New York Financial Statement Form - Universal Use

Description

How to fill out Financial Statement Form - Universal Use?

Are you presently in a situation where you require documents for both professional or personal purposes every single day.

There is a multitude of legitimate document templates accessible online, but identifying those you can rely on is challenging.

US Legal Forms provides thousands of document templates, such as the New York Financial Statement Form - Universal Use, designed to comply with federal and state regulations.

Once you find the correct document, click Buy now.

Select the pricing plan you want, fill in the required information to create your account, and complete your order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the New York Financial Statement Form - Universal Use template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/region.

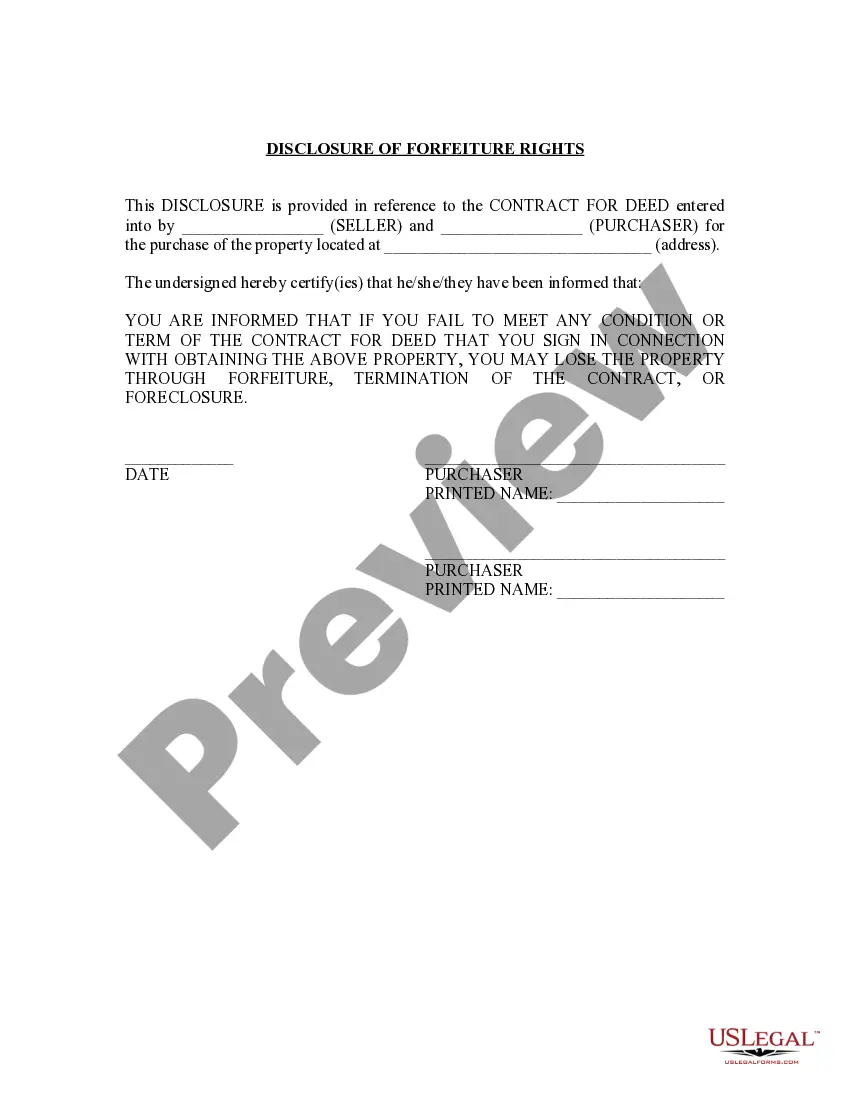

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the right document.

- If the document isn't what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

A financial statement form is a document that summarizes an individual's or business's financial position at a specific point in time. It includes details about income, expenses, assets, and liabilities. The New York Financial Statement Form - Universal Use serves as an effective tool for this purpose, providing a standardized format that simplifies the reporting process for users.

The SBA personal financial statement form is a document used for individuals seeking loans through the Small Business Administration. It helps lenders evaluate your financial health by detailing your assets and liabilities. By using the New York Financial Statement Form - Universal Use, you can easily gather the necessary information to complete the SBA form accurately.

The New York Financial Statement Form - Universal Use typically consists of five key components: assets, liabilities, net worth, income, and expenses. Assets represent what you own, while liabilities reflect what you owe. Your net worth is the difference between these two. Understanding these components is essential for accurate financial planning and assessment.

You should file a UCC with the state’s filing office, often the Secretary of State. In New York, this is managed by the Department of State. For an effective filing, using the New York Financial Statement Form - Universal Use is recommended. USLegalForms is a reliable resource that makes it easier to find and complete the necessary forms.

UCC liens are filed with the appropriate state office, which is usually the Department of State. This filing ensures that creditors can assert their rights against a debtor's property. In New York, using the New York Financial Statement Form - Universal Use is key to a successful lien filing. USLegalForms can assist by providing customizable forms to meet your needs.

UCCs need to be filed with the designated state authority, typically the Secretary of State or Department of State. Each state may have its own specific requirements, so be sure to verify them before filing. For New York, the New York Financial Statement Form - Universal Use is crucial for proper submission. USLegalForms streamlines this process by offering the required forms.

In New York, you file a UCC financing statement with the Department of State. This filing ensures that your financial interests are legally recognized. It is essential to use the New York Financial Statement Form - Universal Use for compliance. For your convenience, USLegalForms provides easy access to this form and helpful instructions.

You can file a UCC with the state office designated for handling such filings, which varies by state. In New York, filings go through the New York Department of State. Ensure that you use the New York Financial Statement Form - Universal Use for correct filing. USLegalForms offers access to these forms along with guidance to streamline the filing process.

To file a UCC fixture filing, you submit your documents to the appropriate state office. In New York, this typically means filing with the Department of State, Division of Corporations. You should ensure that your New York Financial Statement Form - Universal Use is correctly completed to avoid any delays. Utilizing USLegalForms can simplify this process by providing the necessary templates.

In New York, you can file a UCC form at the New York Department of State. It's important to submit your UCC filings at the correct office to ensure effective notice to potential creditors. By using the New York Financial Statement Form - Universal Use, you can organize your financial information seamlessly, which will aid you in the UCC filing process and ensure you fulfill all legal requirements.