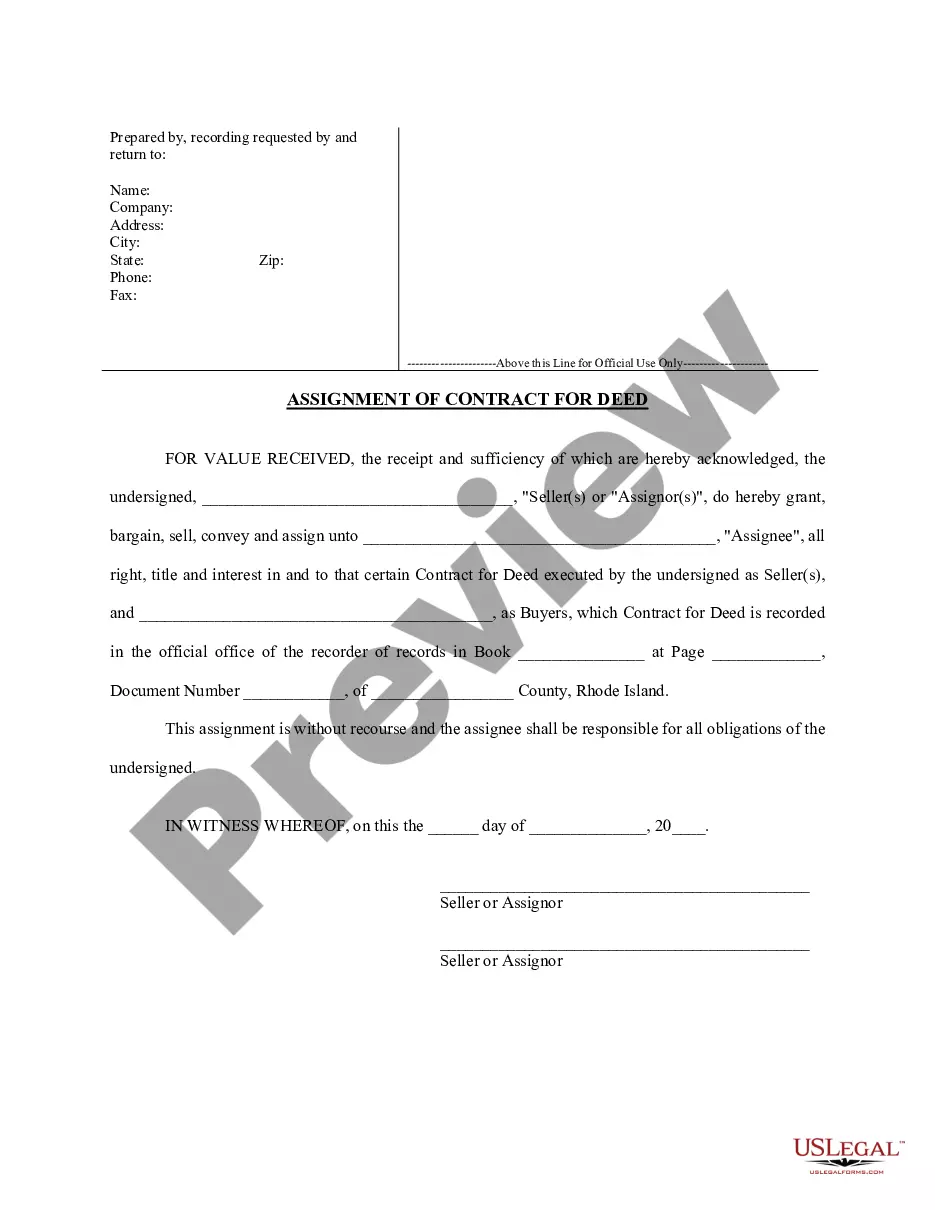

The New York Agreement and Release for Working at a Novelty Store — Self-Employed is a legal document that outlines the terms and conditions of employment between a novelty store owner and a self-employed individual. It serves as a binding agreement between the two parties and provides clarity on various aspects of the working relationship. Keywords: New York Agreement, Release, Working at a Novelty Store, Self-Employed 1. Purpose: The New York Agreement and Release for Working at a Novelty Store — Self-Employed establishes the understanding and expectations between the novelty store owner and the self-employed individual regarding their working arrangement. 2. Parties Involved: This agreement identifies the two main parties involved — the novelty store owner, who operates the business, and the self-employed individual, who provides services to the store. 3. Employment Status: The document clarifies that the self-employed individual is not an employee of the novelty store but an independent contractor who works on a self-employed basis. 4. Scope of Work: The agreement outlines the specific duties, tasks, and responsibilities that the self-employed individual will undertake at the novelty store. This includes areas such as customer service, inventory management, sales, and other relevant tasks. 5. Compensation: Details regarding the structure and amount of compensation are described in the agreement. It may include information about hourly rates, commission percentages, or any other payment arrangements agreed upon. 6. Working Hours: The agreement sets out the expected working hours and days of the self-employed individual. It may also include provisions for flexibility or changes in working hours based on the needs of the novelty store. 7. Termination: The document specifies the conditions under which the working relationship can be terminated by either party. This includes reasons such as breach of agreement, non-performance, or other valid grounds. 8. Release of Liability: The release clause ensures that both parties agree to waive any legal claims or liabilities that may arise during the course of employment. It provides protection to the novelty store owner and the self-employed individual. 9. Non-Compete Clause: A non-compete clause may be included in the agreement to prevent the self-employed individual from engaging in similar activities with competing businesses within a specific geographical location. 10. Confidentiality: This section emphasizes the importance of maintaining the confidentiality of any sensitive information or trade secrets disclosed during the course of employment. 11. Governing Law: The New York Agreement and Release for Working at a Novelty Store — Self-Employed specifies that the agreement will be governed by the laws of the State of New York, ensuring compliance with relevant legal norms and regulations. Types of New York Agreement and Release for Working at a Novelty Store — Self-Employed: 1. Full-Time Agreement: This type of agreement is applicable when a self-employed individual commits to working full-time hours at the novelty store, typically for a fixed period. 2. Part-Time Agreement: This agreement is suitable for self-employed individuals who work on a part-time basis, providing services to the novelty store for a limited number of hours per week or month. 3. Project-Based Agreement: In certain cases, a self-employed individual may be hired on a project-to-project basis. This type of agreement outlines the specific project requirements, deliverables, and compensation terms. 4. Commission-Based Agreement: When a self-employed individual earns a significant portion of their income through commission or sales-based compensation, a commission-based agreement can be designed to accurately reflect the terms and conditions of the working relationship. 5. Independent Contractor Agreement: This general type of agreement covers the self-employed individual's relationship with the novelty store, beyond the specific nature of their work. It typically includes sections on intellectual property, data protection, and dispute resolution.

