The New York Special Cemetery Gift Trust Fund is a unique financial mechanism designed to support and sustain various cemeteries in the state of New York. This trust fund is specifically established to ensure the continuous maintenance, preservation, and beautification of cemeteries, allowing families to honor their loved ones in peaceful and well-kept burial grounds. The primary purpose of the New York Special Cemetery Gift Trust Fund is to accumulate and allocate resources to address the specific needs of cemeteries and enable them to provide a dignified resting place for the deceased. One type of the New York Special Cemetery Gift Trust Fund is the "General Cemetery Gift Trust Fund." This fund encompasses a broad range of cemeteries, both public and private, and aims to support their ongoing operations, renovations, and beautification initiatives. It enables cemetery managers to enhance the overall experience for visitors, ensuring an atmosphere of tranquility, serenity, and respect. Another type is the "Historic Cemetery Gift Trust Fund," which specifically caters to cemeteries with significant historical or cultural importance. These cemeteries often contain the graves of notable individuals, including war veterans, influential figures, or those who played a crucial role in shaping the region's history. The Historic Cemetery Gift Trust Fund supports the preservation and restoration of historically significant structures, monuments, and gravesides, thereby safeguarding the heritage and memory of these special places for future generations. The "Religious Cemetery Gift Trust Fund" caters to cemeteries affiliated with religious institutions. These funds provide financial assistance to religious organizations to ensure the proper upkeep of their cemeteries. They promote the maintenance of sacred grounds where individuals can be laid to rest according to their religious traditions and beliefs. Lastly, the "Pet Cemetery Gift Trust Fund" supports the maintenance and operation of dedicated cemeteries for pets. This fund recognizes the significance of maintaining resting places for beloved animal companions and ensures that these memorials receive proper care and attention. Overall, the New York Special Cemetery Gift Trust Fund, through its various types, plays a vital role in ensuring the longevity, preservation, and continuous improvement of cemeteries across New York State. It is a testament to the importance placed on honoring the deceased and preserving the historical, cultural, and religious significance associated with burial grounds in the area.

