New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage

Description

How to fill out Agreement To Purchase Condominium With Purchase Money Mortgage Financing By Seller, And Subject To Existing Mortgage?

US Legal Forms - among the largest libraries of lawful types in the USA - delivers a variety of lawful document layouts you can obtain or produce. While using site, you may get 1000s of types for business and specific functions, sorted by groups, claims, or keywords and phrases.You can get the most recent types of types like the New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage in seconds.

If you have a monthly subscription, log in and obtain New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage from your US Legal Forms catalogue. The Down load switch will show up on every form you see. You gain access to all earlier delivered electronically types in the My Forms tab of your respective accounts.

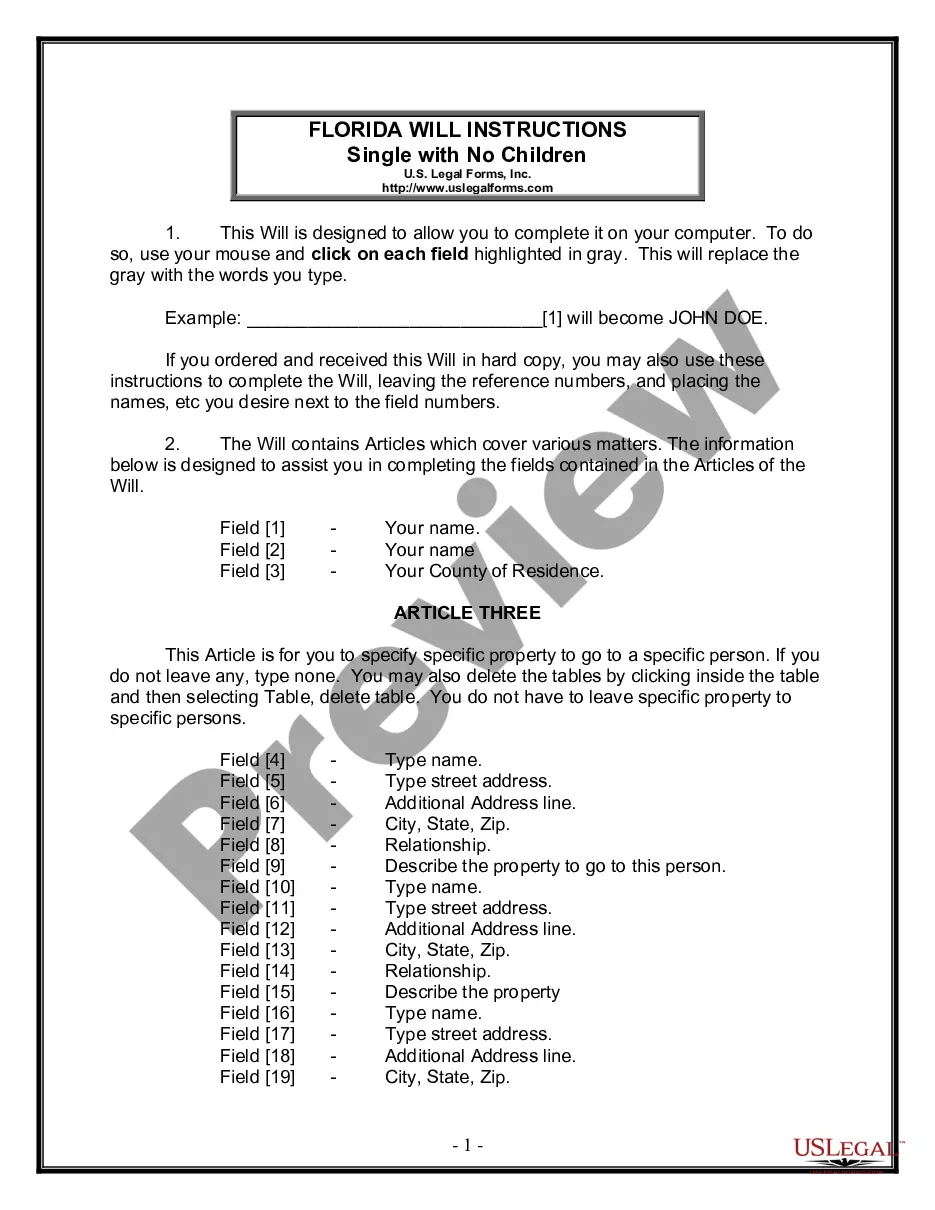

If you wish to use US Legal Forms for the first time, listed here are straightforward recommendations to help you started off:

- Be sure you have picked out the right form for your personal town/state. Select the Preview switch to analyze the form`s information. Read the form outline to ensure that you have selected the appropriate form.

- When the form doesn`t fit your specifications, make use of the Research area on top of the monitor to discover the one who does.

- Should you be satisfied with the shape, confirm your decision by visiting the Acquire now switch. Then, select the rates prepare you want and supply your qualifications to register for the accounts.

- Procedure the deal. Utilize your credit card or PayPal accounts to accomplish the deal.

- Pick the formatting and obtain the shape on your own device.

- Make adjustments. Fill out, modify and produce and indicator the delivered electronically New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage.

Every design you included with your account does not have an expiry day and is your own property permanently. So, if you wish to obtain or produce yet another duplicate, just proceed to the My Forms area and then click around the form you will need.

Get access to the New York Agreement to Purchase Condominium with Purchase Money Mortgage Financing by Seller, and Subject to Existing Mortgage with US Legal Forms, one of the most comprehensive catalogue of lawful document layouts. Use 1000s of skilled and condition-certain layouts that meet up with your company or specific requires and specifications.

Form popularity

FAQ

A major drawback of a contract for deed for buyers is that the seller retains the legal title to the property until the payment plan is completed. On one hand, this means that they're responsible for things like property taxes. On the other hand, the buyer lacks security and rights to their home.

An owner financing contract is an agreement between the owner or seller of the property and the buyer. The seller agrees to finance the balance of the purchase price (not including the down payment) with the buyer making payments to the seller.

Disadvantages of a Contract for Deed Eviction Without Legal Process. ... Monthly Payments Lost. ... Refinancing (Changing Your Loan) May Not Be Possible. ... Paying More For Your Home. ... Balloon Payment.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

In a subject-to real estate closing, a buyer purchases a property ?subject to? the existing mortgage, meaning the mortgage remains in the seller's name, but the buyer takes over the mortgage payments and assumes control of the property.

Other advantages include: no appraisal required, wider range of buyers, possible profit on financing, and quicker settlement. The biggest disadvantage of a contract for deed for a seller is that the property won?t be out of your name for many years. This quite possibly won?t suit your investment strategy.

Primary tabs. Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

A sales and purchase agreement (SPA) is a binding legal contract between two parties that obligates a transaction to occur between a buyer and seller.