New York Agreement and Release for Working at a Novelty Store - Self-Employed

Description

How to fill out New York Agreement And Release For Working At A Novelty Store - Self-Employed?

Locating the appropriate legal document template can be a challenge.

Clearly, there are numerous templates available online, but how can you find the legal form you require.

Make use of the US Legal Forms website. This service offers a vast array of templates, including the New York Agreement and Release for Employment at a Novelty Store - Self-Employed, which can be utilized for business and personal purposes.

Initially, ensure you have chosen the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not fulfill your requirements, use the Search field to find the right document. When you are confident that the form is suitable, click the Purchase now button to obtain the form. Select the payment method you prefer and input the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the downloaded New York Agreement and Release for Employment at a Novelty Store - Self-Employed. US Legal Forms is the largest collection of legal templates where you can find various document formats. Utilize this service to obtain professionally drafted documents that meet state requirements.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the New York Agreement and Release for Employment at a Novelty Store - Self-Employed.

- Use your account to browse the legal forms you have previously obtained.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Self-employed individuals often use titles like Owner, Consultant, or Freelancer, depending on their work. The title you choose should reflect the services you offer and the nature of your business. For those engaging with the New York Agreement and Release for Working at a Novelty Store - Self-Employed, titles such as Novelty Store Operator or Independent Crafter may be appropriate.

To list yourself as self-employed on a resume, create a separate section for your business activities. Include your business name, role, and describe your responsibilities clearly. When using the New York Agreement and Release for Working at a Novelty Store - Self-Employed, detail your specific tasks and achievements, highlighting your skills and experiences effectively.

As a self-employed individual, you hold the position of an entrepreneur. You are essentially your own boss, making critical decisions related to your work and operations. Utilizing the New York Agreement and Release for Working at a Novelty Store - Self-Employed can provide legal clarity regarding your position and agreements with the novelty store.

employed person's job description varies widely depending on their field and business model. Generally, it involves delivering services or products, managing finances, and building client relationships. For those using the New York Agreement and Release for Working at a Novelty Store SelfEmployed, it may include tasks like creating novelty items, handling sales, and managing inventory.

Being self-employed means you operate your own business or work as an independent contractor. You are responsible for your own income, expenses, and taxes. In the context of the New York Agreement and Release for Working at a Novelty Store - Self-Employed, it means you manage your own services and clientele without being an employee of the store.

In New York, independent contractors are not automatically required to carry workers' compensation insurance. However, this may depend on their specific job roles and the agreements made with their clients. To protect yourself and your business, consider a New York Agreement and Release for Working at a Novelty Store - Self-Employed to clearly define responsibilities and liabilities.

Independent contractors in New York generally do not qualify for unemployment benefits since they are self-employed. However, the situation can sometimes change based on specific circumstances and regulations. It's recommended to consult with a legal professional and explore options like a New York Agreement and Release for Working at a Novelty Store - Self-Employed to understand your rights regarding unemployment.

In New York, whether you need a license depends on the type of contracting work you do. Some fields, like construction, require specific licenses, while other forms of contracting may not. It's crucial to check the requirements relevant to your area of work and consider using a New York Agreement and Release for Working at a Novelty Store - Self-Employed to outline your position clearly.

Freelancers and independent contractors both work for themselves, but there are key differences. A freelancer usually provides specific services for various clients without a long-term commitment, while an independent contractor often engages in contractual obligations for a predetermined duration with a particular client. Regardless of your classification, it's essential to use a New York Agreement and Release for Working at a Novelty Store - Self-Employed to clarify the terms of your work relationship.

Yes, employment contracts are completely legal in New York. They can be used to clarify the terms of employment and to protect the rights of both the employer and employee. Crafting a New York Agreement and Release for Working at a Novelty Store - Self-Employed can help establish a clear understanding of roles and responsibilities in your business.