New York Special Cemetery Gift Trust Fund

Description

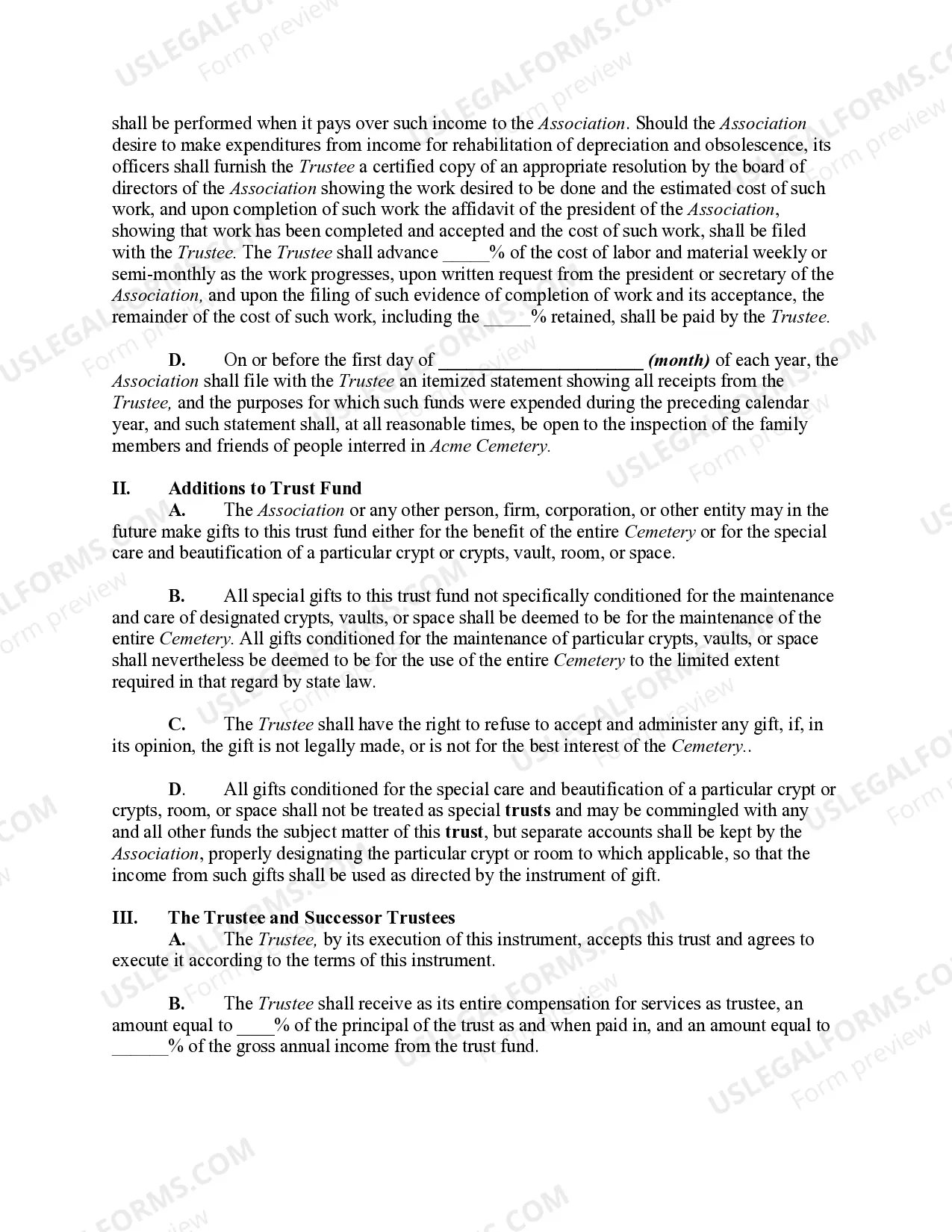

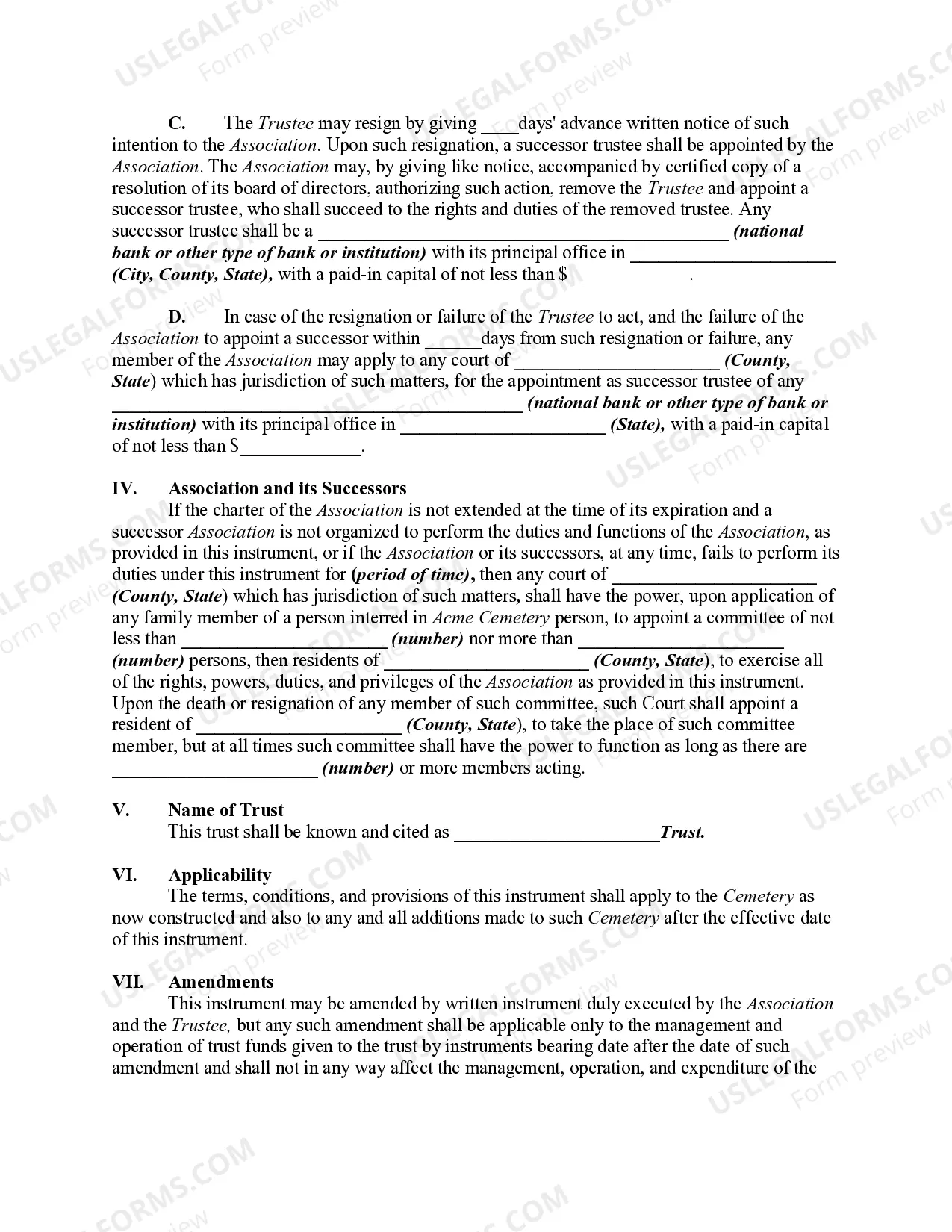

