New York Employment Contract of Consultant with Nonprofit Corporation: A Comprehensive Guide A New York Employment Contract of Consultant with a Nonprofit Corporation is a legally binding document that outlines the terms and conditions of employment between a consultant and a nonprofit organization based in New York. This contract serves as a crucial tool for establishing a mutually beneficial working relationship and ensuring compliance with relevant state laws and regulations. Keywords: New York, Employment Contract, Consultant, Nonprofit Corporation There are several types of New York Employment Contracts of Consultant with Nonprofit Corporations, depending on specific requirements, scope of work, and duration. These may include: 1. Fixed-Term Employment Contract: This type of contract covers a specific duration, such as a few months or years, during which the consultant will provide services to the nonprofit organization. It includes clear start and end dates, along with any provisions for renewal or termination. 2. Project-Based Employment Contract: This contract is suitable for consultants engaged in specific projects or tasks. It outlines the project scope, deliverables, timelines, and any performance metrics that the consultant must meet. This type of contract allows flexibility when the nonprofit corporation requires expertise on short-term projects. 3. Retainer-Based Employment Contract: Nonprofit corporations often hire consultants on a retainer basis when they require ongoing advisory or specialized services. This contract establishes a fixed monthly or annual fee, along with the consultant's responsibilities, availability, and the duration of the retainer agreement. 4. Independent Contractor Agreement: Although not strictly an employment contract, a consultant may be engaged as an independent contractor rather than an employee. This type of agreement clarifies that the consultant is responsible for their own taxes, benefits, and insurance. It also outlines the terms of payment, project scope, and other consulting-specific clauses. Whether it is a fixed-term, project-based, retainer-based, or independent contractor agreement, a comprehensive New York Employment Contract of Consultant with a Nonprofit Corporation typically includes the following key components: a) Parties Involved: Clearly states the names, addresses, and contact details of both the consultant and the nonprofit corporation. b) Agreement Duration: Specifies the contract's start and end dates, renewal or termination provisions, and notice requirements. c) Scope of Work: Defines the consultant's responsibilities, tasks, deliverables, and performance benchmarks. d) Compensation and Payment Terms: Outlines the consultant's remuneration, including the agreed upon hourly rate, retainer fees, project-based payments, or any other financial arrangements. It may include provisions for reimbursement of certain expenses. e) Intellectual Property: Determines the ownership and rights to any intellectual property or work products created by the consultant during the engagement. f) Confidentiality and Non-Disclosure: Includes clauses to protect sensitive information and trade secrets of the nonprofit corporation. g) Non-compete and Non-solicitation: Prevents the consultant from directly competing with the nonprofit corporation or soliciting its employees, clients, or donors for a specified duration after the contract ends. h) Governing Law and Dispute Resolution: Specifies that the contract is governed by the laws of New York and outlines the preferred method of resolving any disputes or conflicts that may arise. i) Termination Conditions: States the grounds on which the contract can be terminated by either party, along with any notice periods or conditions for termination without cause. It is essential to consult with legal and nonprofit professionals to draft an employment contract suitable for the needs of the nonprofit corporation and compliant with New York laws and regulations.

New York Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out New York Employment Contract Of Consultant With Nonprofit Corporation?

You can spend hours online attempting to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

It is straightforward to download or print the New York Employment Contract of Consultant with Nonprofit Corporation from the platform.

