A New York Letter of Credit (LC) is a legal and financial tool used in international trade to ensure payment between a buyer and a seller. It is a document issued by a bank or a financial institution at the request of the buyer, guaranteeing payment to the seller as per the agreed terms and conditions. The New York aspect refers to the jurisdiction in which the terms of the LC are governed. Keywords: New York, Letter of Credit, international trade, payment guarantee, buyer, seller, bank, financial institution, terms and conditions, jurisdiction. There are various types of New York Letters of Credit, including: 1. Commercial Letter of Credit: This is the most common type of LC. It is used in trade transactions to ensure that the seller receives payment upon fulfilling the specified requirements, such as providing the required documents or delivering the goods. 2. Standby Letter of Credit: Unlike a commercial LC, a standby LC is not meant for payment guarantee in trade transactions. Instead, it serves as a backup or guarantee of payment in case the buyer fails to fulfill their obligations. It can be used for various purposes, such as bidding on contracts, securing loans, or assuring performance in an agreement. 3. Revocable Letter of Credit: This type of LC can be amended or canceled by the buyer without prior notice to the seller. It provides flexibility to the buyer but may introduce risks for the seller as the terms can be changed at any time. 4. Irrevocable Letter of Credit: Unlike a revocable LC, an irrevocable LC cannot be changed or canceled without the consent of all parties involved. It provides more security to the seller, assuring that they will receive payment upon fulfilling the agreed conditions. 5. Confirmed Letter of Credit: In a confirmed LC, an additional guarantee is given by a second bank, usually in the seller's country, to ensure payment. This reduces the risk for the seller, as they have assurance from both the buyer's and the confirming bank's end. 6. Transferable Letter of Credit: This type of LC allows the beneficiary (seller) to transfer the credit to another party, usually a supplier or manufacturer, who will then fulfill the buyer's requirements. It enables more efficient sourcing and distribution in complex trade transactions. In conclusion, a New York Letter of Credit is a financial instrument used in international trade to guarantee payment between a buyer and a seller. It offers various types, including commercial, standby, revocable, irrevocable, confirmed, and transferable, each catering to specific trade scenarios and providing specific benefits and safeguards for the parties involved.

