A New York Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction refers to a legal document that outlines the terms and conditions when a business is sold, and certain employees are retained by the buyer. This agreement is commonly used in asset purchase transactions where the buyer acquires particular assets of a business while choosing to retain a selected number of employees. In the state of New York, there are different types of Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transactions, such as: 1. General Sale of Business — Retained Employees Agreement: This agreement encompasses the sale of an entire business or a significant portion of it, where the buyer decides to retain certain employees post-acquisition. It outlines the terms of the transaction, including the purchase price, transfer of assets, the specific employees to be retained, and the terms and conditions of their employment. 2. Partial Sale of Business — Retained Employees Agreement: In this type, only a specific part or department of a business is sold, and the buyer chooses to retain selected employees associated with that section. This agreement clearly defines the assets being transferred, the responsibilities of the retained employees, and any relevant provisions related to the remaining business. 3. Bulk Sale — Retained Employees Agreement: Additionally, a bulk sale occurs when a business sells all of its assets, including inventory, equipment, and furniture. This agreement accounts for the retention of employees who are necessary for the ongoing operations of the acquired assets. It includes details such as the notice to be given to creditors, indemnification obligations, and any repayment terms associated with outstanding liabilities. Regardless of the type, a New York Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction typically covers key aspects, such as the purchase price, the closing date, indemnification provisions, confidentiality obligations, and any non-compete agreements. It also addresses the particular employees to be retained, their positions, compensation, benefits, job descriptions, and the duration of their employment post-acquisition. Overall, the purpose of this agreement is to ensure a smooth transfer of assets and continuity of business operations during and after the sale, while protecting the rights and interests of both the buyer and retained employees. It is essential to consult with legal professionals to draft a comprehensive agreement that adheres to the specific laws and regulations of New York.

New York Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out New York Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

Finding the right authorized file design might be a have a problem. Of course, there are a variety of templates available on the Internet, but how do you find the authorized form you will need? Use the US Legal Forms site. The support gives a large number of templates, for example the New York Sale of Business - Retained Employees Agreement - Asset Purchase Transaction, that can be used for company and private requirements. All the varieties are checked out by specialists and fulfill federal and state specifications.

In case you are presently registered, log in to your accounts and click on the Download switch to have the New York Sale of Business - Retained Employees Agreement - Asset Purchase Transaction. Use your accounts to appear throughout the authorized varieties you might have bought previously. Proceed to the My Forms tab of your own accounts and have another copy from the file you will need.

In case you are a new end user of US Legal Forms, allow me to share easy directions for you to stick to:

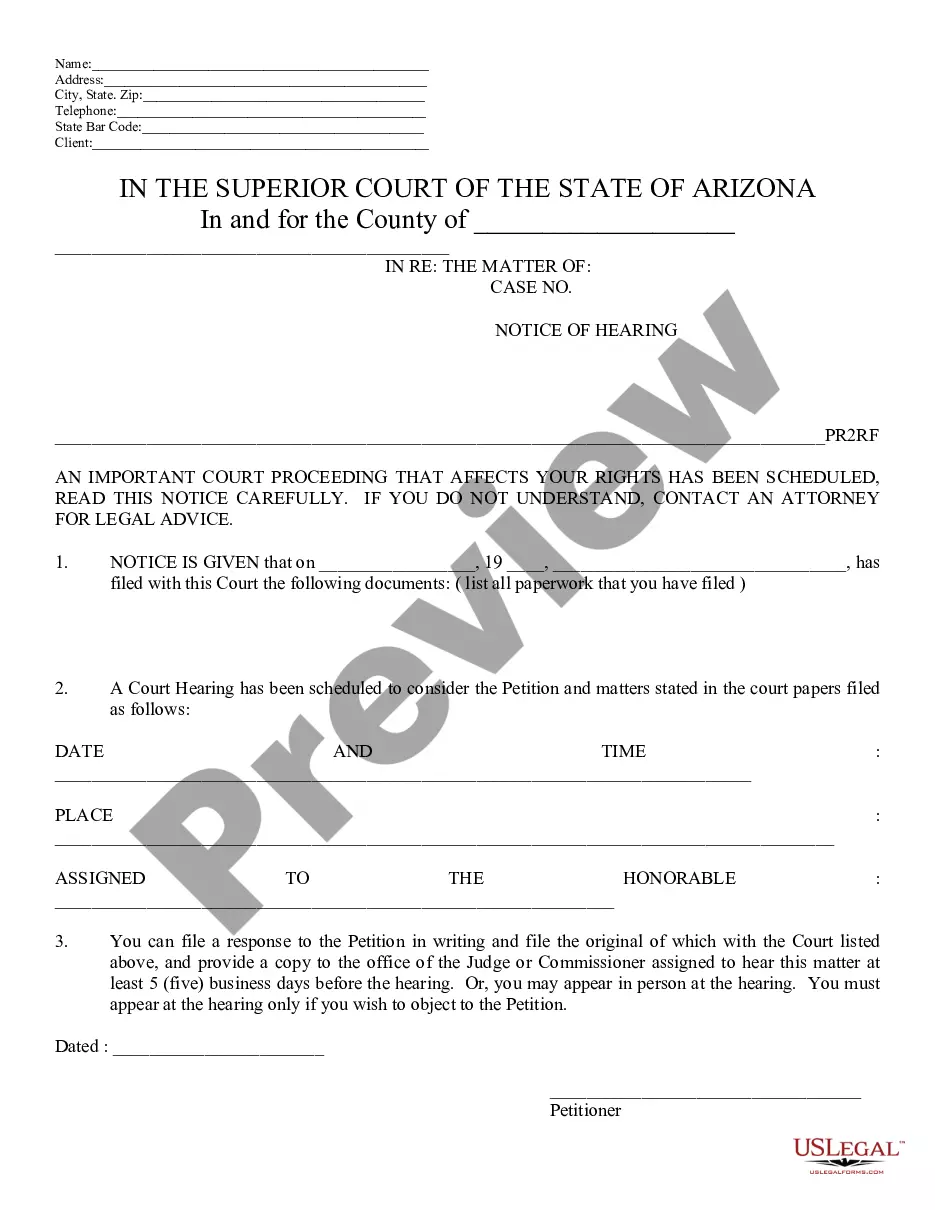

- Initial, be sure you have selected the correct form for your personal city/area. You are able to look over the form using the Review switch and read the form information to guarantee this is the right one for you.

- In case the form does not fulfill your preferences, utilize the Seach area to get the proper form.

- Once you are positive that the form would work, select the Get now switch to have the form.

- Choose the rates prepare you need and enter in the essential details. Make your accounts and pay money for the transaction using your PayPal accounts or credit card.

- Select the file format and obtain the authorized file design to your device.

- Full, edit and produce and signal the obtained New York Sale of Business - Retained Employees Agreement - Asset Purchase Transaction.

US Legal Forms may be the largest local library of authorized varieties where you can see different file templates. Use the company to obtain skillfully-made papers that stick to condition specifications.