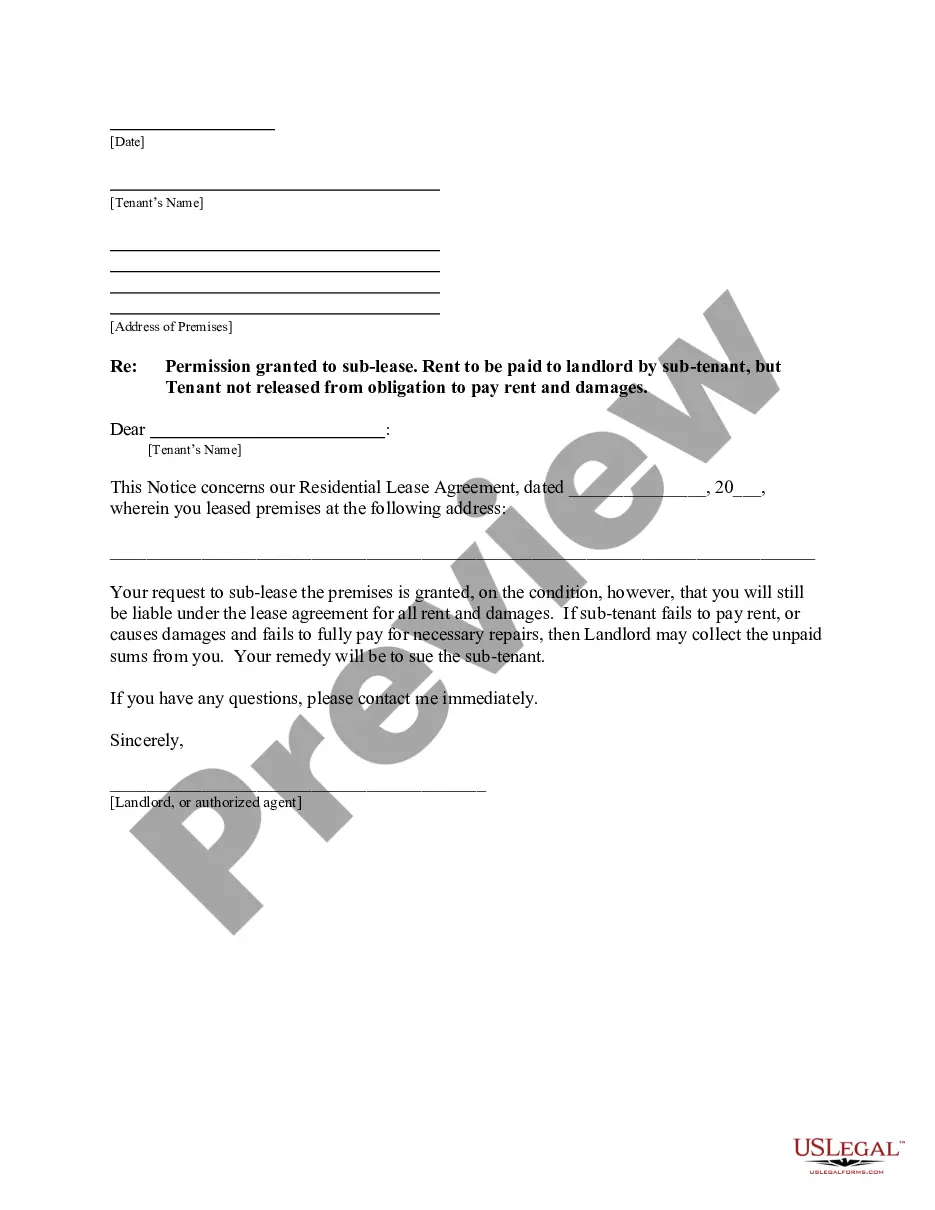

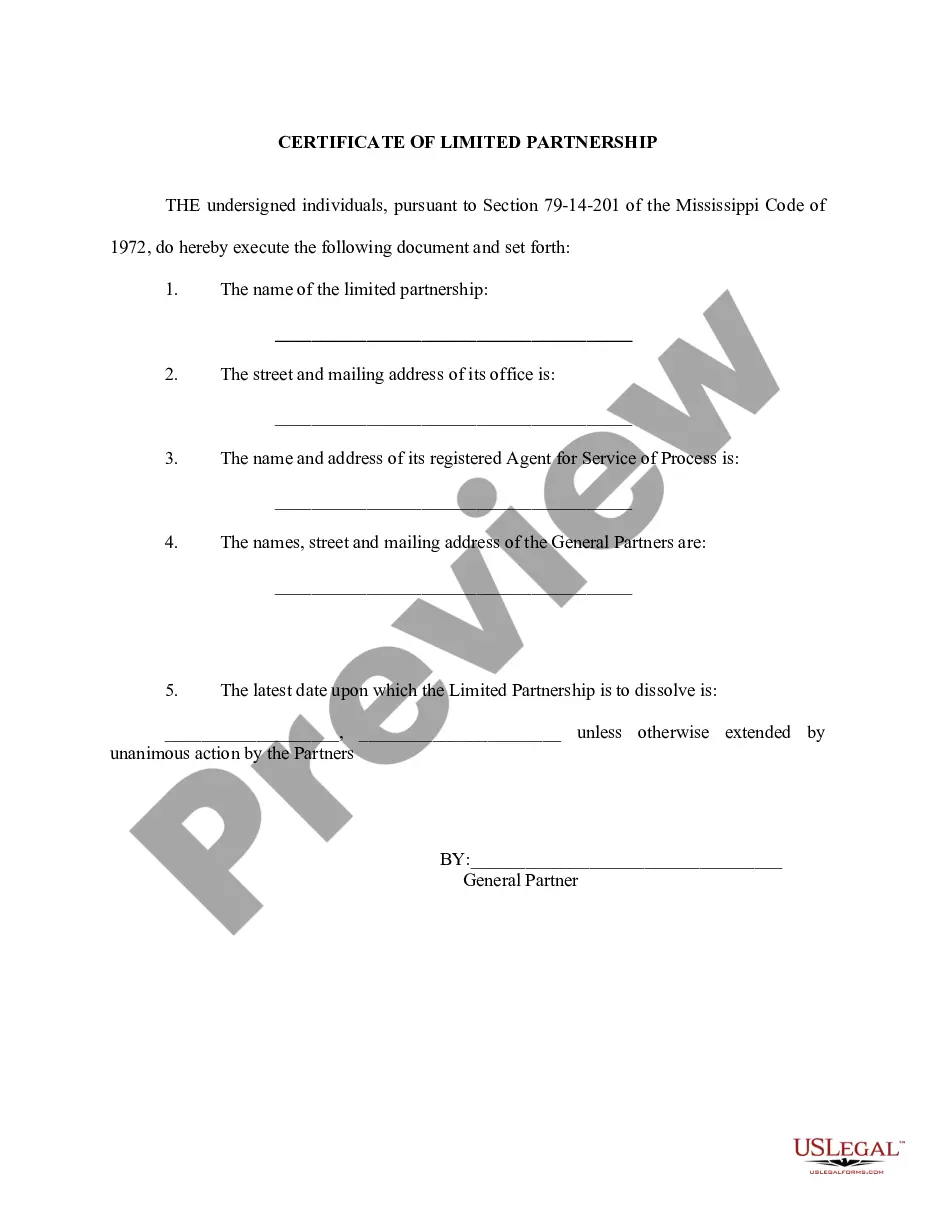

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and then select the Acquire button.

- After that, you can complete, modify, print, or sign the New York Employment Contract of Consultant with Nonprofit Corporation.

- Every legal document template you acquire belongs to you permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you use the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

To draft a consulting agreement, start by clearly identifying the parties involved and defining the scope of work. Include terms related to compensation, duration, and confidentiality to protect both the consultant and the nonprofit organization. By addressing all necessary components, you can ensure that your New York Employment Contract of Consultant with Nonprofit Corporation meets legal standards and aligns with your organization's goals. For added convenience, consider using uslegalforms, which offers templates and resources tailored for this type of contract.

To secure a contract as a consultant, leverage your network and market your skills to potential clients. Attend industry events, and connect with nonprofit organizations in New York that align with your expertise. When offered a project, ensure to use a standard New York Employment Contract of Consultant with Nonprofit Corporation to establish a clear working relationship.

A consulting agreement should include the scope of services, payment terms, and timelines. Additionally, include clauses on confidentiality, intellectual property rights, and dispute resolution. Having a comprehensive New York Employment Contract of Consultant with Nonprofit Corporation helps protect your rights and clarifies expectations.

To become a contracted consultant, start by developing a strong portfolio and network within your field. Promote your services to organizations, particularly nonprofits looking for expertise. Utilize a New York Employment Contract of Consultant with Nonprofit Corporation to formalize relationships and ensure professional standards.

Writing a consultancy agreement involves clearly defining the terms of your engagement, including the duration and scope of work. Set payment terms and include clauses for confidentiality and termination. A well-crafted New York Employment Contract of Consultant with Nonprofit Corporation can be achieved with templates and guidance from uslegalforms.

To create a consulting contract, start by outlining the services you offer and the objectives of the project. Include details like payment structure, deadlines, and confidentiality clauses. Utilizing the resources available on uslegalforms can help you draft a tailored New York Employment Contract of Consultant with Nonprofit Corporation that meets your specific needs.