New York Letter of Credit

Description

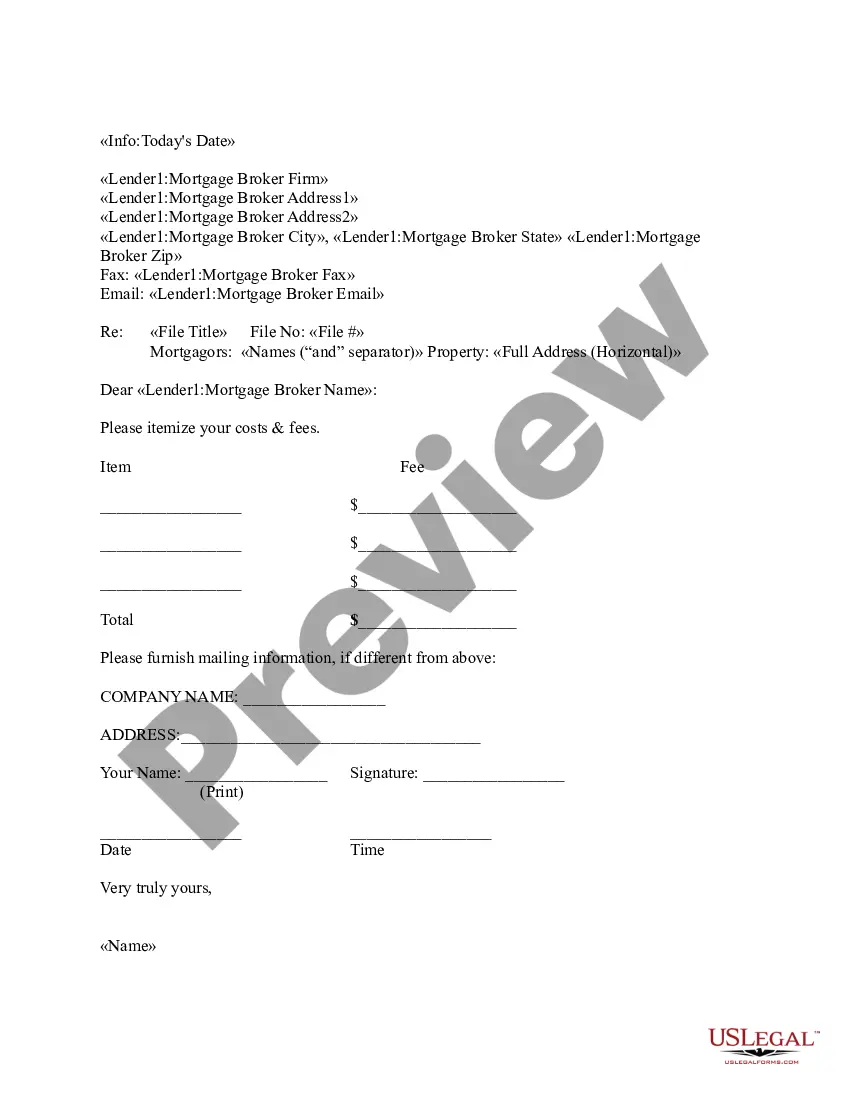

How to fill out New York Letter Of Credit?

Discovering the right legitimate file design could be a have difficulties. Of course, there are a variety of layouts available on the Internet, but how will you obtain the legitimate type you need? Use the US Legal Forms web site. The assistance gives a large number of layouts, for example the New York Letter of Credit, which can be used for business and personal needs. All the types are examined by experts and meet up with state and federal specifications.

When you are presently authorized, log in to the bank account and click the Download key to find the New York Letter of Credit. Use your bank account to look throughout the legitimate types you have ordered earlier. Proceed to the My Forms tab of your respective bank account and get one more duplicate from the file you need.

When you are a brand new customer of US Legal Forms, listed below are simple directions that you should stick to:

- Very first, make certain you have selected the appropriate type to your metropolis/region. You may look through the shape while using Review key and study the shape explanation to ensure it is the best for you.

- If the type fails to meet up with your expectations, make use of the Seach discipline to obtain the proper type.

- When you are certain the shape is acceptable, click on the Purchase now key to find the type.

- Opt for the rates program you would like and type in the required details. Build your bank account and pay for your order using your PayPal bank account or bank card.

- Choose the document format and download the legitimate file design to the system.

- Full, revise and print out and sign the attained New York Letter of Credit.

US Legal Forms will be the largest local library of legitimate types in which you can discover various file layouts. Use the service to download professionally-made documents that stick to express specifications.

Form popularity

FAQ

As the business applying for the letter of credit, the applicant will likely pay a fee to obtain the letter (often, a percentage of the amount the letter of credit is for).

There are different types of letters of credit that may be used, depending on the circumstances. If you need to obtain a letter of credit for a business transaction, your current bank may be the best place to begin your search.

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.

What are the fees for Standby Letters of Credit? It is standard for a fee to be between 1-10% of the SBLC value. In the event that the business meets the contractual obligations prior to the due date, it is possible for an SBLC to be ended with no further charges.

A buyer will typically pay anywhere between 0.75% and 1.5% of the transaction's value, depending on the locations of the issuing banks. Sellers may find that their fees are structured slightly differently. Instead, they may pay a set of small flat fees that vary in cost.

An import letter of credit is a legally binding document that minimizes financial risks to your business. It is a commercial L/C established for a buyer, the importer, to pay a specified sum of money to the overseas seller for the goods described in the L/C.

A Letter of Credit (LC) is a document that guarantees the buyer's payment to the sellers. It is issued by a bank and ensures timely and full payment to the seller. If the buyer is unable to make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

A letter of credit is an instrument issued by a financial institution, usually a bank, which authorizes the bearer to demand payment from the institution. A letter of credit can be general, if it is not addressed to any specific person, or special, if it is addressed to a specific person or entity.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit.