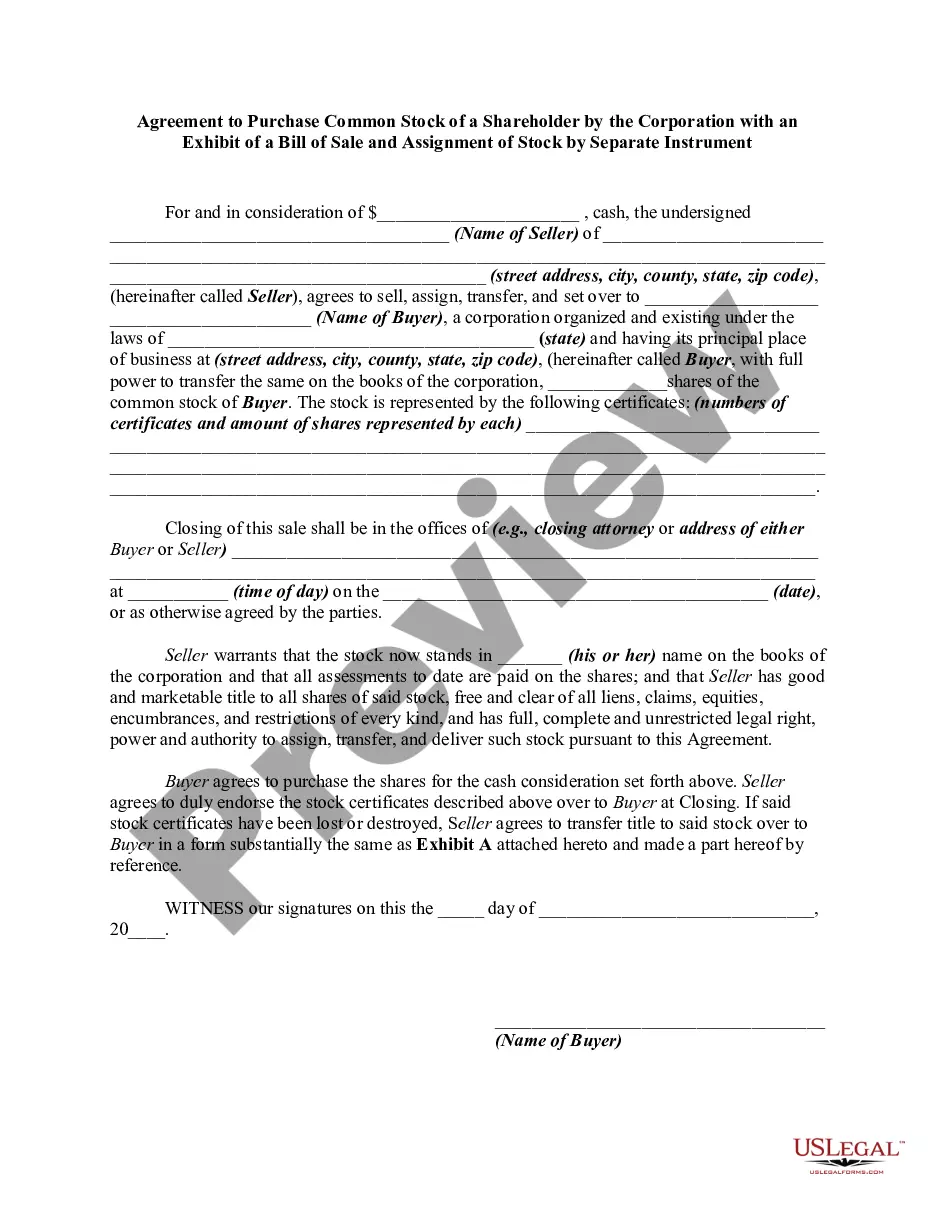

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

New York Bill of Sale and Assignment of Stock by Separate Instrument

Description

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

If you need to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms accessible online.

Benefit from the website's easy and convenient search feature to find the documents you need.

Numerous templates for commercial and personal uses are organized by categories and jurisdictions, or keywords.

Step 4. Once you've found the form you need, click on the Acquire now button. Select the pricing plan you prefer and provide your information to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to locate the New York Bill of Sale and Assignment of Stock by Separate Instrument with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the New York Bill of Sale and Assignment of Stock by Separate Instrument.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to go through the content of the form. Don't forget to check the summary.

- Step 3. If you are not satisfied with the template, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A bulk transfer refers to the sale or transfer of a significant portion of a business's assets outside regular sales activities. This transaction can impact creditors and may require legal notices to inform them. Utilizing the New York Bill of Sale and Assignment of Stock by Separate Instrument can assist in documenting these transfers properly and protecting your interests.

A bulk business typically refers to a company that engages in buying or selling large quantities of goods or services. Such businesses often operate on a larger scale and may involve unique legal requirements and considerations. For those looking to conduct a bulk sale in New York, the New York Bill of Sale and Assignment of Stock by Separate Instrument are vital tools to navigate the process smoothly.

In California, a bulk sale is usually considered a sale of a significant portion of the business's assets not in the ordinary course of business. This often requires notifying creditors and following specific legal procedures. If you plan to conduct such transactions, it’s advantageous to have documents like the New York Bill of Sale and Assignment of Stock by Separate Instrument to streamline your process.

Yes, a bill of sale is generally required in New York for the transfer of personal property. This document serves as evidence of the transaction and outlines the terms involved. When dealing with business assets, incorporating the New York Bill of Sale and Assignment of Stock by Separate Instrument is highly recommended to ensure clarity and legal compliance.

A bulk sale refers to the transfer of a large portion of a business's inventory or assets. This type of sale typically requires compliance with legal obligations to notify creditors and protect their interests. When engaging in a bulk sale in New York, including the New York Bill of Sale and Assignment of Stock by Separate Instrument is essential for proper documentation.

To avoid transfer tax in New York, you can take advantage of certain exemptions that apply under state law. One common method is to ensure that the transfer falls under a tax-exempt status, such as a gifting situation or certain types of sales involving stocks. Utilizing the New York Bill of Sale and Assignment of Stock by Separate Instrument can help clarify the specifics associated with these transactions.

To obtain a certificate of authority in New York, you must register your business as a foreign entity with the state. This involves submitting an Application for Authority along with the required fees and documentation. Once you have the New York Bill of Sale and Assignment of Stock by Separate Instrument in place, it simplifies the process of engaging in business transactions.

A bulk sale involves selling a significant portion of a business's assets outside the ordinary course of business. This usually requires compliance with specific state laws to protect creditors. In New York, understanding the legal framework surrounding a bulk sale is crucial, especially when dealing with the New York Bill of Sale and Assignment of Stock by Separate Instrument.