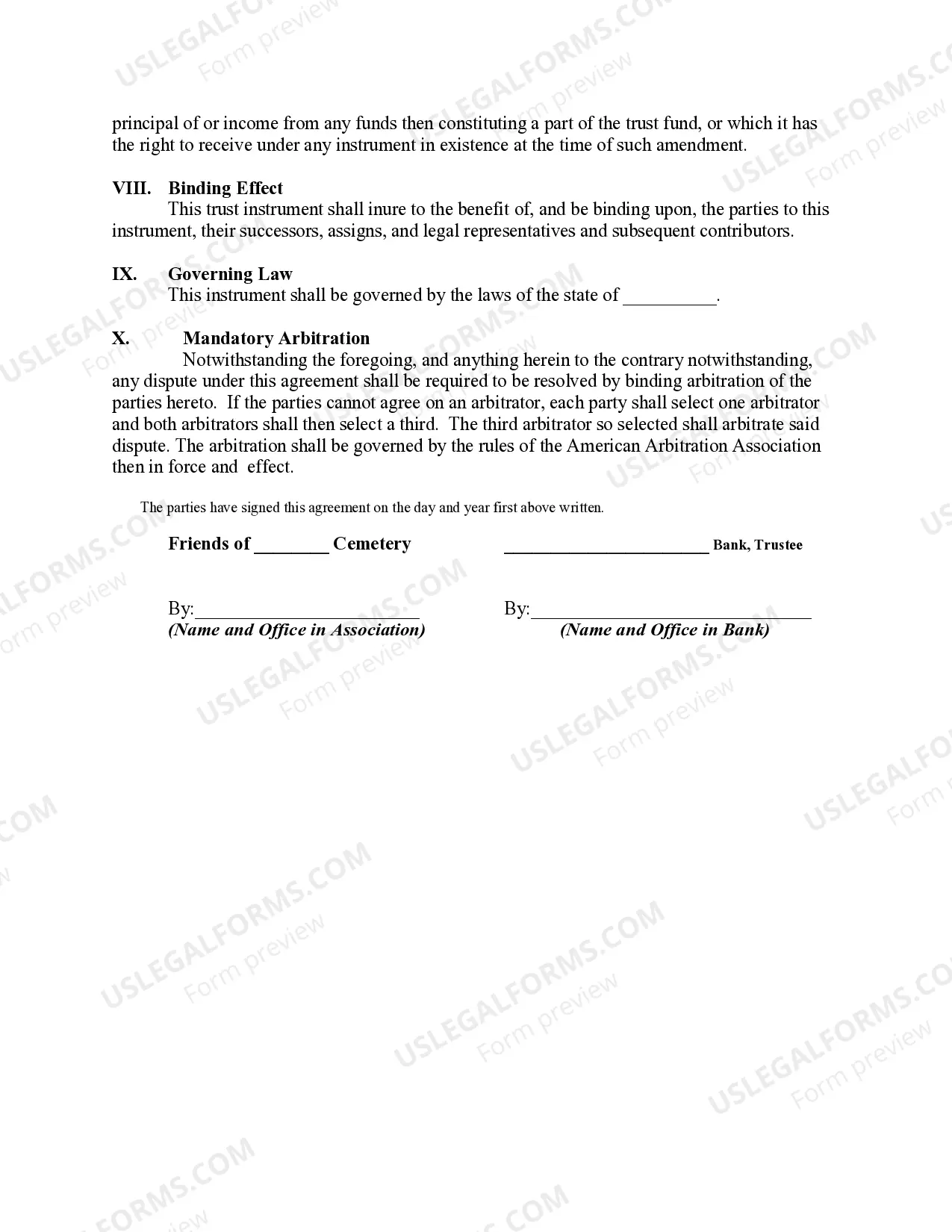

How to fill out New York Special Cemetery Gift Trust Fund?

