary DMV forms to accomplish the transfer of the car by either the surviving spouse, children or nearest relative are available on the DMV website.

$50 title certificate fee. Sales tax of your jurisdiction. There is also a 2-year fee of $32.50 if you drive an electric vehicle, or a car with 6 or more cylinders. Other vehicle registration fees vary based on your vehicle's weight, and cover a period of 2 years.

Driving a deceased person's vehicle is allowed as long as you have the estate's executor's permission and the vehicle is in good standing. If your loved one is the only name on the car title, a surviving spouse can transfer ownership of the vehicle.

Legally driving a deceased person's car requires following state laws and the wishes of your surviving family members. Most states allow a 30-day grace period before any fines or criminal charges apply. If the will goes into probate, the car's title cannot legally be transferred until probate is complete.