New York Receipt and Acceptance of Goods

Description

How to fill out Receipt And Acceptance Of Goods?

You may devote several hours on-line looking for the authorized document design which fits the federal and state specifications you require. US Legal Forms gives 1000s of authorized kinds that happen to be reviewed by specialists. You can actually down load or printing the New York Receipt and Acceptance of Goods from the services.

If you have a US Legal Forms profile, it is possible to log in and then click the Acquire button. Following that, it is possible to complete, modify, printing, or indication the New York Receipt and Acceptance of Goods. Every authorized document design you get is your own permanently. To get another duplicate associated with a acquired type, proceed to the My Forms tab and then click the related button.

If you work with the US Legal Forms web site the first time, follow the easy guidelines beneath:

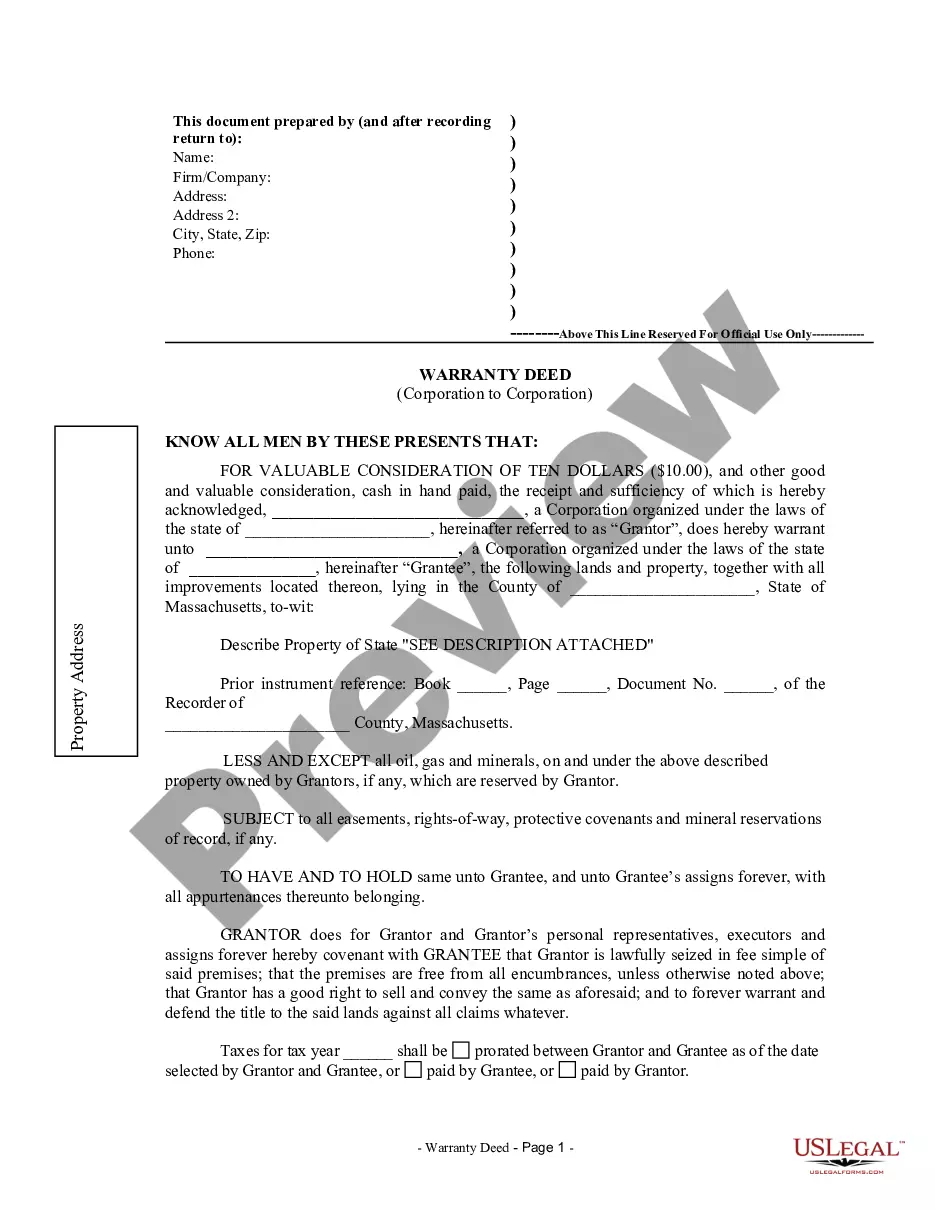

- Initially, ensure that you have chosen the proper document design for your county/area that you pick. Browse the type explanation to make sure you have picked out the appropriate type. If readily available, use the Review button to look with the document design at the same time.

- In order to discover another version in the type, use the Lookup discipline to discover the design that meets your requirements and specifications.

- Once you have identified the design you would like, click on Acquire now to continue.

- Choose the rates plan you would like, type in your references, and register for your account on US Legal Forms.

- Full the purchase. You may use your Visa or Mastercard or PayPal profile to cover the authorized type.

- Choose the file format in the document and down load it in your gadget.

- Make adjustments in your document if possible. You may complete, modify and indication and printing New York Receipt and Acceptance of Goods.

Acquire and printing 1000s of document layouts making use of the US Legal Forms web site, that provides the greatest collection of authorized kinds. Use professional and state-specific layouts to handle your organization or person demands.

Form popularity

FAQ

Poshmark is required to provide a tax form to any seller with $600 or more in gross sales in the 2023 calendar year.

You should report any capital gains you make on Schedule D of your tax return. If you owned the item for less than a year, you'll pay regular income tax on the gain. If you owned it for more than a year, you'll pay capital gains taxes, which are typically lower than your personal tax rate.

The Tax Law exempts purchases for resale; most sales to or by the federal and New York State governments, charitable organizations, and certain other exempt organizations; sales of most food for home consumption; and sales of prescription and nonprescription medicines. Sales tax also does not apply to most services.

New York is a destination-based sales tax state. So if you live in New York, collecting sales tax can be a bit complicated. You should be charging everyone in your state the rate where the item is being delivered. That could include a combination of state, county, city, and district tax rates.

Whether or not you will owe taxes for selling personal items, goods, or services online will depend on several factors, including whether you made a profit. Usually, you need to pay federal income taxes and self-employment taxes if you make more than $400 during the tax year.

Etsy businesses that expect over $1,000 in gross sales income must pay quarterly taxes. You can either use the taxable income you made in the previous year or determine estimated tax payments by deducting business expenses from the expected annual gross income.

Starting in 2023, the threshold changes to $600, meaning many more online sellers will receive 1099-K forms going forward. You should report your taxable online sales to the IRS, regardless of whether a 1099-K is issued. However, when the IRS receives a 1099-K, they can see how much you transacted.

New York City local sales and use tax rate of 4.5 percent. New York State sales and use tax rate of 4.0 percent. Metropolitan Commuter Transportation District surcharge of 0.375 percent.