Are you presently in a situation where you require documents for either business or specific purposes almost every day.

There are numerous document templates available online, but locating reliable versions can be challenging.

US Legal Forms offers a vast selection of form templates, such as the New York Special Cemetery Gift Trust Fund, which can be tailored to meet federal and state criteria.

Choose a convenient file format and download your version.

Access all the document templates you have purchased in the My documents section. You can download or print the New York Special Cemetery Gift Trust Fund form anytime if needed. Just click on the required form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and possess your account, simply Log In.

- Subsequently, you can download the New York Special Cemetery Gift Trust Fund template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/region.

- Utilize the Review button to evaluate the form.

- Check the details to ensure you have chosen the correct form.

- If the form does not meet your needs, use the Search field to locate a form that aligns with you and your requirements.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you desire, fill in the necessary information to create your account, and complete the payment using PayPal or Visa or Mastercard.

Form popularity

FAQ

New York boasts over 1,500 cemeteries, offering varied options for burial and memorial services. This number includes historic, religious, municipal, and private cemeteries scattered across the state. For those navigating these choices, the New York Special Cemetery Gift Trust Fund provides a financial safety net, enabling families to make informed decisions about their burial plans.

In New York, it is possible to be buried on your own property, but there are strict regulations governing this practice. Homeowners must comply with health and zoning laws, making the process somewhat complex. To alleviate financial concerns related to home burials or traditional cemetery options, consider the New York Special Cemetery Gift Trust Fund as a viable solution for securing funds.

Yes, New York has numerous cemeteries that cater to a diverse population. From historic burial grounds to modern memorial parks, these sites provide various options for honoring loved ones. By utilizing the New York Special Cemetery Gift Trust Fund, families can secure funding for cemetery costs, ensuring they can navigate New York's rich landscape of memorial options with confidence.

The largest cemetery in New York City is Green-Wood Cemetery, spanning over 478 acres in Brooklyn. Established in 1838, it is also a national historic landmark and a peaceful resting place for many notable figures. Enrolling in programs like the New York Special Cemetery Gift Trust Fund can offer financial assistance for gravesites in such revered locations.

Cemeteries in New York City operate under specific rules, ensuring they serve the needs of the community while respecting local laws. They offer various plot options, different types of memorialization, and burial services. Additionally, the New York Special Cemetery Gift Trust Fund helps individuals plan for these costs, ensuring that families can focus on honoring their loved ones rather than worrying about financial burdens.

The only city in the United States without a cemetery is Boca Raton, Florida. City planning regulations and the lack of available land contributed to this unique situation. In New York, however, residents benefit from options like the New York Special Cemetery Gift Trust Fund, which offers innovative ways to manage burial expenses in a city rich with cemeteries.

Texas holds the title for having the most cemeteries in the United States. It boasts thousands of burial sites, reflecting its vast size and history. As you explore this topic, consider how the New York Special Cemetery Gift Trust Fund allows families in New York to secure financial support for burial needs, ensuring peace of mind amidst the complexities of cemetery choices.

Natural burials are permitted in New York State, provided certain conditions are met. These burials often use biodegradable materials and do not involve traditional caskets or embalming. The New York Special Cemetery Gift Trust Fund offers guidance on available natural burial sites and helps navigate the regulations surrounding this gentle approach to death.

While burying someone on your own land in New York State is possible, it comes with many restrictions. Local regulations will dictate what is allowed, including zoning laws and health codes. To get detailed information and support, you can turn to resources provided through the New York Special Cemetery Gift Trust Fund.

In New York, burial on private property is restricted by local laws and regulations. If you seek to establish a burial site on your property, you must follow state and local guidelines. Assistance from the New York Special Cemetery Gift Trust Fund can help you navigate these regulations and explore the options available to you.