New York Demand for Collateral by Creditor is a legal concept that refers to the right of a creditor in the state of New York to demand collateral from a debtor to secure the repayment of a debt. In essence, it gives creditors the power to request additional security for a loan or credit facility if they believe that the debtor's financial stability or ability to repay is at risk. The demand for collateral by a creditor is typically made when the creditor feels uncertain about the debtor's financial condition, such as when the debtor's creditworthiness deteriorates or the value of the underlying collateral decreases. By requiring additional collateral, the creditor aims to protect its interests and increase the likelihood of recovering the debt in case of default. There are several types of New York Demand for Collateral by Creditor: 1. Security Agreement: This is a legal document that establishes the collateral and outlines the rights and obligations of both the creditor and debtor. It specifies the types of collateral, such as real estate, vehicles, inventory, accounts receivable, or personal property, that the debtor is required to provide as security for the debt. 2. UCC-1 Financing Statement: This is a form that is filed with the New York Secretary of State to create a public record of the creditor's security interest in the collateral. It serves as notice to other creditors and interested parties that the debtor's assets have been encumbered as collateral for a loan. 3. Lien: A lien is a legal claim that a creditor has on the debtor's property as security for a debt. It gives the creditor the right to take possession of and sell the collateral if the debtor defaults on the loan. Different types of liens may exist, such as a mortgage lien on real property or a security interest in personal property. 4. Foreclosure: If the debtor defaults on the loan and fails to repay the debt, the creditor may initiate a foreclosure proceeding to enforce its rights to the collateral. This typically involves a legal process where the creditor obtains a court order allowing the sale of the collateral to satisfy the debt. 5. Guarantor Liability: In some cases, the creditor may also demand collateral from a guarantor who has provided a personal guarantee for the debtor's debt. The guarantor may be required to pledge personal assets as collateral, providing an additional layer of security for the creditor. Overall, the New York Demand for Collateral by Creditor empowers creditors to request additional collateral from debtors and reinforces their position in case of default or financial instability. This concept helps protect the creditor's interests and provides a legal framework for enforcing the repayment of debts by utilizing the debtor's assets as collateral.

