New York Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

If you want to total, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are available online.

Employ the site’s straightforward and efficient search to find the documents you need.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You may utilize your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the New York Credit Cardholder's Report of Lost or Stolen Credit Card with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the New York Credit Cardholder's Report of Lost or Stolen Credit Card.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

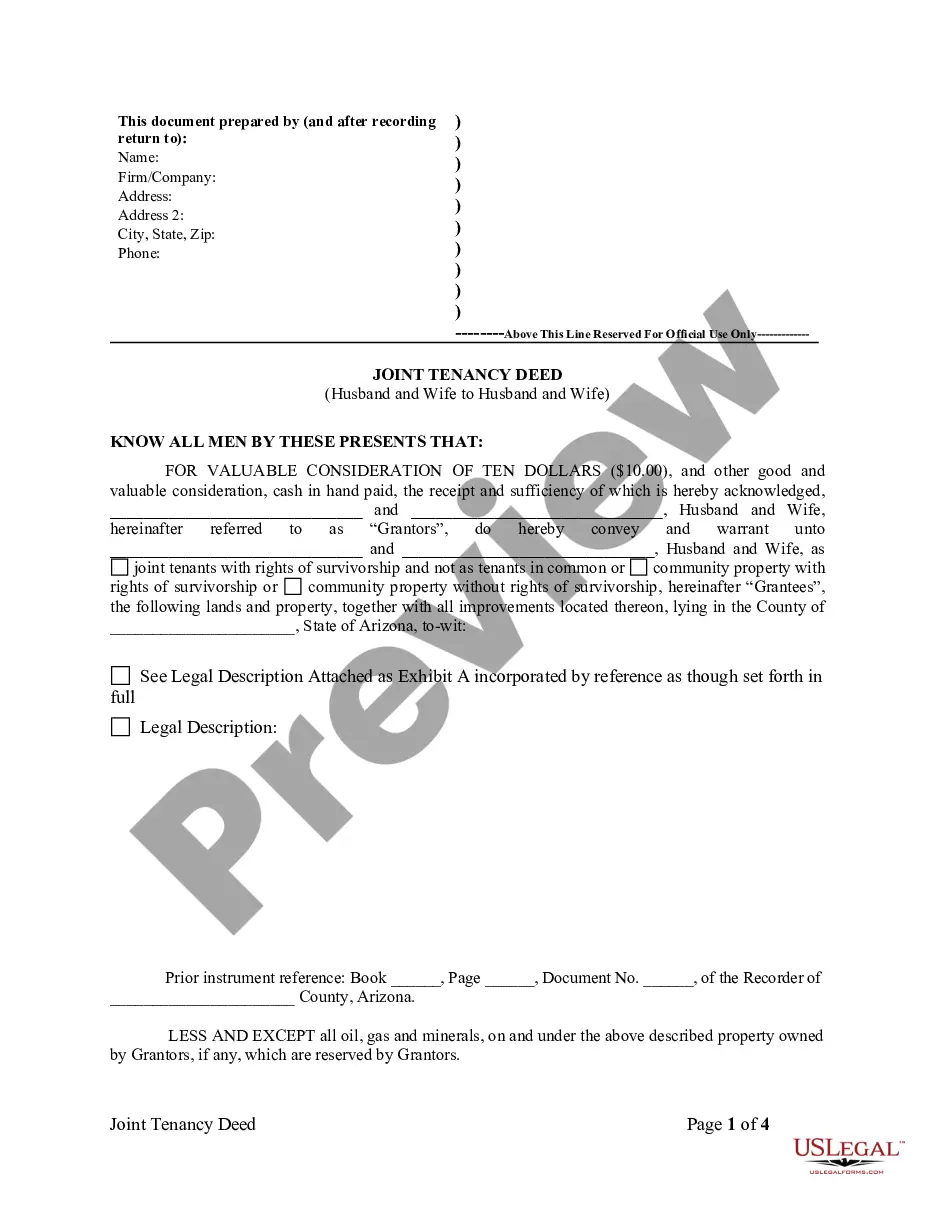

- Step 2. Use the Review option to examine the form’s content. Be sure to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

What to Do If Credit Card Theft Happens to You. In the event that your credit card is stolen in the United States, federal law limits the liability of cardholders to $50, regardless of the amount charged on the card by the unauthorized user.

Many credit card companies will replace your lost credit card for free. But depending on when you report the loss, you could also be on the hook for a small amount of any fraudulent charges made with your stolen credit card.

Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss. It's important to act fast.

How to place: Contact any one of the three credit bureaus ? Equifax, Experian, and TransUnion. You don't have to contact all three. The credit bureau you contact must tell the other two to place a fraud alert on your credit report.

When you lose your credit card, you can avoid an impact to your finances by reporting the card lost or missing immediately. In general, a lost or stolen credit card will have no impact on your credit score. In most cases, you will not be held responsible for charges on a lost or stolen card.

When you report a card as lost or stolen, your credit card company will deactivate or cancel your current credit card number. The card number previously assigned to you will no longer be active and you will be mailed a replacement credit card with a new number.

If you notify your bank or credit union within two business days of discovering the loss or theft of the card, the bank or credit union can't hold you responsible for more than the amount of any unauthorized transactions or $50, whichever is less.

Your card will be deactivated once it's reported missing, so update any accounts where that card is used to make automatic or recurring payments. If you're traveling, be sure to pack more than one credit card, reduce your credit limits, and keep them in separate places to reduce the chances of losing them all at once.