Consultants should have a consulting agreement that details project specifics and expectations. This contract is essential to prevent misunderstandings and ensure both parties align on deliverables. For consultants partnering with a New York nonprofit corporation, a New York Employment Contract of Consultant with Nonprofit Corporation ensures compliance with local regulations and protects your interests.

A consultant contract is a formal agreement between a consultant and a company, outlining the terms of the consultant's services. It defines the scope of work, payment terms, and responsibilities of both parties. When working with a nonprofit corporation in New York, a well-structured New York Employment Contract of Consultant with Nonprofit Corporation is vital for clarity and legal protection.

A consultancy agreement should include essential elements such as the names of the parties, a detailed description of services, payment arrangements, and if applicable, the intellectual property rights. It's also important to cover terms surrounding termination and liability. When drafting a New York Employment Contract of Consultant with Nonprofit Corporation, encompassing these key details facilitates a smoother partnership.

An agreement should clearly document the scope of services, payment terms, duration, and the obligations of both parties. Additionally, including clauses on confidentiality, intellectual property, and dispute resolution is advisable. When preparing a New York Employment Contract of Consultant with Nonprofit Corporation, be thorough to prevent misunderstandings down the line.

More info

For example, a company can provide paid paternity leave or other family-related leave that will allow an employee to use their vacation in order to take care of their family. When your employees are away from the office, they are not working effectively. They are missing out on important work. The amount of holiday that an employee can take with their family is determined by a company's policy. If a company offers paid vacation to its employees, then the company will also offer paid time off. When you decide on what type of leave and what type of leave it is, keep in mind that it may take a bit of thought to get it just right. Many companies set up the same type of leave and then have employees select one of the various options. It is up to you to make sure that your employees know the details of the various types of leave for which they are eligible to take. What to Do When Your Employee Leaves Your Office?