New York Demand for Collateral by Creditor

Description

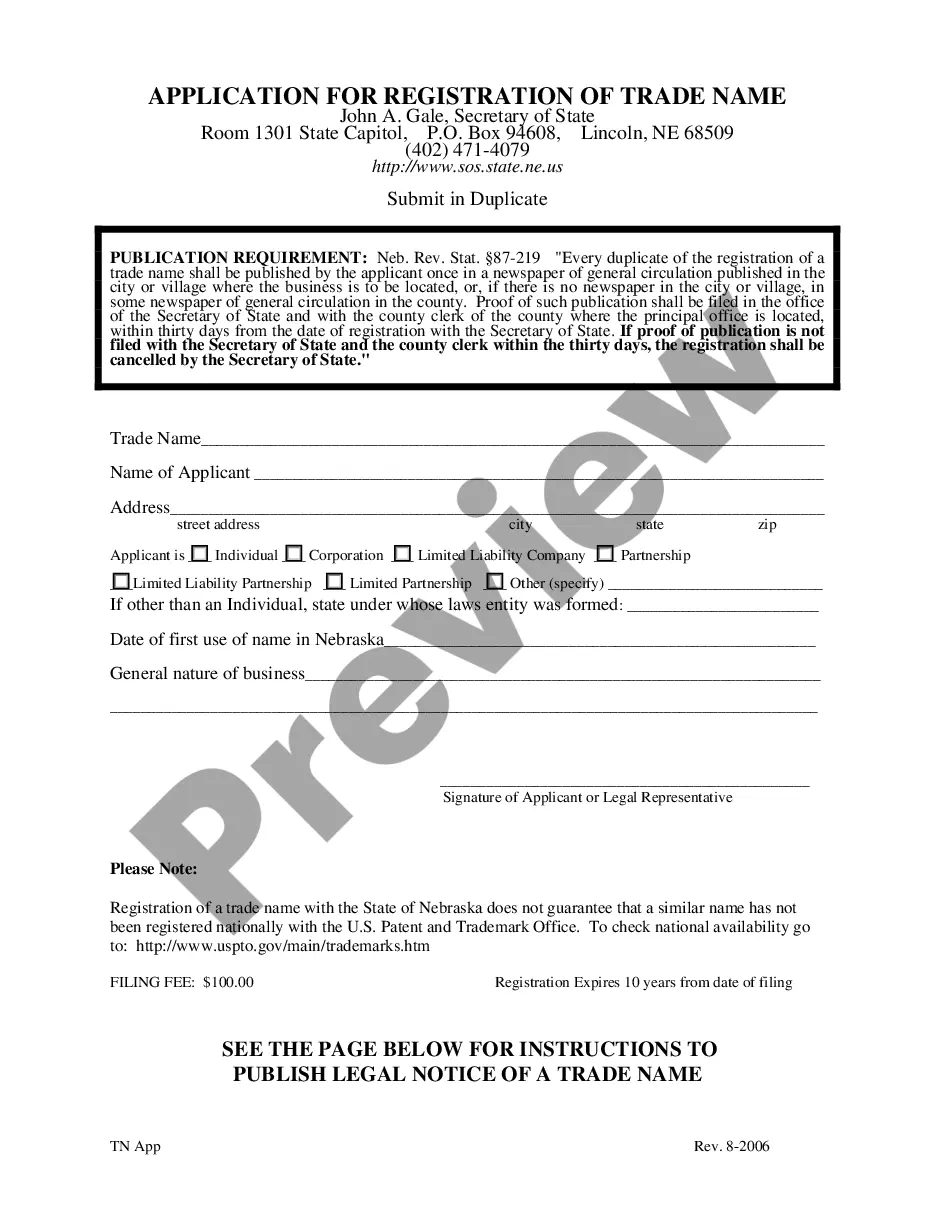

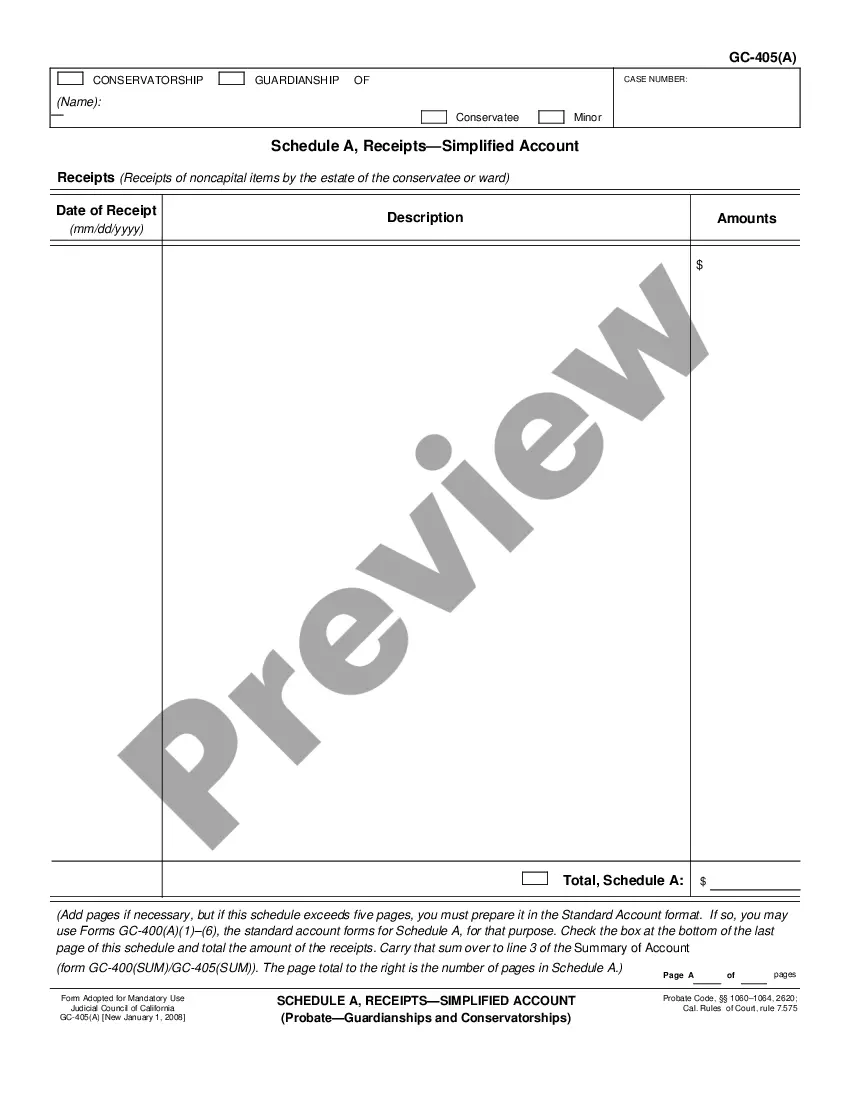

How to fill out New York Demand For Collateral By Creditor?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the New York Request for Security by Lender in just a few minutes.

If you hold a subscription, Log In and download the New York Request for Security by Lender from the US Legal Forms library. The Download option will appear on every document you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded New York Request for Security by Lender. Every template added to your account does not expire and is yours permanently. Therefore, if you wish to download or print another version, simply visit the My documents section and click on the form you desire. Gain access to the New York Request for Security by Lender with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your locality.

- Click the Preview option to review the form's details.

- Read the form summary to confirm that you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find an applicable one.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then choose your preferred pricing plan and provide your information to register for the account.

Form popularity

FAQ

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

Most creditors prefer to repossess the collateral and sell it or retain possession in satisfaction of the debt.

Under Revised Article 9 of the UCC, electronic chattel paper may be used as collateral in a secured transaction.

As noted in Chapter 3 (The Nature of Secured Credit under Article 9), Article 9 generally governs only consensual liens on personal property, i.e., security interests in personal property created by agreement. The creation of most other types of liens is largely outside the scope of Article 9.

In "consumer-goods transactions," Revised Article 9 contains specific provisions delineating the proper notice which secured parties must give regarding the disposition of collateral upon default.

Can a creditor or debt collector take my house? If you own a house, your creditor may be able to place a lien on the house. Before placing a lien on your house, a creditor must sue you to get a judgment against you saying that you owe a certain amount.

True leases are not subject to Article 9, and true lessors do not need to file Article 9 financing statements or otherwise comply with Article 9. See U.C.C. § 1-201 (b)(35) ("The right of a seller or lessor of goods under Article 2 or 2A to retain or acquire possession of the goods is not a 'security interest.

Interesting Questions

More info

Insiders have powers to make payments, approve loans, enter into agreements and lend money without the knowledge or consent of the Creditor or any of its branches. Insiders may be part of a joint venture company and their own share capital and income may be controlled by the Insiders, subject to certain restrictions. When a Bankruptcy Court order has been made about an insider, it is not always clear and clear how they are deemed to be a Creditor, and whether they are a Creditor or not. For example, if a Bankruptcy Court has ruled that an Insiders Bankruptcy has been imposed, but no Creditor has been appointed, the Insiders do not come into the Creditors relationship. A Creditor's interest as a creditor with respect to the Insiders is the same as it would be whether in a Liquidation Order, a Trustee Sale or a Repossession, whether in the UK or elsewhere.